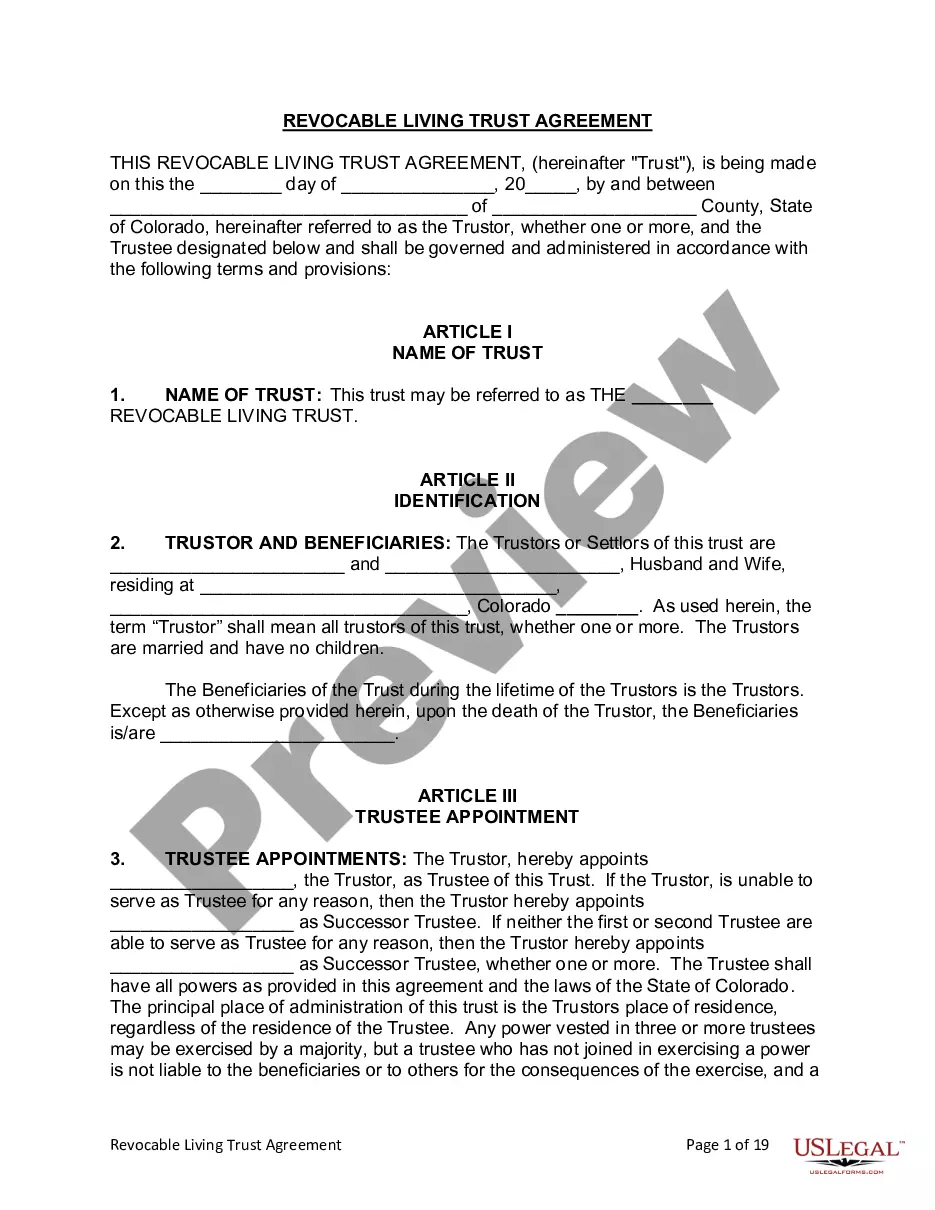

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Colorado Living Trust for Husband and Wife with No Children

Description

How to fill out Colorado Living Trust For Husband And Wife With No Children?

The more papers you need to make - the more stressed you become. You can get thousands of Colorado Living Trust for Husband and Wife with No Children templates online, however, you don't know which of them to have confidence in. Remove the hassle to make getting samples more convenient with US Legal Forms. Get professionally drafted documents that are written to go with the state requirements.

If you already have a US Legal Forms subscription, log in to your profile, and you'll see the Download key on the Colorado Living Trust for Husband and Wife with No Children’s web page.

If you’ve never applied our platform before, complete the sign up process using these directions:

- Make sure the Colorado Living Trust for Husband and Wife with No Children applies in your state.

- Double-check your selection by studying the description or by using the Preview function if they’re available for the chosen record.

- Click Buy Now to begin the signing up procedure and choose a pricing program that suits your needs.

- Provide the requested information to make your profile and pay for the order with the PayPal or bank card.

- Pick a convenient file type and obtain your copy.

Find each file you download in the My Forms menu. Simply go there to prepare fresh copy of the Colorado Living Trust for Husband and Wife with No Children. Even when having properly drafted forms, it’s still essential that you consider requesting your local legal representative to twice-check completed sample to ensure that your record is correctly filled in. Do more for less with US Legal Forms!

Form popularity

FAQ

Some may feel a trust is unnecessary if they have few assets or simple estates. Additionally, if you are content with the guidelines provided by the state for asset distribution, a trust might seem redundant. Nevertheless, a Colorado Living Trust for Husband and Wife with No Children offers more control over your legacy, which can be particularly important, even for those without children.

One significant mistake is not clearly defining the terms of the trust. Without explicit instructions, the intended benefits may not be realized. For couples, it is crucial to ensure your Colorado Living Trust for Husband and Wife with No Children accounts for all relevant scenarios, reducing the potential for confusion later.

Yes, you can create your own living trust in Colorado. However, utilizing a reputable platform like uslegalforms can simplify the process and ensure that all legal requirements are met. A properly drafted Colorado Living Trust for Husband and Wife with No Children can safeguard your interests and provide peace of mind.

A trust can be a valuable tool in a marriage, especially for couples without children. A Colorado Living Trust for Husband and Wife with No Children can streamline the management of shared assets and reduce legal complications. It also allows for more flexibility in asset distribution than a will alone.

Yes, having a will is still essential for married couples without children. A will outlines how you want your assets to be distributed, providing clarity for your spouse. In combination with a Colorado Living Trust for Husband and Wife with No Children, a will ensures comprehensive planning that leaves nothing to chance.

While it is not mandatory, a Colorado Living Trust for Husband and Wife with No Children can be beneficial. It helps ensure that assets are distributed according to your preferences, even without children. A trust can also protect your spouse from probate, making the process smoother during a difficult time.

Yes, a Colorado Living Trust for Husband and Wife with No Children offers several advantages. It allows both partners to manage their assets more effectively during their lifetime. Moreover, it simplifies the transfer of property after death, providing peace of mind that your wishes will be followed.

Yes, you can write your own trust in Colorado. However, creating a Colorado Living Trust for Husband and Wife with No Children requires careful attention to legal details and state laws. While DIY trusts may seem appealing, using a reliable online platform like uslegalforms can help ensure your trust meets all necessary requirements. This way, you can secure your loved ones' future while avoiding potential complications down the road.

A husband and wife may not need separate living trusts, especially when they have no children. A joint Colorado Living Trust for Husband and Wife with No Children often simplifies estate management and reduces administrative costs. Additionally, combining your assets in a single trust can make it easier for each partner to manage and protect those assets. However, unique circumstances may call for separate trusts, so consulting with a legal expert can provide clarity.