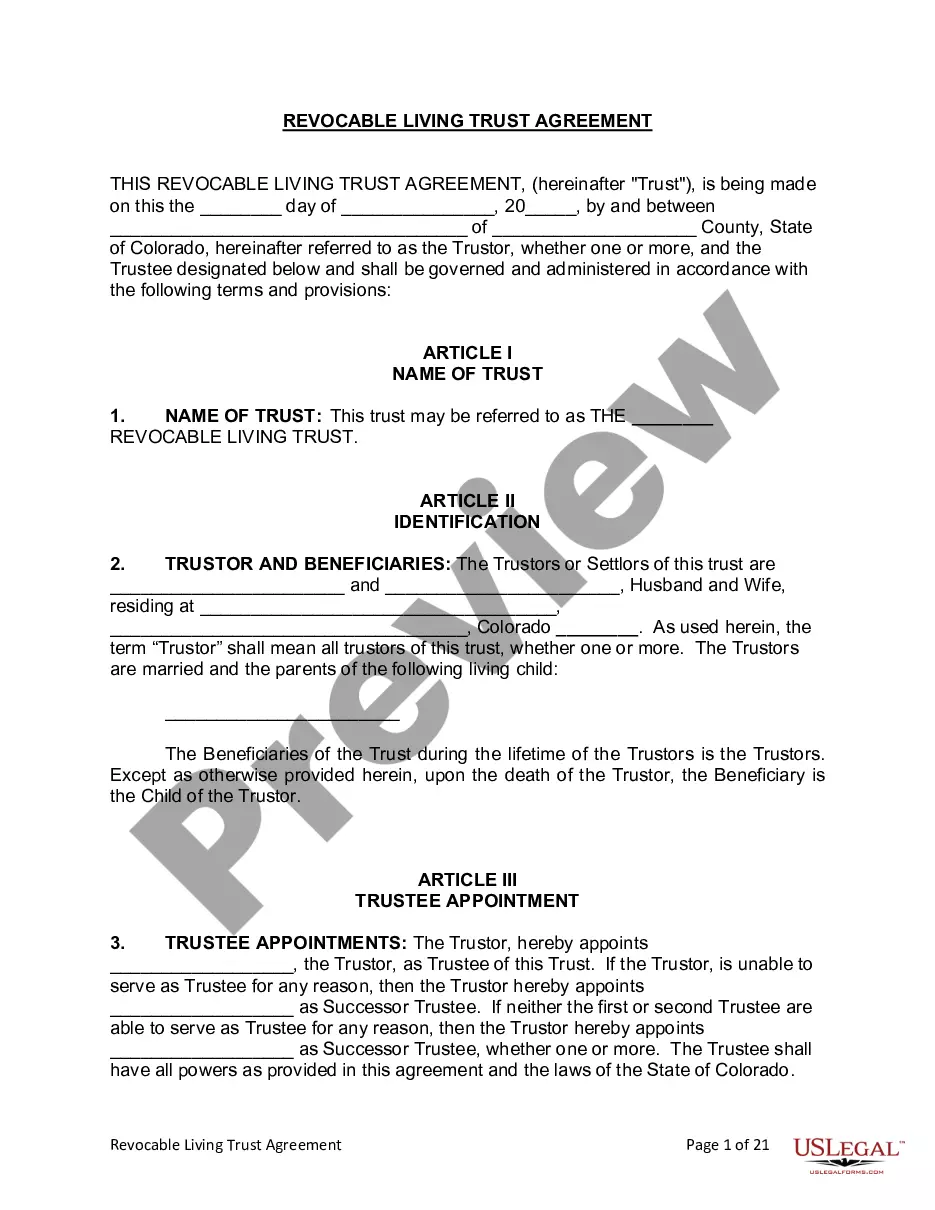

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Colorado Living Trust for Husband and Wife with One Child

Description

How to fill out Colorado Living Trust For Husband And Wife With One Child?

The greater the number of documents you require - the more uneasy you become.

You can find thousands of Colorado Living Trust for Husband and Wife with One Child templates online, however, you may be uncertain about whom to trust.

Remove the difficulty to simplify the search for samples with US Legal Forms.

Input the required information to create your account and pay for your purchase with PayPal or a credit card. Select a convenient file format and obtain your copy. Locate every document you receive in the My documents section. Simply navigate there to generate a new copy of the Colorado Living Trust for Husband and Wife with One Child. Even when utilizing professionally prepared forms, it remains essential to consider consulting a local attorney to verify the completed document to ensure its accuracy. Achieve more for less with US Legal Forms!

- If you already hold a US Legal Forms subscription, Log In to your account, and you'll discover the Download option on the Colorado Living Trust for Husband and Wife with One Child’s page.

- If you haven’t utilized our platform before, complete the registration process with the following steps.

- Verify if the Colorado Living Trust for Husband and Wife with One Child is permissible in your residing state.

- Re-confirm your selection by reviewing the details or by utilizing the Preview feature if available for the chosen document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that meets your requirements.

Form popularity

FAQ

Having only one child does not eliminate the potential benefits of a Colorado Living Trust for Husband and Wife with One Child. A trust can simplify the transfer of wealth, minimize estate taxes, and reduce court involvement. Establishing a trust helps ensure your child's inheritance is protected and distributed according to your wishes, making it a worthwhile consideration.

For a single parent, a Colorado Living Trust for Husband and Wife with One Child may not be applicable, but a revocable living trust can offer invaluable benefits. This type of trust allows the parent to control assets and ensure they are distributed according to their wishes, providing peace of mind. It's essential to consult with an estate planning professional to tailor a trust that best meets your needs.

In most cases, a Colorado Living Trust for Husband and Wife with One Child can effectively manage shared assets while simplifying estate planning. However, there are situations where separate trusts might provide benefits, such as when spouses own separate businesses or properties. Ultimately, discussing your unique circumstances with a legal expert can help determine the best approach for your family.

Some individuals may feel that establishing a Colorado Living Trust for Husband and Wife with One Child is unnecessary if they assume their assets will pass smoothly through wills or beneficiary designations. Additionally, those with limited assets may see the expense and effort of setting up a trust as unwarranted. However, not having a trust can lead to complications and a lack of control over asset distribution, especially for families with children.

Suze Orman advocates for living trusts as vital tools for estate planning. According to her, a Colorado Living Trust for Husband and Wife with One Child can help avoid probate and ensure your assets are distributed according to your wishes. She emphasizes that these trusts provide peace of mind and simplify the transitions of wealth. Her advice often includes reviewing your trust regularly to keep it updated with your current wishes.

Indeed, a married couple can have one living trust. This option consolidates their assets under a single trust, making management straightforward and efficient. If you are looking for a Colorado Living Trust for Husband and Wife with One Child, this unified approach allows for easy distribution of assets. It is important to communicate openly about the trust's provisions to ensure both partners’ wishes are respected.

The best type of trust for a married couple often depends on their unique financial situation and goals. A Colorado Living Trust for Husband and Wife with One Child is commonly recommended, as it offers personal control over assets and flexibility upon death. Couples may choose between revocable and irrevocable trusts based on their needs. Consulting with an expert can help you make an informed decision.

Yes, a married couple can have one trust. This approach can simplify management of assets and streamline the estate planning process. For couples seeking to establish a Colorado Living Trust for Husband and Wife with One Child, having a single trust can provide cohesion in managing joint assets. Ensure both parties are on board with the terms to avoid conflicts.

Yes, you can write your own living trust in Colorado. However, it is important to ensure that your Colorado Living Trust for Husband and Wife with One Child meets all legal requirements. Mistakes may result in complications during execution or when handling your estate. Consider using a trusted resource, like uslegalforms, to help you create a valid trust.

Even if you only have one child, establishing a Colorado Living Trust for Husband and Wife with One Child can provide significant benefits. This trust simplifies the transfer of assets, avoids probate, and offers more control over how and when your child receives their inheritance. Additionally, it can help manage your assets effectively during periods of incapacity, ensuring your wishes are honored.