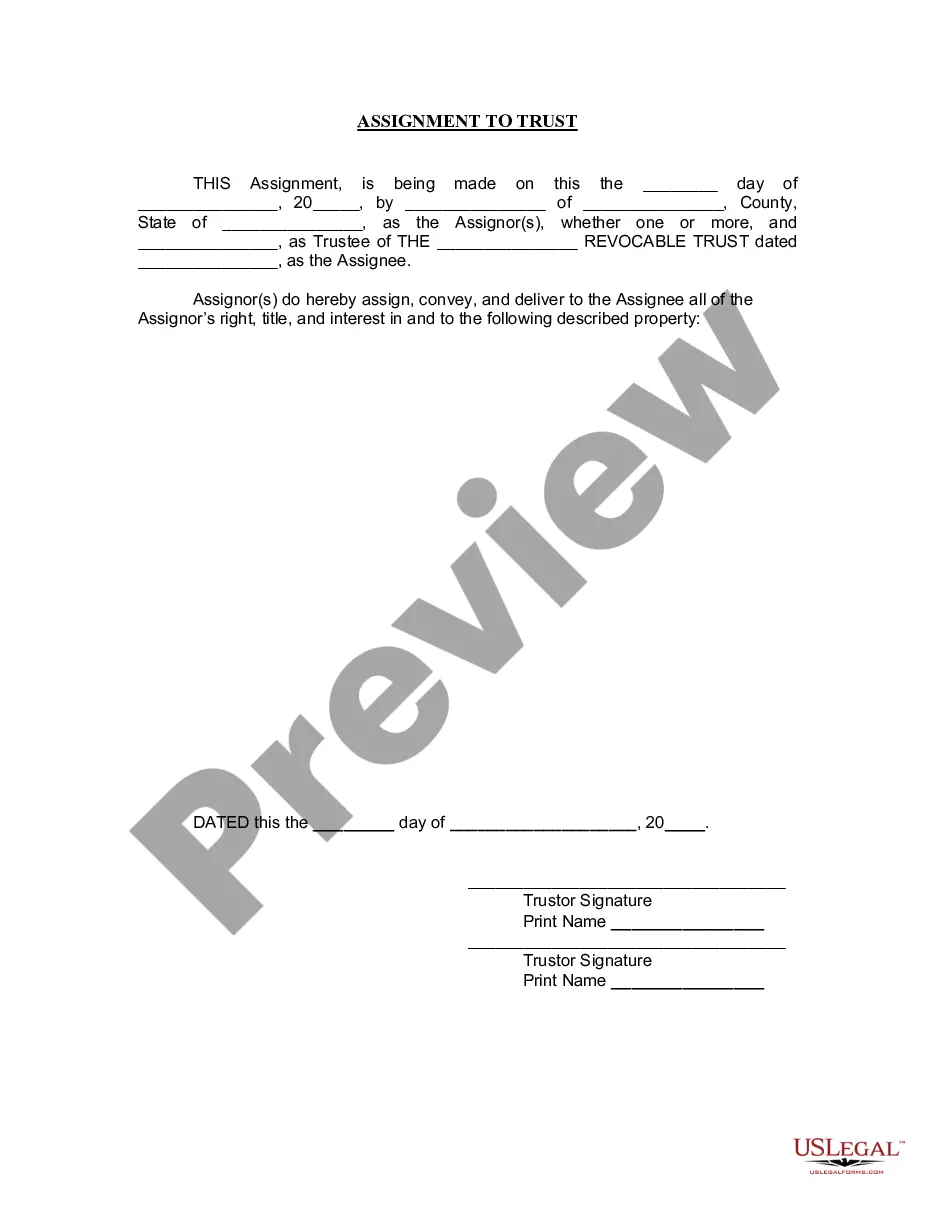

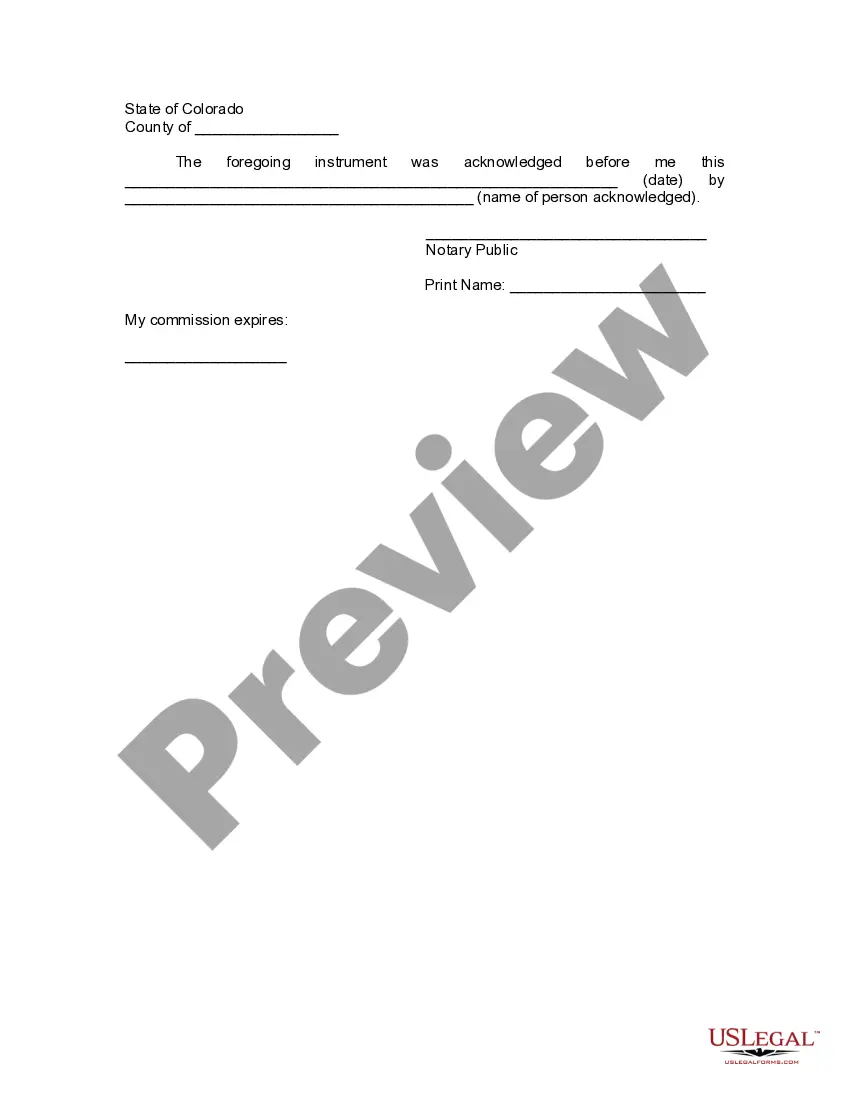

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Colorado Assignment to Living Trust

Description

How to fill out Colorado Assignment To Living Trust?

The greater the number of documents you must prepare - the more anxious you become.

You can find numerous Colorado Assignment to Living Trust templates online, yet you can't determine which ones to trust.

Eliminate the stress of acquiring samples by using US Legal Forms to simplify the process.

Fill in the required information to create your account and settle your payment through PayPal or credit card. Select a convenient format for the document and download your copy. Access every template you acquire in the My documents section. Just visit there to generate a new version of the Colorado Assignment to Living Trust. Even with expertly crafted templates, it’s still important to consider consulting a local attorney to confirm that your completed document is accurate. Achieve more for less with US Legal Forms!

- If you are currently subscribed to US Legal Forms, sign in to your account, and you will discover the Download button on the Colorado Assignment to Living Trust’s page.

- If you haven't previously used our service, complete the registration process by following these instructions.

- Ensure that the Colorado Assignment to Living Trust is applicable in your residing state.

- Verify your selection by reviewing the details or by utilizing the Preview feature if available for the selected document.

- Click Buy Now to initiate the registration process and choose a payment plan that fits your needs.

Form popularity

FAQ

The downfall of having a trust, including a Colorado Assignment to Living Trust, often lies in the administrative responsibilities involved. Trusts require regular maintenance to ensure they remain effective, which can be time-consuming. Furthermore, any changes in financial circumstance or family dynamics may require reevaluation of the trust terms. Professional guidance can simplify this process and help you stay on track.

A family trust, like a Colorado Assignment to Living Trust, can offer significant benefits, yet it also comes with disadvantages. One major issue is that these trusts require ongoing management and can incur costs over time. Additionally, if not properly funded, the trust may not effectively protect assets. It’s crucial to evaluate these potential pitfalls before making a commitment.

Deciding whether your parents should establish a Colorado Assignment to Living Trust depends on their unique financial situation and goals. If they desire a streamlined estate plan and wish to avoid probate, a trust may be a beneficial option. However, it's essential for them to discuss their specific needs with a legal professional who can guide them properly. Ultimately, having a clear strategy can enhance their legacy planning.

Deciding whether to put your house in a trust in Colorado depends on your personal circumstances and goals. Placing your home in a trust can simplify the transfer of ownership upon your passing and avoid probate. If you're considering a Colorado Assignment to Living Trust, assessing the benefits against your unique situation can guide your decision.

Yes, you can write your own living trust in Colorado, but it's crucial to follow legal guidelines to ensure its validity. You should clearly outline your assets, beneficiaries, and the terms of management within the trust document. Using resources from US Legal Forms can help you craft a solid Colorado Assignment to Living Trust that aligns with your goals.

Transferring your property to a living trust in Colorado typically involves a few straightforward steps. First, you must create the trust document and ensure it meets state requirements. Then, you complete a deed transfer to move your property into the trust, which can often be facilitated by a platform like US Legal Forms for efficiency and accuracy.

One of the biggest mistakes parents make when setting up a trust fund is failing to properly fund the trust. Without transferring assets, like properties and bank accounts, into the trust, it cannot fulfill its purpose. It’s essential to complete the Colorado Assignment to Living Trust correctly to ensure your assets are protected and managed according to your wishes.

Transferring property into a living trust in Colorado generally requires a deed to change the title of the property. You must complete a new deed, name the trust as the new owner, and record the deed with the county. To simplify this process and ensure compliance with all legal requirements, consider using US Legal Forms for guidance specific to your Colorado Assignment to Living Trust.

Assigning assets to a trust typically involves transferring ownership of property or financial instruments into the name of the trust. This can include real estate, bank accounts, and investments. It's crucial to execute the assignments properly to ensure clarity and legality, and using resources from US Legal Forms can help facilitate the Colorado Assignment to Living Trust process effectively.

To write an amendment to a living trust, start by identifying the sections you want to modify. Include your name, the date, and clearly outline the changes you wish to make. Ensure that you sign the amendment according to Colorado requirements. US Legal Forms can assist you by providing effective templates for amending your trust in the context of a Colorado Assignment to Living Trust.