Colorado Revocation of Living Trust

About this form

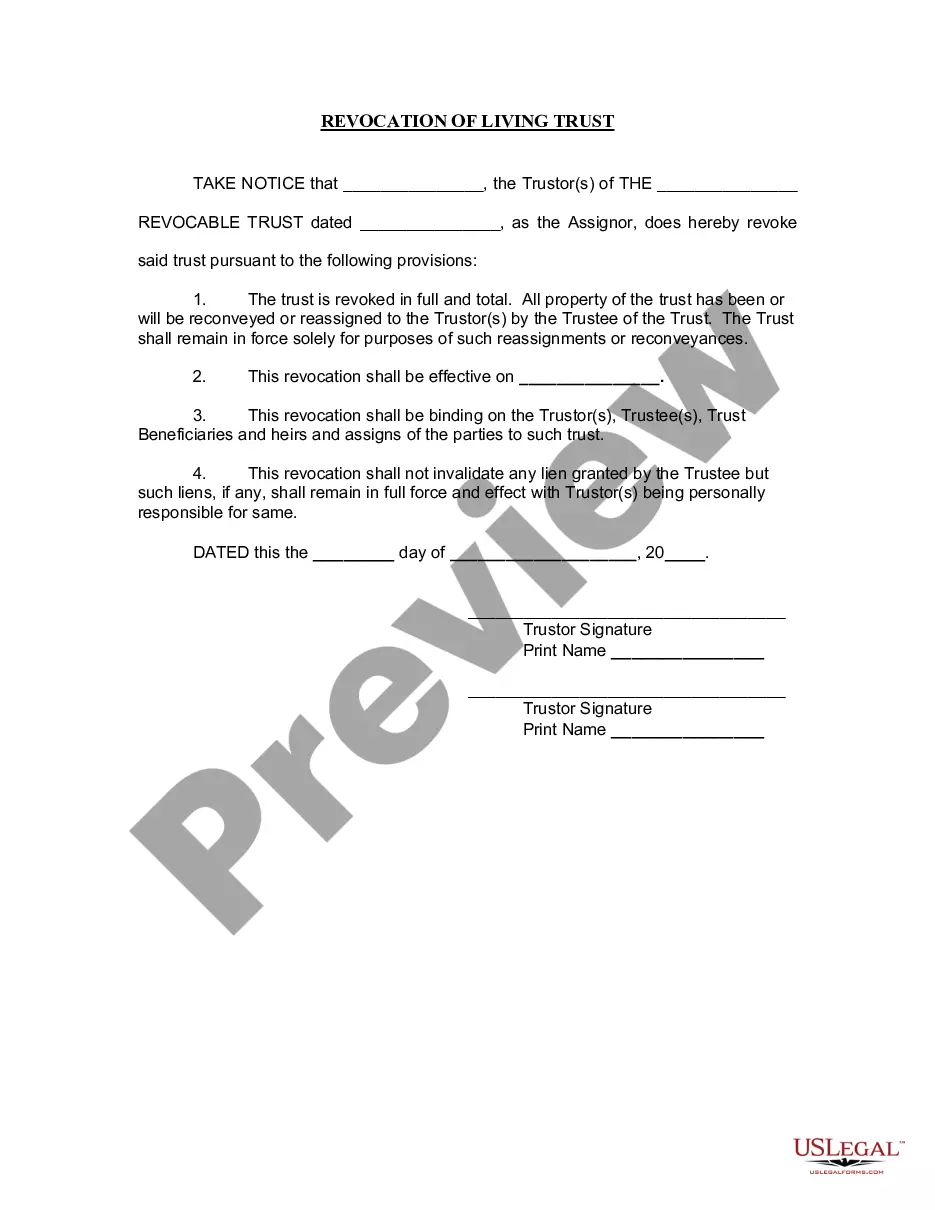

The Revocation of Living Trust form is a legal document used to officially revoke a living trust established during an individual's lifetime. Unlike other types of trusts that may remain active or be amended, this form declares a complete termination of the specific living trust, returning all assets and property back to the trustor. It ensures that all trust components are handled appropriately and includes a notarization requirement to affirm its validity.

Main sections of this form

- Trustor identification: Names of the individuals revoking the trust.

- Specific trust details: Information about the trust being revoked, including its name and date established.

- Revocation declaration: A clear statement of the total revocation of the trust.

- Property reassignment: Confirmation that all property has or will be returned to the Trustor(s).

- Effective date: The date when the revocation takes effect.

- Signatures: Required signatures of the Trustor(s) in the presence of a notary public.

Situations where this form applies

This form should be used when a trustor decides to terminate their living trust, whether due to changes in personal circumstances, estate planning strategies, or the desire to consolidate assets elsewhere. It is appropriate when the trust is no longer effective or needed, and the trustor wants to regain full control over their assets.

Who should use this form

This form is intended for:

- Trustors who wish to revoke an existing living trust.

- Individuals engaged in estate planning who need to reorganize their assets.

- Individuals seeking to simplify their financial management by eliminating a trust.

- Heirs or beneficiaries of a trust who require clarification on asset management.

Completing this form step by step

- Identify the Trustor(s): Enter the names of the individuals revoking the trust.

- Provide trust details: Specify the name of the revocable trust and the date it was created.

- State the revocation: Clearly declare that the trust is being revoked in full and total.

- Set the effective date: Indicate when the revocation will take effect.

- Sign in the presence of a notary: Both Trustor(s) must sign the document and have their signatures notarized.

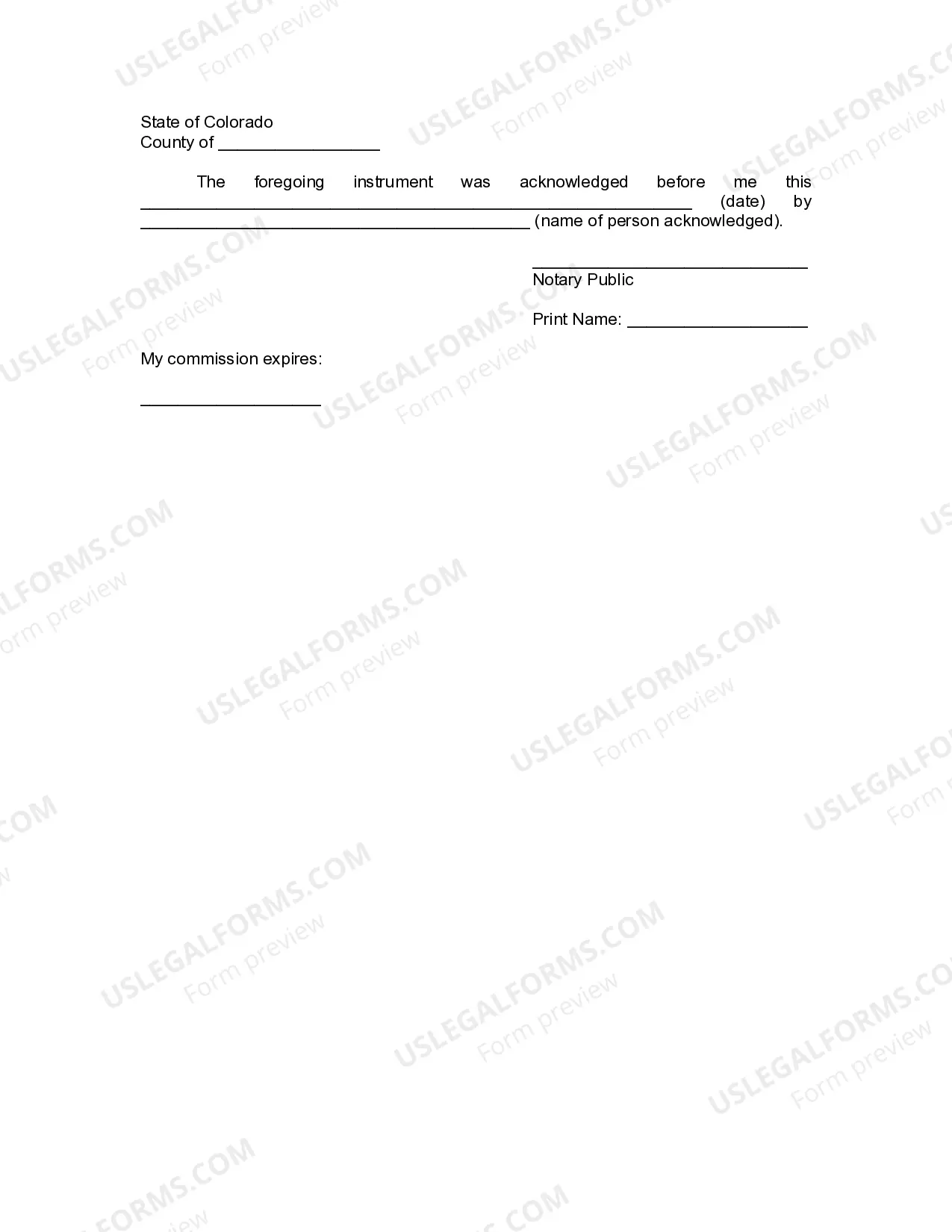

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide the correct trust name and date, leading to confusion about which trust is revoked.

- Not having the signatures notarized, which may invalidate the revocation.

- Leaving the effective date blank, causing uncertainty about when the revocation takes effect.

- Not reconveying or reassigning trust property, which can lead to legal complications.

Benefits of using this form online

- Convenience: Download the form anytime, from anywhere, without needing to visit a legal office.

- Editability: Customize the form to fit your specific circumstances with ease.

- Reliability: Access expert-drafted templates that ensure compliance with state laws.

Looking for another form?

Form popularity

FAQ

A trust may be deemed invalid if it fails to meet legal requirements, such as lacking a clear grantor, clear beneficiaries, or defined trust property. Additionally, issues like the grantor’s lack of legal capacity or undue influence can contribute to invalidity. Understanding the Colorado Revocation of Living Trust process can help avoid such pitfalls.

To invalidate a living trust, one generally demonstrates flaws in its formation or proof of the grantor’s lack of capacity or undue influence during its creation. The Colorado Revocation of Living Trust outlines certain instances where invalidation applies. Seeking legal advice can help understand the intricacies surrounding this sensitive matter.

A revocation of living trust refers to a legal act where the grantor cancels the living trust, nullifying its terms and effectively returning assets. In Colorado, this process can be straightforward when you document your intent properly. It's often used when circumstances change, such as marriage, divorce, or changes in financial status.

To terminate a trust in Colorado, you can follow the procedure for revocation as outlined in the trust agreement or Colorado statutes. The grantor needs to execute a written revocation. Consulting with professionals familiar with the Colorado Revocation of Living Trust can provide clarity and ensure that all necessary legal steps are followed.

A trust can be terminated through revocation by the grantor, fulfillment of the trust's purpose, or by court order when deemed necessary. Specifically, in Colorado, individuals may benefit from understanding the Colorado Revocation of Living Trust process to simplify trust termination. It’s prudent to engage an attorney to navigate the specifics effectively.

A trust can be voided through a legal process that may involve revoking the trust document or demonstrating that the trust lacked valid elements at its creation. In the context of the Colorado Revocation of Living Trust, the grantor can revoke or amend their trust through a written statement, provided that they follow applicable state laws. It's essential to consult legal requirements to ensure proper execution.

A trust can be terminated through several methods, including by the terms defined in the trust document, upon completion of the trust's purpose, or by mutual agreement of the beneficiaries. In Colorado, it is important to follow legal guidelines to ensure proper termination. Always consult with a legal expert to avoid pitfalls. US Legal Forms provides resources to help you navigate trust termination effectively.

Shutting down a trust involves completing the trust's obligations, liquidating its assets, and formally dissolving the trust. In Colorado, this process usually requires the consent of all beneficiaries and may need the assistance of an attorney for compliance with relevant laws. Keeping everything documented is essential to avoid future disputes. Consider US Legal Forms for templates that simplify this process.

To revoke a revocable living trust in Colorado, you need to create a formal document that declares your intention to revoke it. Make sure to sign this document in front of a notary to ensure its validity. After revocation, distribute the remaining assets according to your wishes. Utilizing US Legal Forms can guide you through this process smoothly.

Typically, a nursing home cannot directly take your revocable trust assets, but the assets may be considered when determining eligibility for Medicaid. In Colorado, the assets held in a revocable trust can be counted towards your resource limit when applying for government assistance. Therefore, it's crucial to understand how a revocable trust affects your long-term care planning. Consulting with a legal professional can help you navigate these complexities and protect your assets.