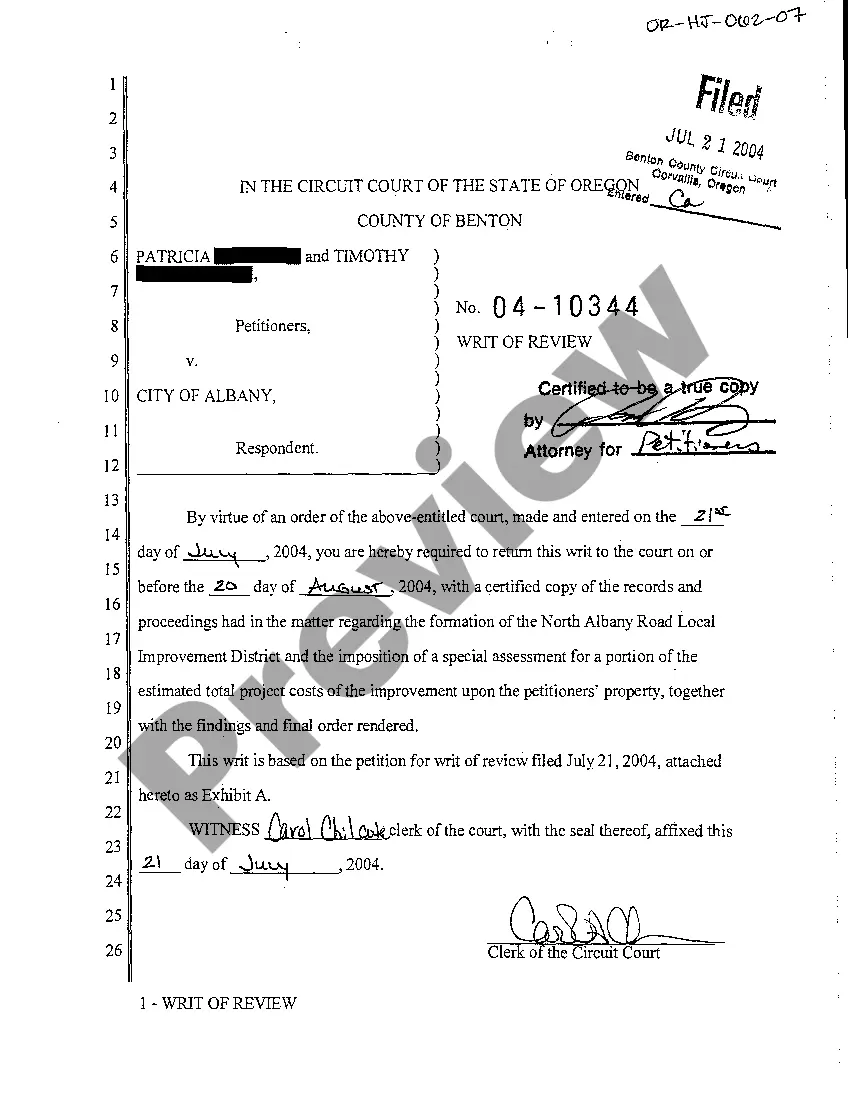

Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2): This is an official form from the Colorado State Judicial Branch, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Colorado statutes and law.

Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2)

Description Jdf1125

How to fill out Colorado Mandatory Disclosure Form 35.1 - Reference To 16.2 (e)(2)?

The more paperwork you need to make - the more stressed you feel. You can find a huge number of Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) blanks on the internet, nevertheless, you don't know those to trust. Remove the headache and make getting exemplars easier with US Legal Forms. Get skillfully drafted documents that are published to satisfy state specifications.

If you already possess a US Legal Forms subscribing, log in to the account, and you'll find the Download option on the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2)’s web page.

If you’ve never tried our website earlier, finish the signing up procedure with the following recommendations:

- Check if the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) is valid in your state.

- Re-check your option by studying the description or by using the Preview mode if they’re provided for the selected record.

- Click on Buy Now to begin the registration procedure and choose a costs program that meets your needs.

- Provide the asked for info to make your profile and pay for the order with the PayPal or credit card.

- Select a hassle-free file type and have your copy.

Access every sample you obtain in the My Forms menu. Simply go there to produce a new duplicate of your Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2). Even when having expertly drafted forms, it’s still vital that you think about asking the local legal representative to double-check completed sample to ensure that your record is correctly filled in. Do more for less with US Legal Forms!

Rule 35 1 Form popularity

Mandatory Disclosure Colorado Other Form Names

FAQ

In Colorado, the seller is primarily responsible for completing the seller's property disclosure form. This obligation ensures that sellers provide all relevant information about the property's condition and any issues that might affect its value. By fulfilling this requirement, sellers adhere to the standards of the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2). This promotes a fair and informed transaction process for all parties involved.

The Colorado dual status disclosure form must be utilized whenever a licensee represents both the buyer and seller in a transaction. It ensures that all parties are aware of the dual representation and its implications. Proper use of this form fosters trust and transparency, which is vital in real estate transactions. This practice aligns with the guidelines set forth in the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2).

The Colorado change of status form must be completed promptly whenever there is a change in the relationship between the licensee and the parties involved. This could occur if the licensee transitions from being a buyer's agent to a seller's agent, for instance. Timely completion helps in maintaining clear communication and understanding among all parties. This is crucial in adhering to regulations such as the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2).

A Colorado licensee must disclose any material facts that could influence a party's decision to buy or sell a property. This includes details about property condition, potential hazards, and financial obligations associated with the property. The aim is to provide a clear and honest representation to all involved. This requirement is outlined in the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2), ensuring that all parties are fully informed.

The timeframe for disclosing the Colorado dual status disclosure depends on the specific transaction. Generally, it should be presented to all parties right after contract acceptance. This ensures that everyone involved understands the dual agency relationships, promoting transparency. By adhering to this timeline, you comply with the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2).

The JDF 1111 SS is a specific form used in Colorado that relates to financial disclosures during divorce proceedings. This form serves as a standardized financial statement designed to facilitate fair settlements. Including the JDF 1111 SS along with the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) can help you comply with state regulations and streamline your financial disclosure process.

Sworn financial statements are legal documents that declare your financial status under oath. These statements list your income, expenses, assets, and liabilities, providing a complete picture for the court. It is crucial to present truthful and comprehensive information to avoid legal repercussions. The Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) typically requires such sworn statements to uphold transparency.

Filling out a financial statement for divorce requires gathering all your financial documents. You need to include details on income, expenses, assets, and debts. Make sure to accurately reflect your financial situation, as this will be essential for legal purposes. Utilizing the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2) can simplify this process, ensuring you meet state requirements.

Mandatory disclosures in financial statements are essential pieces of information that accompany financial reports, providing insight into the financial health of the parties involved. These disclosures may include details about outstanding liabilities, assets, and any contingent liabilities. Under the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2), these disclosures help maintain fairness and transparency in legal proceedings.

Financial disclosure requirements dictate the types of financial information individuals need to reveal during legal proceedings. These requirements ensure transparency and can vary by case type. For cases involving the Colorado Mandatory Disclosure Form 35.1 - Reference to 16.2 (e)(2), parties must adhere to specific guidelines that define what financial data must be disclosed.