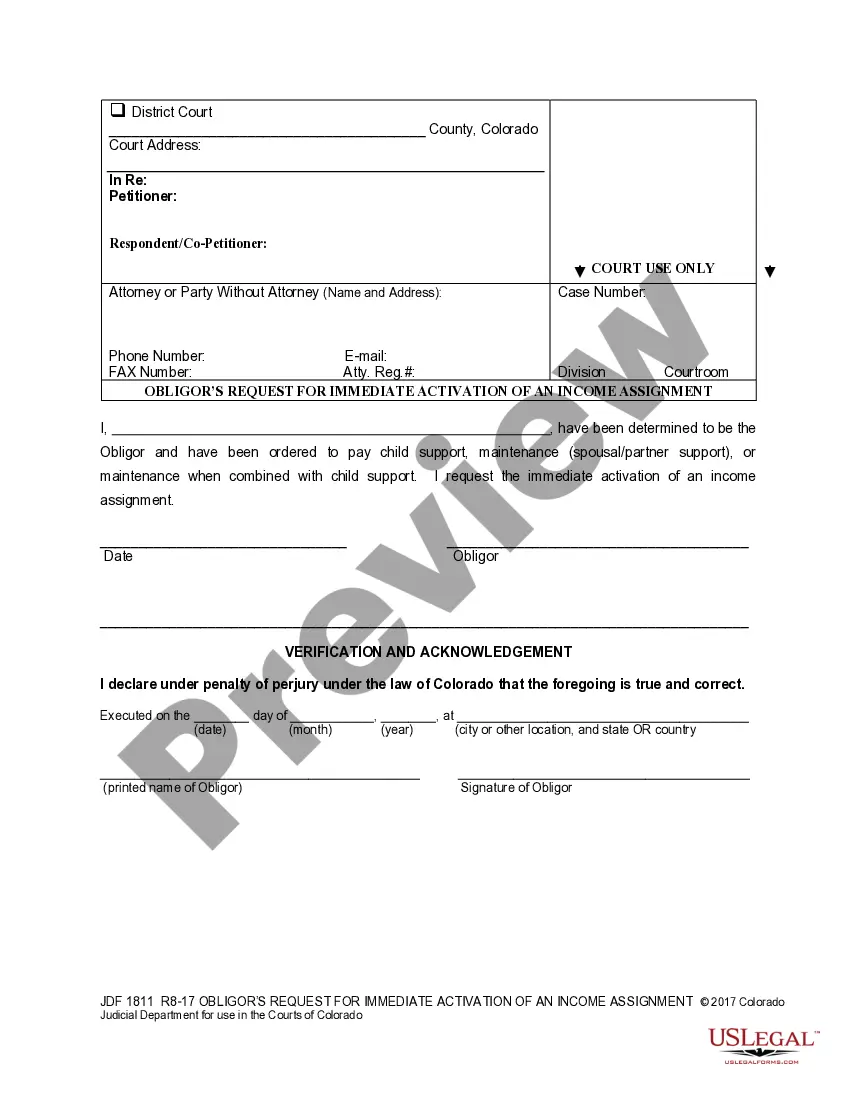

Colorado Obligor's Request for Immediate Activation of an Income Assignment

Description

How to fill out Colorado Obligor's Request For Immediate Activation Of An Income Assignment?

The more documents you need to create - the more stressed you become. You can get thousands of Colorado Obligor's Request for Immediate Activation of an Income Assignment blanks on the internet, however, you don't know which of them to rely on. Get rid of the headache and make getting exemplars less complicated with US Legal Forms. Get accurately drafted documents that are composed to meet state requirements.

If you currently have a US Legal Forms subscribing, log in to the account, and you'll see the Download option on the Colorado Obligor's Request for Immediate Activation of an Income Assignment’s page.

If you have never used our service earlier, complete the registration procedure using these recommendations:

- Make sure the Colorado Obligor's Request for Immediate Activation of an Income Assignment applies in the state you live.

- Double-check your choice by reading the description or by using the Preview functionality if they are available for the selected record.

- Simply click Buy Now to begin the registration procedure and select a pricing program that meets your needs.

- Provide the asked for details to create your account and pay for the order with your PayPal or credit card.

- Select a prefered document structure and get your example.

Find each document you get in the My Forms menu. Simply go there to fill in fresh version of your Colorado Obligor's Request for Immediate Activation of an Income Assignment. Even when using properly drafted web templates, it’s still essential that you think about requesting the local lawyer to twice-check filled out form to make sure that your record is correctly completed. Do more for less with US Legal Forms!

Form popularity

FAQ

Colorado-source income includes any income derived from sources within Colorado including, but not limited to: (a)Ownership of Real or Tangible Personal Property.

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

However, verify the refund amount you have entered and verify that you are using the primary SSN for the refund. If it's still not showing anything, you may contact customer service at 1-303-238-7378, Monday through Friday, 8 a.m. to p.m. or contact the Colorado Department of Revenue.

To check the status of your Colorado state refund online, go to https://www.colorado.gov/revenueonline/. There is no need to login. Simply choose the option Check the Status of Your Refund under Welcome to Revenue Online.

Colorado has a flat income tax rate of 4.63%.

DENVER (KDVR) The Colorado Department of Revenue announced Thursday that it will extend the individual income tax payment and filing deadline.Individuals now have the option to postpone any 2020 income tax payments due on April 15, 2021 to May 17, 2021 without penalties and interest, regardless of the amount owed.

Find out if Your Tax Return Was Submitted Using the IRS Where's My Refund tool. Viewing your IRS account information. Calling the IRS at 1-800-829-1040 (Wait times to speak to a representative may be long.) Looking for emails or status updates from your e-filing website or software.

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or.

You can check the status of your refund on Revenue Online. There is no need to login. Simply choose the option "Tax Refund for Individuals" in the box labeled "Where's my Refund?". Then, enter your SSN or ITIN and the refund amount you claimed on your current year income tax return.