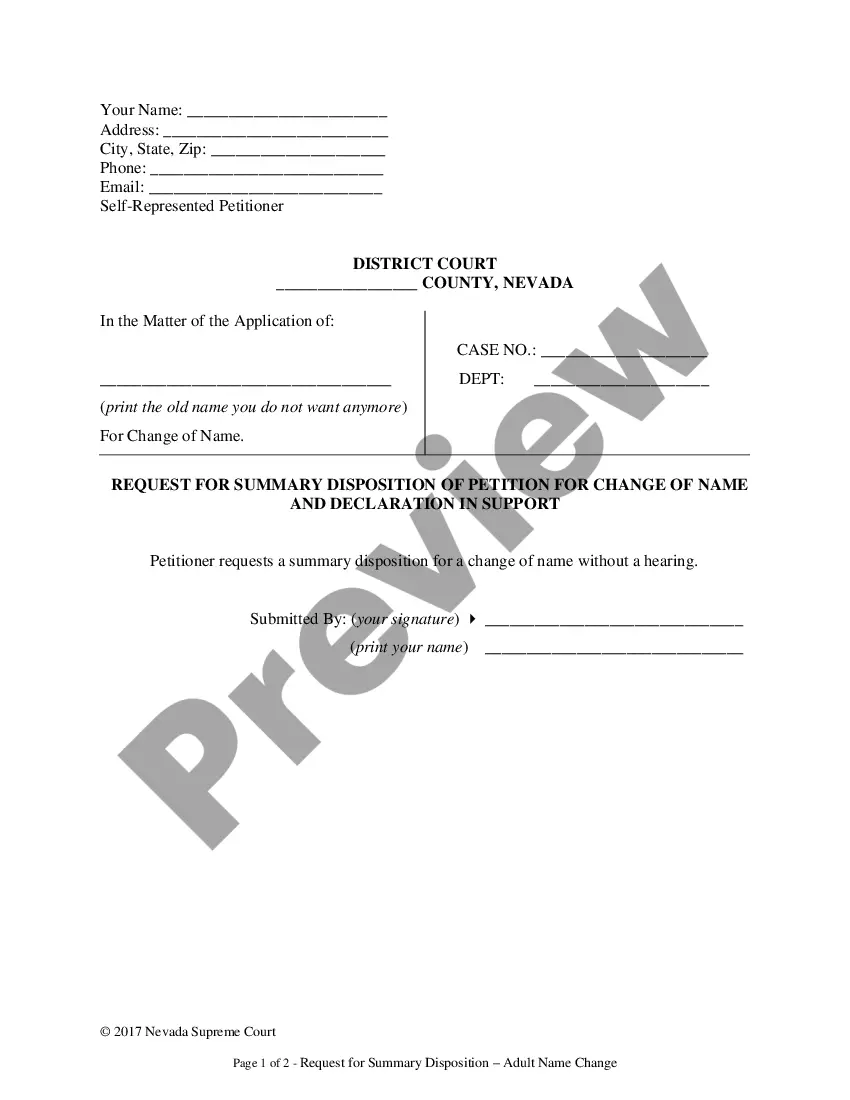

This is an official state court form used to object to an action sceduled to take place at a non-appearance hearing.

Colorado Objection to Hearing without Appearance - Probate

Description

How to fill out Colorado Objection To Hearing Without Appearance - Probate?

The greater number of documents you should create - the more stressed you become. You can get a huge number of Colorado Objection to Non-Appearance Hearing blanks online, nevertheless, you don't know those to trust. Eliminate the headache to make finding exemplars more straightforward employing US Legal Forms. Get professionally drafted forms that are published to go with the state demands.

If you currently have a US Legal Forms subscribing, log in to the account, and you'll see the Download key on the Colorado Objection to Non-Appearance Hearing’s web page.

If you have never used our website before, complete the sign up process using these directions:

- Ensure the Colorado Objection to Non-Appearance Hearing applies in your state.

- Double-check your selection by reading the description or by using the Preview function if they are provided for the selected file.

- Click on Buy Now to begin the signing up process and select a pricing plan that suits your expectations.

- Insert the asked for data to create your profile and pay for the order with the PayPal or credit card.

- Pick a handy document formatting and get your example.

Access each file you obtain in the My Forms menu. Simply go there to fill in fresh version of your Colorado Objection to Non-Appearance Hearing. Even when preparing properly drafted forms, it’s nevertheless essential that you think about asking the local attorney to double-check completed form to be sure that your document is accurately completed. Do much more for less with US Legal Forms!

Form popularity

FAQ

Yes, probate can be avoided in Colorado through various estate planning strategies. For instance, joint ownership of property, beneficiary designations, and trusts can help bypass probate. Additionally, utilizing a Colorado Objection to Hearing without Appearance - Probate can assist individuals in managing their estates while reducing the likelihood of probate complications. Embracing these strategies promotes smoother transitions and can simplify your estate management.

Rule 62 outlines the requirements for filing objections in Colorado probate cases. It specifies the procedure for individuals who wish to contest a probate matter without being present at a hearing. This rule supports the use of a Colorado Objection to Hearing without Appearance - Probate, allowing parties to express their concerns effectively. Understanding this rule can be crucial for those involved in probate proceedings.

One effective method to avoid probate in Colorado is by creating a living trust. A living trust allows you to transfer your assets into the trust while you are alive. Thus, upon your death, the assets in the trust do not have to go through the probate process. Utilizing a Colorado Objection to Hearing without Appearance - Probate can provide guidance on navigating the complexities of this process.

Assets that do not go through probate include retirement accounts, life insurance policies, and jointly owned properties. These assets pass directly to beneficiaries or surviving owners, bypassing the probate process. Understanding these types of assets can help clarify your estate strategy and reduce occurrences of a Colorado Objection to Hearing without Appearance - Probate.

Not all estates are required to go through probate in Colorado. Small estates, typically valued under a certain threshold, can often be settled without probate. If your estate qualifies, it can simplify the process for your heirs and avoid the need for a Colorado Objection to Hearing without Appearance - Probate, allowing them to access assets quicker.

To avoid probate in Colorado, consider using tools like living trusts, joint ownership, and beneficiary designations. By effectively structuring your estate, you can transfer assets without undergoing the probate process. It's essential to consult with professionals who understand Colorado law to ensure your estate is properly arranged, especially if you wish to prevent a Colorado Objection to Hearing without Appearance - Probate.

Non-probate assets in Colorado include items such as bank accounts with payable-on-death designations and trusts. These assets bypass the probate process and go directly to the designated beneficiaries. Knowing which of your assets are non-probate can significantly streamline the estate settlement process, potentially avoiding complications like a Colorado Objection to Hearing without Appearance - Probate.

In Colorado, certain assets are exempt from probate. For example, jointly owned property with right of survivorship automatically passes to the surviving owner. Additionally, life insurance policies and retirement accounts with designated beneficiaries are not subject to probate. Understanding these exemptions can ease the process of managing your estate and may reduce the need for a Colorado Objection to Hearing without Appearance - Probate.

In Colorado, an estate must exceed $66,000 in value to enter probate proceedings if there is a will. Estates valued below this threshold may qualify for simplified procedures. For those without a will, the threshold is lower. Leveraging a Colorado Objection to Hearing without Appearance - Probate can help clarify the process for smaller estates and ensure proper handling of your assets.

To avoid probate in Colorado, you can use strategies such as establishing a living trust or designating beneficiaries for your accounts. You could also consider joint ownership of property which can pass directly to the co-owner upon death. Each of these methods can simplify the transfer of assets, minimizing delays. Utilizing a Colorado Objection to Hearing without Appearance - Probate is another method that can ensure your wishes are respected in a non-invasive way.