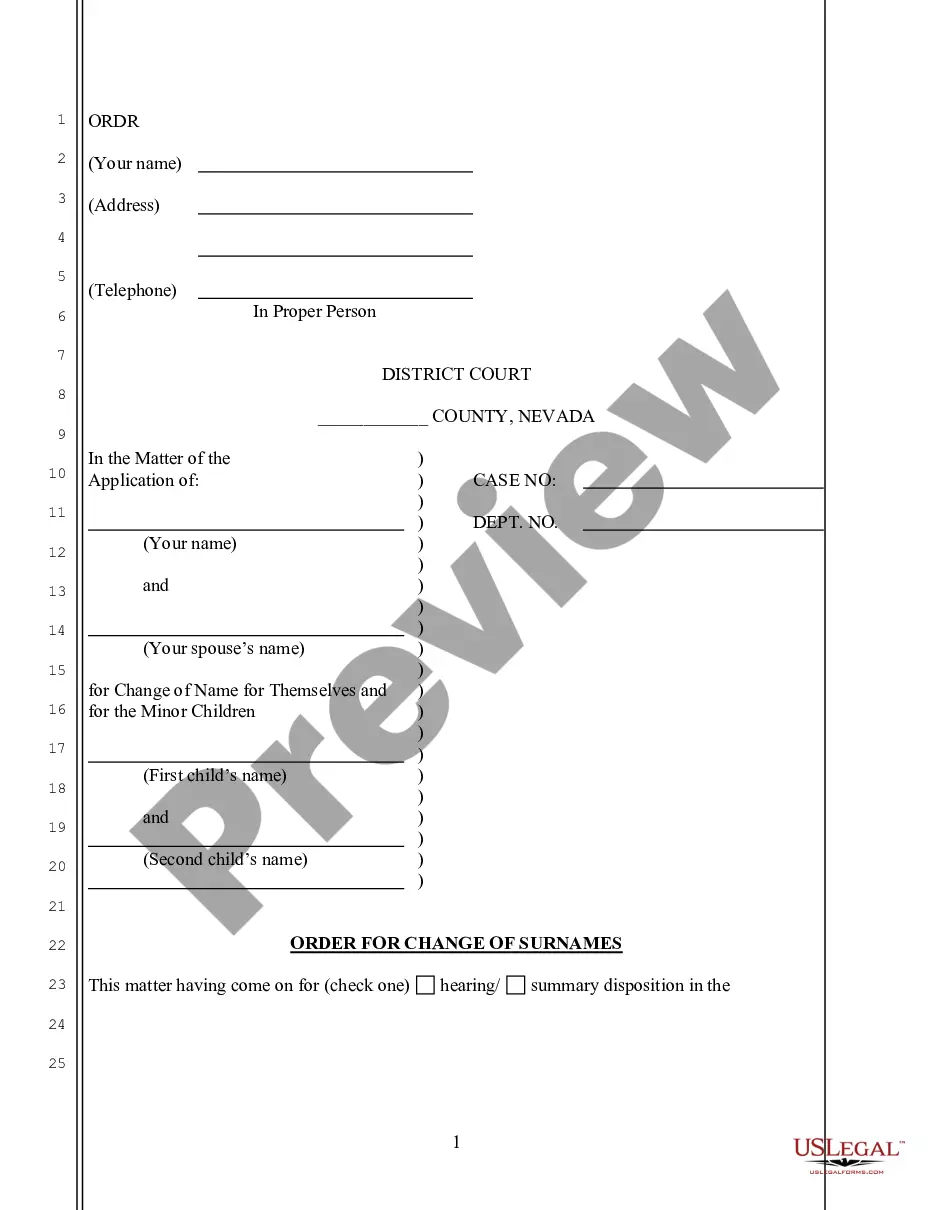

This form is used to help establish a trust. The undersigned trustee acknowledges the existence of this trust and submits to the jurisdiction of the court in any proceeding relating to this trust. File this Registration Statement in the county where the trust is being administered pursuant to ?§15-16-101(1), C.R.S. For further requirements, see ?§15-11-901, C.R.S. and ?§15-16-101, C.R.S. and Colorado Rules of Probate Procedure Rule 8.6.

Colorado Trust Registration Statement

Description Trust Registration Forms

How to fill out Colorado Trust Registration Statement?

The greater number of paperwork you have to make - the more anxious you feel. You can find thousands of Colorado Trust Registration Statement blanks on the web, nevertheless, you don't know those to rely on. Remove the hassle and make getting samples easier with US Legal Forms. Get accurately drafted forms that are published to satisfy state specifications.

If you already possess a US Legal Forms subscribing, log in to the account, and you'll find the Download option on the Colorado Trust Registration Statement’s web page.

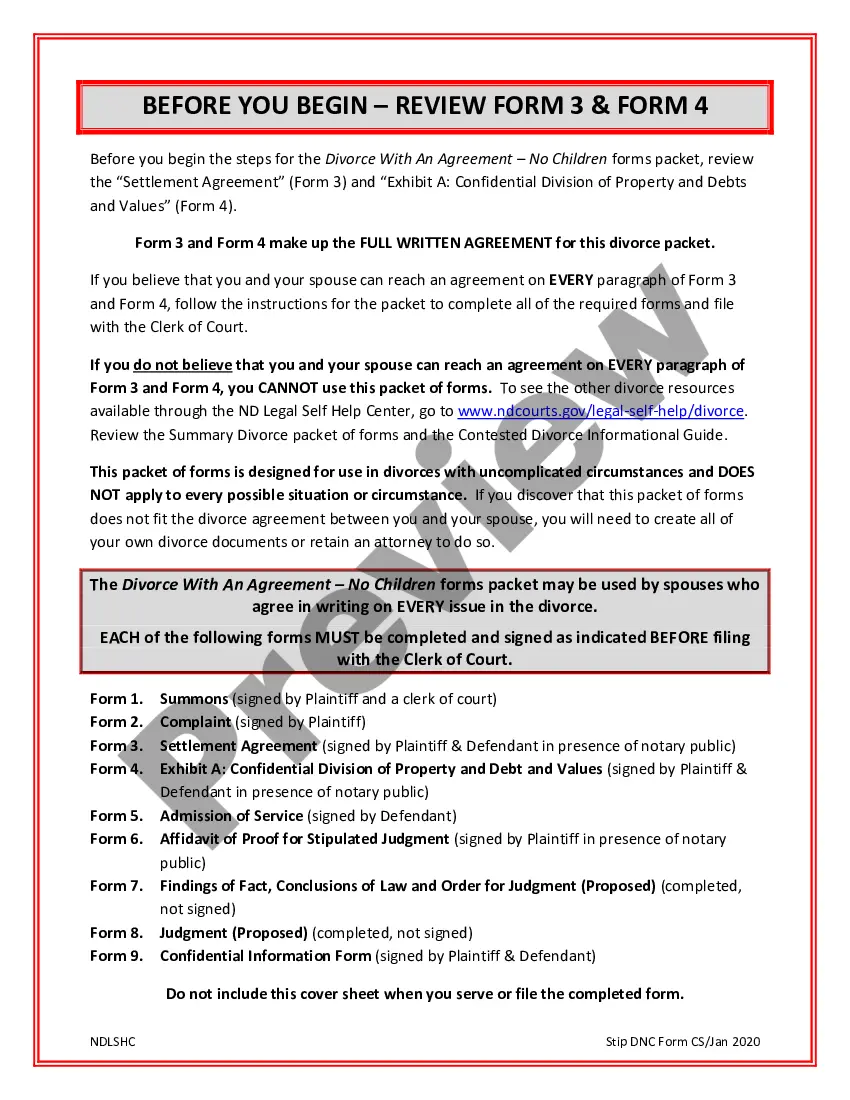

If you’ve never tried our website before, complete the registration procedure using these steps:

- Check if the Colorado Trust Registration Statement applies in the state you live.

- Re-check your selection by reading through the description or by using the Preview mode if they are available for the chosen record.

- Click Buy Now to begin the sign up procedure and choose a pricing program that meets your requirements.

- Insert the requested info to create your profile and pay for your order with your PayPal or credit card.

- Choose a practical document format and have your copy.

Find each document you download in the My Forms menu. Simply go there to fill in new copy of your Colorado Trust Registration Statement. Even when having expertly drafted forms, it is nevertheless crucial that you think about asking the local lawyer to re-check filled in sample to be sure that your document is correctly filled out. Do much more for less with US Legal Forms!

Form popularity

FAQ

In Colorado, a trust does not necessarily need to be notarized to be valid, but notarization can offer additional legal protection. Notarizing your trust documents can help confirm their authenticity and may simplify the process of proving the trust's validity later. Consider using a platform like USLegalForms to streamline this process and ensure all legal requirements are met.

No, a trust generally does not need to be registered in Colorado. Trusts can operate without formal registration, but specific situations might require additional documentation. For clarity and proper administration, filing a Colorado Trust Registration Statement can be helpful, especially for significant assets.

In most cases, you do not need to register your trust in Colorado. However, if your trust has income-generating assets or complex structures, considering a Colorado Trust Registration Statement may be beneficial. Always consult with a legal expert to assess your specific needs and ensure you meet any applicable requirements.

One common mistake parents make when establishing a trust fund is failing to properly fund the trust with assets. If you do not place assets into the trust, it cannot serve its purpose effectively. It is vital to complete a Colorado Trust Registration Statement and ensure that the trust is funded to provide the intended support for your beneficiaries.

Colorado does not have a specific statute mandating trust registration for all trusts. However, certain types of trusts, especially those that generate income, may have specific filing requirements. Understanding these regulations and possibly filing a Colorado Trust Registration Statement can help you navigate compliance more effectively.

In Colorado, a trust does not need to be officially recorded like a deed. However, it is recommended to keep a well-documented record of the trust and any changes made to it. Filing a Colorado Trust Registration Statement can further ensure your trust is recognized and administratively sound, especially for complex assets.

Placing your house in a trust in Colorado can provide significant advantages, including avoiding probate and maintaining privacy. It allows for easier management of your property and can simplify the transfer of assets to beneficiaries. If you're considering this, preparing the necessary Colorado Trust Registration Statement can help formalize the process.

To register a revocable trust in Colorado, you typically do not need to complete formal registration but must keep detailed documentation. Creating a Colorado Trust Registration Statement can help clarify your intentions and details about the trust. Using services like USLegalForms can simplify the documentation process and ensure compliance with state requirements.

Generally, a Colorado trust return must be filed by the trustee if the trust generates income that exceeds specified thresholds. This return reports the income earned by the trust to the Colorado Department of Revenue. If you're unsure about your filing obligations, consulting with a tax professional or using platforms like USLegalForms can provide clear guidance.

The requirement for trust registration varies by state. While Colorado does not require all trusts to be registered, some states mandate the registration of certain trusts for tax purposes or asset protection. Researching the specific regulations related to trust registration, including the Colorado Trust Registration Statement, is crucial if you have assets in multiple states.