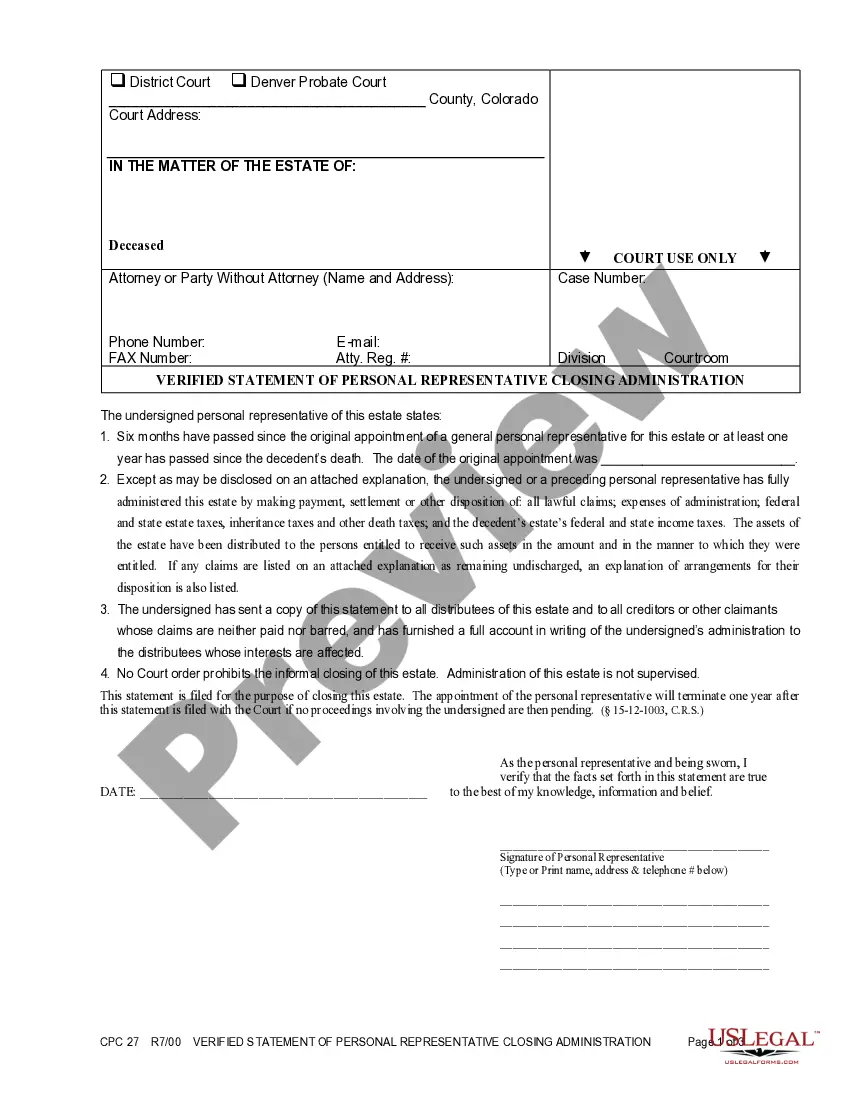

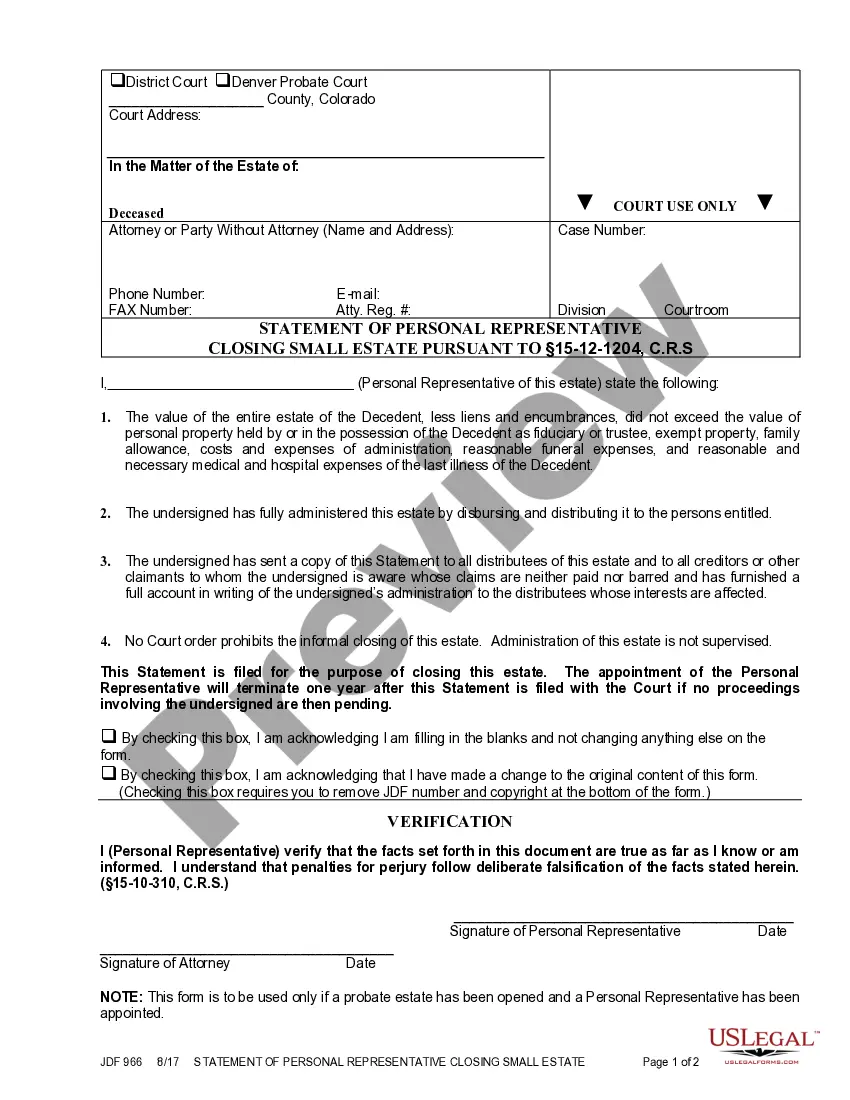

Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S

Description

How to fill out Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S?

The greater the documentation you must complete - the more anxious you get.

You can discover countless Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S templates on the internet, but you are unsure which ones to trust.

Remove the inconvenience and simplify finding examples with US Legal Forms. Obtain expertly crafted documents intended to meet state requirements.

Enter the required information to create your account and finalize the purchase with your PayPal or credit card. Choose a suitable document type and receive your example. Access each sample you obtain in the My documents section. Just go there to fill in a new copy of your Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S. Even with expertly prepared forms, it's still essential to consider consulting with a local attorney to review the completed form to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you will find the Download option on the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S webpage.

- If you have not utilized our website previously, follow these steps to complete the registration process.

- Ensure the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To §15-12-1204, C.R.S is applicable in your state.

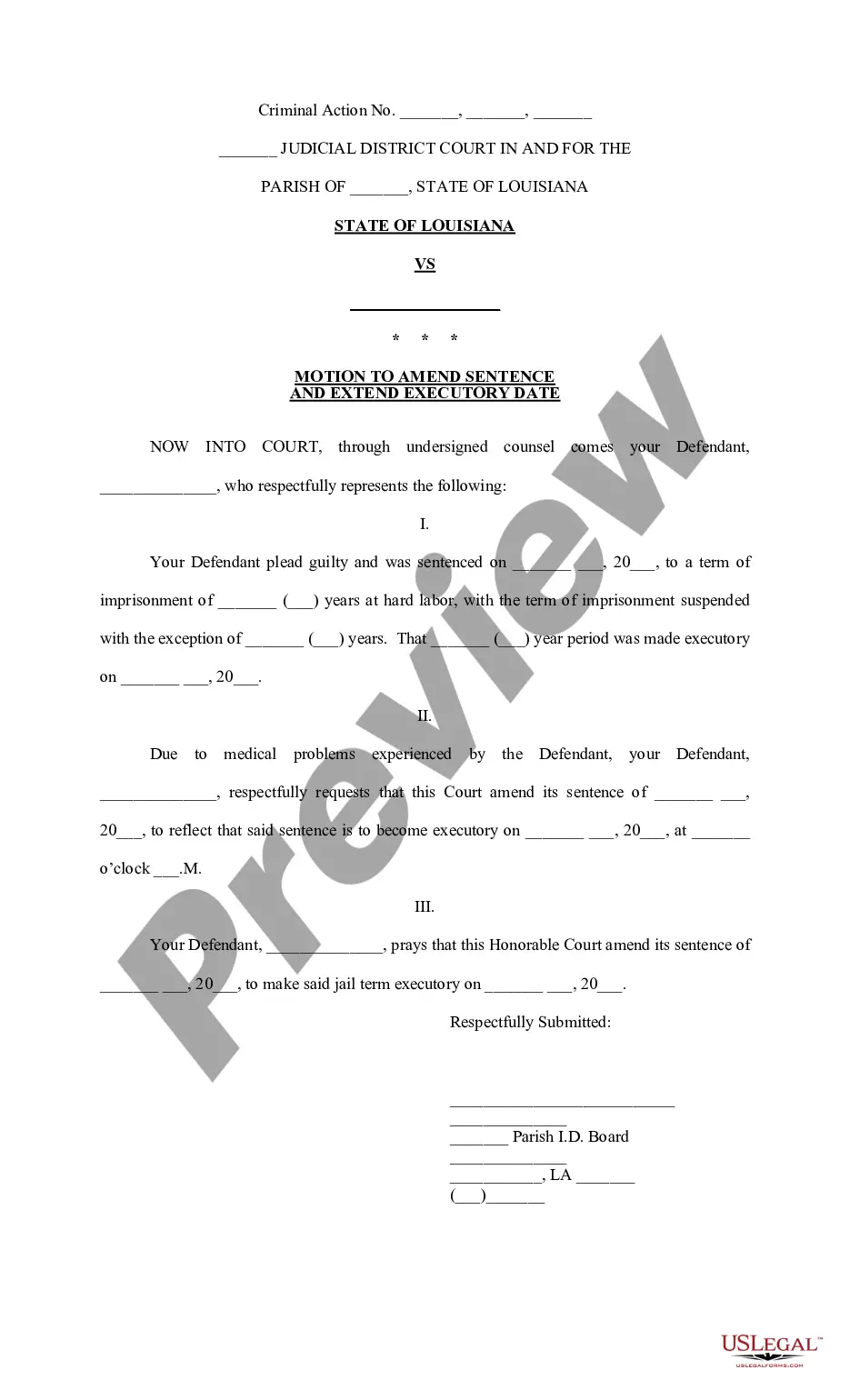

- Verify your decision by reading the description or by using the Preview feature if available for the selected document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that suits your needs.

Form popularity

FAQ

Executing a will in Colorado demands a few essential actions. First, ensure that the will complies with state laws—this includes making it in writing and signing it in front of two witnesses. Once executed properly, you should keep the original will in a secure place. When the time comes, the next steps can involve utilizing the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S., if applicable.

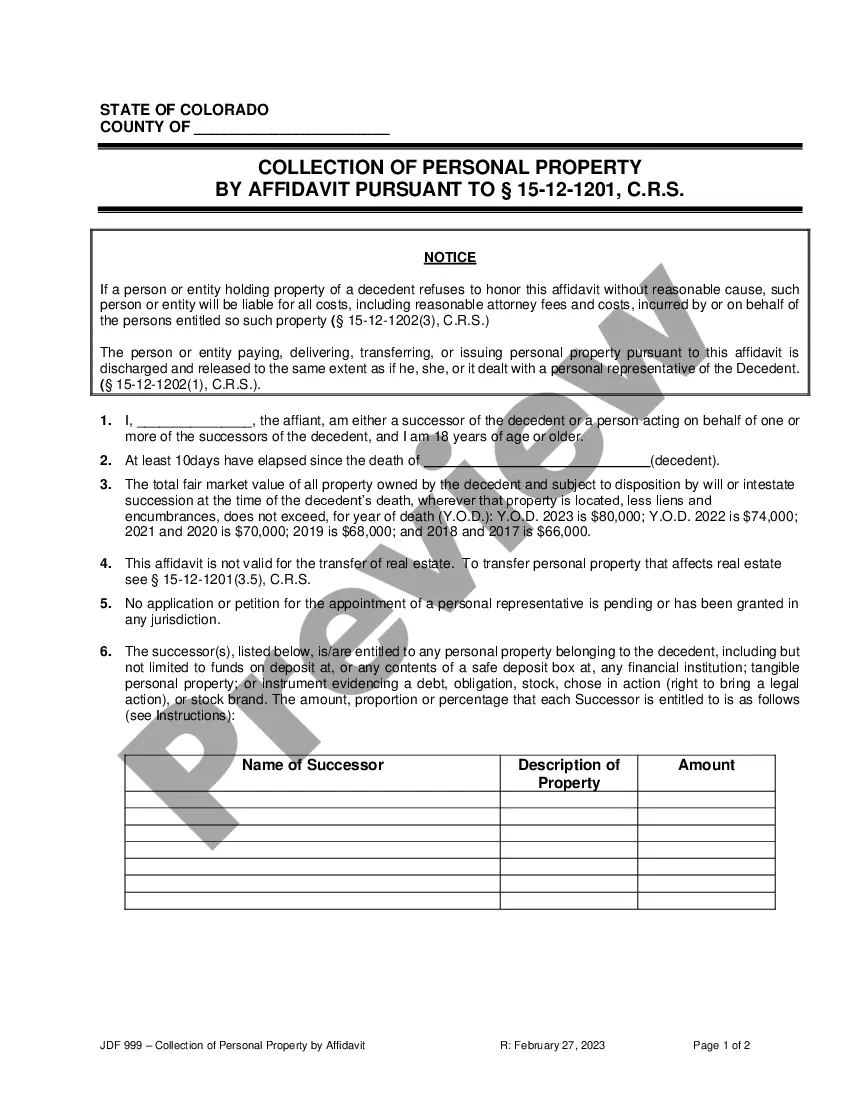

In Colorado, filing a will with the court is necessary only if you are initiating a probate case. If the total value of the estate is below a certain threshold, you may use the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S. This allows you to bypass the probate process entirely, streamlining estate management for smaller estates.

To close an estate in Colorado, you generally need to file a petition with the court and fulfill specific legal requirements. The process often involves providing a detailed inventory of the estate’s assets and liabilities. Once everything is evaluated, you can apply for the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S., which simplifies the closing of smaller estates and minimizes court involvement.

In Colorado, executing a will requires adhering to specific guidelines. The person creating the will, known as the testator, must be of sound mind and at least 18 years old. Additionally, the will must be in writing, signed by the testator, and witnessed by at least two individuals. Meeting these criteria is crucial for the subsequent steps involving the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S.

The execution of a will in Colorado involves several key steps. First, the testator must sign the will, usually in the presence of two witnesses. These witnesses must sign the will as well, affirming that they observed the testator's signature. Following this process ensures that the will is valid and paves the way for the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S.

To close a small estate in Colorado, you must first gather the necessary asset information and prepare the appropriate documentation. This includes completing the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S., and filing it with the probate court. Following these steps can simplify the process and ensure that the estate is settled in accordance with state laws.

A personal representative in Colorado holds significant authority, including managing the deceased's assets, paying debts, and distributing the remaining estate to beneficiaries. This person also has the responsibility of ensuring all necessary documents, like the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S., are filed properly and timely. It is crucial to understand these powers to fulfill the role effectively.

While hiring a lawyer is not legally required to close out an estate in Colorado, it can be beneficial, especially for complex cases. A lawyer can provide guidance on the required documents and help avoid legal pitfalls. Many find that resources, like the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S., can simplify the process and reduce the need for legal assistance.

In Colorado, the value of a small estate is capped at $70,000. This amount excludes specific exempt assets such as real property and certain personal items. Understanding this limit is vital when determining your eligibility for the simplified probate process. By following the procedures outlined in the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S., you can navigate this process effectively.

The time required to close an estate in Colorado can vary significantly, ranging from a few months to longer, depending on various factors such as asset complexity and beneficiary disputes. Generally, if the estate is small and straightforward, the process can be expedited. Utilizing the Colorado Statement Of Personal Representative Closing Small Estate Pursuant To Sec.15-12-1204, C.R.S. can aid in making this journey more efficient.