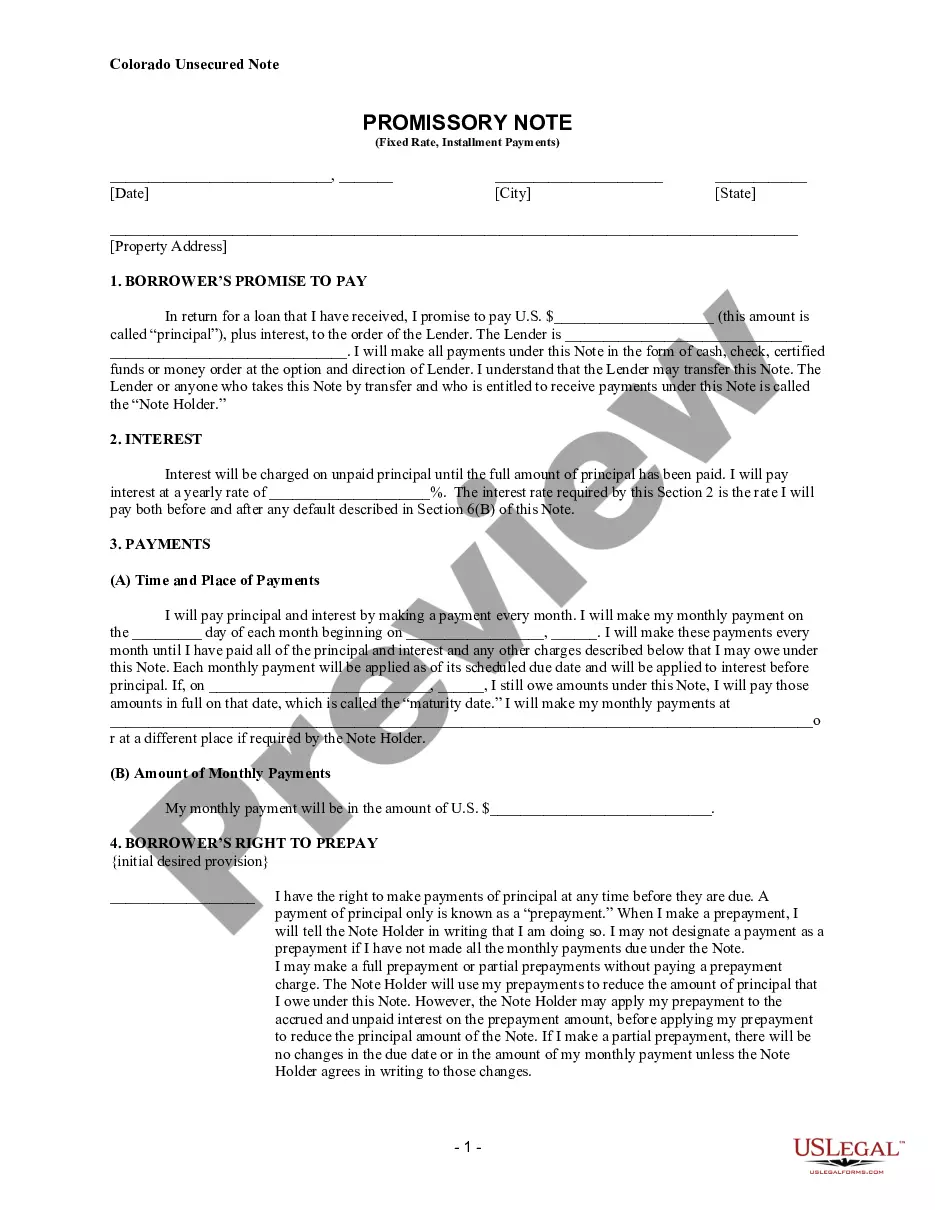

Colorado Unsecured Installment Payment Promissory Note for Fixed Rate

Description Promissory Note For School

How to fill out Promissory Note In Tuition Fee?

The more papers you should create - the more stressed you become. You can find thousands of Colorado Unsecured Installment Payment Promissory Note for Fixed Rate templates online, however, you don't know those to have confidence in. Get rid of the headache to make finding exemplars more convenient using US Legal Forms. Get accurately drafted forms that are composed to go with the state requirements.

If you already have a US Legal Forms subscribing, log in to the account, and you'll find the Download button on the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate’s page.

If you’ve never applied our platform before, complete the signing up process using these steps:

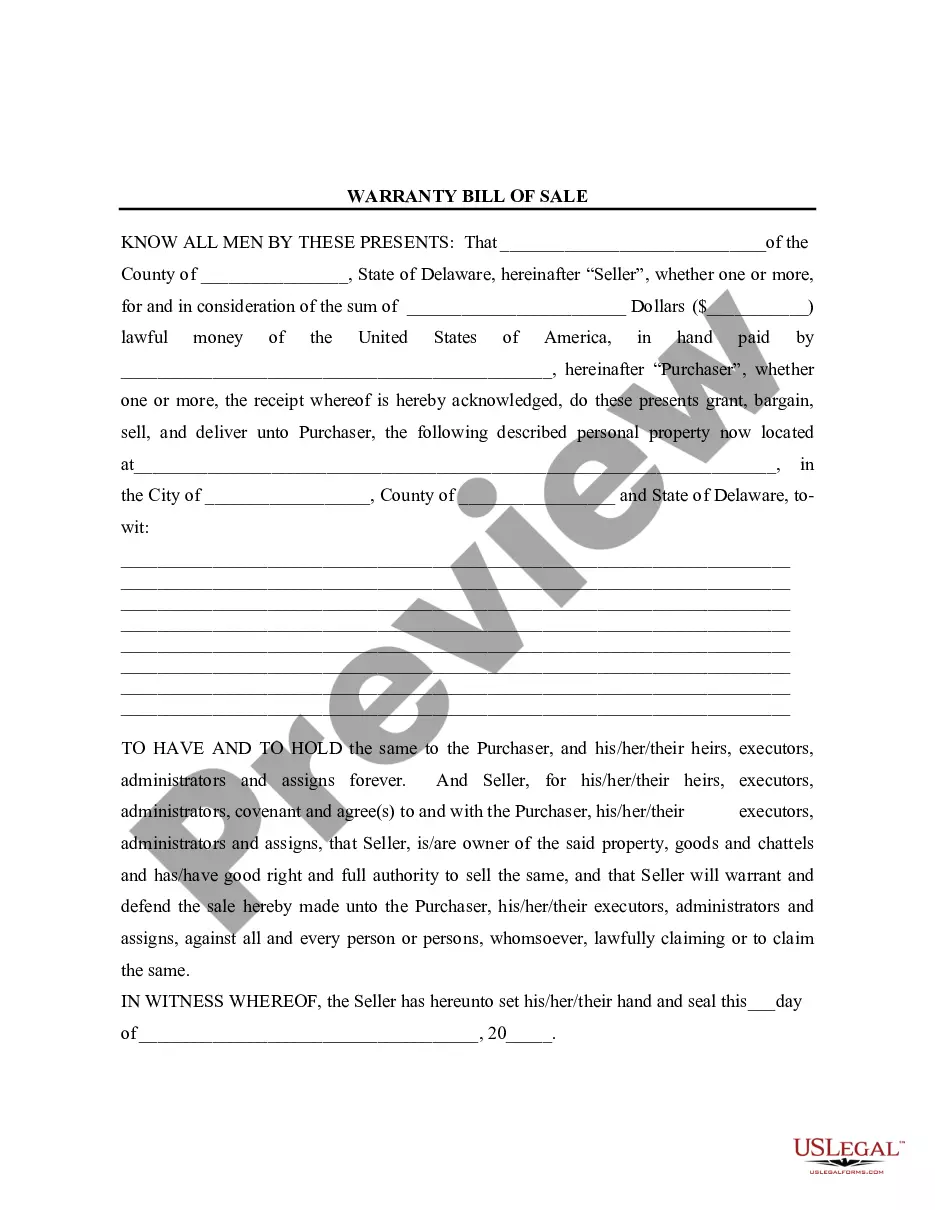

- Make sure the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is valid in the state you live.

- Re-check your decision by reading the description or by using the Preview function if they are provided for the selected document.

- Click on Buy Now to get started on the registration process and select a costs plan that fits your needs.

- Insert the asked for data to make your profile and pay for your order with your PayPal or bank card.

- Select a convenient document format and acquire your duplicate.

Find each document you get in the My Forms menu. Simply go there to produce a new duplicate of your Colorado Unsecured Installment Payment Promissory Note for Fixed Rate. Even when having properly drafted templates, it’s nevertheless crucial that you consider asking the local legal representative to twice-check filled out sample to make certain that your document is accurately completed. Do more for less with US Legal Forms!

Sample Of Promissory Note For School Tuition Fee Form popularity

Promissory Letter For School Tuition Fee Other Form Names

Installment Promissory Note FAQ

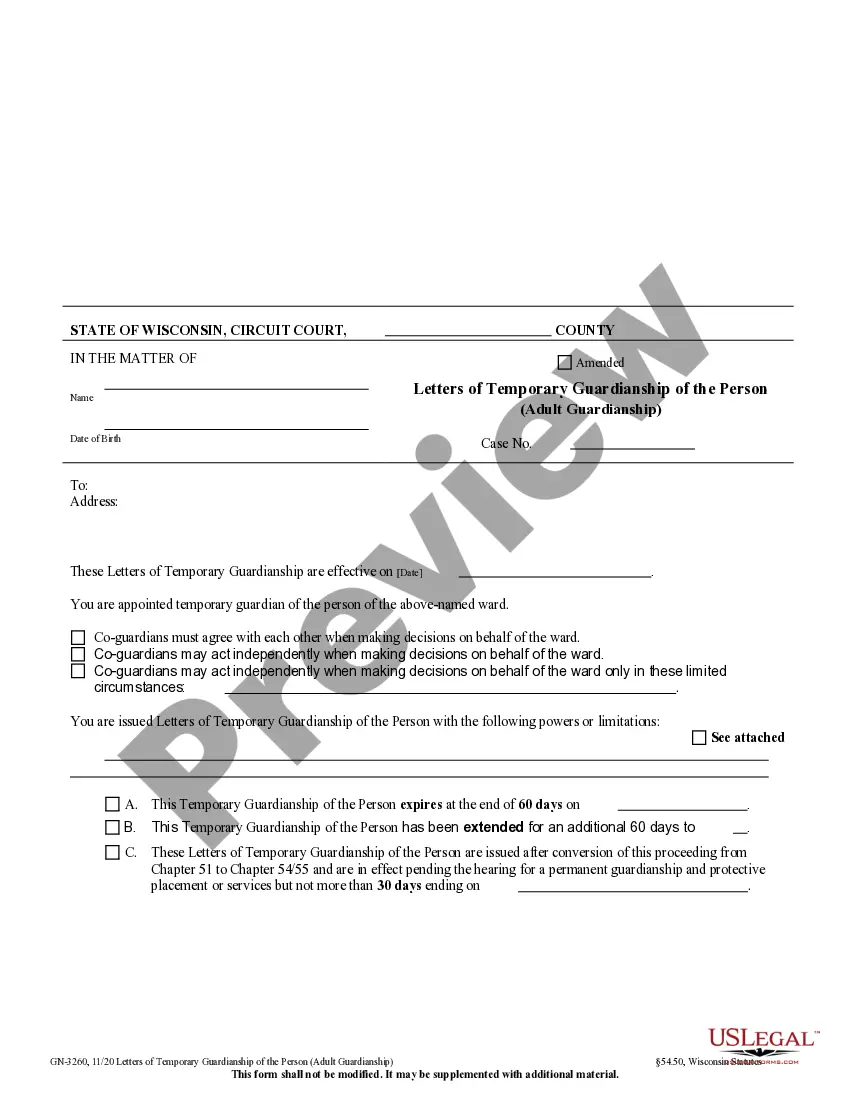

A note generally refers to any written document acknowledging a debt, while a promissory note specifically includes a borrower's commitment to repay that debt under certain conditions. Thus, all promissory notes are notes, but not all notes are promissory notes. The Colorado Unsecured Installment Payment Promissory Note for Fixed Rate stands out as a dedicated document that outlines specific repayment terms, aiding borrowers in organizing their finances.

An installment note typically involves a series of scheduled payments and outlines terms such as interest rates and payment intervals. On the other hand, a promissory note is broader and can exist without specifying any payment schedule. Thus, the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate is a specific form of a promissory note that incorporates installment payment features, making it easier to manage loans.

Legal requirements for a promissory note in Colorado include the necessity for the note to be written, signed by the borrower, and to clearly state the payment terms. The document should reflect that it is a debt obligation, and ideally, it should be clear and straightforward to avoid ambiguity. Using a structured Colorado Unsecured Installment Payment Promissory Note for Fixed Rate can assist in fulfilling these legal requirements effectively.

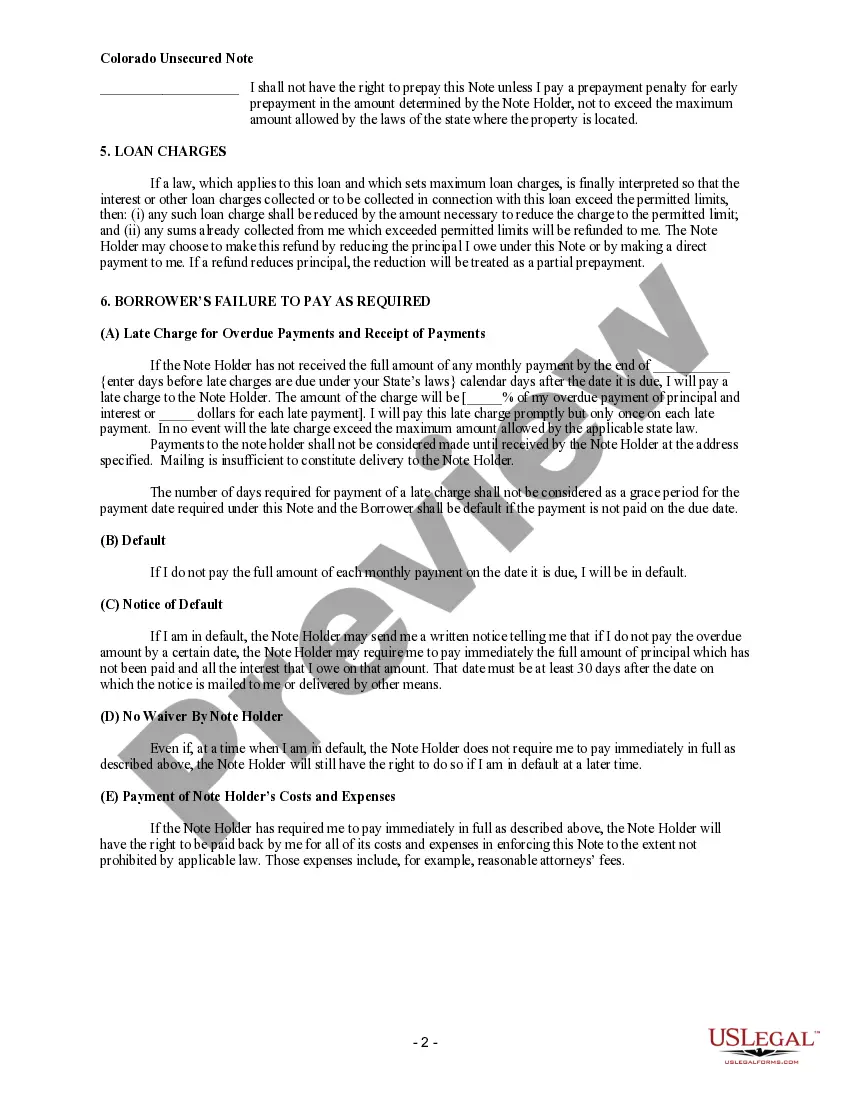

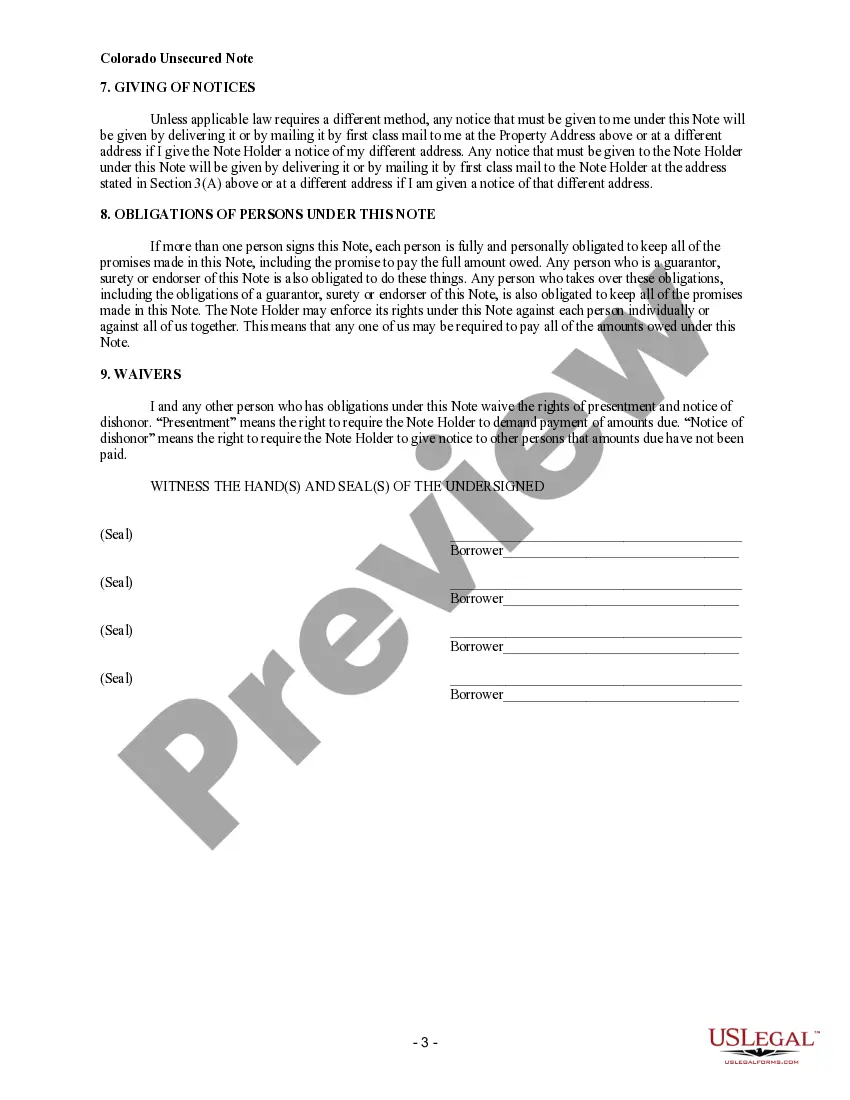

A comprehensive Colorado Unsecured Installment Payment Promissory Note for Fixed Rate should contain clear information such as the names of the parties involved, the amount being borrowed, the interest rate, and the repayment timeline. Furthermore, it should detail any penalties for late payments and the resolution process in case of default. Including these components ensures clarity and mutual understanding for all involved.

In Colorado, notarization of a promissory note is not specifically required for it to be valid. However, having a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate notarized may enhance its credibility and may be necessary for certain lenders. It serves to confirm the identity of the signer and can help in avoiding disputes in the future.

A promissory note can be deemed invalid for several reasons, such as missing critical information, lack of signatures, or if it contains illegal terms. Additionally, if the document does not meet Colorado's legal requirements, it could be challenged in court. To avoid these pitfalls, consider using a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate that complies with all necessary regulations.

Yes, a promissory note can be unsecured, meaning it does not require collateral from the borrower. This type of note relies heavily on the trust between the lender and borrower. For those exploring this option, a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate can provide a structured approach to managing payments while minimizing risk.

To obtain a copy of a promissory note, you should contact the lender or institution that issued the note. If the note is part of a larger agreement, it may also be filed with the county recorder's office. Utilizing the right templates, like the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate, can simplify the process of keeping accurate records for future reference.

In Colorado, a promissory note must contain specific elements to be legally valid. It should clearly state the amount being borrowed, the interest rate, and the payment schedule. Additionally, it must outline the borrower's obligations and include both signatures. Using a Colorado Unsecured Installment Payment Promissory Note for Fixed Rate can help ensure all of these details are accurately included.