Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Colorado Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

The greater the quantity of documents you are required to produce - the more anxious you become.

You can obtain numerous templates for the Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate online, yet you're unsure which ones to trust.

Eliminate the stress to simplify the process of locating samples with US Legal Forms. Acquire precisely formulated documents that meet state specifications.

Enter the necessary information to set up your account and complete your order using PayPal or a credit card. Choose a convenient document format and obtain your template. Access all samples you've downloaded in the My documents section. Simply navigate there to prepare a new copy of your Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Even with expertly crafted templates, it’s still wise to consider consulting your local attorney to review the completed form to ensure your document is correctly filled out. Achieve more for less with US Legal Forms!

- If you are currently a subscriber to US Legal Forms, Log In to your account, and you will find the Download option on the webpage for the Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

- If you haven't utilized our platform before, follow these steps to register.

- Verify that the Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate is applicable in your state.

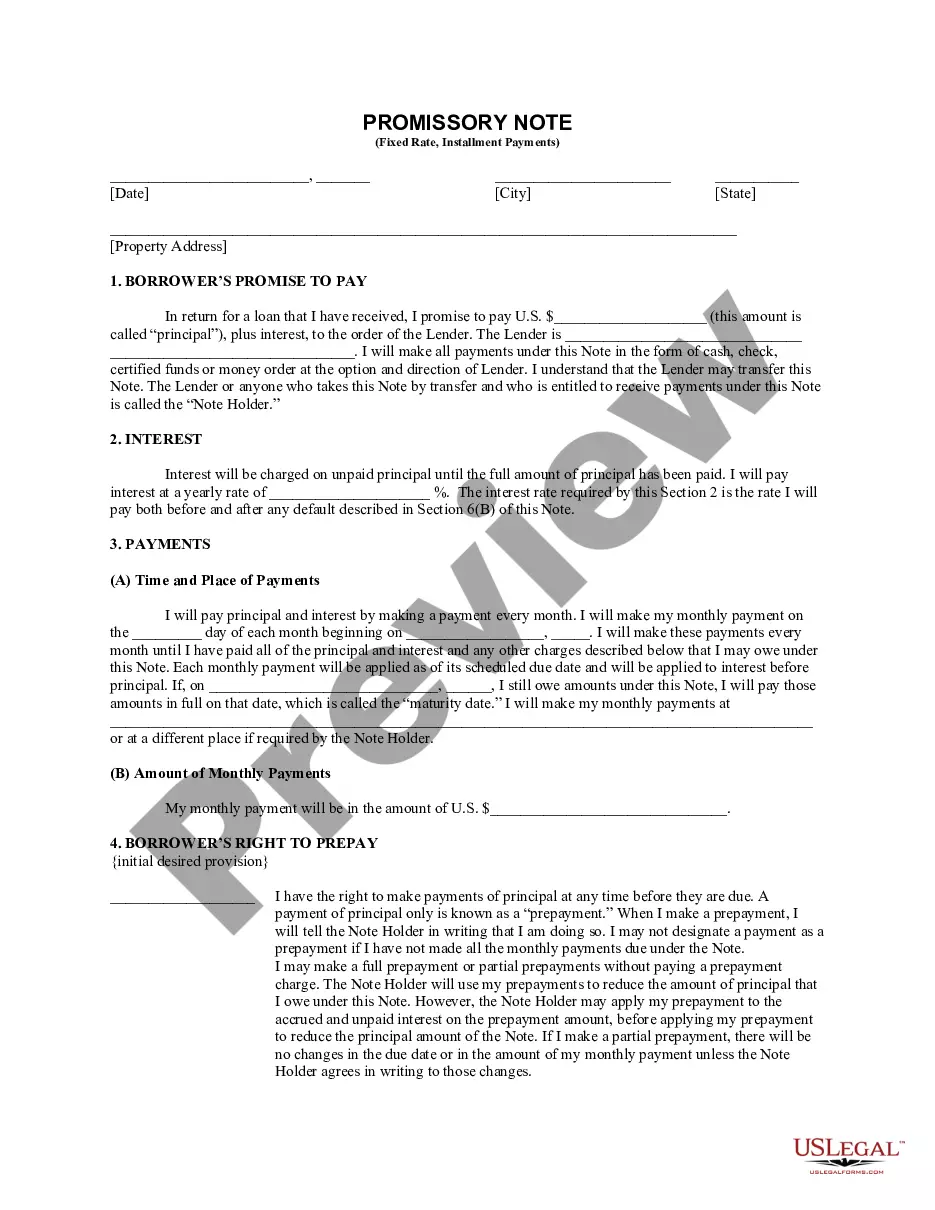

- Confirm your selection by reviewing the description or by using the Preview feature if it is available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that suits your requirements.

Form popularity

FAQ

To obtain a promissory note for your mortgage, you can start by contacting a lender or financial institution that specializes in real estate loans. They will guide you through the application process and provide you with the necessary documentation. Additionally, consider utilizing resources like USLegalForms, which can help you create a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate tailored to your specific needs.

A promissory note must contain the names of the borrower and lender, the principal amount, interest rate, and repayment schedule. It should also outline any penalties for late payments and the method of payment. When dealing with a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, including the collateral details is essential to safeguard the lender’s interests.

In Colorado, notarization of a promissory note is not strictly required for it to be valid. However, having the document notarized can enhance its credibility and may prove beneficial in case of disputes. For a more secure process, consider following the formalities recommended for a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

To fill out a promissory note, start by entering the date and names of the lender and borrower. Next, specify the amount borrowed and the repayment schedule, including any interest rates. For a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, detail the security provided to ensure the lender's rights are protected.

The legal requirements for a promissory note include the document being written, signed, and dated by the borrower. It should clearly indicate the payment terms and conditions. In the context of a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is vital to ensure compliance with state laws to guarantee enforceability.

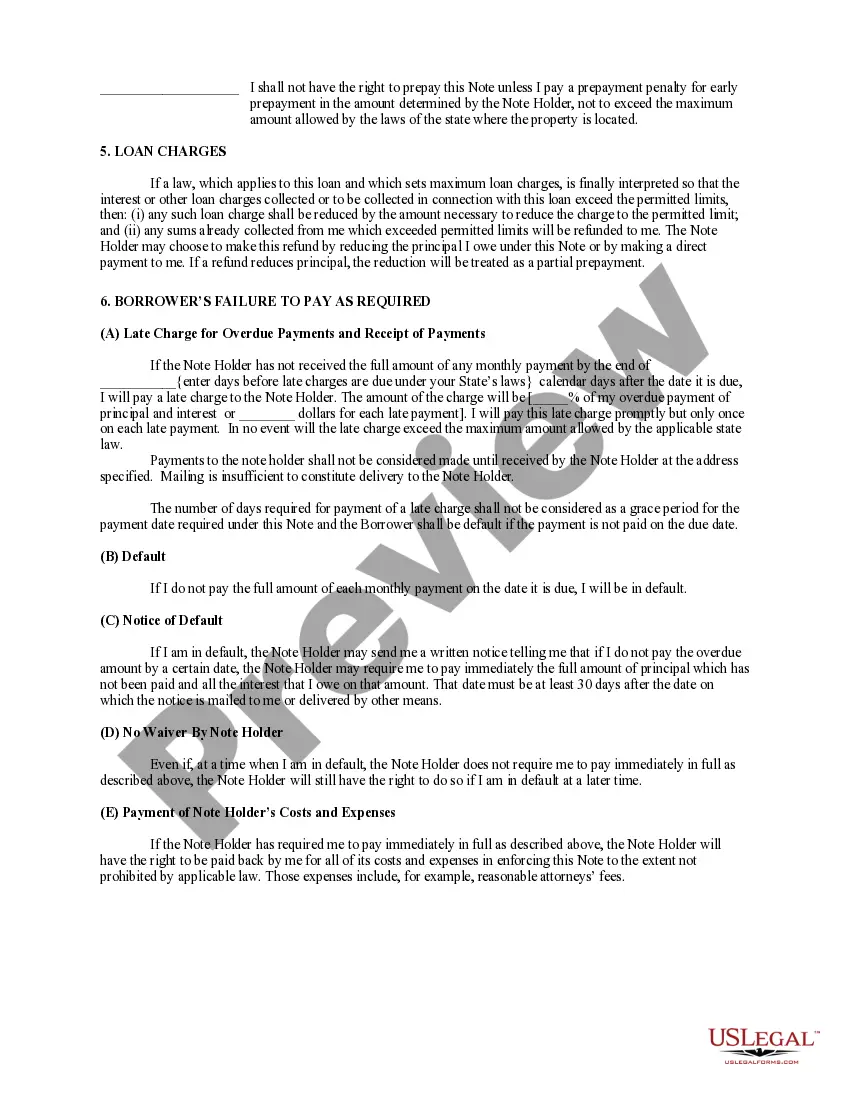

Yes, a promissory note can hold up in court if it meets specific legal requirements. When you create a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it serves as a legally binding document. Courts recognize it as an enforceable agreement as long as it includes clear terms and both parties' signatures. This makes it crucial to document all agreements accurately to protect your interests.

Promissory notes can indeed be backed by collateral, providing an added layer of security. For instance, a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate uses the property as collateral, thereby reducing the lender's risk. This arrangement benefits both parties, as it incentivizes timely repayments while also enabling the borrower access to funds.

Filing a promissory note generally does not require a formal filing process, but you can record it with the local county clerk or recorder. In the context of a Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it may also be wise to register the associated security interest. This enhances the document's legitimacy and helps protect the lender's rights.

To secure a promissory note with real property, you typically create a security agreement that links the note to the property in question. The Colorado Installments Fixed Rate Promissory Note Secured by Residential Real Estate becomes enforceable by placing a lien on the property. This process ensures that the lender has a claim against the property in case of default, providing added peace of mind.