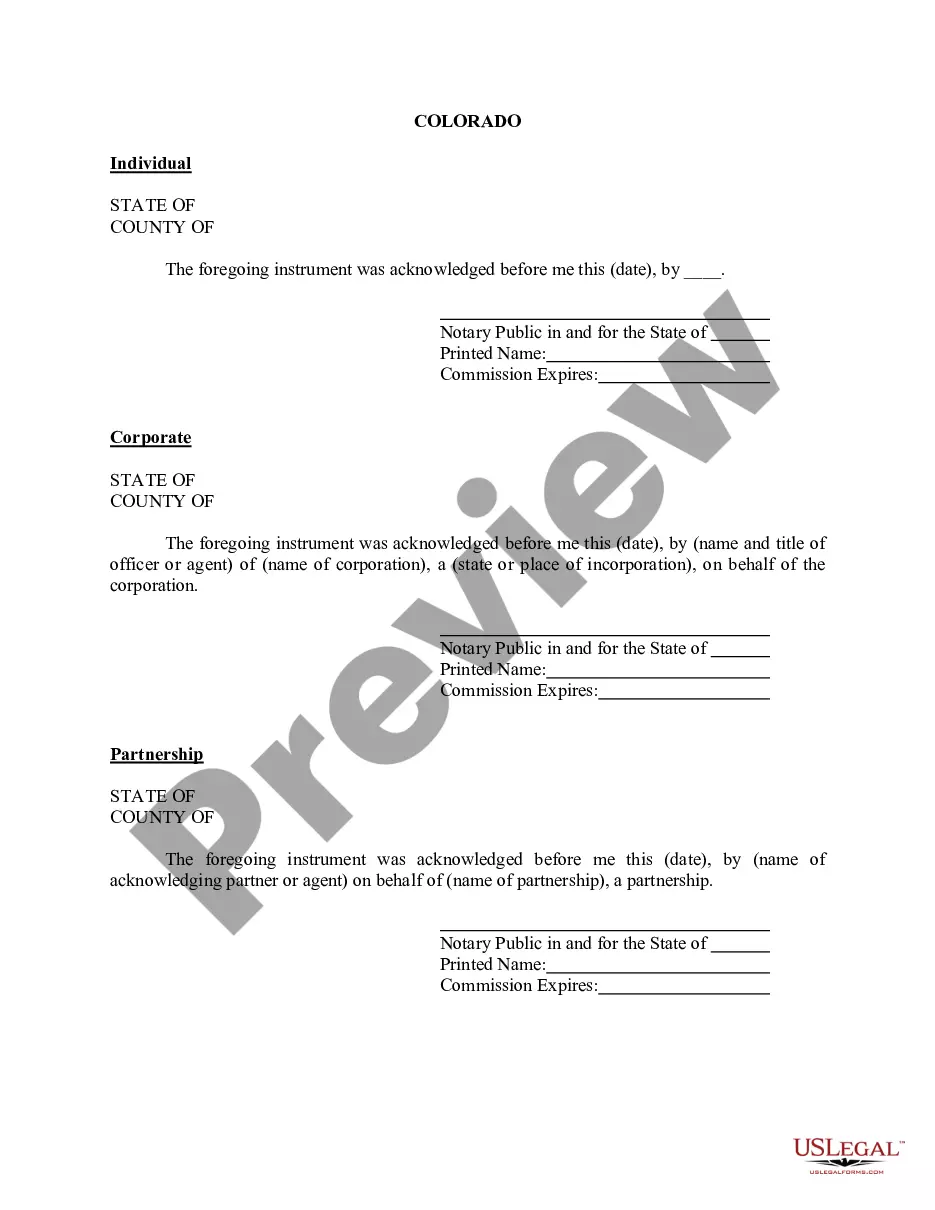

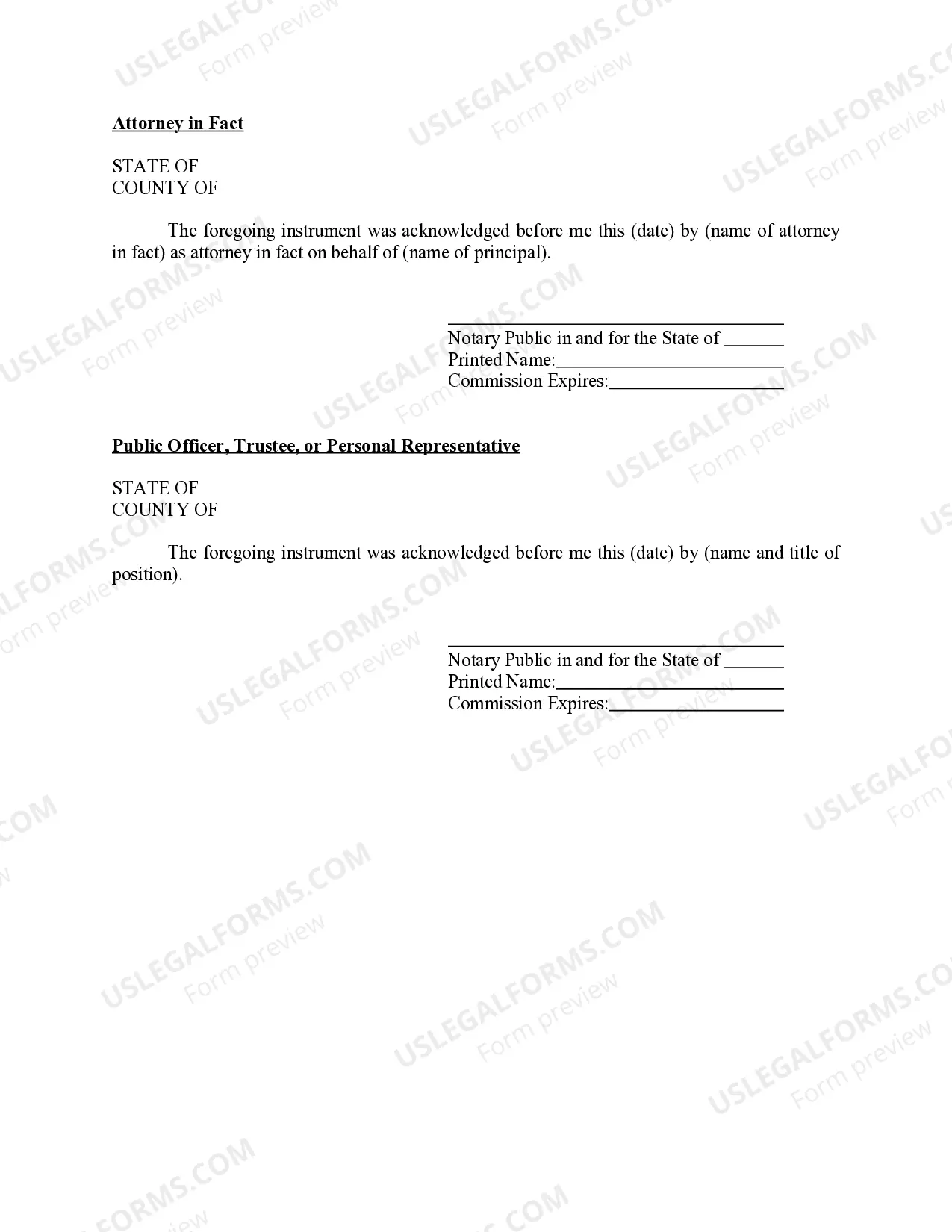

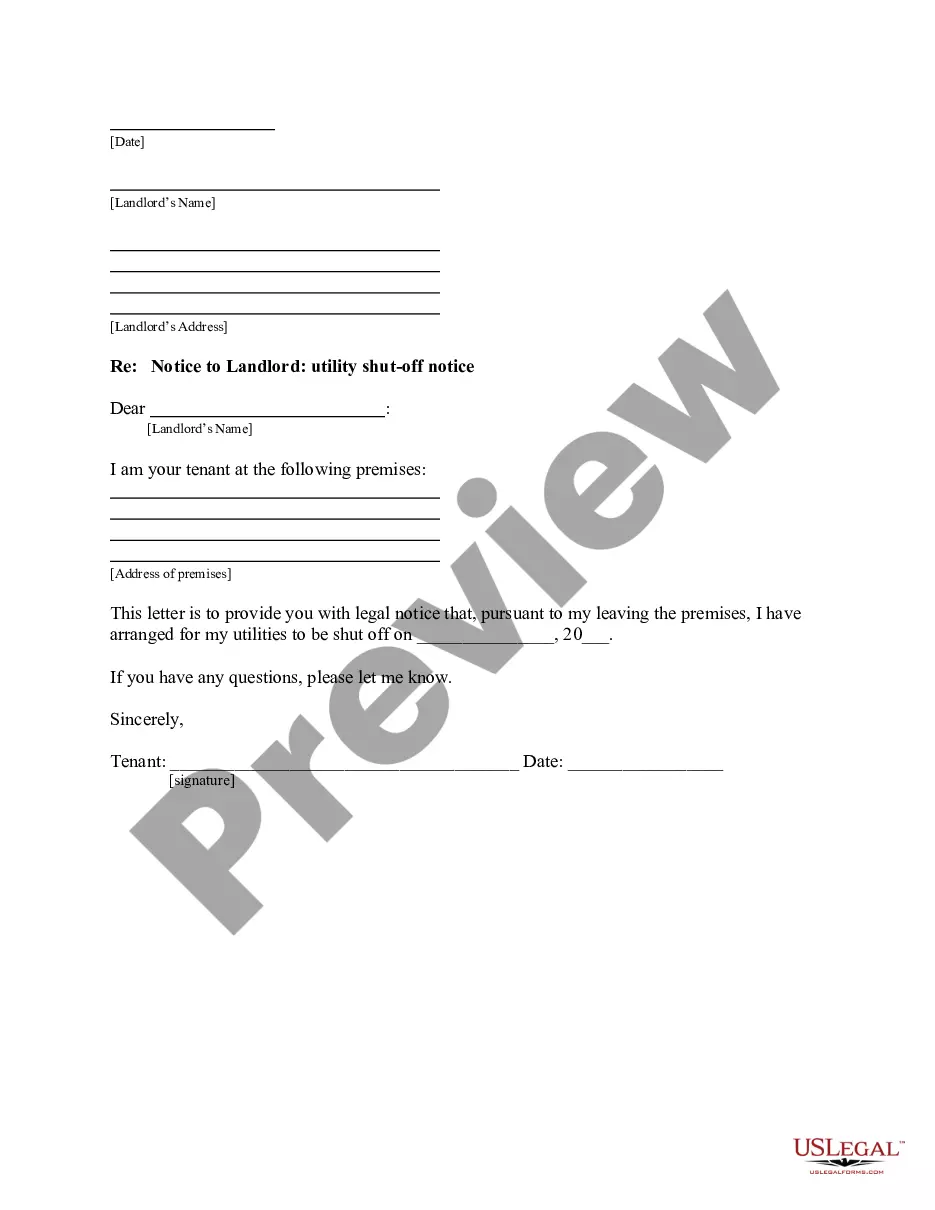

Colorado Oil and Gas Acknowledgment

Description

How to fill out Colorado Oil And Gas Acknowledgment?

The larger quantity of documents you need to produce - the more anxious you feel.

You can discover numerous Colorado Oil and Gas Acknowledgment templates online, but you're unsure which ones to trust.

Eliminate the difficulty to make obtaining samples simpler with US Legal Forms. Obtain precisely drafted documents that are designed to comply with state requirements.

Enter the required information to create your account and pay for your order with your PayPal or credit card. Select a convenient file format and obtain your copy. Access every document you receive in the My documents section. Just visit there to prepare a new copy of the Colorado Oil and Gas Acknowledgment. Even when filling out professionally drafted documents, it’s still essential to consider consulting your local attorney to double-check the completed form to ensure that your record is accurately filled out. Do more for less with US Legal Forms!

- If you possess a US Legal Forms subscription, Log In to your account, and you'll find the Download option on the Colorado Oil and Gas Acknowledgment’s page.

- If you haven't used our service before, complete the registration process following these guidelines.

- Verify that the Colorado Oil and Gas Acknowledgment functions in your state.

- Re-confirm your choice by reviewing the description or by utilizing the Preview feature if they’re available for the chosen file.

- Click Buy Now to initiate the registration process and choose a pricing plan that aligns with your needs.

Form popularity

FAQ

Senate Bill 35 in Colorado involves regulations aimed at managing groundwater resources in the context of oil and gas development. This bill emphasizes the importance of monitoring and mitigating potential impacts to water supplies from energy extraction activities. Familiarizing yourself with Senate Bill 35 can aid in comprehending how it relates to the broader framework of the Colorado Oil and Gas Acknowledgment.

Colorado's biggest oil producer is often considered to be Extraction Oil and Gas, which has a substantial presence in the state's oil and gas industry. This company plays a significant role in energy production while also adhering to the regulations dictated by the Colorado Oil and Gas Acknowledgment. Understanding who the main players are can help stakeholders and local communities gauge the impact of the industry's operations on their lives.

Senate Bill 118 in Colorado focuses on modernizing regulations surrounding oil and gas drilling practices. This bill is intended to enhance transparency, community involvement, and safety measures in the industry. By staying informed about pertinent legislation like Senate Bill 118, those affected in Colorado can better navigate the complexities associated with the Colorado Oil and Gas Acknowledgment.

In Colorado, the oil and gas setback refers to the required distance between drilling sites and occupied structures or sensitive areas, which is often designed to protect public health and the environment. These setback regulations can vary based on local ordinances and specific site conditions. Awareness of these setbacks is crucial for anyone involved in energy operations, as it directly relates to the Colorado Oil and Gas Acknowledgment.

The Colorado Senate bill for oil and gas outlines regulations and policies that govern oil and gas operations within the state. This legislation aims to balance energy development with environmental protection and community health. By understanding the Colorado Oil and Gas Acknowledgment, stakeholders can comply with legal requirements and stay informed about changes that impact operations.

Colorado form DR 1778 is the state’s Employee Withholding Certificate. This form allows employers to calculate the correct amount of state income tax to withhold from employee wages. It's important to understand how this form interacts with your financial role in oil and gas operations, particularly in regard to any Colorado Oil and Gas Acknowledgment. For assistance with this form, platforms like uslegalforms can provide valuable resources.

The Colorado Oil and Gas Act governs the exploration and production of oil and gas in the state. Enacted to ensure resource development is responsible and safe, the Act also promotes environmental protection. If you're involved in any aspect of oil and gas operations, familiarizing yourself with the Colorado Oil and Gas Acknowledgment sections of the Act is vital for compliance.

To determine if you own mineral rights in Colorado, you should review your property deed and any associated documentation. Payment records, title searches, or information from a landman can also provide insights into mineral ownership. Understanding your rights is crucial, especially if you are considering entering into agreements related to Colorado Oil and Gas Acknowledgment.

A Colorado composite return can include nonresident partners and shareholders of a partnership or corporation. This allows them to report their share of Colorado-source income collectively, simplifying the process. When preparing your composite return, it's essential to stay informed about any relevant Colorado Oil and Gas Acknowledgment implications, ensuring compliance with state regulations.

Yes, you should fill out a Colorado employee withholding certificate. This form allows your employer to withhold the correct amount of state income tax from your paycheck. When you provide accurate information on the certificate, it helps you avoid owing taxes at the end of the year. For any specific concerns regarding the Colorado Oil and Gas Acknowledgment in relation to withholding, consider consulting with a tax professional.