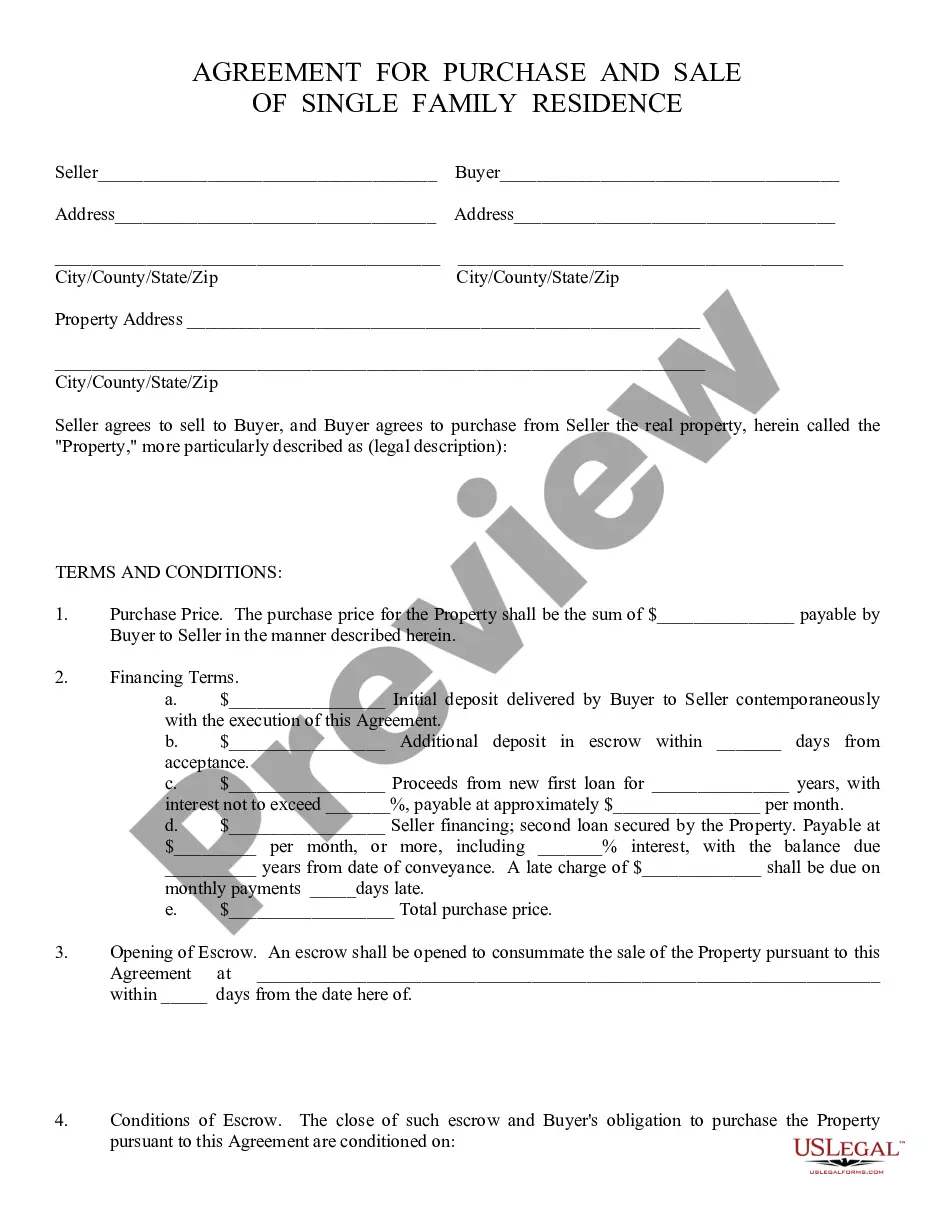

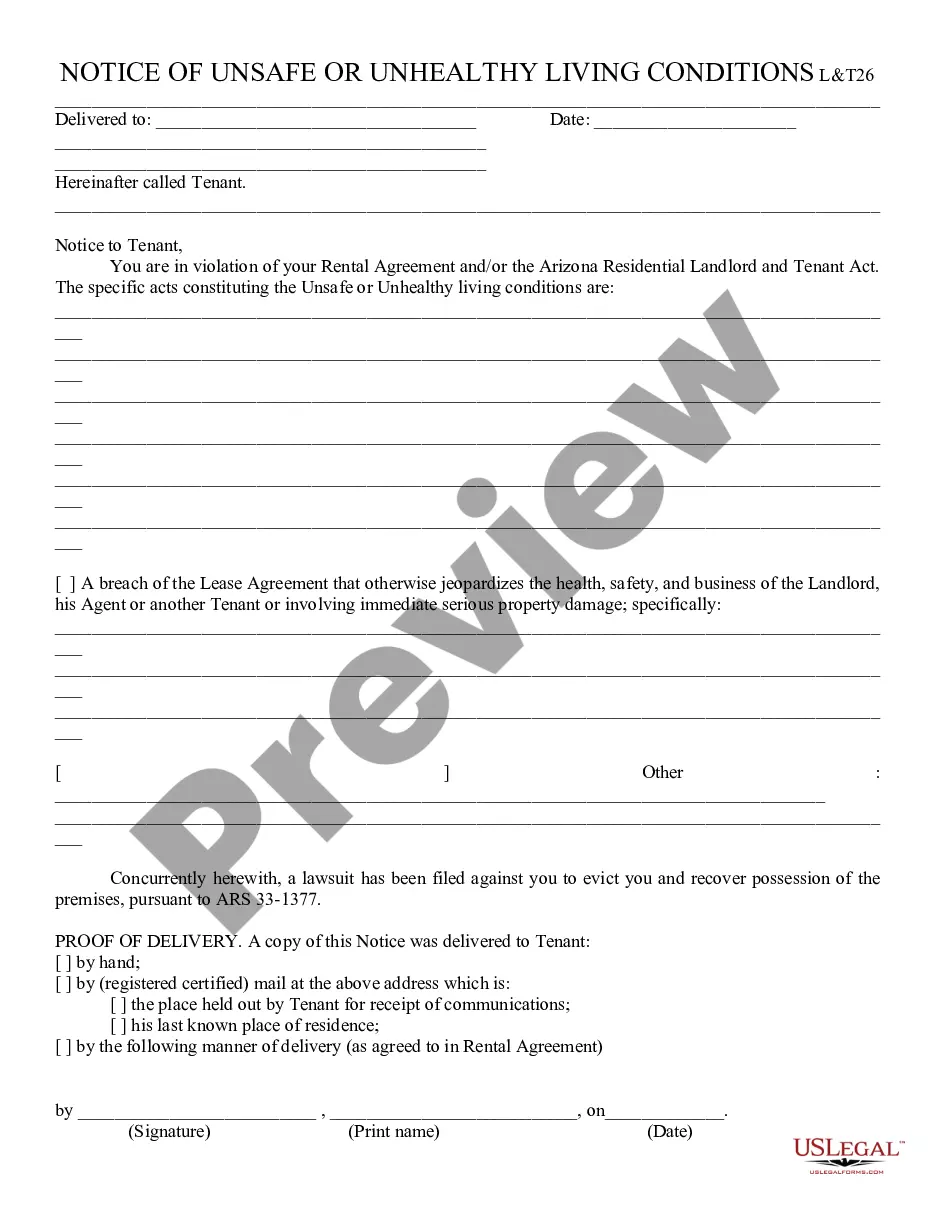

This form is a Quitclaim Deed where the grantors are husband and wife and the grantee is an individual. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Colorado Quitclaim Deed - Husband and Wife to an Individual

Description

How to fill out Colorado Quitclaim Deed - Husband And Wife To An Individual?

The larger quantity of documentation you have to produce - the more stressed you feel.

You can find numerous Colorado Quitclaim Deed - Husband and Wife to an Individual templates online, but you may not know which ones to trust.

Eliminate the frustration and simplify finding samples with US Legal Forms. Obtain expertly composed forms that are tailored to meet state requirements.

You can locate every document you download in the My documents section. Simply access it to complete a new version of the Colorado Quitclaim Deed - Husband and Wife to an Individual. Even when utilizing professionally drafted documents, it’s still advisable to consider consulting a local attorney to ensure that your form is correctly completed. Achieve more for less with US Legal Forms!

- Verify whether the Colorado Quitclaim Deed - Husband and Wife to an Individual is valid in your state.

- Confirm your choice by reading the description or utilizing the Preview feature if available for the chosen document.

- Click on Buy Now to initiate the signup process and select a payment plan that fits your needs.

- Provide the required information to set up your account and complete your purchase using PayPal or credit card.

- Select a convenient document format and obtain your copy.

Form popularity

FAQ

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

Under the gift tax rules, the grantor must pay tax on the property through a federal income tax return. The recipient of the property is allowed to pay the tax if she agrees to make the payment. Individuals are allowed an exclusion of $13,000.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

One of the simplest ways to add your wife to the home title is by using an interspousal deed. You can transfer the property from your sole and separate property to mutual tenancy, such as joint tenants with right of survivorship, with your wife.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

No law forbids adding someone to your mortgaged home's deed or in signing your home over to others through one. Mortgage lenders understand deeds, though, and use loan due-on-sale clauses to prevent unauthorized property sales or transfers.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.