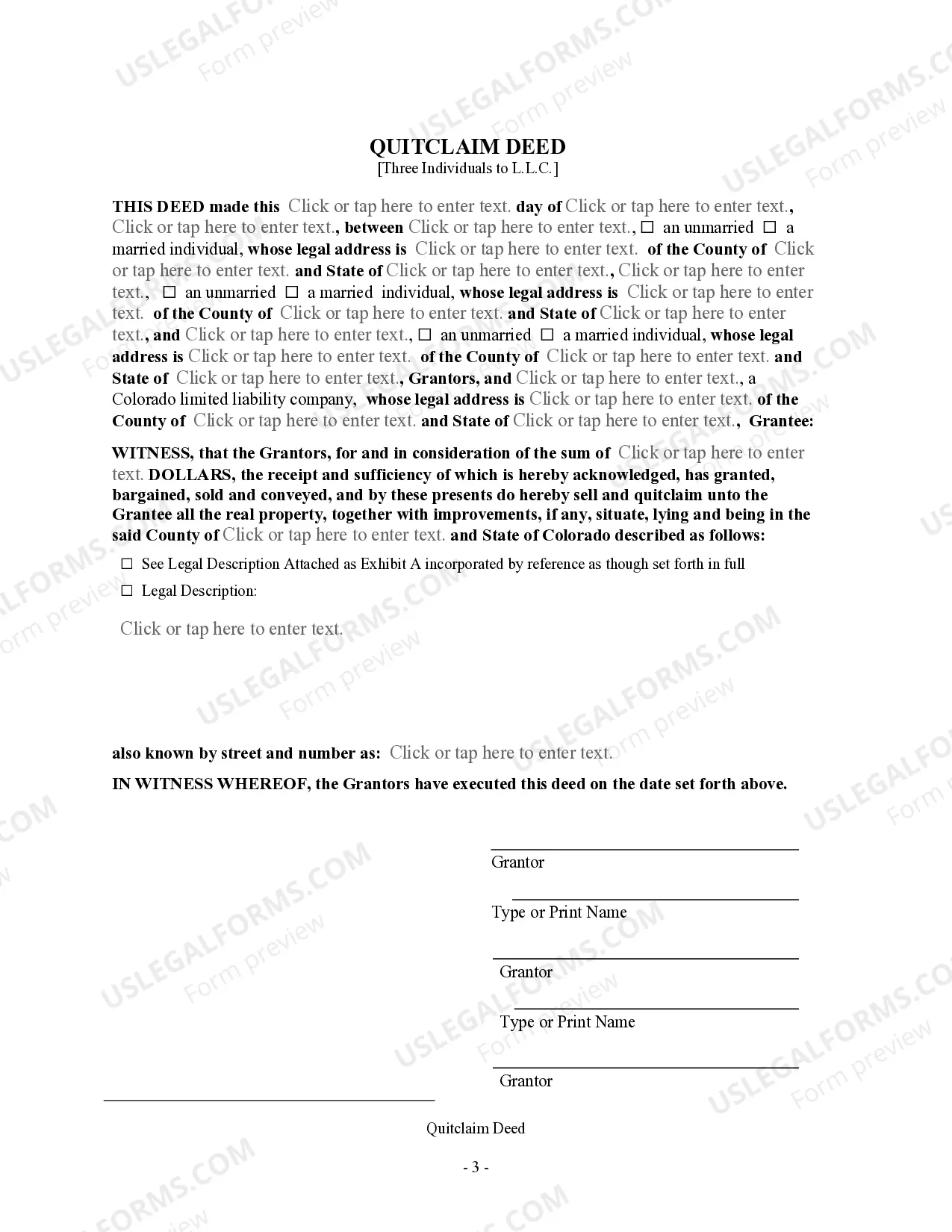

This form is a Quitclaim Deed where the grantors are three individuals and the grantee is a limited liability company. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Colorado Quitclaim Deed - Three Individuals to a limited liability company

Description

How to fill out Colorado Quitclaim Deed - Three Individuals To A Limited Liability Company?

The larger the quantity of documents you need to produce - the more anxious you become.

You can discover numerous Colorado Quitclaim Deed - Three Individuals to a limited liability company templates online, yet you’re unsure which ones to trust.

Remove the frustration and simplify your search for examples using US Legal Forms. Acquire expertly prepared forms that are designed to meet state standards.

Provide the requested information to create your profile and make your payment using PayPal or a credit card. Choose a desired document format and download your sample. Access every document you obtain in the My documents section. Simply navigate there to create a new copy of your Colorado Quitclaim Deed - Three Individuals to a limited liability company. Even when utilizing professionally created templates, it remains essential to consider consulting a local attorney to double-check completed forms to ensure that your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, Log In to your account, and you’ll find the Download button on the Colorado Quitclaim Deed - Three Individuals to a limited liability company’s page.

- If you have never utilized our service before, complete the registration process by following these instructions.

- Ensure that the Colorado Quitclaim Deed - Three Individuals to a limited liability company is permissible in your state.

- Verify your choice by reviewing the description or by using the Preview feature if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your requirements.

Form popularity

FAQ

A quitclaim deed is dangerous if you don't know anything about the person giving you the property. You should be sure that a person actually has rights to a property before signing it over with a quitclaim deed.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

In Colorado, a quit claim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.Essentially, a quit claim deed only guarantees that a seller cannot come back at a later date and claim any interest on a property after he or she sells it.

Under the gift tax rules, the grantor must pay tax on the property through a federal income tax return. The recipient of the property is allowed to pay the tax if she agrees to make the payment. Individuals are allowed an exclusion of $13,000.

A quitclaim deed is sometimes used to avoid probate court by transferring an interest in real property before someone's death. The property is transferred by deed during their life, instead of being transferred by a will after the grantor's death.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.