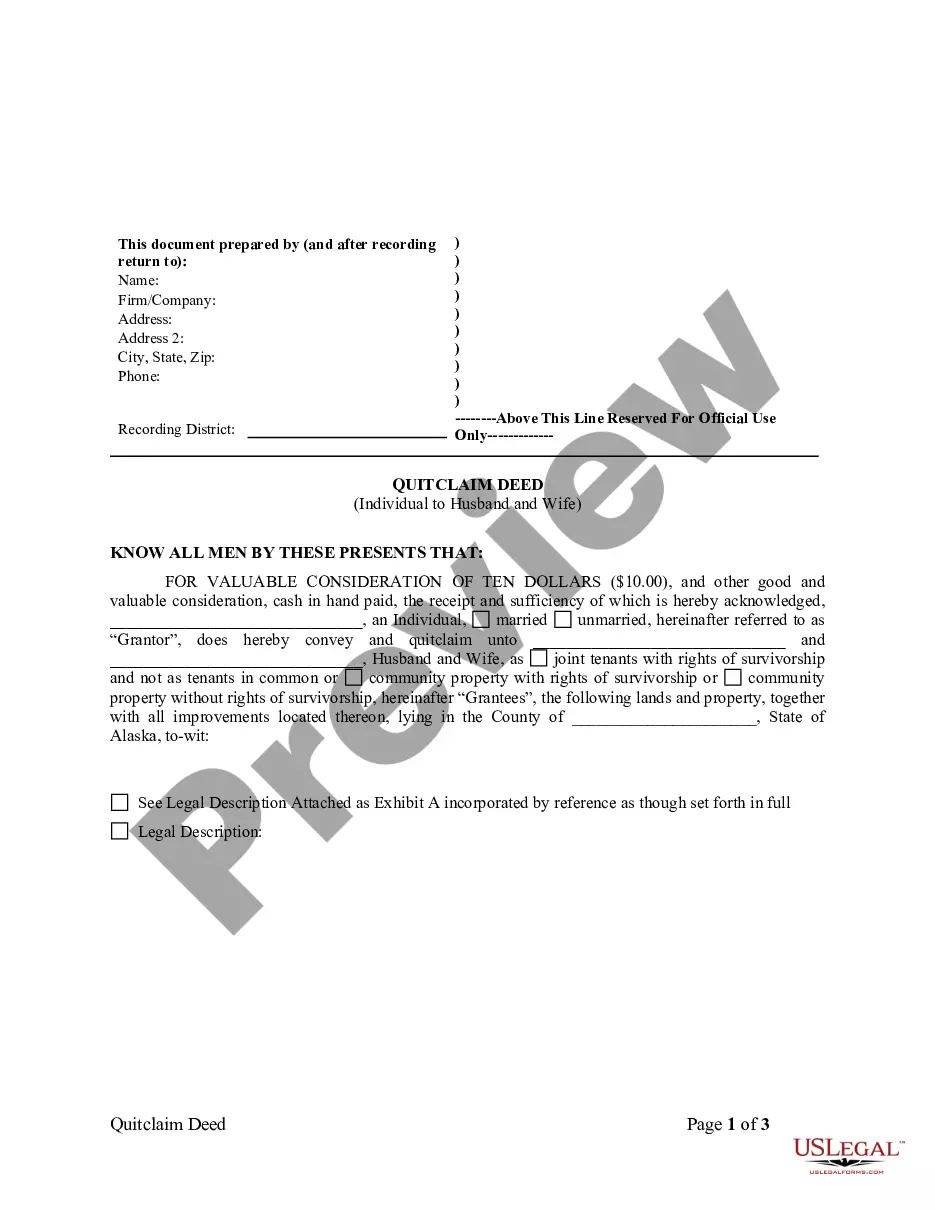

This form is a Quitclaim Deed where the Grantor is an Individual and the grantee is a Limited Liability Company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Colorado Quitclaim Deed from an Individual to a Limited Liability Company

Description

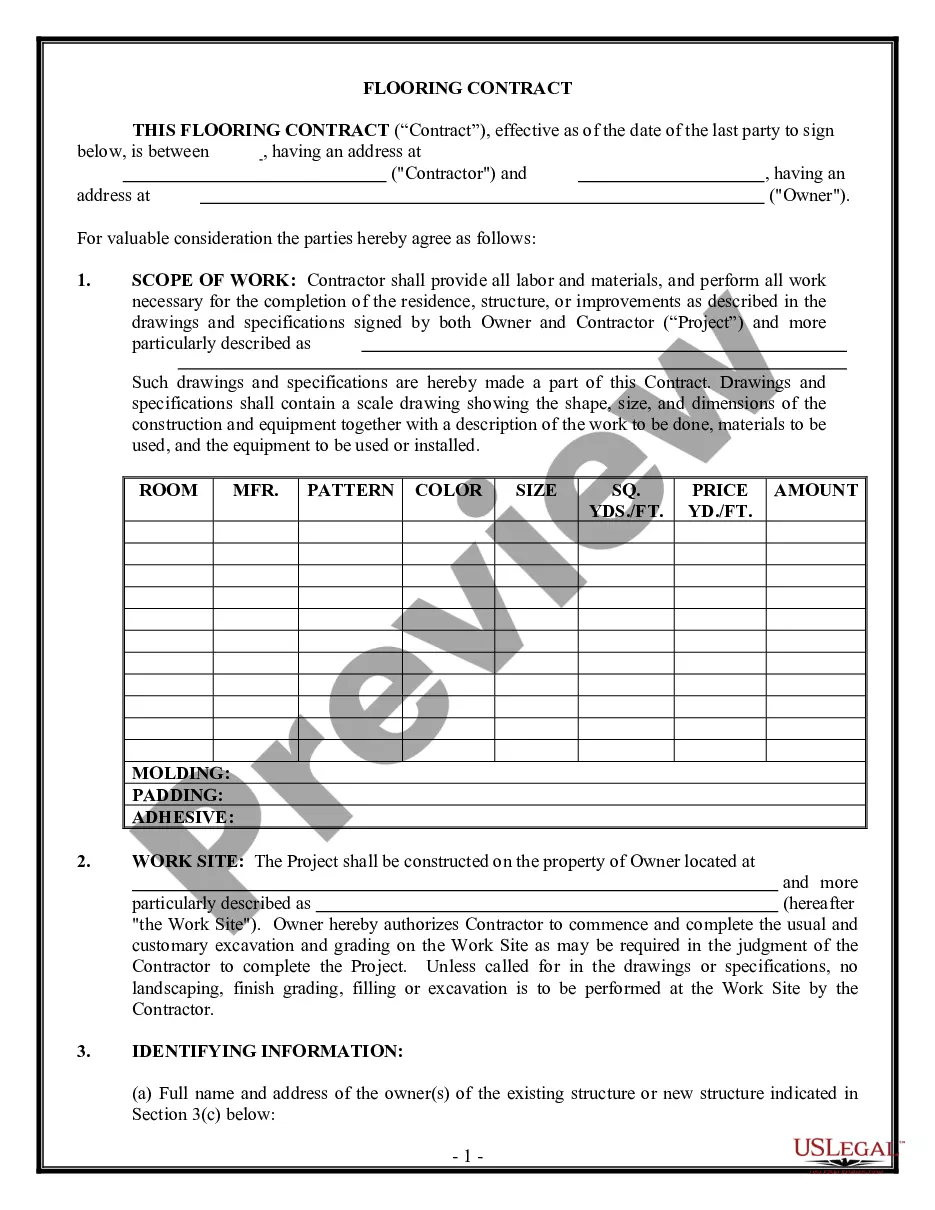

How to fill out Colorado Quitclaim Deed From An Individual To A Limited Liability Company?

The larger quantity of documents you ought to produce - the more uneasy you become.

You can find numerous Colorado Quitclaim Deed templates from an Individual to a Limited Liability Company online, yet you are uncertain which ones to rely on.

Remove the trouble and simplify the identification of samples by using US Legal Forms. Obtain professionally crafted documents that comply with state regulations.

Enter the necessary details to create your account and process your order using PayPal or a credit card. Choose a suitable file format and obtain your copy. Access all templates obtained in the My documents section. Simply navigate there to prepare a new version of your Colorado Quitclaim Deed from an Individual to a Limited Liability Company. Even when utilizing professionally crafted documents, it remains crucial to consider asking a local attorney to review the completed form to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- If you are a US Legal Forms subscriber, Log In to your account, and you will find the Download option on the Colorado Quitclaim Deed from an Individual to a Limited Liability Company’s webpage.

- If you have not used our platform before, complete the registration process by following these steps.

- Ensure the Colorado Quitclaim Deed from an Individual to a Limited Liability Company is valid in your state.

- Verify your choice by reviewing the description or utilizing the Preview feature if it is available for the selected file.

- Click Buy Now to start the registration process and choose a pricing plan that suits your requirements.

Form popularity

FAQ

Under the gift tax rules, the grantor must pay tax on the property through a federal income tax return. The recipient of the property is allowed to pay the tax if she agrees to make the payment. Individuals are allowed an exclusion of $13,000.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

In Colorado, a quit claim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.Essentially, a quit claim deed only guarantees that a seller cannot come back at a later date and claim any interest on a property after he or she sells it.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.

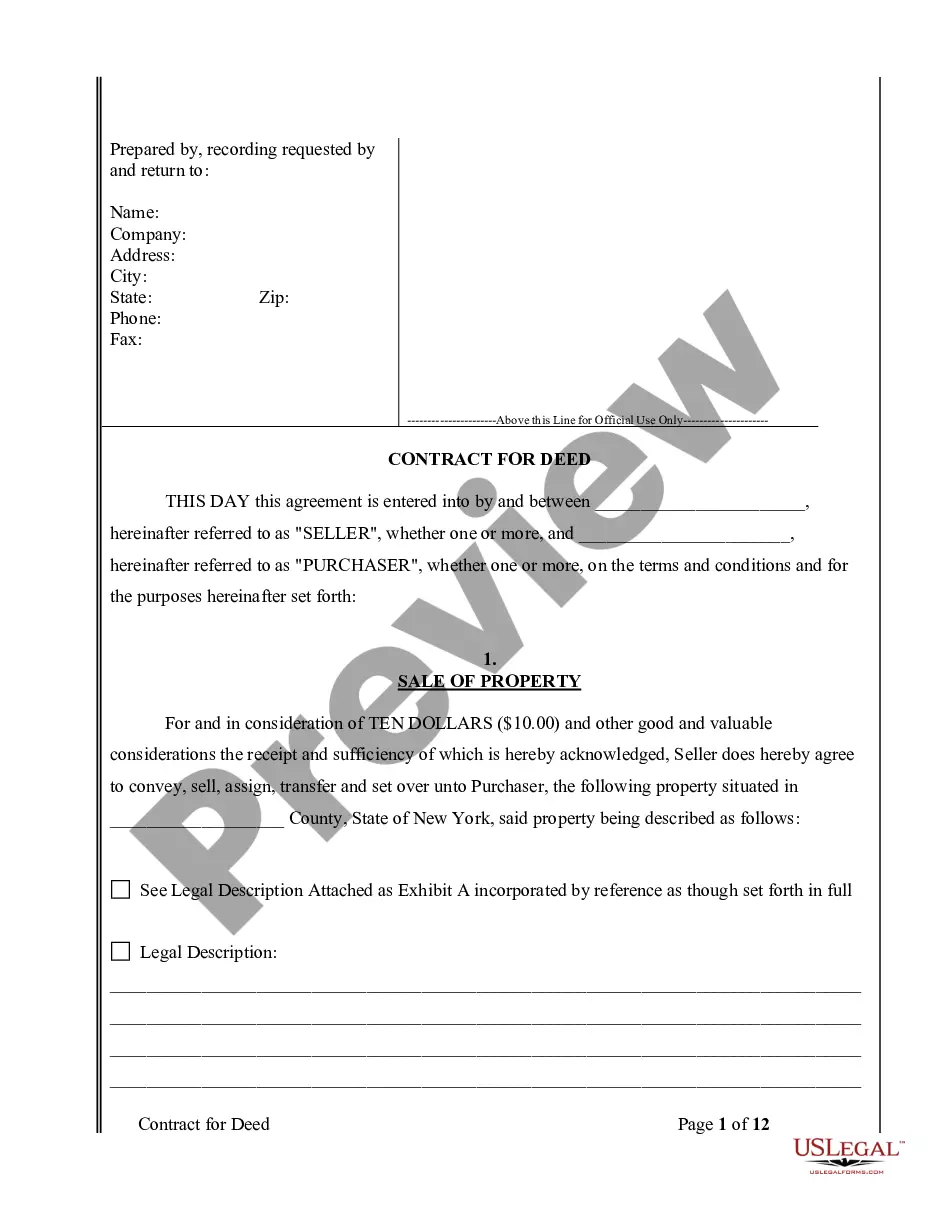

For any type of real estate title transfer, you'll need to fill out the appropriate forms and have all parties sign in front of a notary. The new owner is responsible for filling out a Real Property Transfer Declaration form and recording the deed at both the recorder's and county clerk's offices.