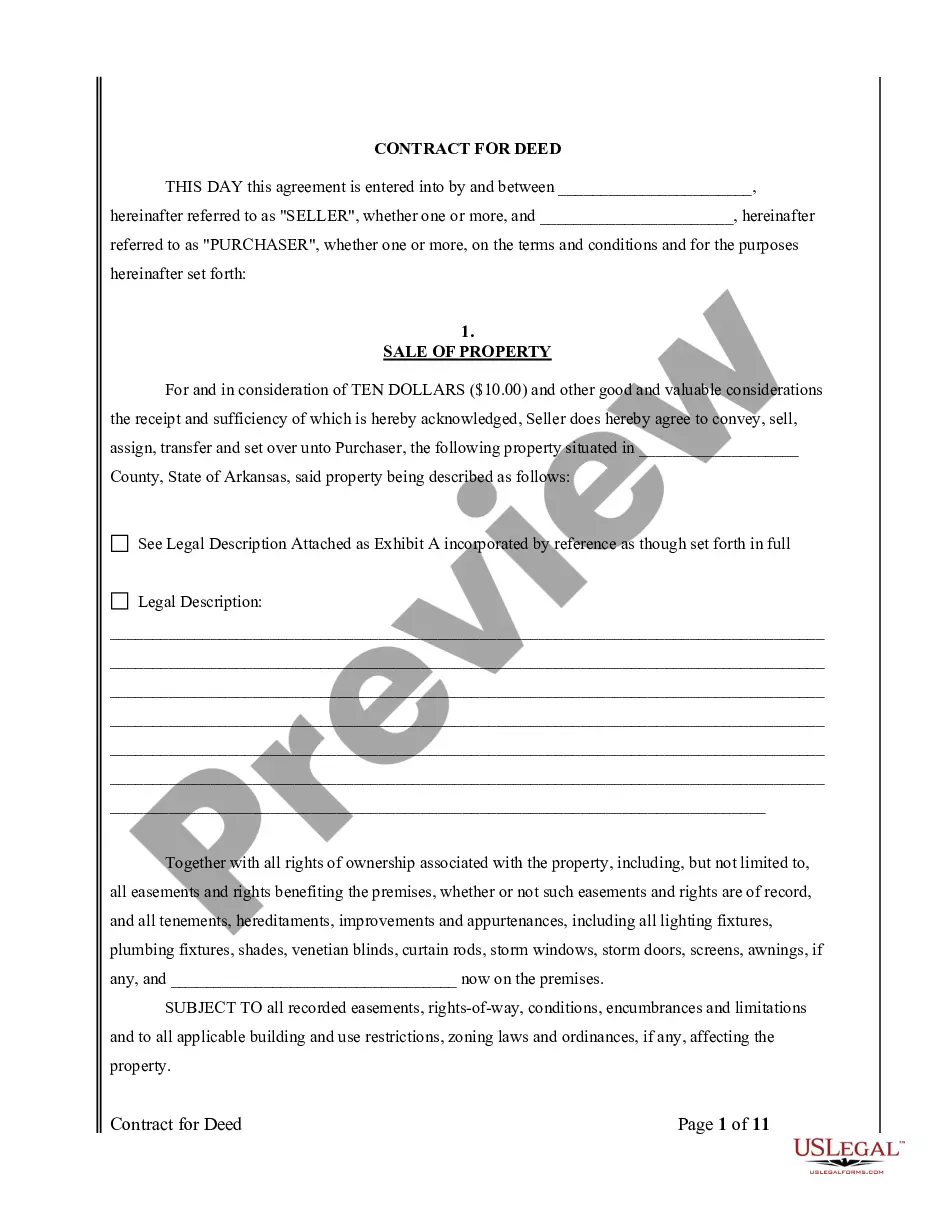

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantee is a Trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Colorado Quitclaim Deed - Husband and Wife to a Trust

Description

Key Concepts & Definitions

A quitclaim deed is a legal instrument used to transfer interest in real property. The grantor (the party transferring the property) terminates any right and claim to the property, allowing the right or claim to transfer to the grantee (the recipient of the transfer), without any guarantee of clear title. In the context of 'quitclaim deed husband and wife to a trust', a married couple transfers their property rights directly to a trust. This process often involves interspousal transfer property clauses to manage how properties are handled within marriage and in estate planning scenarios.

Step-by-Step Guide to Transferring Property via Quitclaim Deed

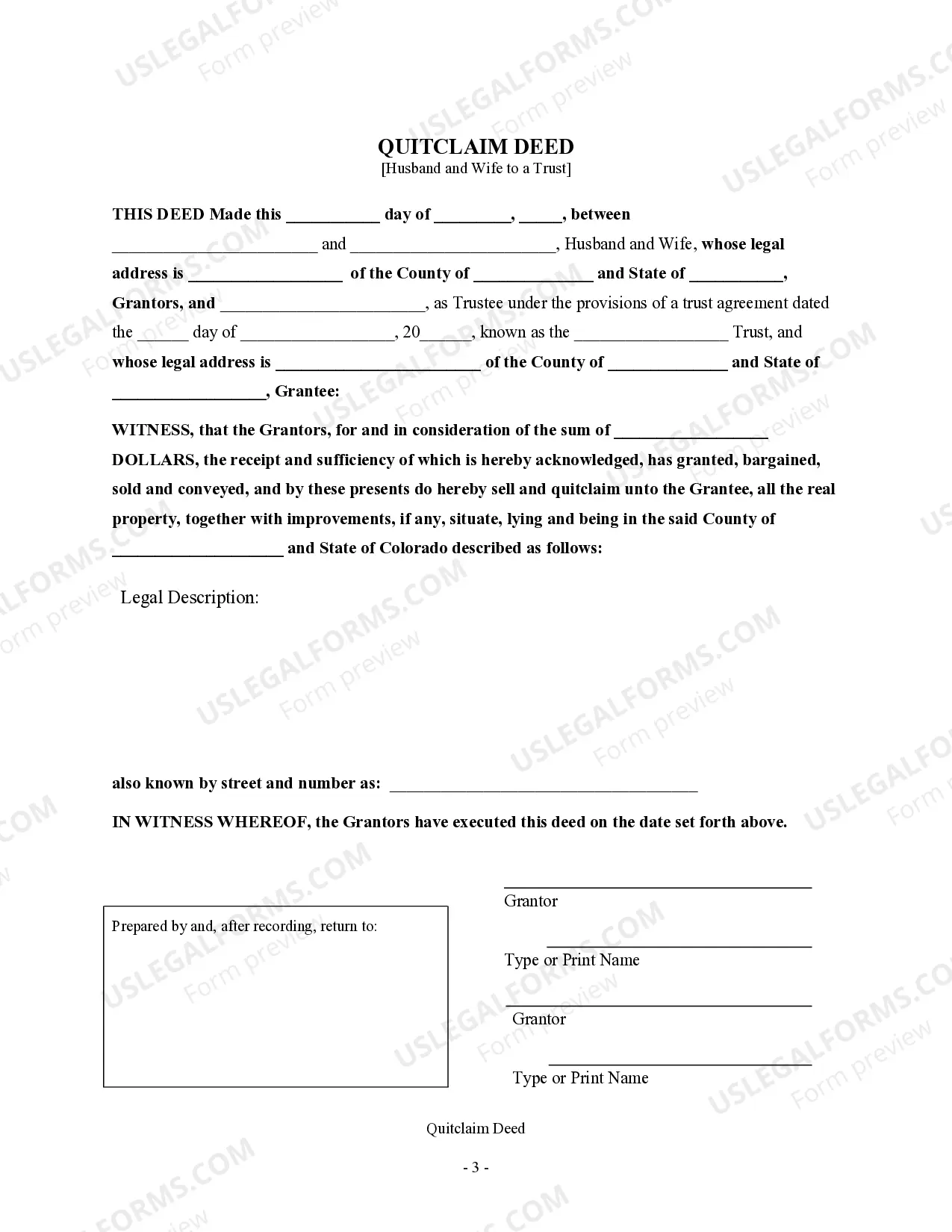

- Prepare the Quitclaim Deed Form: Obtain the appropriate quitclaim deed form from online legal services or consult a family law attorney to ensure accurate completion.

- Enter Valid Information: Fill out the deed form by entering valid information, such as the names of parties involved, legal description of the property, and the details of the trust that will receive the property.

- Review and Verification: Both parties should review the form thoroughly. Verification might require phone number confirmation or other personal details for identity verification.

- Signature: Both husband and wife must sign the deed, potentially in the presence of a notary, depending on state law.

- File Legal Documents: File the signed deed at the local county recorder or land registry office to make the transfer legal and binding.

- Start Mortgage Process: If there's an existing mortgage on the property, contact the lender to discuss the implications of the transfer on the mortgage agreement.

Risk Analysis of Quitclaim Deeds

- No Warranty: Quitclaim deeds do not guarantee a clear title; there might be other claims or liens against the property.

- Financial Risk: If the grantee assumes property with undisclosed encumbrances or liens, they might incur unforeseen financial liabilities.

- Legal Disputes: Poorly managed quitclaim deeds or improper filing can lead to legal disputes between parties, potentially involving extensive legal costs.

How to fill out Colorado Quitclaim Deed - Husband And Wife To A Trust?

The greater the number of documents you need to create - the more anxious you become.

You can discover a vast array of Colorado Quitclaim Deed - Husband and Wife to a Trust templates online, but you may not know which ones to trust.

Eliminate the confusion and simplify the process of finding samples with US Legal Forms. Obtain professionally drafted documents that are prepared to satisfy state requirements.

Provide the required information to create your account and settle your order using your PayPal or credit card. Choose a convenient file format and obtain your copy. Access every document you acquire in the My documents section. Simply navigate there to prepare a new version of the Colorado Quitclaim Deed - Husband and Wife to a Trust. Even when utilizing well-prepared templates, it remains essential to consider consulting your local attorney to verify that your filled-out form is completed correctly. Achieve more for less with US Legal Forms!

- If you currently hold a US Legal Forms subscription, Log In to your account, and you will see the Download button on the Colorado Quitclaim Deed - Husband and Wife to a Trust’s webpage.

- If you have never used our site before, complete the registration process by following these instructions.

- Verify that the Colorado Quitclaim Deed - Husband and Wife to a Trust is applicable in your state.

- Double-check your selection by reading the description or using the Preview feature, if available for the chosen document.

- Click on Buy Now to initiate the registration process and choose a pricing plan that fits your needs.

Form popularity

FAQ

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.