This form is a Quitclaim Deed where the Grantors are Two Individuals and the Grantee is a Limited Liability Company. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Colorado Quitclaim Deed - Two Individuals to a Limited Liability Company

Description

How to fill out Colorado Quitclaim Deed - Two Individuals To A Limited Liability Company?

The greater the number of documents you have to produce - the more anxious you become.

You can locate numerous Colorado Quitclaim Deed - Two Individuals to a Limited Liability Company templates online, but you aren't sure which ones to trust.

Eliminate the stress and simplify your search for samples with US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing plan that meets your needs. Enter the required details to set up your account and complete your purchase using your PayPal or credit card. Pick a convenient file format and obtain your copy. Locate each document you download in the My documents section. Go there to fill out a new copy of the Colorado Quitclaim Deed - Two Individuals to a Limited Liability Company. Even when dealing with professionally crafted templates, it’s still advisable to consult a local legal professional to verify that your document is properly completed. Achieve more for less with US Legal Forms!

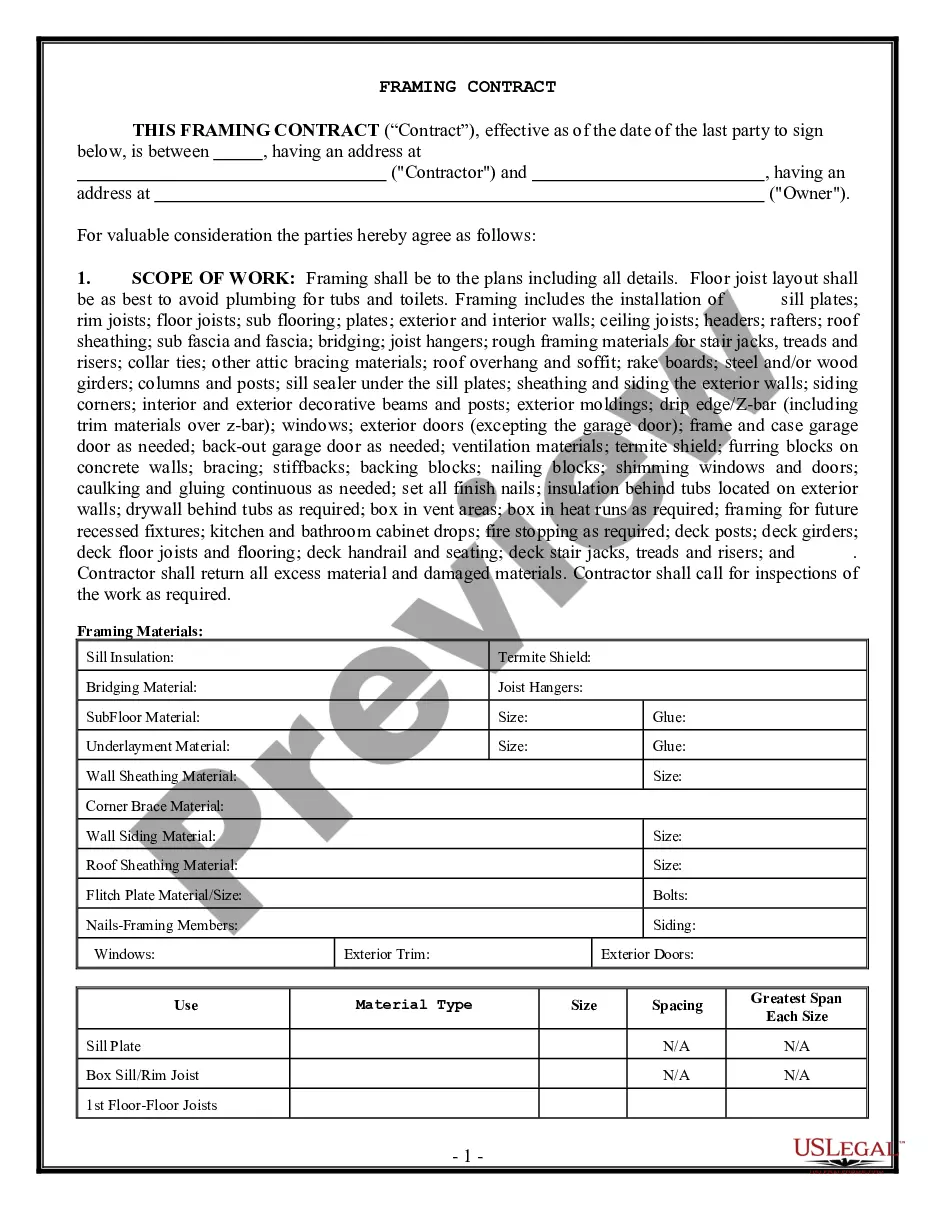

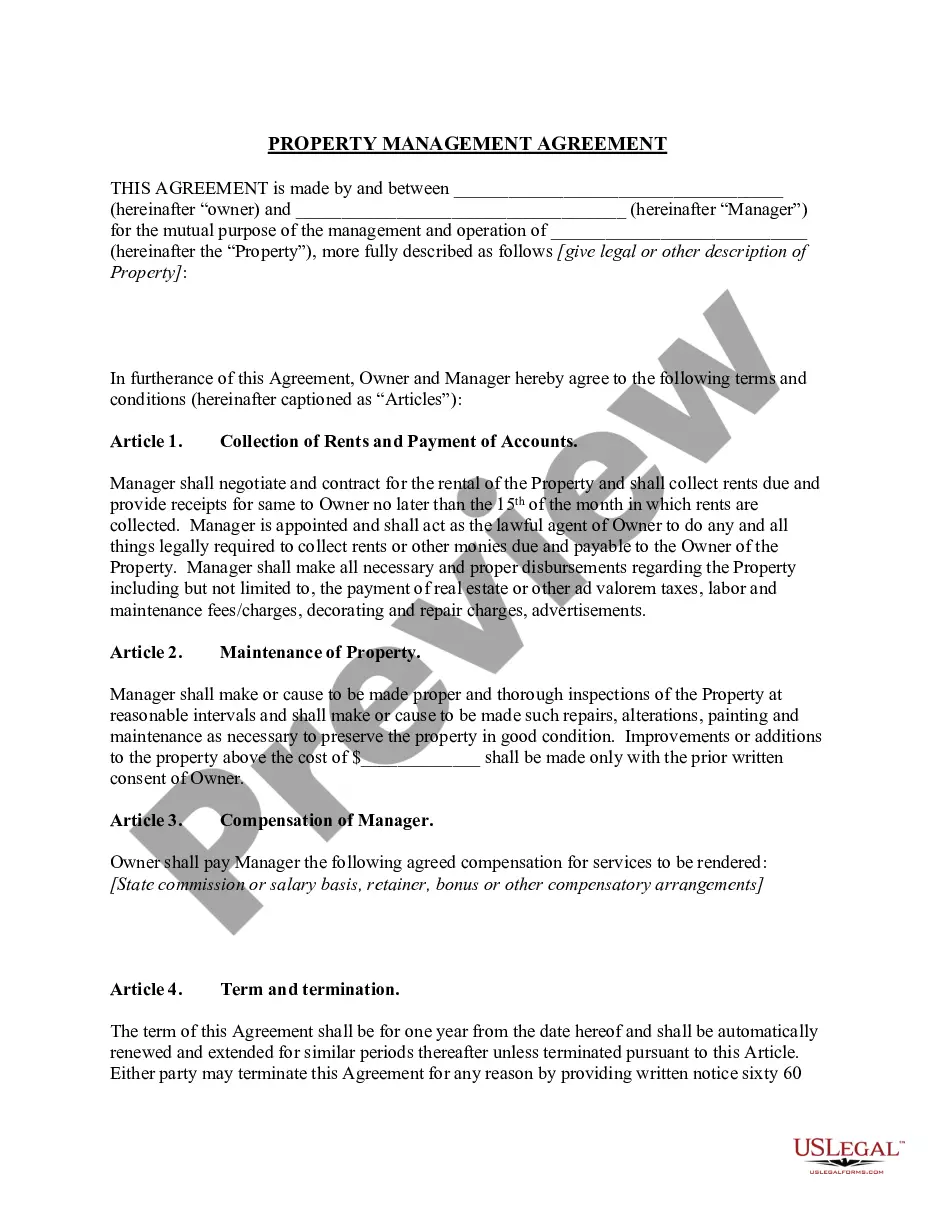

- Obtain expertly crafted forms designed to meet state regulations.

- If you currently possess a US Legal Forms subscription, sign in to your account, and you will find the Download button on the Colorado Quitclaim Deed - Two Individuals to a Limited Liability Company’s page.

- If you haven’t yet experienced our platform, complete the registration process following these steps.

- Verify that the Colorado Quitclaim Deed - Two Individuals to a Limited Liability Company is applicable in your state.

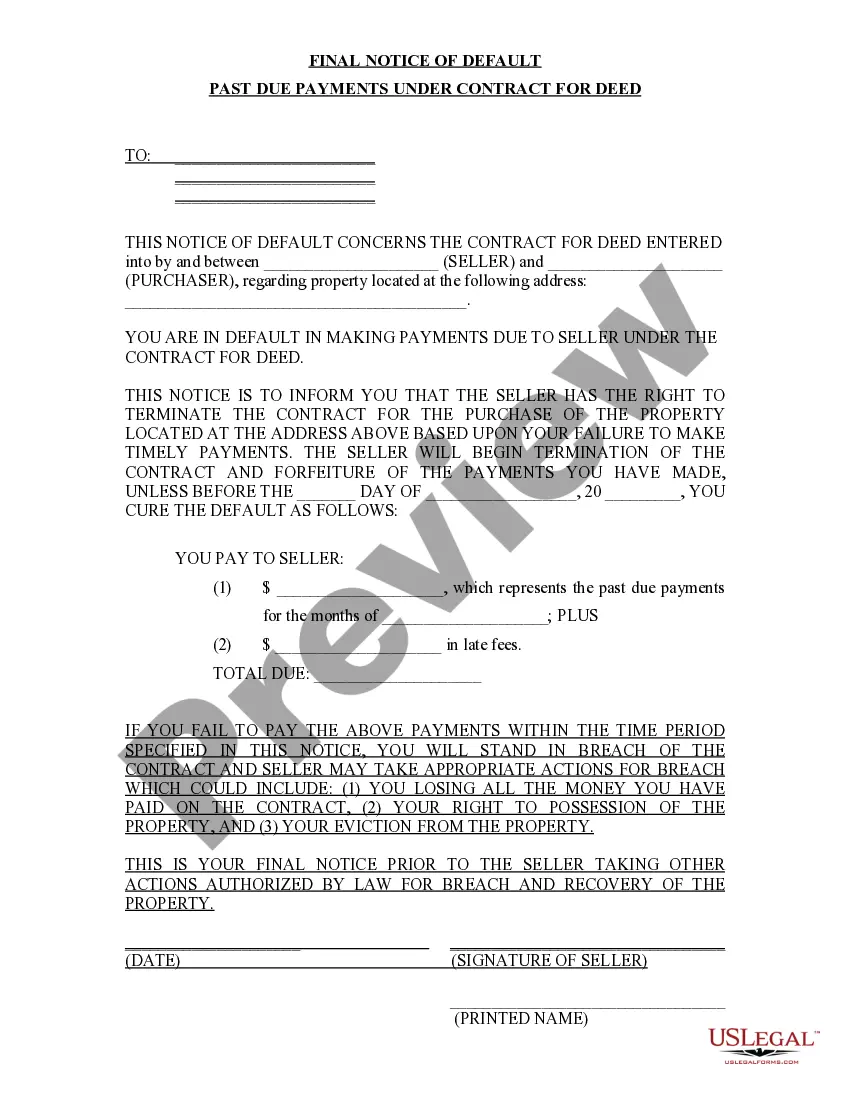

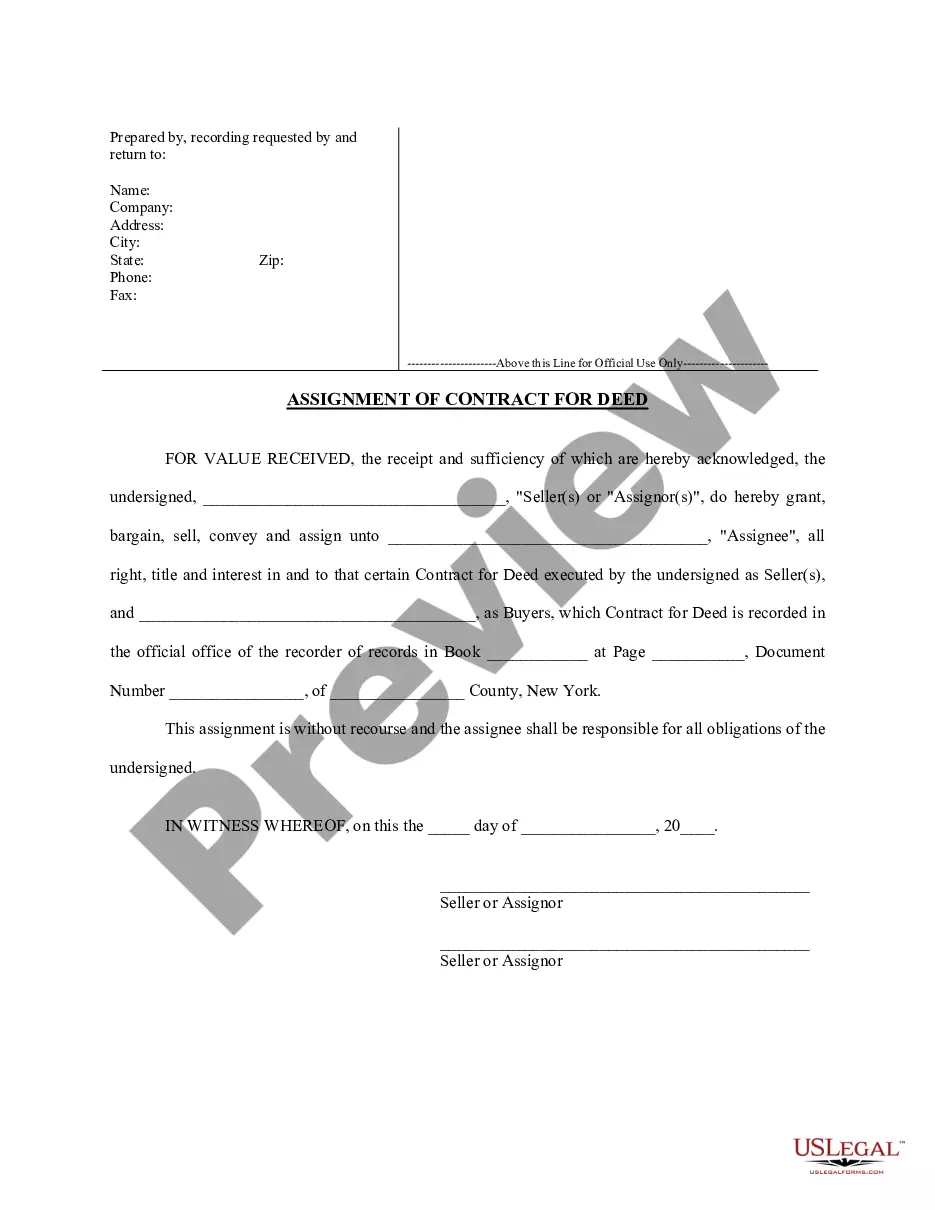

- Confirm your choice by reviewing the description or by using the Preview feature if it's available for the selected document.

Form popularity

FAQ

For any type of real estate title transfer, you'll need to fill out the appropriate forms and have all parties sign in front of a notary. The new owner is responsible for filling out a Real Property Transfer Declaration form and recording the deed at both the recorder's and county clerk's offices.

Transfer documents (Warranty Deeds, Quit Claim Deeds, etc) will be assessed a documentary tax if the consideration is $500 or more in addition to the recording fee. The documentary tax is $. 01 per $100. Plats are assessed a recording fee of $13 for the first page and $10 for each additional page.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed is sometimes used to avoid probate court by transferring an interest in real property before someone's death. The property is transferred by deed during their life, instead of being transferred by a will after the grantor's death.

Step 1: Form an LLC or Corporation. You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity. Step 2: Complete a Quitclaim Deed. Step 3: Record Your Quitclaim Deed.

In Colorado, a quit claim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.Essentially, a quit claim deed only guarantees that a seller cannot come back at a later date and claim any interest on a property after he or she sells it.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

Under the gift tax rules, the grantor must pay tax on the property through a federal income tax return. The recipient of the property is allowed to pay the tax if she agrees to make the payment. Individuals are allowed an exclusion of $13,000.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.