Colorado Warranty Deed from Individual, Individuals, or Husband and Wife to Trust

Description Warranty Individual Form Fillable

How to fill out Deed Husband Wife Download?

Out of numerous paid and complimentary templates available online, you cannot be certain of their dependability.

For instance, it is unclear who created them or if they possess the necessary expertise for your requirements.

Always stay composed and utilize US Legal Forms! Locate Colorado Warranty Deed from Individual, Individuals, or Husband and Wife to Trust samples crafted by expert lawyers and evade the costly and laborious task of searching for an attorney and subsequently compensating them to draft a document for you that you could conveniently find on your own.

Once you have signed up and completed your subscription purchase, you can use your Colorado Warranty Deed from Individual, Individuals, or Husband and Wife to Trust as many times as needed or until it remains valid in your state. Modify it with your preferred editor, fill it out, sign it, and produce a hard copy. Achieve more for less with US Legal Forms!

- If you have a subscription, Log In to your account and find the Download button beside the file you are looking for.

- You will also have access to your previously downloaded documents in the My documents section.

- If you’re utilizing our website for the first time, follow the directions below to quickly obtain your Colorado Warranty Deed from Individual, Individuals, or Husband and Wife to Trust.

- Verify that the document you find is acceptable in your location.

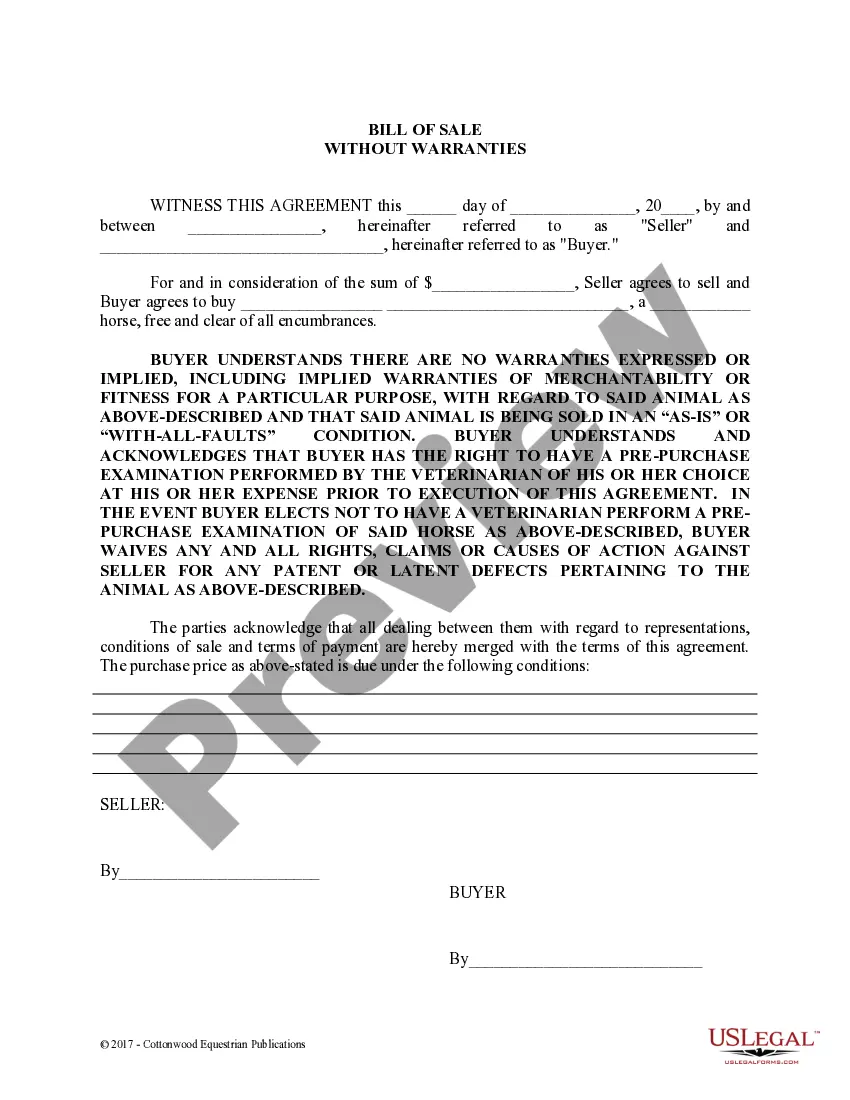

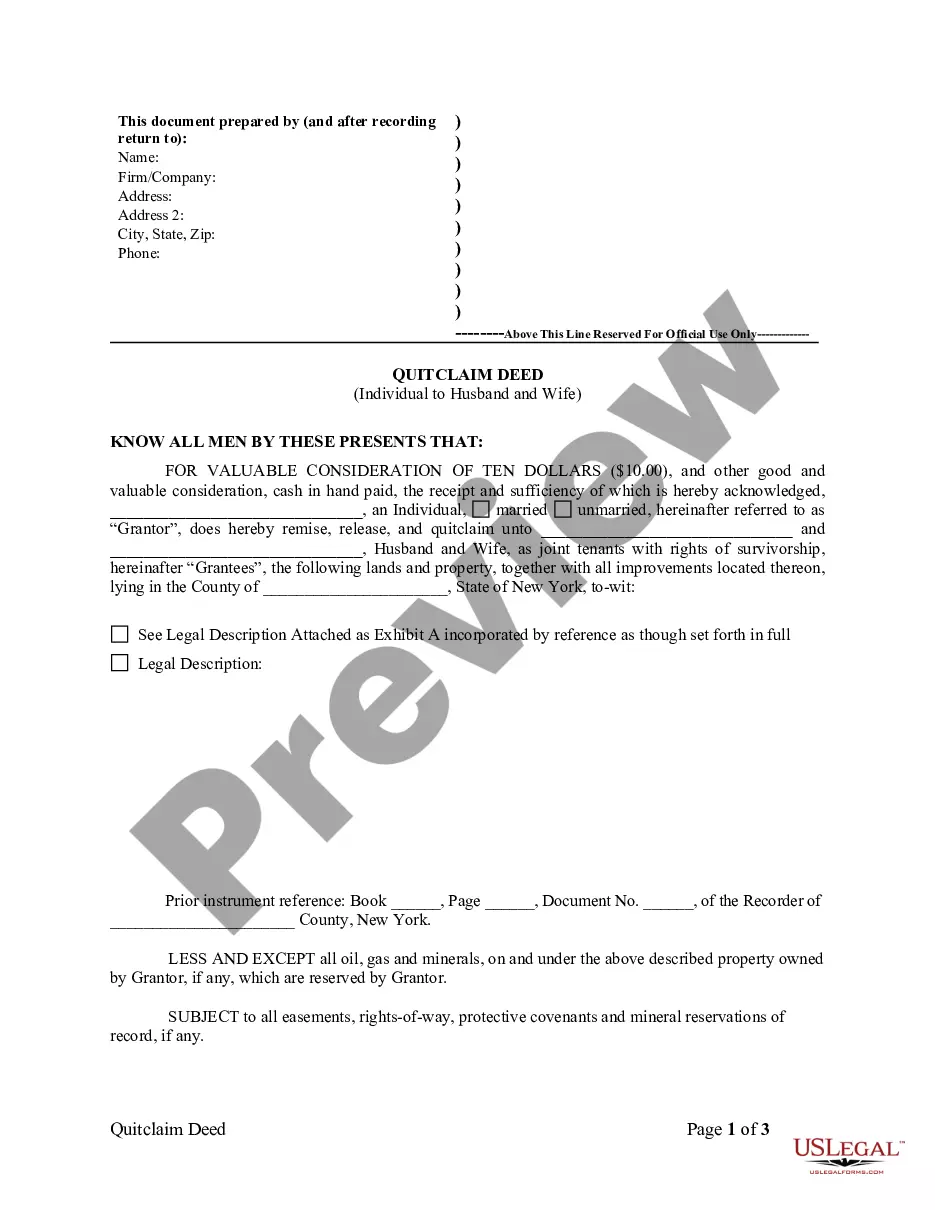

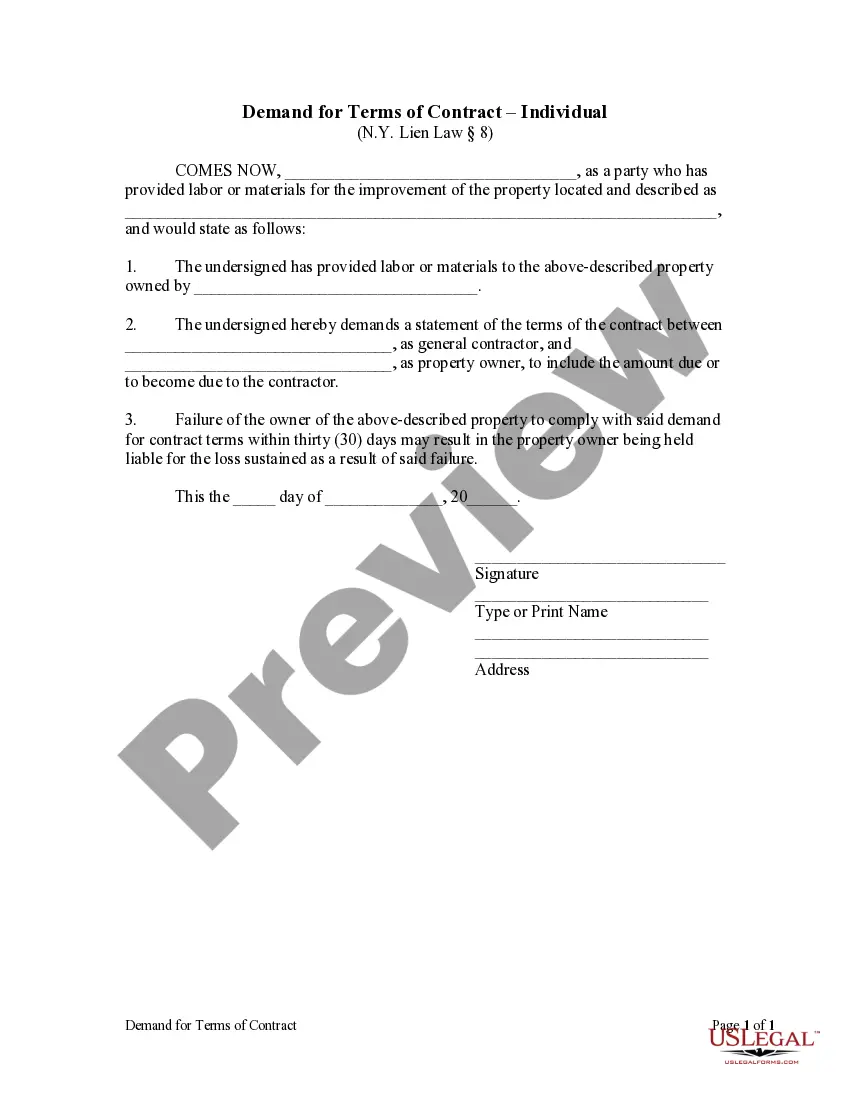

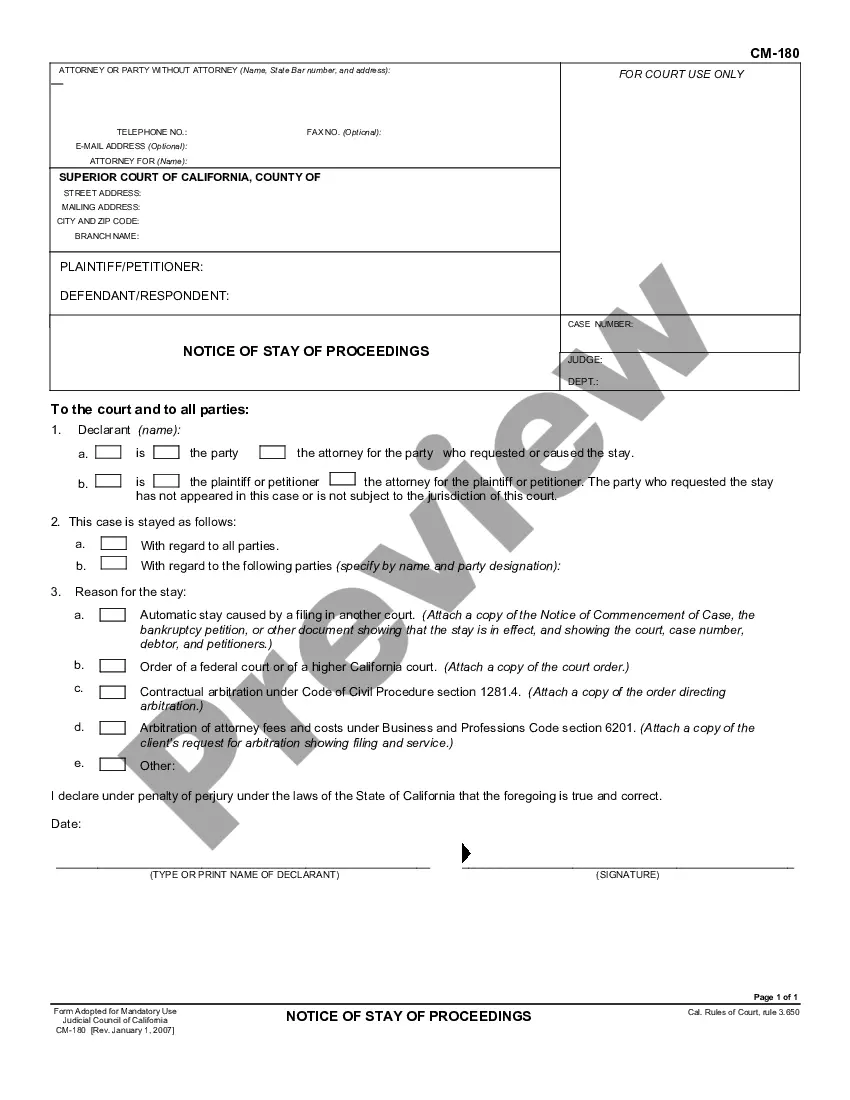

- Examine the file by reviewing the information using the Preview feature.

- Click Buy Now to initiate the purchasing process or search for another sample utilizing the Search field located in the header.

- Select a pricing plan and register for an account.

- Charge the subscription with your credit or debit card or PayPal.

- Download the form in the desired format.

Deed Husband Wife Purchase Form popularity

Colorado Individual Form Other Form Names

Warranty Husband Wife FAQ

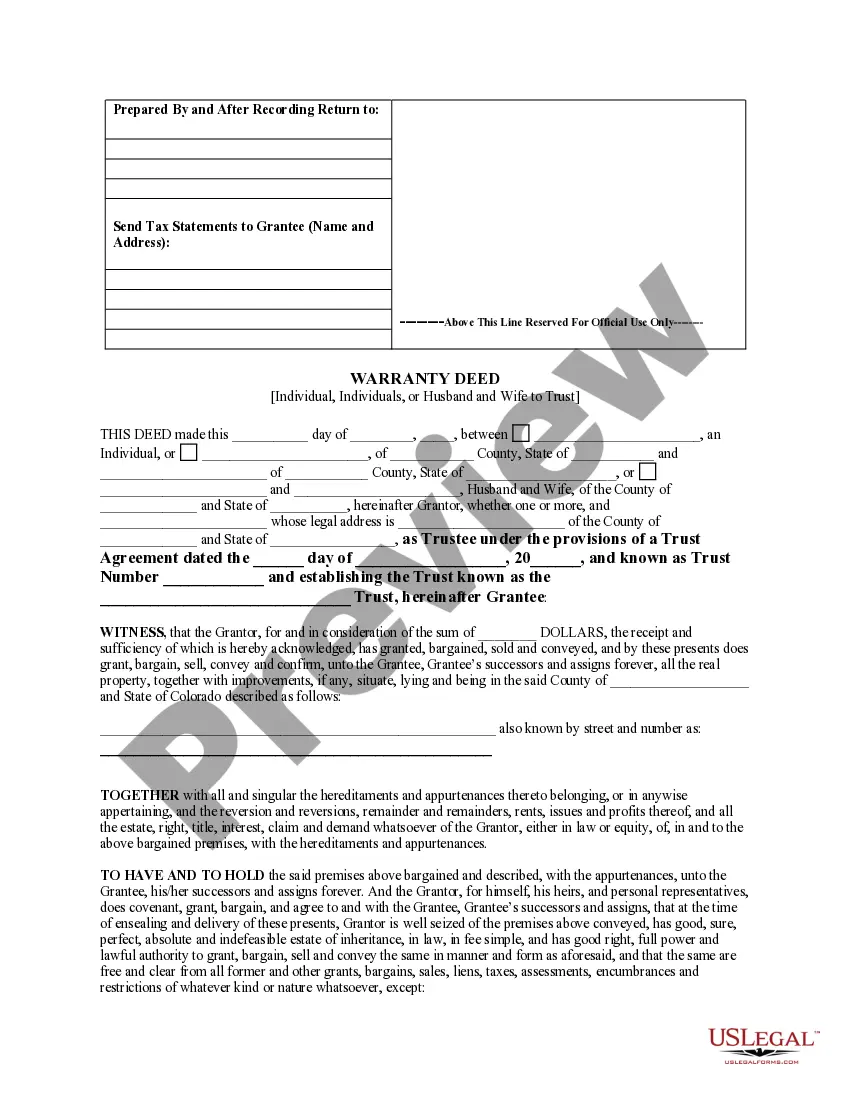

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.