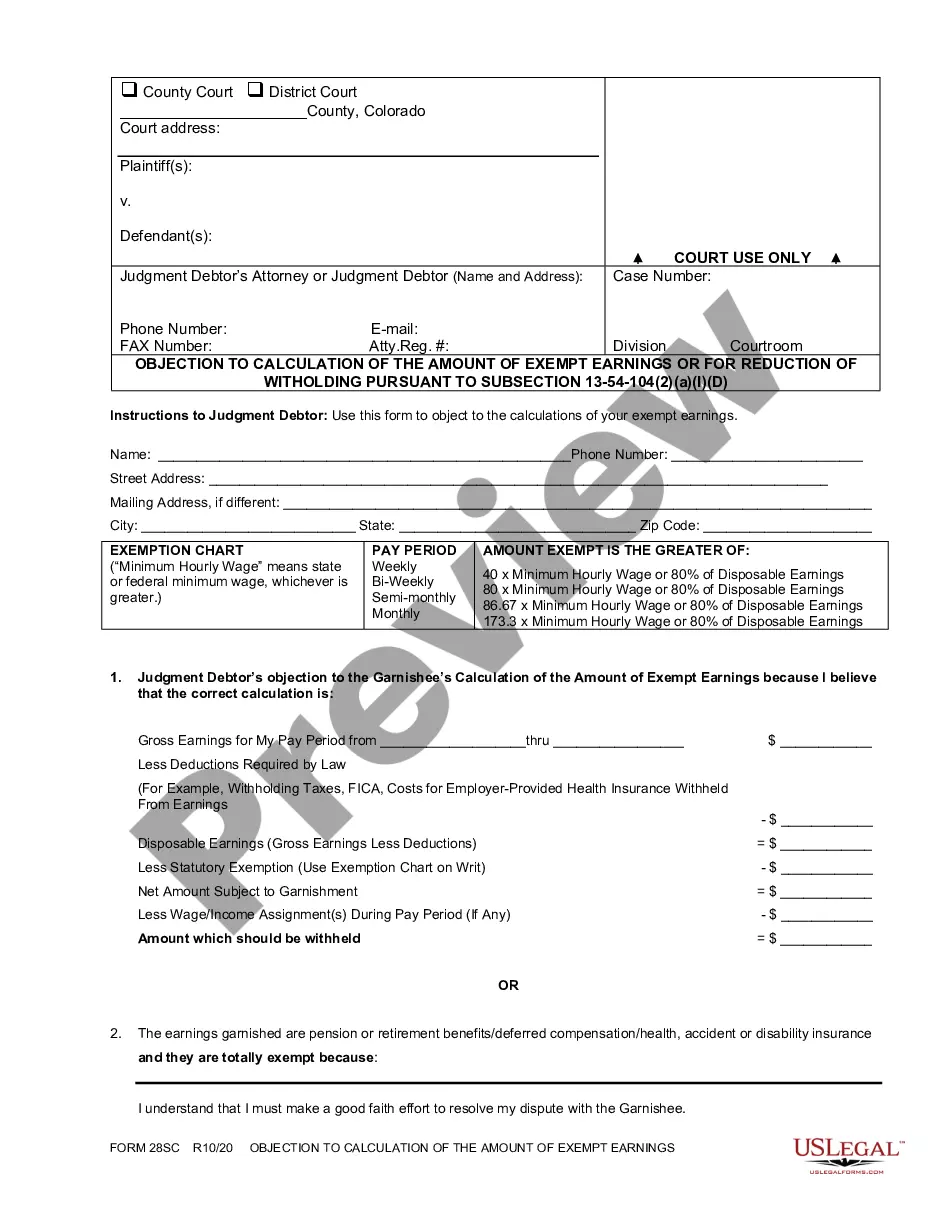

Colorado Objection To Calculation of Amount Of Exempt Earnings is a legal document that can be submitted to the Colorado Department of Revenue in order to dispute a calculation of the amount of exempt earnings in a particular case. The document can be used to contest the amount of exempt earnings calculated by the Department of Revenue and to make a claim for a higher amount. Generally, this document is used when the taxpayer believes that the Department of Revenue has miscalculated the amount of exempt earnings due to them. The two types of Colorado Objection To Calculation of Amount Of Exempt Earnings are: 1. Objection to Exempt Earnings Based on Error: This type of objection is used when the taxpayer believes that the Department of Revenue has made an error in calculating the exempt earnings due to them. 2. Objection to Exempt Earnings Based on Discretion: This type of objection is used when the taxpayer believes that the Department of Revenue has used its discretion to calculate the amount of exempt earnings due to them, and that the Department of Revenue's decision was not reasonable or appropriate based on the facts of the case.

Colorado Objection To Calculation of Amount Of Exempt Earnings

Description

How to fill out Colorado Objection To Calculation Of Amount Of Exempt Earnings?

US Legal Forms is the easiest and most budget-friendly method to locate appropriate formal templates.

It is the largest online archive of business and personal legal documents created and verified by attorneys.

Here, you can discover printable and editable forms that adhere to federal and state regulations - just like your Colorado Objection To Calculation of Amount Of Exempt Earnings.

Examine the form description or preview the document to ensure you’ve found the one that satisfies your needs, or search for another one using the search tab above.

Click Buy now when you’re confident about its relevance to all your requirements, and select the subscription plan that suits you best.

- Acquiring your template requires only a few straightforward steps.

- Users who already possess an account with an active subscription just need to Log In to the online service and download the document onto their device.

- Subsequently, they can locate it in their profile under the My documents section.

- And here’s how you can acquire a professionally prepared Colorado Objection To Calculation of Amount Of Exempt Earnings if you're using US Legal Forms for the first time.

Form popularity

FAQ

To calculate wage garnishment in Colorado, you need to determine your disposable income first. This is your gross income minus mandatory deductions. From there, you should apply the state’s garnishment limits, factoring in exemptions. If you need help with this calculation, the Colorado Objection To Calculation of Amount Of Exempt Earnings can provide a means to contest any inaccuracies, ensuring that your earnings are appropriately protected.

The new garnishment law in Colorado impacts how much of your earnings can be garnished. Under this law, the amount exempt from garnishment has been adjusted to better protect consumers. Understanding this law is crucial, especially if you believe your earnings may not have been calculated accurately. Utilizing the Colorado Objection To Calculation of Amount Of Exempt Earnings can be a solid approach if you feel the calculations do not reflect your true income.

To stop wage garnishment in Colorado, you can file a Colorado Objection To Calculation of Amount Of Exempt Earnings with the court. This formal objection allows you to challenge the calculations used to determine your exempt earnings. If the court finds that your exempt earnings have been miscalculated, it may reduce or eliminate your wage garnishment. Additionally, consider consulting with a legal expert or using platforms like US Legal Forms for guidance.

Once a writ of garnishment is filed, your employer receives notification to withhold a portion of your earnings. They will then begin to deduct the specified amount from your paycheck according to the garnishment's terms. If you believe the deductions are incorrect or exceed your allowable exemptions, you may need to file a Colorado Objection To Calculation of Amount Of Exempt Earnings. This ensures that your income remains protected while navigating the complexities of garnishment.

In Colorado, the priority of garnishment refers to the order in which multiple garnishments are processed against a single person's income. Generally, the first writ of garnishment takes precedence over others, but there are specific rules governing this process. If you're confronted with multiple garnishments, it's crucial to understand how to file a Colorado Objection To Calculation of Amount Of Exempt Earnings. This objection can clarify confusion and safeguard your financial resources.

A Writ of garnishment with notice of exemption and pending levy notifies your employer that part of your earnings may be subject to garnishment based on a court order. This document also informs you of your right to claim exemptions on a portion of your wages. If you believe the amount calculated is incorrect, you can file a Colorado Objection To Calculation of Amount Of Exempt Earnings. This action allows you to dispute the garnishment and protect your income appropriately.

In Colorado, the exemption for wage garnishment ensures that a portion of your earnings remains protected from creditors. Specifically, your disposable earnings are limited to a certain percentage or a set dollar amount, whichever is greater. Understanding this exemption is essential when considering a Colorado Objection To Calculation of Amount Of Exempt Earnings. This objection helps you assert your rights and ensure that your necessary income remains intact.

The effective period of garnishment in Colorado can vary depending on several factors, including the nature of the debt. Generally, it remains in effect until the debt is satisfied or the court vacates the judgment. If you face challenges regarding your earnings being garnished unfairly, consider a Colorado Objection To Calculation of Amount Of Exempt Earnings to address your concerns. Understanding these timeframes can empower you to take the right actions.

Yes, garnishments can expire in Colorado. The duration of a garnishment usually aligns with the judgment it stems from, which can last for a specific time period unless extended. Importantly, if you notice a garnishment that you believe is not calculated correctly, you have the right to file a Colorado Objection To Calculation of Amount Of Exempt Earnings to challenge it. Staying informed about the expiration can help you manage your finances better.

In Colorado, a wage garnishment typically goes into effect shortly after the court issues the order. Generally, employers receive notice of the garnishment within a few days. Once notified, employers must begin deducting the specified amount from your wages. If you believe the calculations related to your garnishment are incorrect, you can file a Colorado Objection To Calculation of Amount Of Exempt Earnings.