This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

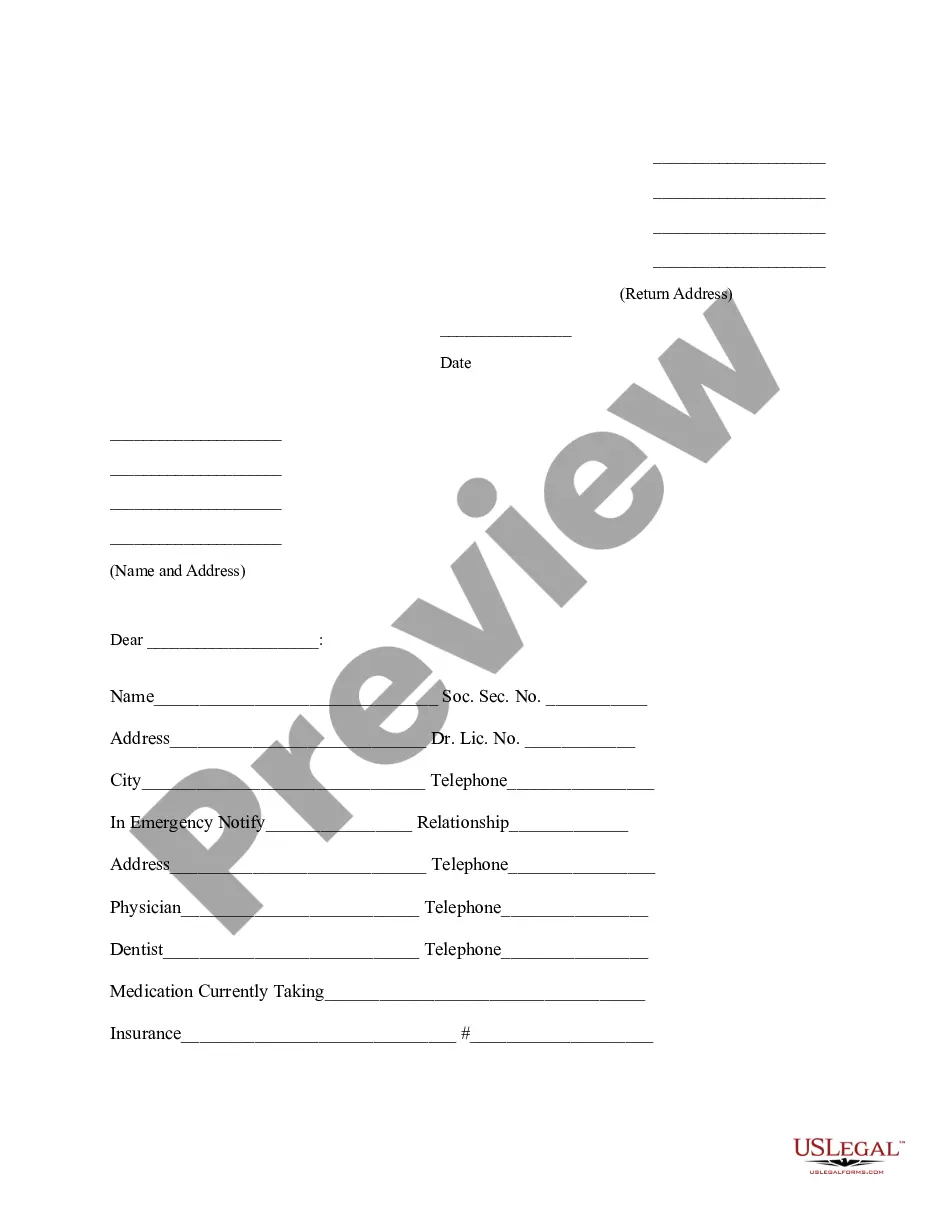

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

If you wish to finalize, acquire, or reproduce legal document templates, utilize US Legal Forms, the largest repository of legal forms available online. Employ the site's user-friendly and efficient search to find the documents you require. Various templates for business and personal purposes are categorized by groups and states, or keywords.

Use US Legal Forms to locate the Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage with just a few clicks. If you are currently a US Legal Forms user, sign in to your account and then click the Download button to obtain the Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. You can also access forms you previously downloaded in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow these steps: Step 1. Ensure you have selected the form for the correct region/state. Step 2. Utilize the Preview option to review the form’s contents. Remember to read through the description. Step 3. If you are not satisfied with the document, use the Search section at the top of the screen to find alternative versions of the legal document template. Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for the account. Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage.

- Every legal document template you obtain is yours permanently.

- You will have access to every form you downloaded in your account.

- Click on the My documents section and select a form to print or download again.

- Stay competitive and download, and print the Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage with US Legal Forms.

- There are millions of professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

The Unfair Claims Practice Act in Colorado is designed to protect consumers from unfair treatment by insurance companies. It outlines specific practices that insurers must avoid, such as unreasonable delays in claim processing and failing to provide a reasonable explanation for claim denials. If you believe your rights have been violated, you can consider a Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to seek clarity and resolution.

Filing an insurance complaint in Colorado involves submitting your concerns to the Colorado Division of Insurance. You can do this online, by mail, or by phone, providing all relevant details about your situation. Ensure you include any documentation that supports your complaint. If you feel your credit life policy coverage is in question, a Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage can help resolve disputes.

To prove that an insurance company acted in bad faith, you must demonstrate that they failed to uphold their contractual obligations. This includes showing that they did not conduct a thorough investigation of your claim or denied it without a valid reason. Collecting documentation, like correspondence and claim records, can support your case. If you need assistance, consider filing a Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage to clarify your rights.

The Supreme Court has made significant rulings on insurance claims that impact how policies are interpreted, including those related to Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. These decisions often clarify the obligations of insurers and the rights of policyholders. It’s essential to stay informed about these rulings, as they can influence your case and the outcome of your claims. Consulting resources like USLegalForms can help you navigate these complexities effectively.

To write a complaint letter to the insurance commissioner, start by clearly stating your issue regarding your Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Include relevant details, such as your policy number, the insurance company’s name, and a description of the claims process you've experienced. Be concise but thorough, and request a specific resolution. Finally, provide your contact information for follow-up.

A dec action, or declaratory judgment action, is a legal process used to resolve disputes regarding insurance policy interpretations. This action allows individuals to clarify their rights and obligations under an insurance policy, such as a Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. By initiating a dec action, you can seek a court's ruling to determine coverage and prevent further disputes. Utilizing platforms like US Legal Forms can simplify this process, offering templates and guidance tailored to your needs.

The Colorado Revised Statute 10-3-1115 provides guidelines for insurance claims handling in Colorado. This statute allows policyholders to seek a Colorado Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage when their insurer denies a claim. It aims to protect consumers by ensuring that insurance companies act in good faith. Understanding this statute can empower you to navigate disputes regarding insurance coverage effectively.