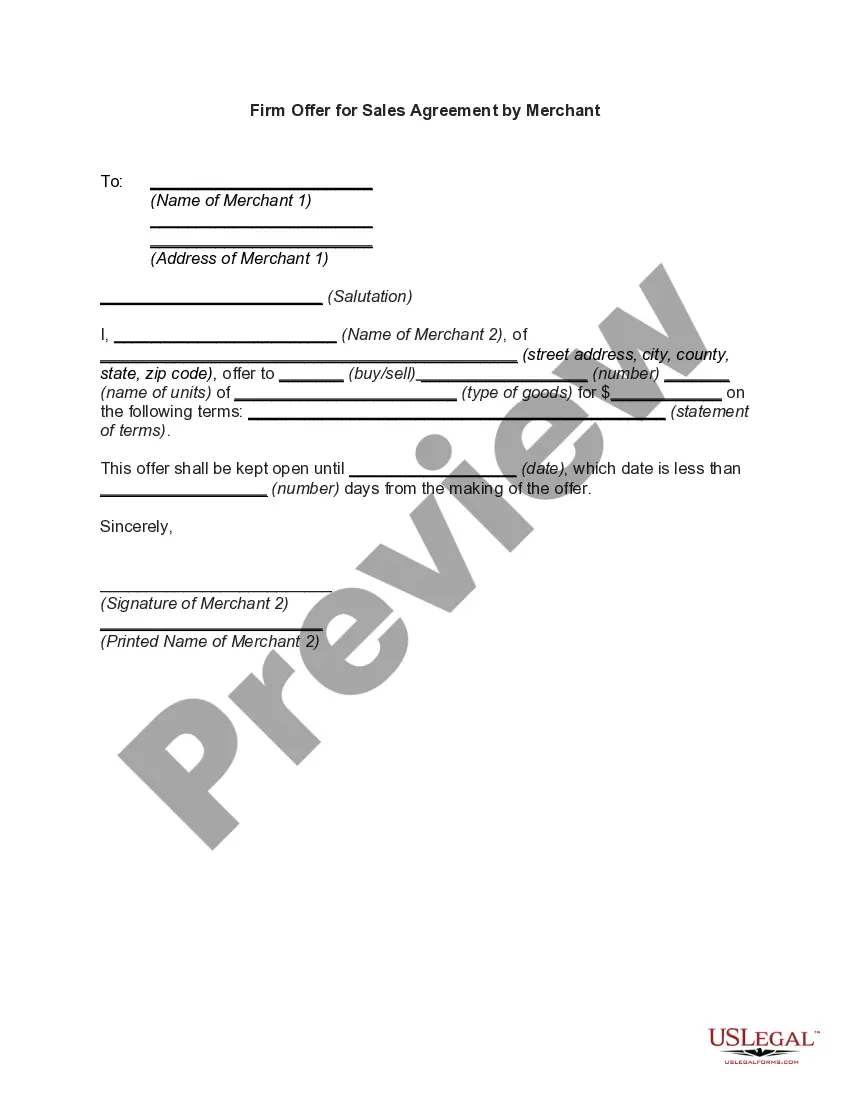

This form is a sample letter in Word format covering the subject matter of the title of the form.

Colorado Sample Letter for Payoff of Loan held by Mortgage Company is a comprehensive document that outlines the details and requirements for finalizing and settling a loan with a mortgage company. This letter can serve as a formal request and agreement between the borrower and the lending institution. It is crucial to use the right language and keywords to ensure clarity and accuracy. Some essential keywords to include in the content are: 1. Payoff Amount: The letter should clearly state the precise amount required to settle the loan in full, including any additional fees or interests. This ensures transparency and avoids any discrepancies. 2. Loan Account Number: The borrower should include their loan account number in the letter to ensure that the mortgage company can accurately identify and locate their loan details. 3. Property Address: It is essential to provide the complete address of the property associated with the loan. This aids in confirming the correct loan and avoiding any confusion or potential errors. 4. Request for Payoff Quote: The letter should explicitly request the mortgage company to provide a payoff quote or statement that summarizes the amount due for complete loan repayment. This quote should include all relevant details such as the effective date, calculation methodology, and any applicable fees. 5. Payment Method: The borrower should specify their preferred method of payment, such as a certified check, wire transfer, or other accepted forms of payment. Including this information will facilitate efficient and timely loan closure. 6. Escrow Account: If the borrower has an escrow account associated with the loan, it should be addressed in the letter. Clarify whether the mortgage company should refund any remaining balance or apply it towards the loan payoff amount. 7. Confirmation of Release: Upon successful loan payoff, the borrower should request a written confirmation from the mortgage company stating that the loan has been fully satisfied and closed. This document will serve as proof of loan clearance and can be useful for future reference. 8. Contact Information: Provide accurate contact information, including the borrower's name, address, phone number, and email address, to facilitate communication between all parties involved. By including these relevant keywords and ensuring clarity throughout the content, the Colorado Sample Letter for Payoff of Loan held by Mortgage Company will successfully convey the borrower's intentions and requirements to the mortgage company.Colorado Sample Letter for Payoff of Loan held by Mortgage Company is a comprehensive document that outlines the details and requirements for finalizing and settling a loan with a mortgage company. This letter can serve as a formal request and agreement between the borrower and the lending institution. It is crucial to use the right language and keywords to ensure clarity and accuracy. Some essential keywords to include in the content are: 1. Payoff Amount: The letter should clearly state the precise amount required to settle the loan in full, including any additional fees or interests. This ensures transparency and avoids any discrepancies. 2. Loan Account Number: The borrower should include their loan account number in the letter to ensure that the mortgage company can accurately identify and locate their loan details. 3. Property Address: It is essential to provide the complete address of the property associated with the loan. This aids in confirming the correct loan and avoiding any confusion or potential errors. 4. Request for Payoff Quote: The letter should explicitly request the mortgage company to provide a payoff quote or statement that summarizes the amount due for complete loan repayment. This quote should include all relevant details such as the effective date, calculation methodology, and any applicable fees. 5. Payment Method: The borrower should specify their preferred method of payment, such as a certified check, wire transfer, or other accepted forms of payment. Including this information will facilitate efficient and timely loan closure. 6. Escrow Account: If the borrower has an escrow account associated with the loan, it should be addressed in the letter. Clarify whether the mortgage company should refund any remaining balance or apply it towards the loan payoff amount. 7. Confirmation of Release: Upon successful loan payoff, the borrower should request a written confirmation from the mortgage company stating that the loan has been fully satisfied and closed. This document will serve as proof of loan clearance and can be useful for future reference. 8. Contact Information: Provide accurate contact information, including the borrower's name, address, phone number, and email address, to facilitate communication between all parties involved. By including these relevant keywords and ensuring clarity throughout the content, the Colorado Sample Letter for Payoff of Loan held by Mortgage Company will successfully convey the borrower's intentions and requirements to the mortgage company.