This form is a sample letter in Word format covering the subject matter of the title of the form.

Colorado Sample Letter to Credit Bureau concerning Decedent's Credit Report - Attorney

Description

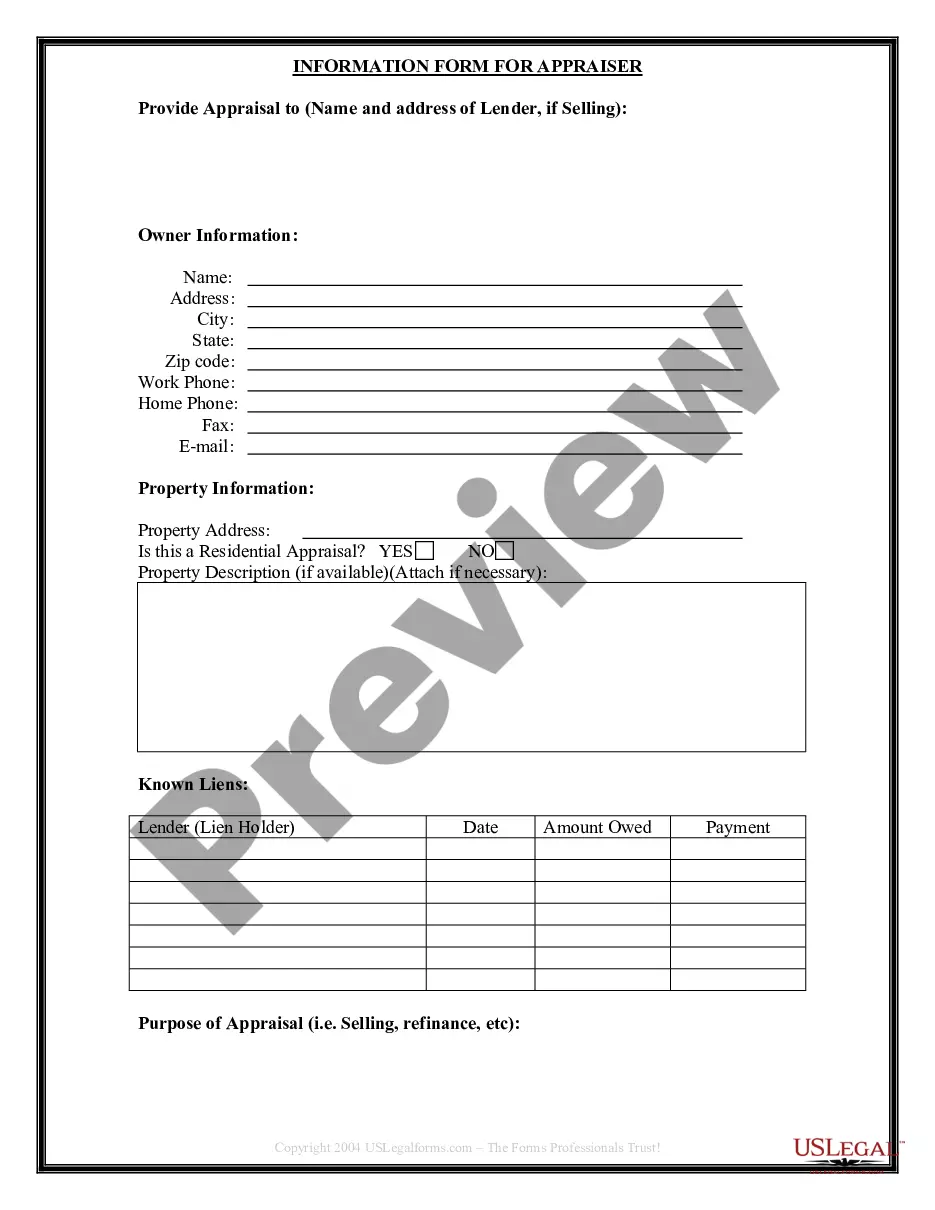

How to fill out Sample Letter To Credit Bureau Concerning Decedent's Credit Report - Attorney?

You can spend numerous hours online looking for the valid document template that meets the state and federal criteria you require. US Legal Forms offers thousands of legitimate forms that have been reviewed by experts.

It is easy to download or print the Colorado Sample Letter to Credit Bureau regarding Decedent's Credit Report - Attorney from my service. If you possess a US Legal Forms account, you can Log In and select the Download option.

After that, you can complete, modify, print, or sign the Colorado Sample Letter to Credit Bureau regarding Decedent's Credit Report - Attorney. Every legal document template you purchase is yours indefinitely. To obtain another copy of a purchased form, go to the My documents tab and click the appropriate option.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make adjustments to your document if necessary. You can complete, modify, and sign and print the Colorado Sample Letter to Credit Bureau regarding Decedent's Credit Report - Attorney. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legitimate forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your state/city that you select.

- Read the form description to ensure you have selected the correct form.

- If available, use the Review option to look through the document template as well.

- If you wish to find another version of your form, use the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you want, click on Purchase now to proceed.

- Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

To do that, of course, the SSA itself needs to have been notified about the death. This is often done by the funeral home. Additionally, the deceased person would need to have been receiving Social Security benefits for the SSA to inform the credit bureaus. From the executor or a relative.

Credit reporting companies regularly receive notifications from the Social Security Administration about individuals who have passed away, but it's better to also notify them on your own to ensure no one applies for credit in the deceased's name in the meantime.

That notification can happen one of two ways ? from the executor of the person's estate or from the Social Security Administration.

In most cases, the funeral home will report the person's death to us. You should give the funeral home the deceased person's Social Security number if you want them to make the report. If you need to report a death or apply for benefits, call 1-800-772-1213 (TTY 1-800-325-0778).

How to Notify Credit Bureaus of Death Obtain the death certificate. Call the credit agencies and request a credit freeze. Send the death certificate. Request a copy of the credit report. Work with the estate executor to close out credit accounts or pay off any remaining balance.

Notifying any one of the three credit bureaus -- Equifax, Experian, and TransUnion -- allows the individual's credit report to be updated with a deceased notice, which may help prevent theft of their identity.

Notifying any one of the three credit bureaus -- Equifax, Experian, and TransUnion -- allows the individual's credit report to be updated with a deceased notice, which may help prevent theft of their identity.

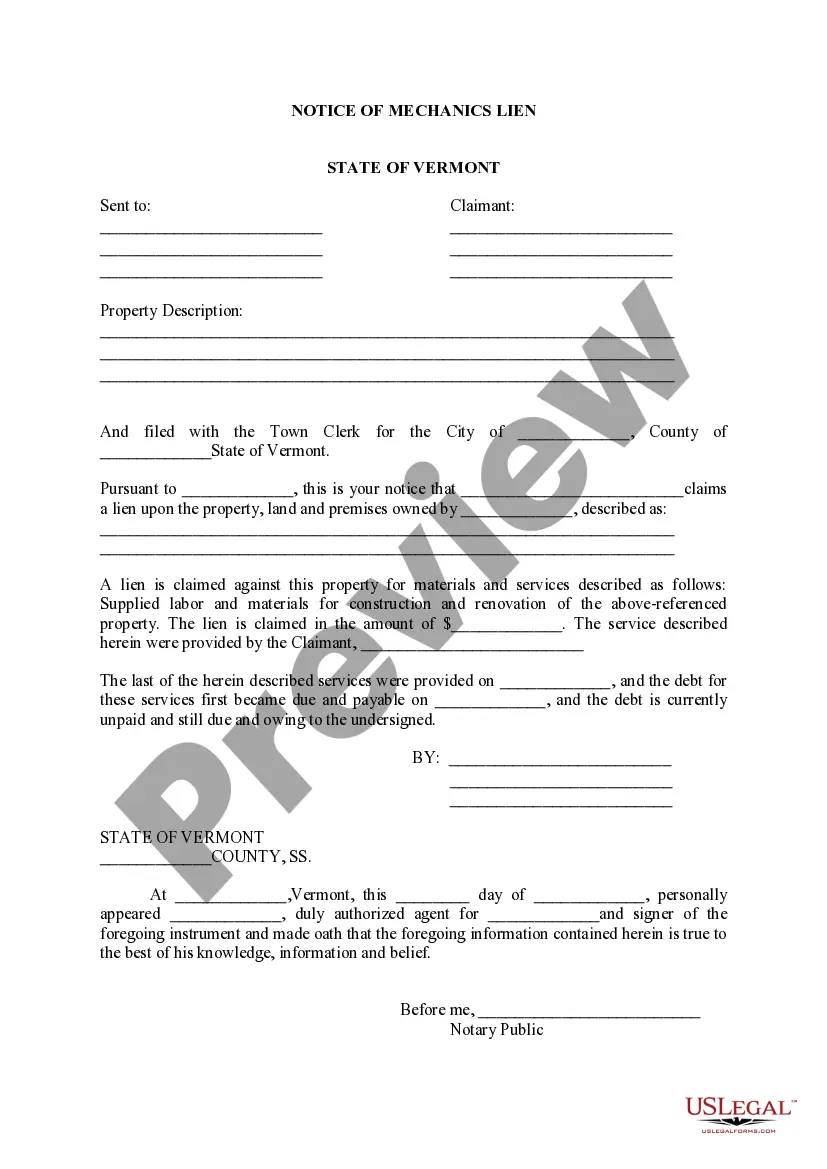

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.