Colorado Direct Deposit Form for Chase

Description

How to fill out Direct Deposit Form For Chase?

US Legal Forms - one of the most prominent collections of legal documents in the USA - provides a variety of legal template options that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest editions of forms such as the Colorado Direct Deposit Form for Chase in just seconds.

When the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Download Now button. Then, choose your preferred payment method and provide your information to create an account.

- If you have a subscription, Log In and download the Colorado Direct Deposit Form for Chase from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

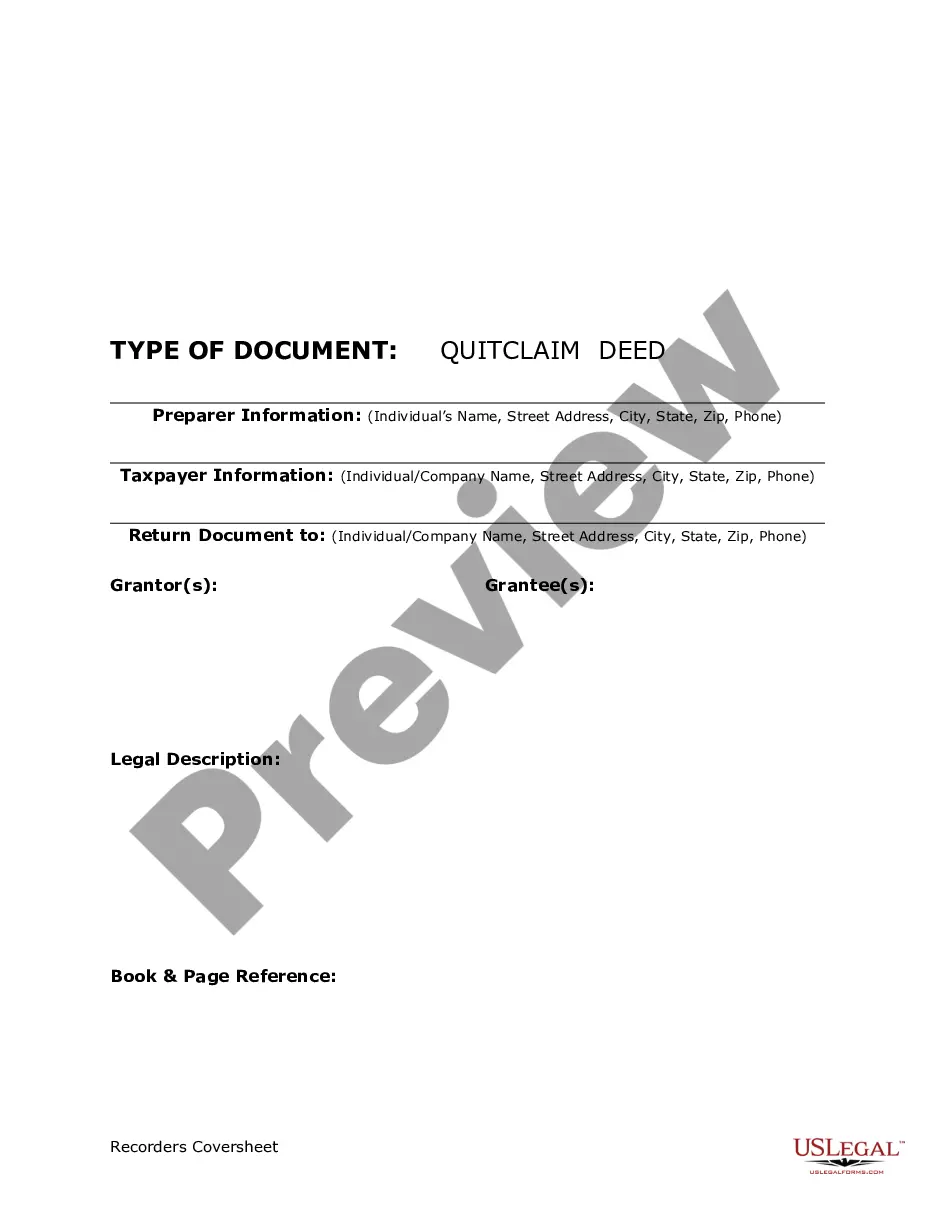

- Select the Review button to evaluate the contents of the form.

Form popularity

FAQ

You can acquire a Colorado Direct Deposit Form for Chase from the Chase website or by visiting a local branch. Additionally, some payroll departments may provide these forms directly to employees. If you're looking for a streamlined experience, US Legal Forms offers easy access to various templates and forms related to direct deposit paperwork.

No, you do not have to visit the bank physically to obtain a Colorado Direct Deposit Form for Chase. Many banks provide downloadable versions of these forms on their websites. You can complete the form online or print it out at home. If you need help understanding the process, US Legal Forms can provide clear resources and templates.

To obtain a bank verification letter for direct deposit, visit your local Chase branch or contact customer service. This letter confirms your account details, making it easier for employers to set up direct deposit with your banking information. Remember, you can request this letter to be expedited if you're in a hurry. Consider using US Legal Forms for templates to streamline your requests.

An example of authorization for direct deposit includes a signed statement permitting your employer to deposit your paycheck directly into your bank account. This typically requires you to provide account details such as your account number and routing number. Including a Colorado Direct Deposit Form for Chase with your authorization is advisable. For more guidance, check out resources on US Legal Forms.

Yes, you can print off a Colorado Direct Deposit Form for Chase directly from their website or through various banking resources. Make sure you have the right account details handy, as you will need to fill out the form accurately. Printing it allows you to complete it by hand and submit it to your employer or the payor. If you're unsure, you can visit US Legal Forms for assistance.

You can obtain a direct deposit authorization form by contacting your employer or human resources department. They usually provide this form for employees to authorize direct deposits. If you prefer an online option, the Colorado Direct Deposit Form for Chase is easily accessible through the Chase website or via services like USLegalForms, which can simplify the process.

To get the Colorado Direct Deposit Form for Chase online, start by logging into your Chase account. Once logged in, look for the direct deposit section, where you will find the necessary forms for online access. Additionally, consider using platforms like USLegalForms for a user-friendly experience in obtaining and filling out the form.

You can get a Colorado Direct Deposit Form for Chase by requesting it from your employer. They typically provide this form for setting up direct deposits into your bank account. Alternatively, you can download a generic direct deposit form online from Chase's website or use services like USLegalForms to streamline the process.

To obtain a direct deposit authorization form from Chase, visit the Chase website or your local branch. You can easily download the Colorado Direct Deposit Form for Chase directly from their site. Utilizing resources like US Legal Forms can also provide you with the necessary authorization form efficiently and securely.

You should send your Colorado Direct Deposit Form for Chase to your employer's payroll department or human resources. They will handle the processing and ensure your payment goes directly into your Chase account. Double-check with your employer for any specific instructions regarding where to send the form, as this can vary by organization.