Subject: Detailed Description of Colorado Sample Letter to State Tax Commission concerning Decedent's Estate Dear [State Tax Commission], I am writing to provide you with a detailed description of the necessary steps to address the tax obligations related to the estate of the deceased individual in the state of Colorado. This letter aims to clarify the specific procedures and forms required to ensure compliance with state tax regulations. Colorado state law imposes certain tax requirements to be fulfilled upon the death of an individual. These obligations may include filing a final income tax return, estate tax return, and/or inheritance tax return. It is crucial to handle these responsibilities promptly and accurately to avoid potential penalties or legal repercussions. The Colorado Sample Letter to State Tax Commission concerning Decedent's Estate serves as a template to guide individuals acting as executors, administrators, or personal representatives in meeting the required tax obligations. This sample letter helps ensure that all necessary information is provided when communicating with the tax commission. There might be different types of Colorado Sample Letters to the State Tax Commission concerning Decedent's Estate, tailored to specific situations: 1. Final Income Tax Return Letter: This type of letter guides the executor or personal representative in reporting the final income and taxes of the deceased individual. It includes details such as the decedent's name, Social Security number, date of death, and any income received before or after their passing. 2. Estate Tax Return Letter: When applicable, this specific letter provides guidance on reporting and paying estate taxes owed to the state of Colorado. It outlines the necessary forms to be filed with the State Tax Commission, such as the Colorado Estate Tax Return (Form DR 0014) and supporting documentation. 3. Inheritance Tax Return Letter: Inheritance tax may be applicable in certain cases. This letter guides individuals in reporting and paying any inheritance tax due after the decedent's passing. It explains the process for completing the Colorado Inheritance Tax Return (Form DR 1024) and includes details concerning beneficiaries, asset valuations, and tax rates. When drafting any of the aforementioned letters, it is crucial to include accurate information to ensure the prompt processing of necessary tax documents. Additionally, it is recommended to consult with a tax professional or an attorney experienced in estate planning to ensure compliance with all legal requirements. Please find enclosed the Colorado Sample Letter to State Tax Commission concerning Decedent's Estate, which highlights the necessary steps, forms, and documentation required to address tax obligations in the state. Feel free to reach out should you have any questions or require further clarification. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]

Colorado Sample Letter to State Tax Commission concerning Decedent's Estate

Description

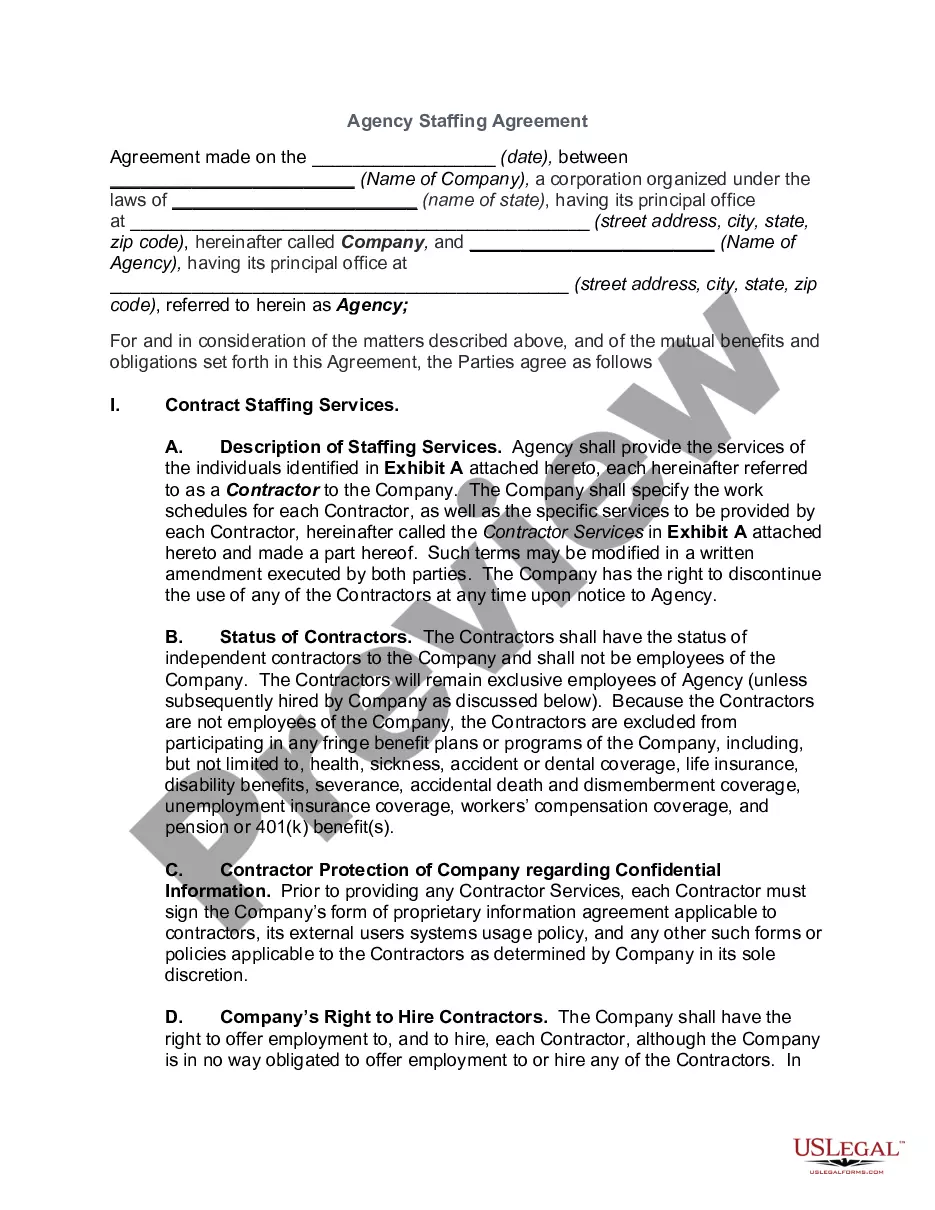

How to fill out Colorado Sample Letter To State Tax Commission Concerning Decedent's Estate?

Finding the right lawful papers design could be a have difficulties. Obviously, there are a lot of web templates available on the Internet, but how do you get the lawful kind you will need? Take advantage of the US Legal Forms site. The support offers a large number of web templates, for example the Colorado Sample Letter to State Tax Commission concerning Decedent's Estate, which you can use for business and personal requirements. Each of the kinds are checked out by specialists and fulfill federal and state requirements.

Should you be presently authorized, log in to your accounts and click on the Acquire key to get the Colorado Sample Letter to State Tax Commission concerning Decedent's Estate. Make use of accounts to appear with the lawful kinds you might have acquired formerly. Proceed to the My Forms tab of your accounts and obtain yet another copy of your papers you will need.

Should you be a whole new consumer of US Legal Forms, allow me to share straightforward recommendations that you can follow:

- Very first, make sure you have selected the right kind for the area/county. It is possible to look over the shape utilizing the Preview key and browse the shape information to make certain it will be the right one for you.

- In the event the kind fails to fulfill your requirements, take advantage of the Seach discipline to find the right kind.

- Once you are certain that the shape is acceptable, click on the Purchase now key to get the kind.

- Pick the prices plan you desire and enter in the necessary information and facts. Design your accounts and pay for an order making use of your PayPal accounts or credit card.

- Pick the data file formatting and obtain the lawful papers design to your device.

- Full, edit and print out and sign the received Colorado Sample Letter to State Tax Commission concerning Decedent's Estate.

US Legal Forms will be the biggest library of lawful kinds that you can discover a variety of papers web templates. Take advantage of the company to obtain expertly-made paperwork that follow status requirements.