A Colorado Buy Sell or Stock Purchase Agreement Covering Common Stock in a Closely Held Corporation with an Option to Fund Purchase through Life Insurance is a legally binding agreement entered into by shareholders or owners of a closely held corporation in Colorado. This agreement outlines the terms and conditions under which the stocks or shares of a deceased or departing shareholder can be bought and sold. The primary purpose of this agreement is to provide a mechanism for the orderly transfer of ownership in the event of the death, disability, or departure of a shareholder. It aims to ensure that the remaining shareholders have the right and ability to purchase the departing shareholder's stocks or shares, while also providing financial security to the departing shareholder or their family. The agreement typically includes various provisions and clauses to protect the interests of all parties involved. Some key elements covered in the agreement include: 1. Identification of the Parties: The agreement will identify the closely held corporation and all shareholders who are party to the agreement. 2. Trigger Events: The agreement will specify the events that will trigger the buy-sell provision, such as the death, disability, retirement, or voluntary departure of a shareholder. These events are critical as they determine when the agreement comes into effect and the shares become eligible for purchase. 3. Purchase Price Determination: The agreement will set forth the mechanism for determining the purchase price of the shares, typically using a predetermined formula or appraisal process. This ensures a fair valuation of the shares and prevents disputes over pricing. 4. Funding the Purchase: One specific option available in Colorado is the use of life insurance to fund the purchase of the shares. This means that the corporation or the remaining shareholders will take out life insurance policies on the lives of each shareholder, with the policy proceeds being used to buy the shares upon the triggering event. This approach ensures that the necessary funds are readily available and provides financial security to the departing shareholder's family. 5. Terms of Purchase: The agreement will outline the terms and conditions of the purchase, including the payment process, timing, and any required approvals. It may also include provisions for financing the purchase or establishing payment terms. 6. Restrictive Covenants: The agreement may include non-competition or non-solicitation clauses to prevent the departing shareholder from competing with the corporation or soliciting clients or employees after the sale of their shares. It is worth noting that there can be variations or different types of Buy Sell or Stock Purchase Agreements in Colorado covering common stock in closely held corporations. These variations can include agreements with different funding mechanisms, such as self-financing or installment payments, or agreements tailored to specific industries or circumstances. However, the essential elements mentioned above are typically included in all such agreements to provide clarity, fairness, and protection for all parties involved.

Colorado Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

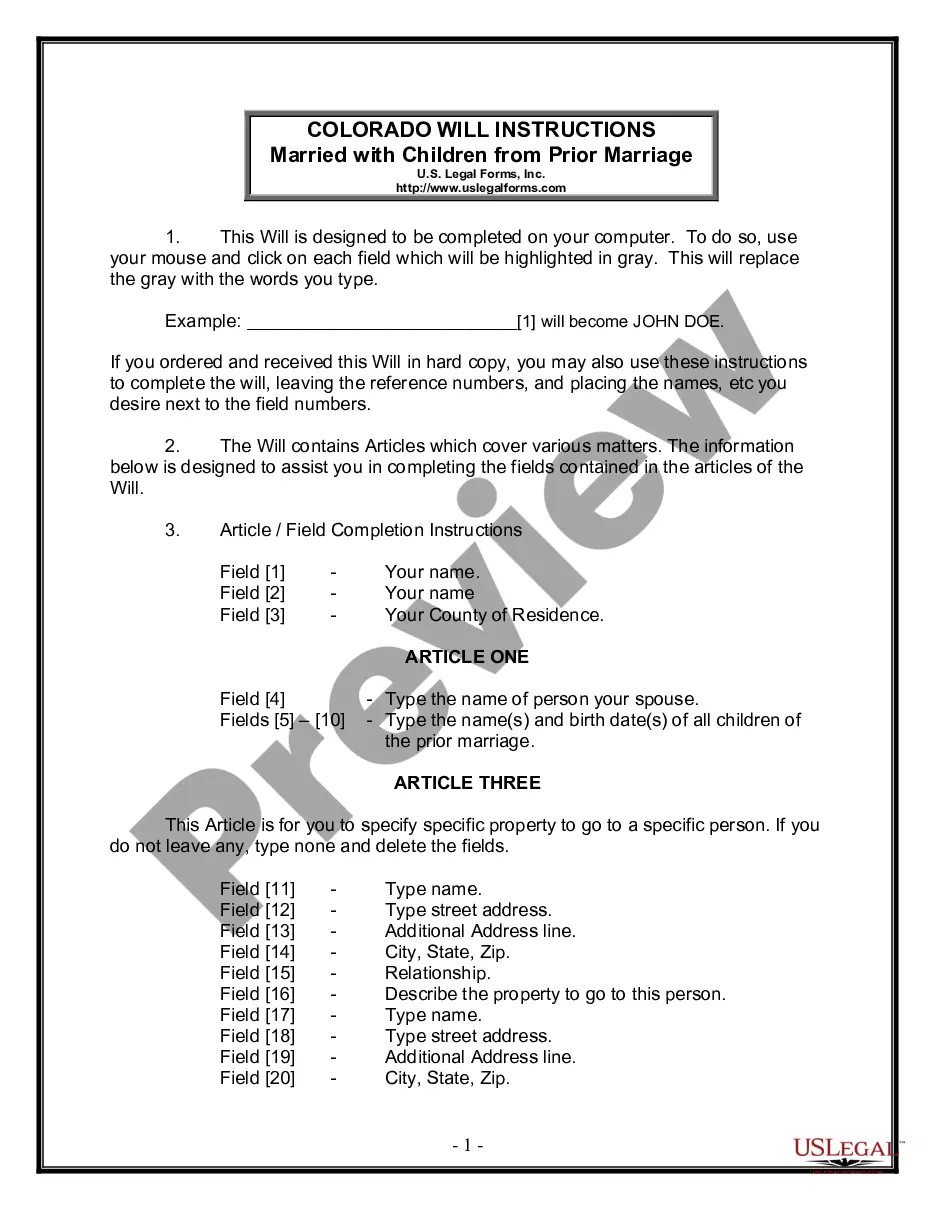

How to fill out Colorado Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Locating the appropriate sanctioned document template can be a challenge. Undoubtedly, there are numerous designs available online, but how can you find the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of designs, including the Colorado Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, which can be utilized for both business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download option to access the Colorado Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance. Use your account to review the legal forms you may have previously obtained. Navigate to the My documents section of your account and get another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can preview the document using the Review option and browse the document outline to confirm it is the suitable one for you. If the form does not satisfy your needs, use the Search field to find the right form. Once you are certain that the document is appropriate, choose the Buy now option to obtain the form. Select the payment plan you wish and enter the necessary information. Create your account and complete the purchase with your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, edit, and print, then sign the obtained Colorado Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

- US Legal Forms is the largest collection of legal forms where you can find a variety of document templates.

- Utilize the platform to obtain professionally crafted paperwork that adheres to state requirements.

Form popularity

FAQ

Establish a market for the corporation's stock that might otherwise be difficult to sell; Ensure that the ownership of the business remains with individuals selected by the owners or remains closely held; Provide liquidity to the estate of a deceased shareholder to pay estate taxes and costs; and.

Here is how buy-sell agreements work:Determine which events invoke a triggered buyout.Establish who has rights and purchase obligations.Identify the names and address of the purchasers.Set a purchase price or valuation with applicable discounts.Establish payment terms as well as their intervals.More items...

Definition. 1. A buy-sell agreement is an agreement among the owners of the business and the entity. 2. The buy-sell agreement usually provides for the purchase and sale of ownership interests in the business at a price determined in accordance with the agreement, upon the occurrence of certain (usually future) events.

The sale of the shares may be accomplished in two very different ways. First, each shareholder can agree to purchase, pro rata or otherwise, all the stock being sold. This is called a "cross purchase" of stock.

When does a business need a buy-sell agreement? Every co-owned business needs a buy-sell, or buyout agreement the moment the business is formed or as soon after that as possible. A buy-sell, or buyout agreement, protects business owners when a co-owner wants to leave the company (and protects the owner who's leaving).

Some of the common triggers include death, disability, retirement or other termination of employment, the desire to sell an interest to a non-owner, dissolution of marriage or domestic partnership, bankruptcy or insolvency, disputes among owners, and the decision by some owners to expel another owner.

sell agreement generally provides that if a shareholder attempts to sell or give his or her shares to a third party, the corporation or the other shareholders have a right of first refusal to purchase the shares for a given period.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

Entity-purchase agreement Under an entity-purchase plan, the business purchases an owner's entire interest at an agreed-upon price if and when a triggering event occurs. If the business is a corporation, the plan is referred to as a stock redemption agreement.

Interesting Questions

More info

This page may require JavaScript to be enabled. If you require JavaScript or the ability to load a web page, click on the “Internet Options” icon located to the right of the address bar.