Colorado Revocable Living Trust for Married Couple

Description

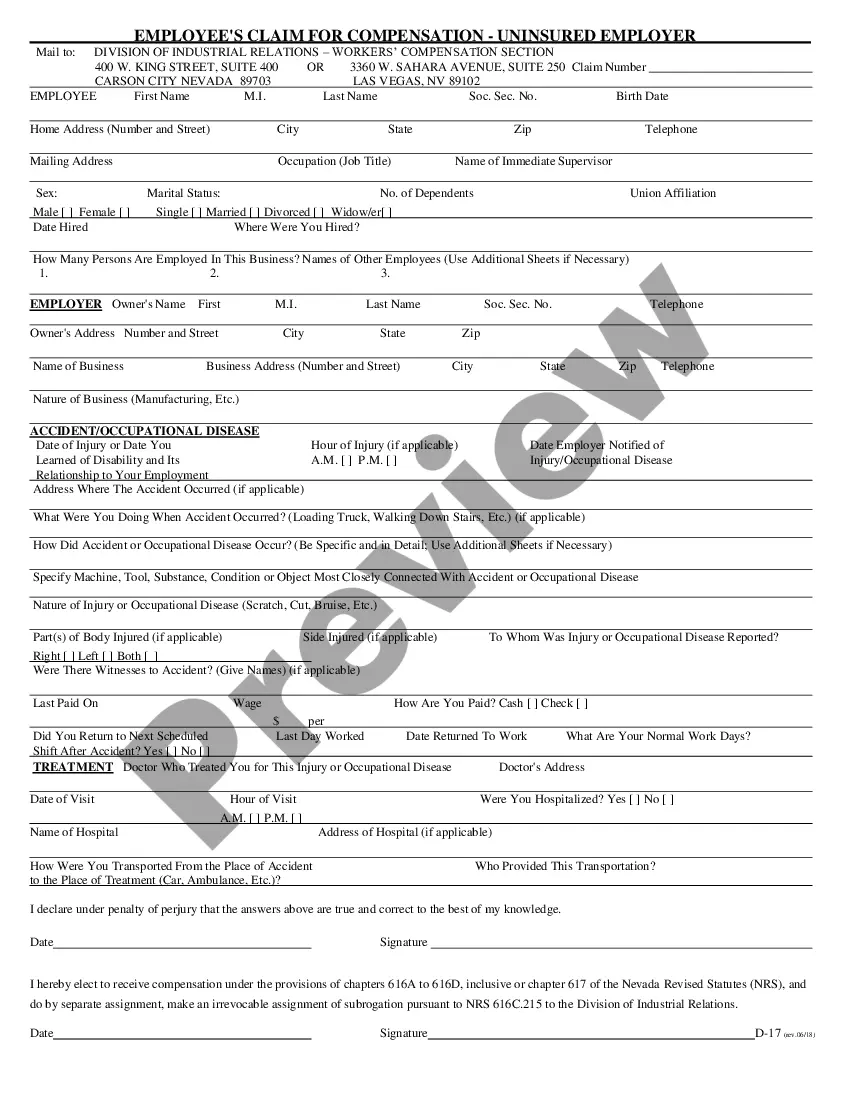

How to fill out Revocable Living Trust For Married Couple?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the Colorado Revocable Living Trust for Married Couple in mere seconds.

If you already have a subscription, Log In to download the Colorado Revocable Living Trust for Married Couple from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Make modifications. Complete, edit, and print and sign the downloaded Colorado Revocable Living Trust for Married Couple. Each template you add to your account does not expire and is yours indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the form you need.

- Make sure you have selected the correct form for your state/region.

- Click the Preview button to review the content of the form.

- Check the form description to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Trust funds, including a Colorado Revocable Living Trust for Married Couple, can present certain risks if not managed properly. For instance, if the trust lacks clear instructions, beneficiaries may face disputes over asset distribution. Moreover, if the trust is not properly funded, it may fail to achieve its intended purpose. To mitigate these risks, it's important to work with reputable legal documents providers like uslegalforms to ensure accurate setup and ongoing management.

Considering a Colorado Revocable Living Trust for Married Couple can be a wise decision for your parents, as it provides a way to manage their assets during their lifetime and ensures a smooth transition upon their passing. It allows them to retain control of their assets while potentially avoiding the probate process. By creating a trust, they can also specify how and when their assets will be distributed, giving them greater peace of mind. It’s always advisable to consult with a legal professional to explore if this option suits their financial situation.

When one spouse dies, a joint revocable trust, such as a Colorado Revocable Living Trust for Married Couple, typically remains intact but may become irrevocable. The surviving spouse usually gains full control of the trust assets, allowing them to manage and distribute the assets according to their wishes. It's crucial to review and possibly update the trust documents after such an event.

You might consider putting your house in a trust in Colorado if you are looking to simplify your estate management. A Colorado Revocable Living Trust for Married Couple can facilitate smoother asset transfer and ensure your wishes are executed after your death. It's a beneficial option, especially if you want to manage how your assets are distributed.

Deciding whether to put your house in a trust in Colorado depends on your estate planning goals. A Colorado Revocable Living Trust for Married Couple can help simplify the distribution of your estate and avoid the lengthy probate process. It’s advisable to consult with a legal professional to discuss how this option aligns with your financial and legal needs.

The best living trust for a married couple often depends on your specific needs and goals. A Colorado Revocable Living Trust for Married Couple is a popular choice, as it allows both spouses to retain control over the assets while providing flexibility for future changes. This type of trust can help avoid probate and ensure a smooth transition of assets upon death.

One potential disadvantage of placing your home in a Colorado Revocable Living Trust for Married Couple is that it can complicate your property management. If you expect to sell or refinance your home, you will need to have the trust involved in those transactions. Additionally, you'll incur some administrative costs associated with setting up and maintaining the trust.

Filling out a Colorado Revocable Living Trust for Married Couple involves several key steps. First, you need to list all assets that you wish to include in the trust. Next, you'll specify the trustees, which could be you and your spouse, and outline the distribution of assets upon your passing. You can use platforms like uslegalforms to access easy-to-follow templates, ensuring that you fill the trust out correctly and comprehensively.

Yes, a married couple can certainly establish a Colorado Revocable Living Trust for Married Couple. This type of trust allows both spouses to manage their assets collectively while retaining the flexibility to make changes. It ensures that the couple's wishes are honored, providing peace of mind and clarity for future beneficiaries. Using a revocable trust can also help in avoiding potentially lengthy probate processes after one spouse passes away.

Yes, you have the option to write your own living trust in Colorado. Creating a Colorado Revocable Living Trust for Married Couples lets you maintain control over your assets while providing a clear outline for their distribution. However, ensure you educate yourself on the legal requirements to avoid common pitfalls. Utilizing resources like US Legal Forms can help simplify this process and guide you through the necessary steps.