Colorado Classification of Employees for Personnel Manual or Employee Handbook: In the state of Colorado, employers are advised to adhere to specific guidelines when it comes to classifying employees in their Personnel Manual or Employee Handbook. Understanding the distinctions between full-time, part-time, temporary, leased, exempt, and nonexempt employees is crucial for compliance with state labor laws. Below, we will explore each category in detail: 1. Full-Time Employees: Full-time employees are typically hired to work a standard 40-hour workweek, although some organizations may have a different definition based on their industry or operational requirements. These employees are entitled to benefits such as health insurance, vacation days, sick leave, and retirement plans, as outlined by the employer's policies. 2. Part-Time Employees: Part-time employees are those who work fewer hours than full-time employees. Colorado's law does not provide a specific definition of part-time work, so employers have the flexibility to determine the number of hours that classify an employee as part-time. Part-time employees may receive certain benefits, but they are often prorated based on their hours worked. 3. Temporary Employees: Temporary employees are hired for a fixed period to fulfill specific project needs, assist during busy seasons, or cover for absent employees. Their employment may range from a few days to several months and is generally non-permanent in nature. Temporary employees may receive limited benefits or none at all, depending on employer policy and state regulations. 4. Leased Employees: Leased employees are individuals who are contracted through a staffing agency or professional employer organization (PEO). In such cases, the staffing agency or PEO is the employer of record, responsible for payroll, benefits, and HR administration. The employer who leases these employees typically supervises and directs their work. The specific classification and employment terms should be addressed in the Personnel Manual or Employee Handbook. 5. Exempt Employees: Exempt employees are those who meet certain criteria defined by federal and state labor laws for exemption from overtime pay. These individuals are generally employees in executive, administrative, professional, or outside sales roles, receiving a salary instead of hourly wages. The classification of exempt employees must conform to the criteria laid out in the Colorado Wage Order and Fair Labor Standards Act (FLEA). 6. Nonexempt Employees: Nonexempt employees, in contrast to exempt employees, are entitled to receive overtime pay for hours worked beyond the standard 40-hour workweek. They are typically eligible for hourly wages and must be paid at least the minimum wage set by Colorado labor laws. It is important for employers in Colorado to clearly define the classification of employees in their Personnel Manual or Employee Handbook to ensure proper treatment, compensation, and compliance with applicable labor laws. These classifications help establish expectations regarding benefits, working hours, and overtime eligibility for each employee category. Employers may consult legal professionals or the Colorado Department of Labor and Employment for precise guidelines tailored to their specific circumstances.

Colorado Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees

Description

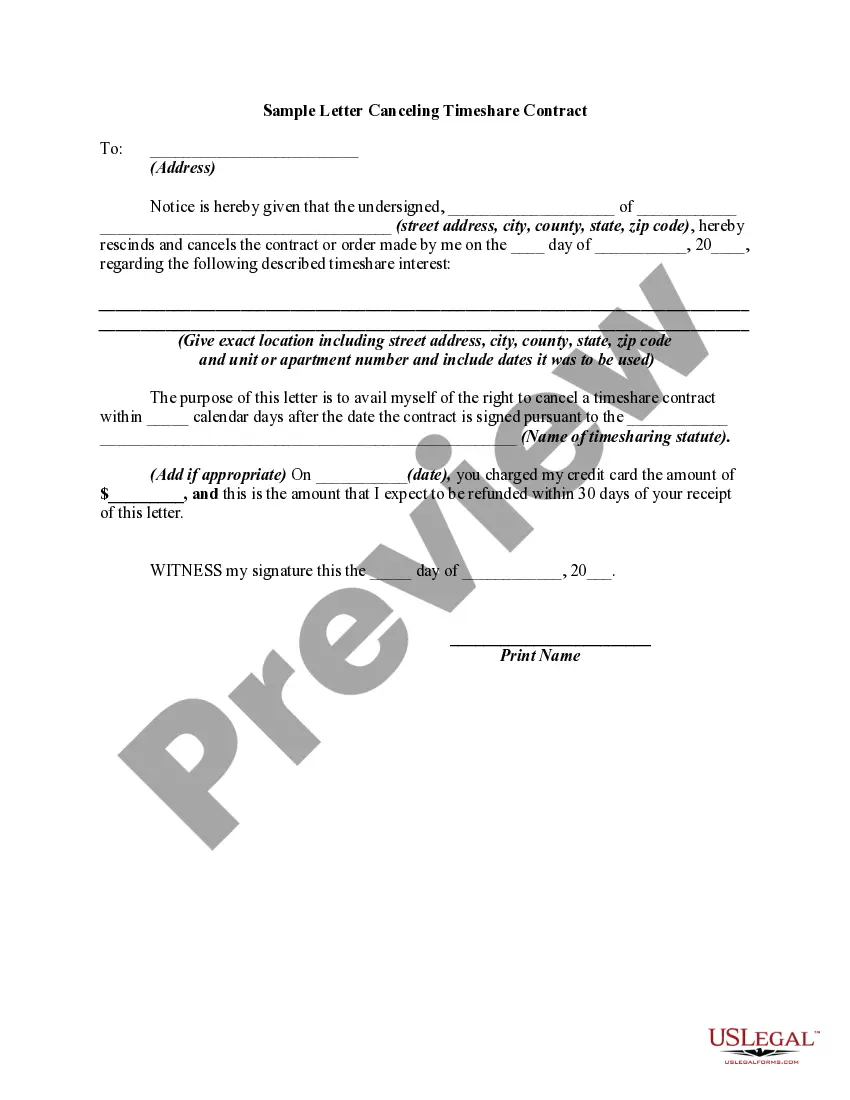

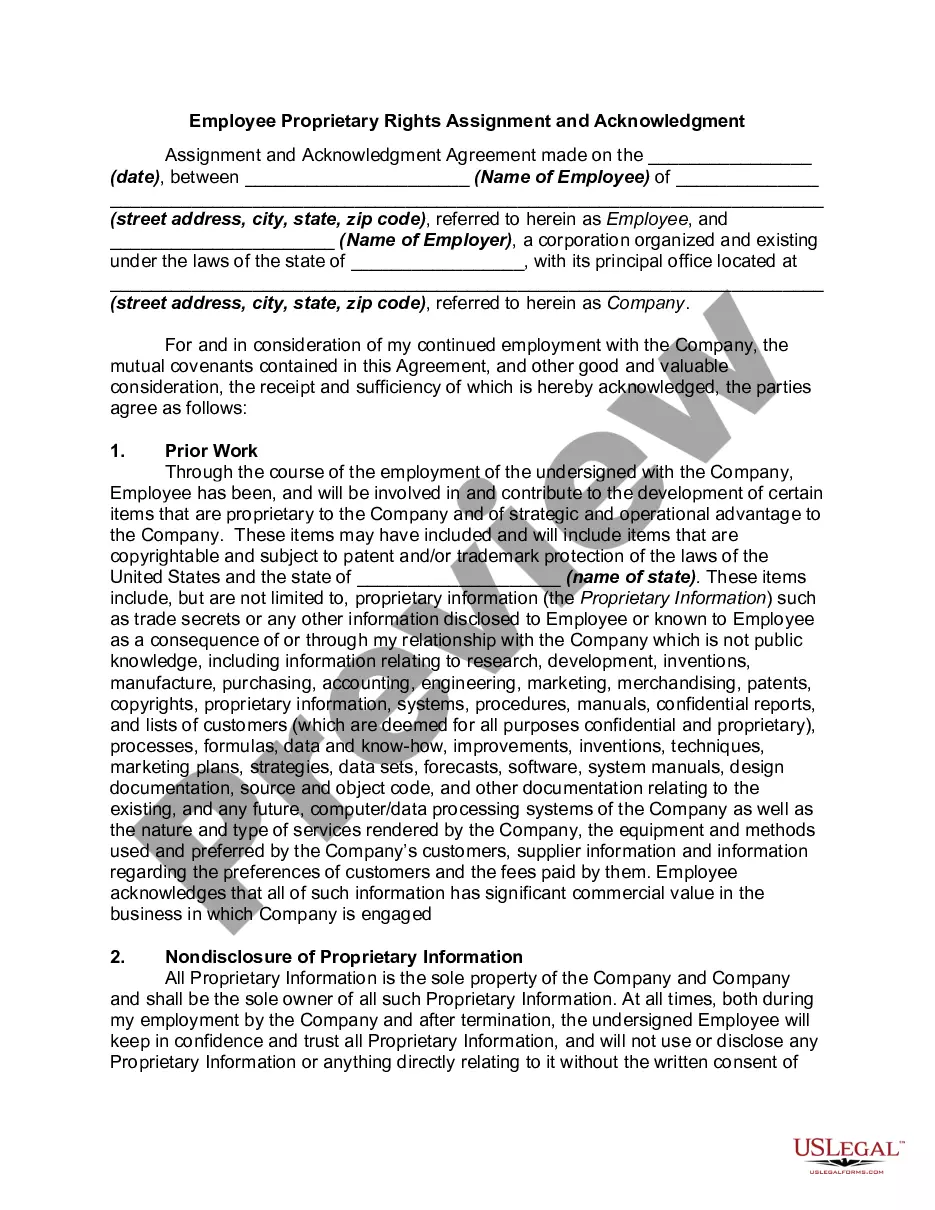

How to fill out Colorado Classification Of Employees For Personnel Manual Or Employee Handbook Regarding Full Time, Part Time, Temporary, Leased, Exempt, And Nonexempt Employees?

Locating the appropriate legal document template can be challenging.

Naturally, numerous templates are accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website.

This service provides thousands of templates, such as the Colorado Classification of Employees for Personnel Manual or Employee Handbook concerning Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees, which you can utilize for business and personal purposes.

You can browse the form using the Preview button and read the form description to confirm it is the right one for you.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Download button to obtain the Colorado Classification of Employees for Personnel Manual or Employee Handbook concerning Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees.

- Use your account to review the legal forms you have previously acquired.

- Visit the My documents tab in your account to download an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

A classified Colorado state employee refers to individuals who have specific job classifications under state employment laws. This classification includes criteria based on job duties, performance, and level of supervision, impacting status as Full Time, Part Time, Temporary, Leased, Exempt, or Nonexempt Employees. Understanding this classification helps employers structure their employee handbook effectively. By clearly articulating these classifications, you can ensure compliance and clarity in your Colorado Classification of Employees for Personnel Manual or Employee Handbook.

While it is not legally required for all businesses to have an employee handbook, having one is highly recommended. An employee handbook clarifies your policies and procedures regarding Colorado Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees. It serves as a valuable resource that helps prevent misunderstandings and ensures compliance with state and federal laws. By implementing a well-structured handbook, you enhance transparency and support a positive workplace culture.

The term employment-at-will in a personnel policy handbook conveys that the employee can leave the job or be terminated at any time, barring illegal reasons. This mutual agreement fosters a clear understanding of the employment dynamic, which can be critical for addressing Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees. For further assistance, USLegalForms offers resources to help organizations develop compliant and comprehensive employee handbooks.

Employment on an at-will basis means that the employee serves without a formal contract tying them to a specific duration. This arrangement provides freedom for both parties to make employment decisions without prior notice or justification. Understanding this concept helps managers effectively classify Colorado employees in their Personnel Manual or Employee Handbook, particularly when distinguishing between various classifications like Full Time, Part Time, Temporary, and others.

Including an employment-at-will statement in a personnel policy indicates that the employment does not have a fixed term. It sets the expectation that both employees and employers can end the employment relationship whenever they choose. This provision is crucial for the Colorado Classification of Employees for Personnel Manual or Employee Handbook, allowing organizations to adapt to changing needs and circumstances.

The at-will statement in an employee handbook outlines the nature of the employment relationship. It clarifies that either the employee or the employer can terminate the employment at any time, for any reason, consistent with federal and state laws. This flexibility allows businesses in Colorado to structure their personnel policies regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees effectively.

time resident in Colorado is typically someone who has established their primary home in the state and resides there for a significant portion of the year. This designation can impact income tax obligations and eligibility for certain state programs. Familiarity with the Colorado Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees can enhance your understanding of employment and residency classifications. For detailed legal guidance, consider resources like US Legal Forms to help navigate these regulations.

While 32 hours may be considered full-time by some employers in the USA, there is no federal standard defining full-time employment. Different industries may set their criteria, and often, 40 hours per week is the common threshold. Therefore, understanding the Colorado Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees is essential for clarity. Each company should specify its expectations in their guidelines.

A classified employee in Colorado generally refers to an individual employed by state or local government in a position that fits defined categories. They enjoy certain benefits and protections that unclassified or temporary employees may lack. These classifications must be detailed in the Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees. Ensuring proper classification can help promote a fair workplace.

In Colorado, temporary employees are typically hired for a specific period or project, and their classification must align with the employer’s policies. They do not usually qualify for the same benefits as full-time employees. Understanding the Colorado Classification of Employees for Personnel Manual or Employee Handbook regarding Full Time, Part Time, Temporary, Leased, Exempt, and Nonexempt Employees helps ensure that all legal guidelines are followed. For clarity, consult comprehensive resources or legal platforms like US Legal Forms.

Interesting Questions

More info

Hire better hire faster with Workable Source attract hire talent with world leading recruiting software Take tour.