Colorado Restricted Endowment to Educational, Religious, or Charitable Institution

Description

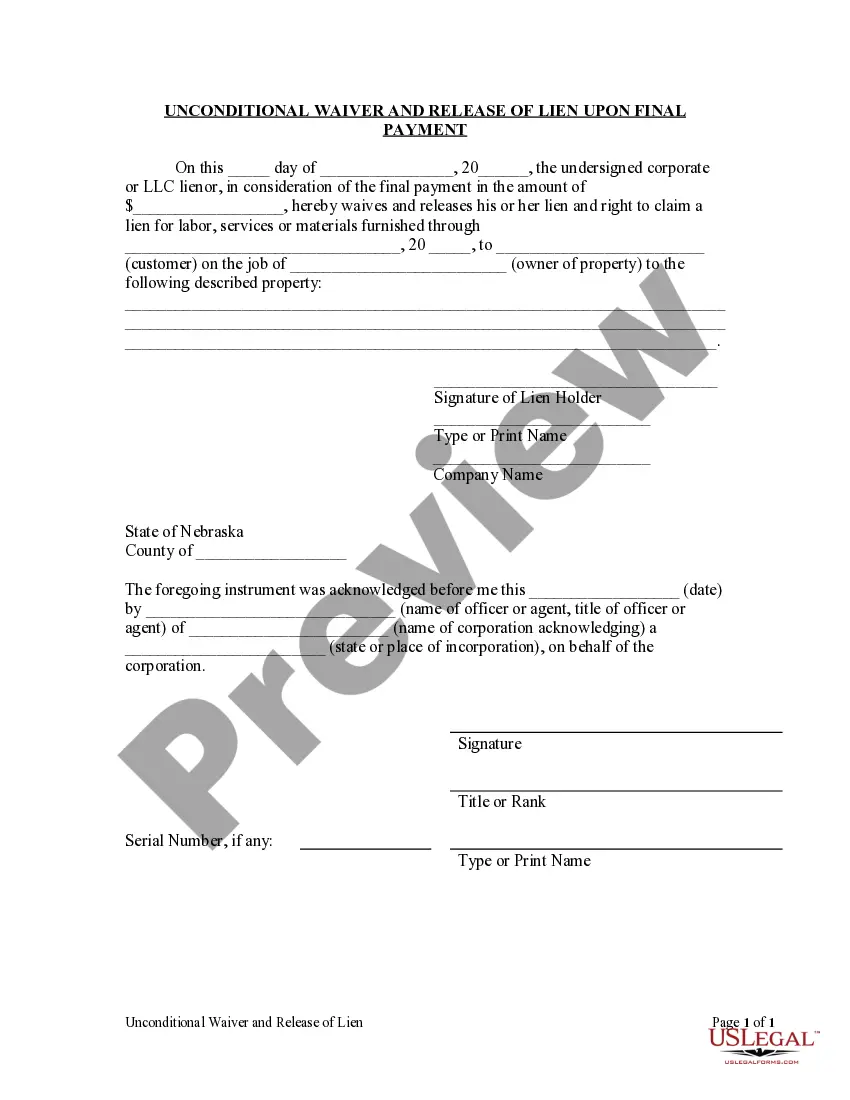

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

It is feasible to invest hours online attempting to locate the legal documents template that fulfills the federal and state requirements you need.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

It is easy to download or print the Colorado Restricted Endowment to Educational, Religious, or Charitable Institution from the services.

If available, use the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Colorado Restricted Endowment to Educational, Religious, or Charitable Institution.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form details to make sure you have selected the right form.

Form popularity

FAQ

The 4% rule indicates that an endowment can safely withdraw 4% of its investments annually without risking depletion of the principal amount. This approach allows institutions to support their programs while preserving the endowment's value for future use. When setting up a Colorado Restricted Endowment to Educational, Religious, or Charitable Institution, consider this rule to ensure sustainability for years to come.

The 5% rule suggests that endowment funds should distribute approximately 5% of their total value each year to support operational needs and programming. This guideline aims to balance current spending with the endowment's growth over time. When managing a Colorado Restricted Endowment to Educational, Religious, or Charitable Institution, adhering to this rule can help maintain financial stability.

You can secure endowment funds by soliciting donations from individuals or organizations that share your mission. Implementing fundraising strategies, engaging with your community, and maintaining transparency about how these funds will be used can attract contributors. Platforms like US Legal Forms can provide assistance with legal documentation and compliance related to establishing a Colorado Restricted Endowment to Educational, Religious, or Charitable Institution.

An endowment generally refers to a specific fund where the principal amount is invested with the goal of generating income to support a particular institution or cause. In contrast, a foundation usually acts as an independent entity that provides grants to various organizations and may hold multiple funds. Understanding the role of each is key when considering how to utilize a Colorado Restricted Endowment to Educational, Religious, or Charitable Institution effectively.

To acquire endowment funds, you can approach individuals, corporations, or philanthropic foundations that are interested in supporting educational, religious, or charitable institutions. It is crucial to craft a compelling proposal that outlines the goals and impacts of your organization. Furthermore, utilizing platforms like US Legal Forms can guide you through the necessary legal processes involved in establishing funds, particularly under the Colorado Restricted Endowment to Educational, Religious, or Charitable Institution.

Yes, Colorado provides a sales tax exemption form for qualifying organizations. Nonprofits, particularly those involved in a Colorado Restricted Endowment to Educational, Religious, or Charitable Institutions, should apply for this exemption to help reduce operational costs. Completing this form correctly is essential for maintaining compliance. If you need assistance with the application, USLegalForms can guide you through the process.

A charitable organization in Colorado is defined as a nonprofit entity established for purposes such as education, religion, or charitable activities. Many of these organizations manage funds like a Colorado Restricted Endowment to Educational, Religious, or Charitable Institutions to support their missions. Knowing the classification of your organization can aid in compliance and fundraising efforts. For more details, check with USLegalForms.

Yes, individuals and certain organizations in Colorado must file an income tax return if they meet specific criteria. For nonprofits, especially those managing a Colorado Restricted Endowment to Educational, Religious, or Charitable Institutions, understanding filing requirements is essential for compliance. If you have questions about your obligations, USLegalForms is here to help.

Yes, Colorado requires LLCs to file tax returns, regardless of whether they have any income or not. This includes any LLCs that may be formed for handling a Colorado Restricted Endowment to Educational, Religious, or Charitable Institutions. Filing these returns is crucial for maintaining compliance with state regulations. To streamline the process, consider utilizing USLegalForms.

Yes, Colorado requires some nonprofits to file Form 990, which offers essential financial information. This requirement helps ensure these organizations operate transparently, especially for those involved with a Colorado Restricted Endowment to Educational, Religious, or Charitable Institutions. It’s important to be aware of your eligibility and filing deadlines. Use USLegalForms for expert support in completing this form.