Title: Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises: Explained & Key Types Introduction: Are you a sole proprietor in Colorado planning to sell your business that operates from leased premises? To ensure a smooth transaction, it is essential to have an agreement in place that outlines the terms and conditions of the sale. In Colorado, the Agreement for Sale of Business by Sole Proprietorship with Leased Premises serves this purpose. This article will provide a detailed description of this agreement, its significance, and highlight different types that may exist. 1. Understanding the Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises: This legal document essentially binds the seller (sole proprietor) and the buyer to a set of mutually agreed upon terms for the sale of a business. With a focus on transactions involving leased premises, the agreement outlines the specifics of the sale process, including key details concerning the business, lease arrangements, purchase price, payment terms, liabilities, and much more. 2. Key Components of the Agreement for Sale of Business by Sole Proprietorship with Leased Premises: a. Purchase Price: This section specifies the agreed-upon amount the buyer will pay for the business. b. Assets: Details all the assets being sold, including inventory, equipment, intellectual property, goodwill, etc. c. Lease Terms: Includes relevant information about the leased premises, such as address, lease duration, conditions of assignment, and the landlord's consent. d. Financial Statements: Ensures the buyer has access to the business's financial information, allowing them to make informed decisions. e. Representations and Warranties: Outlines assurances made by the seller regarding the business's legitimacy, financial status, and legal compliance. f. Transition Period: Specifies the period during which the seller aids the buyer in the transition process, ensuring a smooth handover. g. Assumption of Liabilities: Addresses whether the buyer assumes any existing debts or liabilities of the business. h. Governing Law: Identifies the applicable laws of the State of Colorado that will govern the agreement. 3. Different Types of Colorado Agreements for Sale of Business by Sole Proprietorship with Leased Premises: While there may not be distinct types of these agreements, variations typically occur based on the specific industry, unique terms negotiated between the parties, or the level of complexity involved. These agreements may include provisions for seller financing, non-compete clauses, purchase of real estate along with the business, or customization to accommodate specific requirements. Conclusion: The Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a vital legal document that aims to protect the rights and interests of both the buyer and seller during a business sale. By addressing the essential aspects relevant to the transaction, this agreement provides clarity and helps avoid potential disputes. Whether you are the seller or buyer, understanding the key components of this agreement is crucial for a successful business sale in Colorado.

Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises

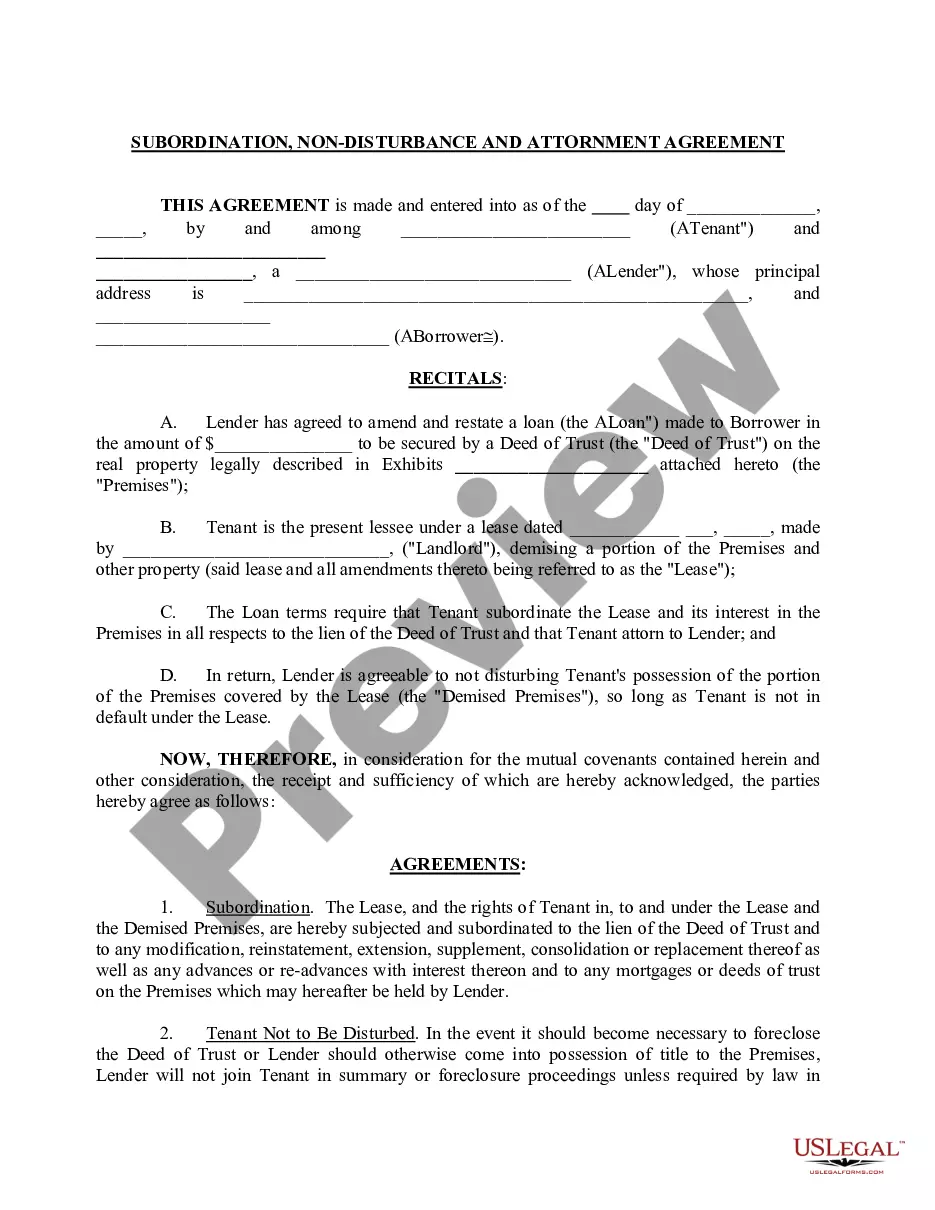

Description

How to fill out Colorado Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

US Legal Forms - one of many biggest libraries of legitimate kinds in the USA - offers a wide range of legitimate record web templates you may acquire or print. While using site, you can get 1000s of kinds for enterprise and individual uses, sorted by groups, states, or keywords.You will discover the latest models of kinds just like the Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises within minutes.

If you currently have a monthly subscription, log in and acquire Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises in the US Legal Forms local library. The Acquire option will appear on every single kind you view. You gain access to all formerly acquired kinds from the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, listed here are basic recommendations to obtain started off:

- Be sure to have picked the best kind for your personal town/state. Click on the Review option to examine the form`s articles. Browse the kind description to ensure that you have chosen the right kind.

- If the kind does not suit your specifications, take advantage of the Lookup field on top of the display screen to get the one which does.

- In case you are content with the form, verify your choice by simply clicking the Get now option. Then, choose the prices plan you want and supply your accreditations to register for an bank account.

- Approach the financial transaction. Utilize your Visa or Mastercard or PayPal bank account to perform the financial transaction.

- Find the file format and acquire the form on your device.

- Make modifications. Fill out, edit and print and signal the acquired Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

Each and every web template you added to your bank account lacks an expiry particular date and is yours forever. So, if you would like acquire or print yet another backup, just proceed to the My Forms portion and then click about the kind you require.

Gain access to the Colorado Agreement for Sale of Business by Sole Proprietorship with Leased Premises with US Legal Forms, probably the most substantial local library of legitimate record web templates. Use 1000s of skilled and status-particular web templates that fulfill your company or individual needs and specifications.