The Colorado Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document that outlines the terms and conditions for the sale of a business owned by a sole proprietor in the state of Colorado. This agreement is specifically designed for situations where the purchase price of the business will be contingent on the results of an audit. Keywords: Colorado Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Audit, Terms and Conditions, Legal document. This agreement is essential for both the buyer and the seller as it clearly defines the rights, responsibilities, and obligations of each party involved in the transaction. It helps ensure a transparent and fair sale process by outlining the parameters for the audit that will determine the final purchase price of the business. The Colorado Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit typically includes the following provisions: 1. Identification of the Parties: The agreement will clearly identify the sole proprietor as the seller and the buyer who intends to purchase the business. 2. Purchase Price: The agreement will address how the purchase price will be determined. It establishes that the final price will be contingent upon the results of an audit conducted by an independent third party. 3. Audit Process: The document will specify the timeframe and procedures for conducting the audit. It may outline the specific areas of the business that will be audited, such as financial statements, assets, liabilities, and any other relevant factors. 4. Adjustments and Negotiations: The agreement may include provisions for potential adjustments to the purchase price based on the findings of the audit. This allows for negotiations between the buyer and seller in case any discrepancies or unforeseen issues arise during the audit process. 5. Representations and Warranties: Both the seller and the buyer will likely provide certain representations and warranties to ensure the accuracy and validity of the information exchanged during the sale. These may include guarantees regarding the business's financial health, ownership of assets, absence of legal liabilities, etc. 6. Closing Conditions: The agreement will outline the conditions that need to be met before the closing of the sale can take place. This may include obtaining necessary licenses, permits, consents, or approvals for the transfer of the business. 7. Confidentiality: The agreement may include confidentiality clauses to protect sensitive business information disclosed during the audit process. Other possible variations or types of Colorado Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit could include those tailored specifically to different industries or businesses of varying sizes and complexities. It is crucial for buyers and sellers to consult with legal professionals to ensure the agreement is customized to meet their specific needs and comply with relevant laws and regulations in the state of Colorado.

Colorado Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Purchase Price Contingent On Audit?

Are you presently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous lawful document templates available online, but finding reliable ones can be challenging.

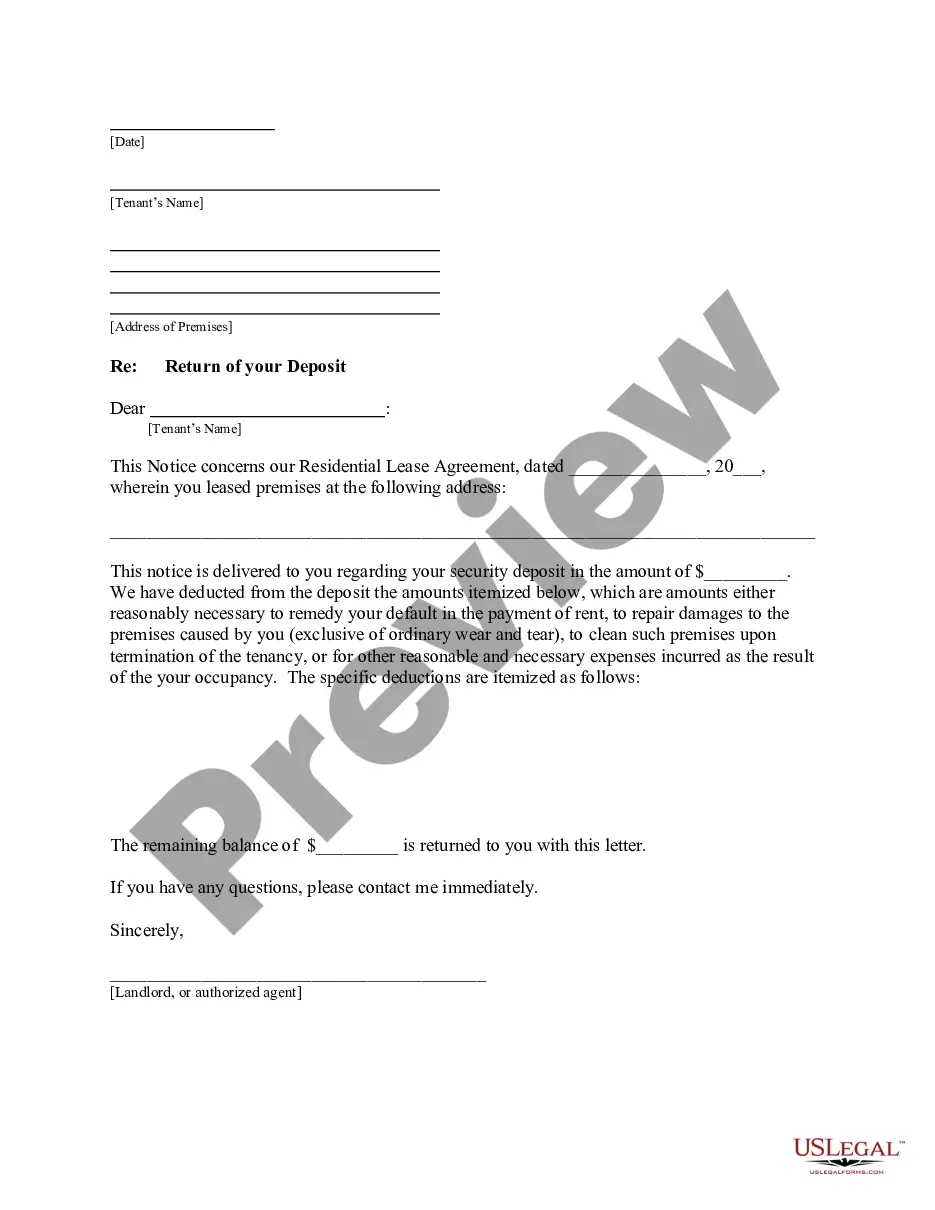

US Legal Forms offers thousands of document templates, including the Colorado Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, designed to meet state and federal requirements.

Once you find the correct template, click Purchase now.

Select the pricing plan you want, fill out the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Colorado Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for the correct city/county.

- Use the Review button to preview the form.

- Read the description to ensure you have selected the appropriate template.

- If the template isn't what you seek, use the Search field to find the one that meets your needs.

Form popularity

FAQ

An SPA is a contract between a buyer/purchaser and a seller/vendor. It can be conditional or unconditional. Under a conditional SPA, there are conditions that must be fulfilled beforehand, before the agreement becomes unconditional.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A conditional contract is an agreement or contract conditional upon a specific event, the occurrence of which, at the date of the agreement, is uncertain. A common example is a contract conditional upon the buyer getting planning permission.

A business purchase agreement should detail the names of the buyer and seller at the start of the agreement. It will also need to include the information of the business being sold, such as name, location, a description of the business and the type of business entity it is.

A Conditional Sale agreement is the same as Hire Purchase, except that you will automatically own the car once the finance has been repaid in full.

A conditional contract, also called a hypothetical contract, is a contract agreement that only requires performance once the delineated conditions are met. This legal agreement requires prior performance of another agreement or clause in order to be enforceable.

A contract must be signed by both parties involved in the purchase and sale of a property to be legally enforceable. All parties signing must be of legal age and must enter into the contract voluntarily, not by force, to be enforceable.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A conditional sale refers to a transaction in which the purchaser receives possession of and the right to use certain goods, but the title remains with the seller until the performance of a condition is met by the buyer.

Interesting Questions

More info

中文 Français Deutsite국어Site SearchSite Search.