Colorado Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale is a legal transaction that occurs when the interest of a deceased partner in a business partnership is sold to the surviving partner as stated in the state's laws and regulations. The purpose of this transaction is to transfer the ownership rights and responsibilities of the deceased partner to the surviving partner, ensuring the continuity and stability of the partnership. In Colorado, there are two main types of Sale of Deceased Partner's Interest to Surviving Partner transactions: 1. Voluntary Purchase Agreement: This type of sale occurs when the partnership agreement or a separate buy-sell agreement provides provisions for the surviving partner to purchase the deceased partner's interest. In this case, the surviving partner has the option to buy the interest, usually at a predetermined price or through a valuation process outlined in the agreement. 2. Statutory Purchase Agreement: In the absence of a voluntary purchase agreement, the Colorado Revised Statutes (C.R.S) outline provisions for a statutory purchase agreement. According to C.R.S. §§ 7-64-203, if a partner passes away, the surviving partner has the right, upon giving written notice to the deceased partner's personal representative or the estate, to purchase their interest at the fair market value. The Sale of Deceased Partner's Interest to Surviving Partner transaction requires a Purchase Agreement and Bill of Sale to document the transfer of ownership. The Purchase Agreement contains all the terms and conditions agreed upon by the surviving partner and the representative of the deceased partner's estate. It typically includes details such as the purchase price or valuation method, payment terms, closing date, representations and warranties, and any additional provisions specific to the partnership. Additionally, a Bill of Sale is executed to legally transfer the deceased partner's interest in the partnership to the surviving partner. This document outlines the specific interest being transferred and serves as proof of the transaction. The Sale of Deceased Partner's Interest to Surviving Partner transaction is a critical step in maintaining the stability and continuity of a partnership following the passing of a partner. It ensures that the surviving partner assumes complete control and ownership over the business, allowing them to continue operations and make necessary decisions. Consulting with a qualified attorney familiar with Colorado partnership laws is advisable to navigate the legal requirements and ensure a smooth and lawful transaction.

Colorado Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

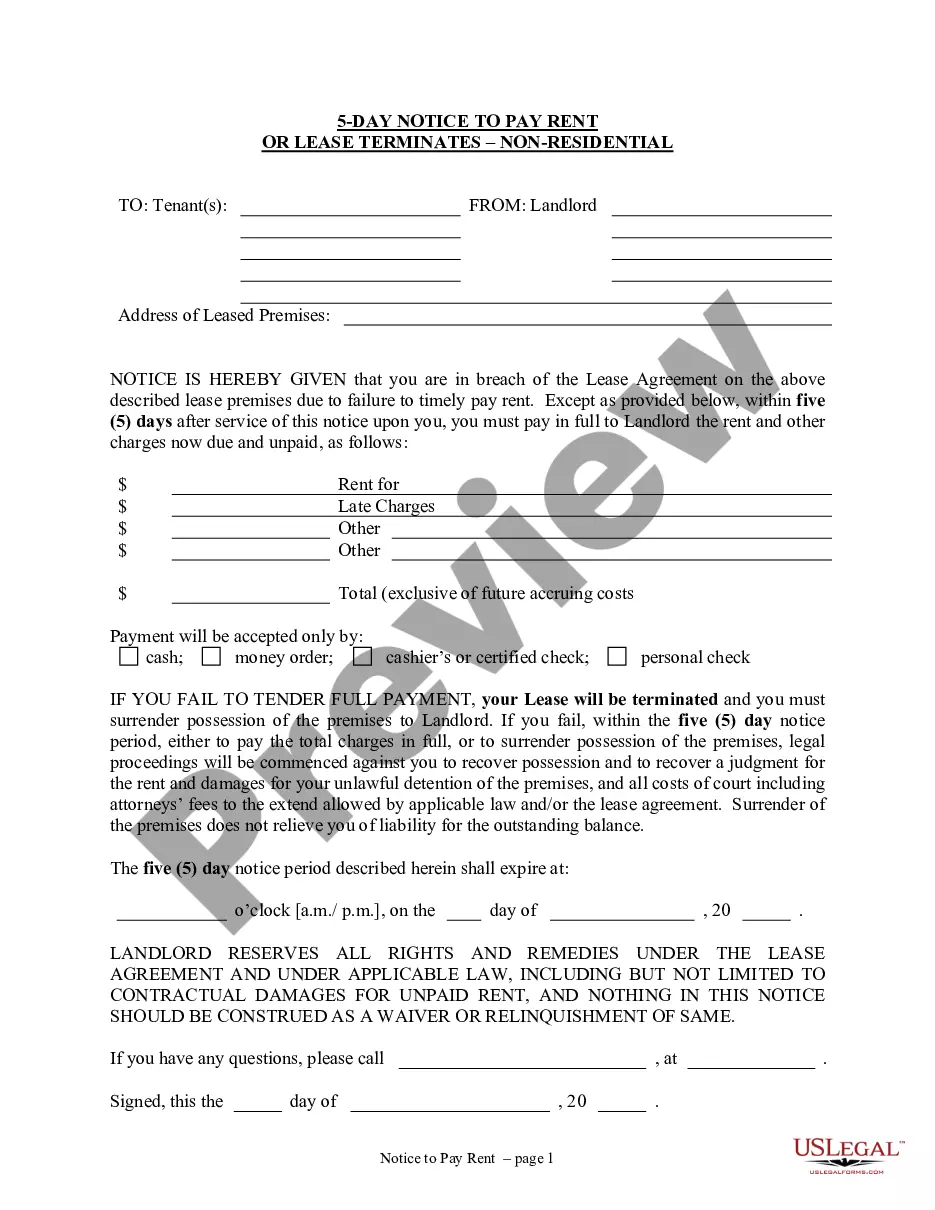

How to fill out Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

US Legal Forms - among the greatest libraries of legal types in the States - offers a wide range of legal file web templates you can download or printing. Making use of the web site, you can get 1000s of types for business and person uses, sorted by categories, states, or keywords.You can get the most up-to-date models of types such as the Colorado Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale within minutes.

If you have a monthly subscription, log in and download Colorado Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale from your US Legal Forms collection. The Obtain switch will show up on every form you look at. You have accessibility to all previously delivered electronically types from the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, listed here are basic guidelines to get you started out:

- Ensure you have picked out the best form to your town/county. Click on the Preview switch to examine the form`s content. Read the form description to actually have chosen the right form.

- In the event the form does not suit your demands, make use of the Search area near the top of the screen to discover the one that does.

- In case you are content with the shape, affirm your decision by visiting the Get now switch. Then, select the costs program you want and offer your accreditations to sign up for the bank account.

- Procedure the deal. Use your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Find the structure and download the shape in your gadget.

- Make modifications. Load, edit and printing and signal the delivered electronically Colorado Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale.

Each and every design you put into your account does not have an expiration particular date and is yours for a long time. So, in order to download or printing yet another duplicate, just proceed to the My Forms area and then click on the form you will need.

Gain access to the Colorado Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale with US Legal Forms, probably the most considerable collection of legal file web templates. Use 1000s of professional and state-particular web templates that fulfill your organization or person needs and demands.

Form popularity

FAQ

Disadvantages of Cross-Purchase Buy-Sell Plans The disadvantages of cross-purchase buy-sell agreements include: Life insurance policies are not owned by the business so any cash values cannot be considered company assets. Depending on the varying ages of the business owner's actual premium payments may vary greatly.

In a cross purchase buy-sell agreement, each co-owner buys a life insurance policy on the life of the other co-owner, pays the annual premium and is the beneficiary of the policy they own. While this strategy can be used with more than two owners, it is generally only used with businesses that have two owners.

A Limited Partner's death shall not cause the Partnership to dissolve. The estate of the deceased Limited Partner and the person entitled to succeed to the Percentage Interest of a deceased Limited Partner under the decedent's will or the laws of intestate succession shall be referred to as the Successor.

purchase agreement is a document that allows a company's partners or other shareholders to purchase the interest or shares of a partner who dies, becomes incapacitated or retires. The mechanism often relies on a life insurance policy in the event of a death to facilitate that exchange of value.

If the partner dies, the partner's estate will typically succeed to that decedent's interest in the partnership. The partner may sell his interest to a third party or to one of the remaining partners. The partnership may make payments to a retiring partner or a deceased partner's successor in interest under IRC §736.

Advantages of a Cross Purchase Agreement A cross purchase agreement allows a smooth transition of ownership from departing partners or shareholders to others in the company. The transfer of ownership through the proceeds from life insurance is not subject to income tax.

Each owner buys, owns and is the beneficiary of individual policies covering the life of each owner. Example: Three partners own equal shares in a business valued at $300,000, with each owner's share worth $100,000. To fund a cross-purchase agreement, Owners 1 and 2 each purchase a $50,000 policy covering Owner 3.

Advantages of a Cross Purchase Agreement A cross purchase agreement allows a smooth transition of ownership from departing partners or shareholders to others in the company. The transfer of ownership through the proceeds from life insurance is not subject to income tax.