Colorado Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

Are you currently in the situation where you need documents for either business or personal reasons every single day.

There are numerous legal document templates available online, but finding reliable ones can be quite challenging.

US Legal Forms provides a vast array of form templates, including the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental, which are designed to comply with state and federal regulations.

When you locate the appropriate form, simply click Purchase now.

Choose your desired pricing plan, complete the necessary details to create your account, and place an order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Identify the form you need and ensure it corresponds to the correct city/region.

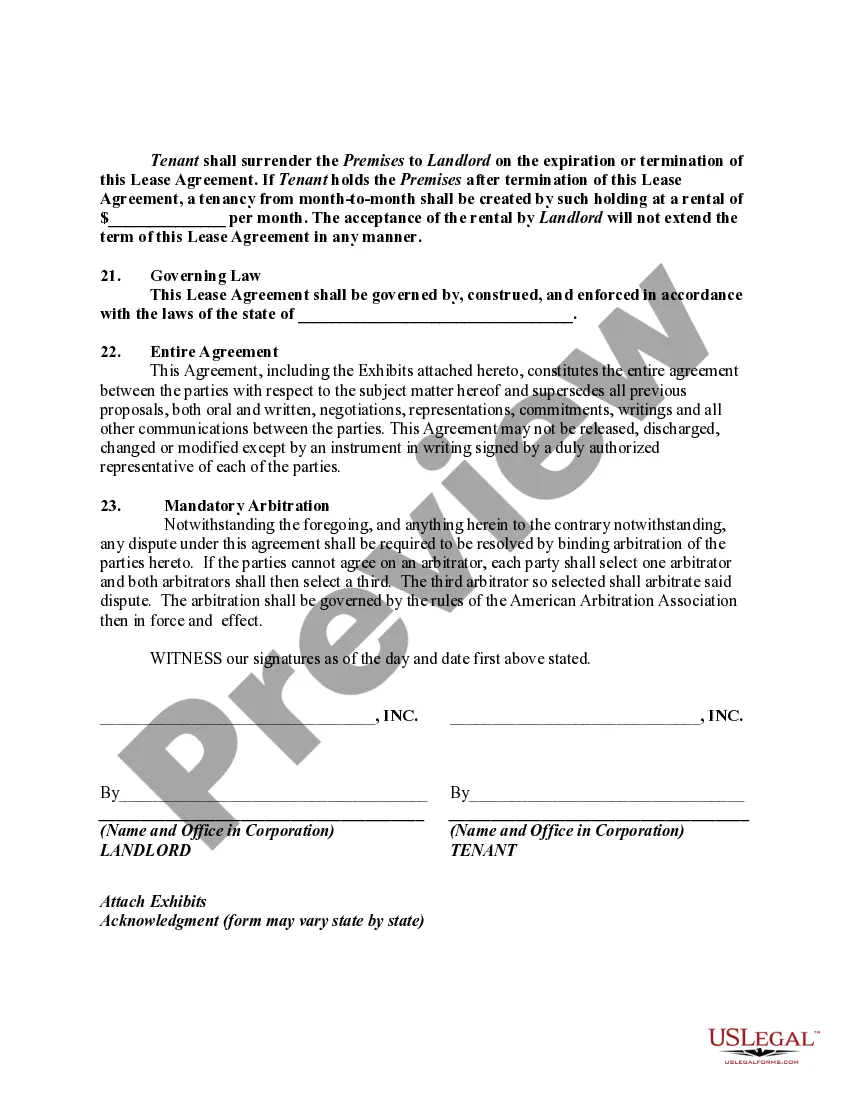

- Use the Review option to examine the form.

- Check the information to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Wills in Colorado do not have to be notarized to be valid; however, having a will notarized can simplify the probate process. When creating a Colorado Triple Net Commercial Lease Agreement - Real Estate Rental, incorporating your wishes into a well-prepared will enhances your estate planning. If you choose to notarize your will, ensure that the witnesses and notary follow the state's legal requirements. For assistance in preparing legal documents, consider using services like US Legal Forms.

In Colorado, a variety of documents can be notarized, including contracts, declarations, and property titles. For instance, a Colorado Triple Net Commercial Lease Agreement - Real Estate Rental often requires notarization to confirm authenticity and prevent fraud. It is essential to have a notary public available during the signing process, as they help ensure all forms meet legal standards. If you have questions about specific documents, platforms like US Legal Forms can assist you.

In Colorado, notarization is generally required for titles, especially in real estate transactions. When dealing with a Colorado Triple Net Commercial Lease Agreement - Real Estate Rental, ensuring correct documentation is crucial. A notary verifies the identity of the parties involved, providing an added layer of protection. It is advisable to check specific requirements for each type of document, as regulations can vary.

The three main types of leases are gross leases, modified gross leases, and triple net leases. Gross leases require the landlord to cover all property operating costs, while modified gross leases split expenses between landlord and tenant. The triple net lease stands out as it places most financial responsibilities on tenants, making the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental a preferred option for many landlords.

The most common type of leasehold in commercial real estate is the leasehold estate created by the triple net lease. This type of leasehold grants the tenant exclusive use of the property while making them responsible for property expenses. Understanding the implications of the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental can help both landlords and tenants optimize their agreements.

The most common commercial lease agreement is the triple net lease. This type of lease is widely used due to its simplicity and the financial predictability it offers landlords. By utilizing the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental, property owners can ensure a steady income while transferring many risk-related costs to tenants.

In Colorado, commercial leases do not generally need to be notarized unless specifically required by the parties involved. However, having a lease notarized can provide additional legal security and make the agreement more enforceable. Always consult with a legal expert to determine if notarization is necessary for your Colorado Triple Net Commercial Lease Agreement - Real Estate Rental.

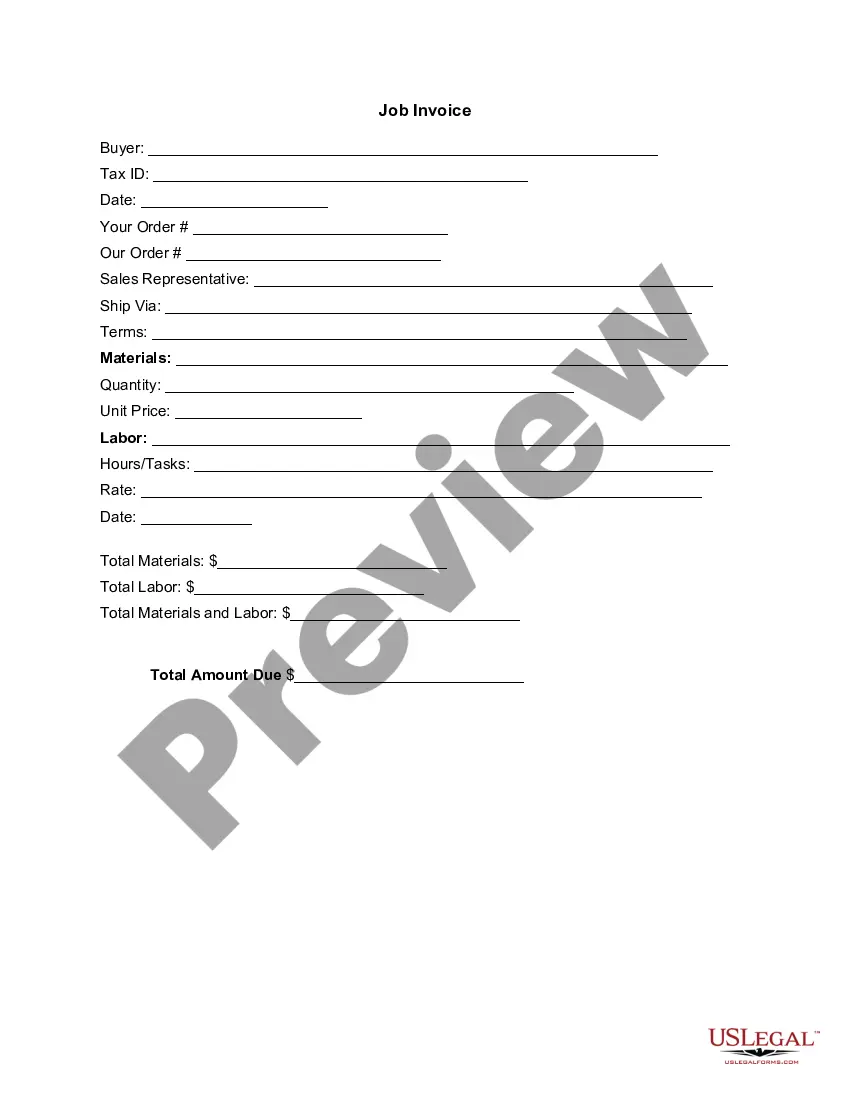

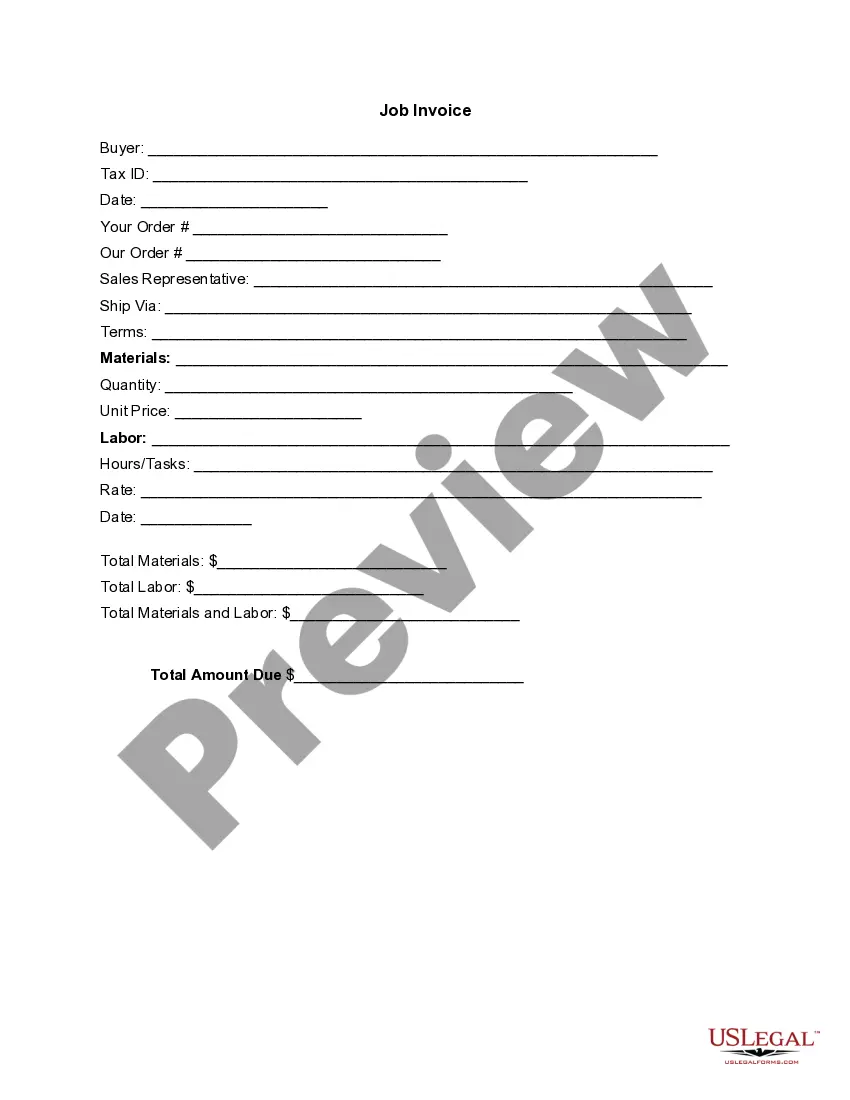

To structure a triple net lease, clear terms must be outlined in the agreement regarding the responsibilities of both the landlord and tenant. The lease should specify the base rent amount and detail how operating expenses will be calculated and billed. This clarity is essential in the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental, ensuring both parties understand their obligations and financial duties.

In commercial real estate, the most common lease is the triple net lease. This lease type allows property owners to pass on many expenses to their tenants, which can include taxes, insurance, and maintenance costs. This arrangement creates a predictable income stream for landlords, making the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental highly attractive.

Colorado does not have a specific standard lease agreement mandated by law. However, many landlords and tenants use tailored agreements that suit their needs, such as the Colorado Triple Net Commercial Lease Agreement - Real Estate Rental. This type of agreement outlines the responsibilities of both parties regarding property expenses, such as taxes, insurance, and maintenance. Therefore, you can find a variety of lease agreements that cater to specific scenarios in the Colorado real estate market.