Colorado Letter Tendering Payment

Description

How to fill out Letter Tendering Payment?

If you want to accumulate, retrieve, or create authorized document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Employ the website's straightforward and user-friendly search tool to find the documents you require.

A selection of templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase. Step 6. Choose the format of your legal document and download it to your device. Step 7. Complete, modify, and either print or sign the Colorado Letter Tendering Payment. Each legal document format you obtain is yours indefinitely. You can access every document you have downloaded within your account. Select the My documents section and choose a document to print or download again. Stay proactive and obtain, and print the Colorado Letter Tendering Payment with US Legal Forms. There are numerous professional and state-specific documents available for your business or personal needs.

- Use US Legal Forms to obtain the Colorado Letter Tendering Payment in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Acquire button to locate the Colorado Letter Tendering Payment.

- You may also access documents you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/country.

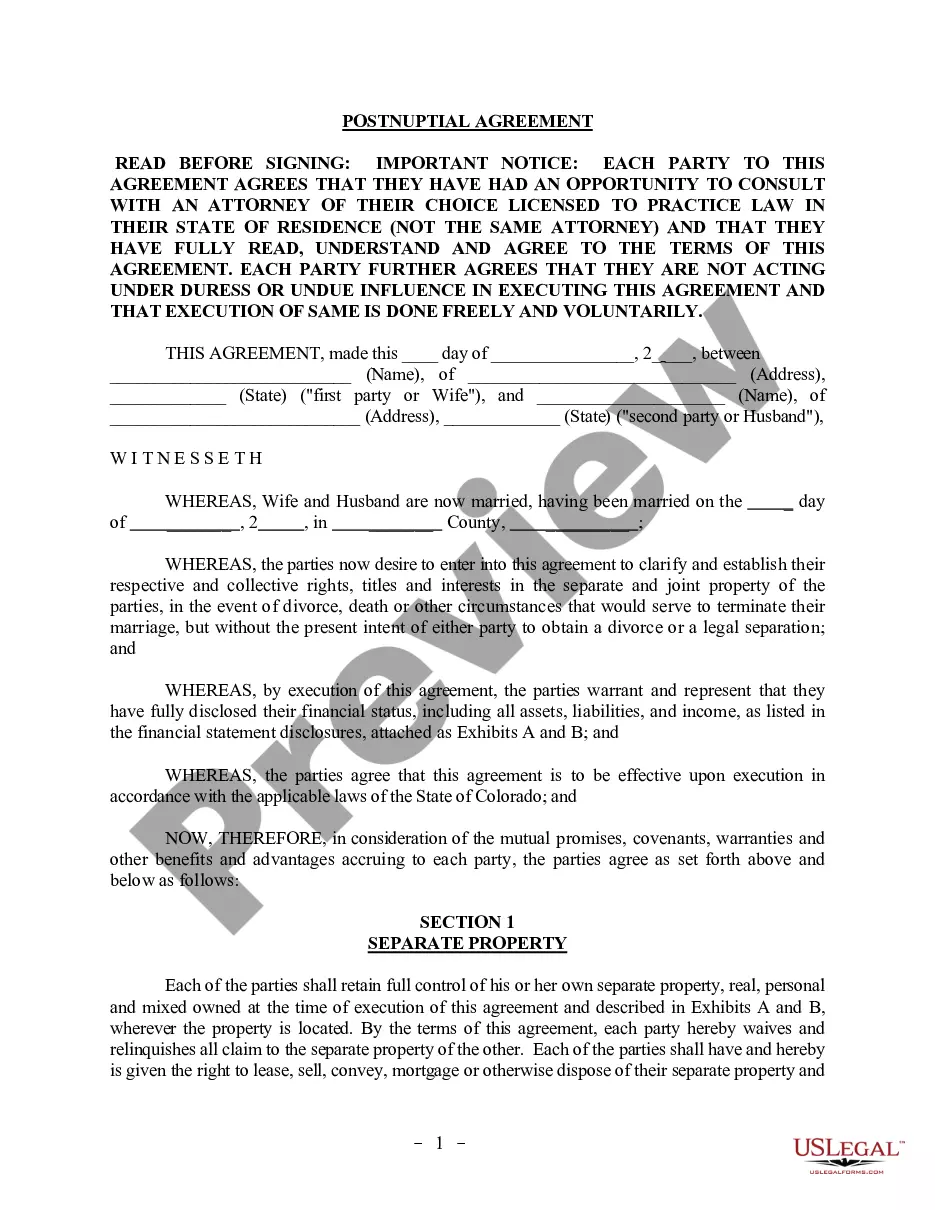

- Step 2. Use the Preview option to review the form's content. Be sure to read the overview.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal document template.

Form popularity

FAQ

Payments to the Colorado Department of Revenue should be sent to the address listed on their official website, or the address indicated on your tax form. Always include your payment method details, such as your taxpayer identification number. To ensure proper handling of your payment, attaching a Colorado Letter Tendering Payment is highly beneficial.

You should mail your Colorado tax forms to the address specified on the forms themselves. This can vary depending on the form type, so it is important to confirm before sending. Additionally, including a Colorado Letter Tendering Payment helps clarify your intentions and can facilitate smoother processing of your documents.

To register for Electronic Funds Transfer (EFT) in Colorado, visit the Colorado Department of Revenue's website. You will need to complete the appropriate application form and provide details about your business. Utilizing the EFT option simplifies your Colorado Letter Tendering Payment, making transactions quicker and more efficient.

When sending your taxes to Colorado, the address depends on the type of payment you're making. Generally, you can find the appropriate address on the Colorado Department of Revenue’s website or your tax return. If applicable, always consider including a Colorado Letter Tendering Payment along with your submission to streamline the process.

To write a check to the Colorado Department of Revenue, ensure you use the correct payee name, which is the 'Colorado Department of Revenue.' Include your account number on the memo line to ensure proper application of your payment. Also, remember to utilize the Colorado Letter Tendering Payment process when submitting to avoid delays in processing your payment.

The Colorado Department of Revenue may send you a letter for various reasons, such as tax notifications, notices of payment due, or requests for additional information regarding your tax filings. It's vital to read these letters carefully, as they may contain information about your responsibility regarding Colorado Letter Tendering Payment and other tax-related matters.

The 183-day rule in Colorado functions similarly to the general rule applicable in many states. Spending more than 183 days in Colorado can establish tax residency, which influences your tax obligations. If you think you might cross this threshold, understanding the implications of things like Colorado Letter Tendering Payment becomes important.

To request a letter ID, you can visit the Colorado Department of Revenue website or contact their office directly. They typically require your personal information, such as Social Security number and address, to verify your identity. This letter ID can often be useful for matters related to Colorado Letter Tendering Payment.

After accounting for state and federal taxes, a $100,000 income in Colorado might leave you with about $70,000 to $75,000. Factors such as deductions and credits can influence this number. It is wise to consult a tax professional, especially if you're unfamiliar with Colorado's tax structure, including aspects like Colorado Letter Tendering Payment.

The 183-day rule determines tax residency based on physical presence. If you are in a state, like Colorado, for more than 183 days in a year, you may be considered a resident for tax purposes. This rule is crucial for understanding your obligations, especially when dealing with Colorado Letter Tendering Payment.