A judgment lien is created when a court grants a creditor an interest in the debtor's property, based upon a court judgment. A plaintiff who obtains a monetary judgment is termed a "judgment creditor." The defendant becomes a "judgment debtor."

Judgment liens may be created through a wide variety of circumstances.

Colorado Lien on Real Property Regarding Judgment in a Federal Court

Description

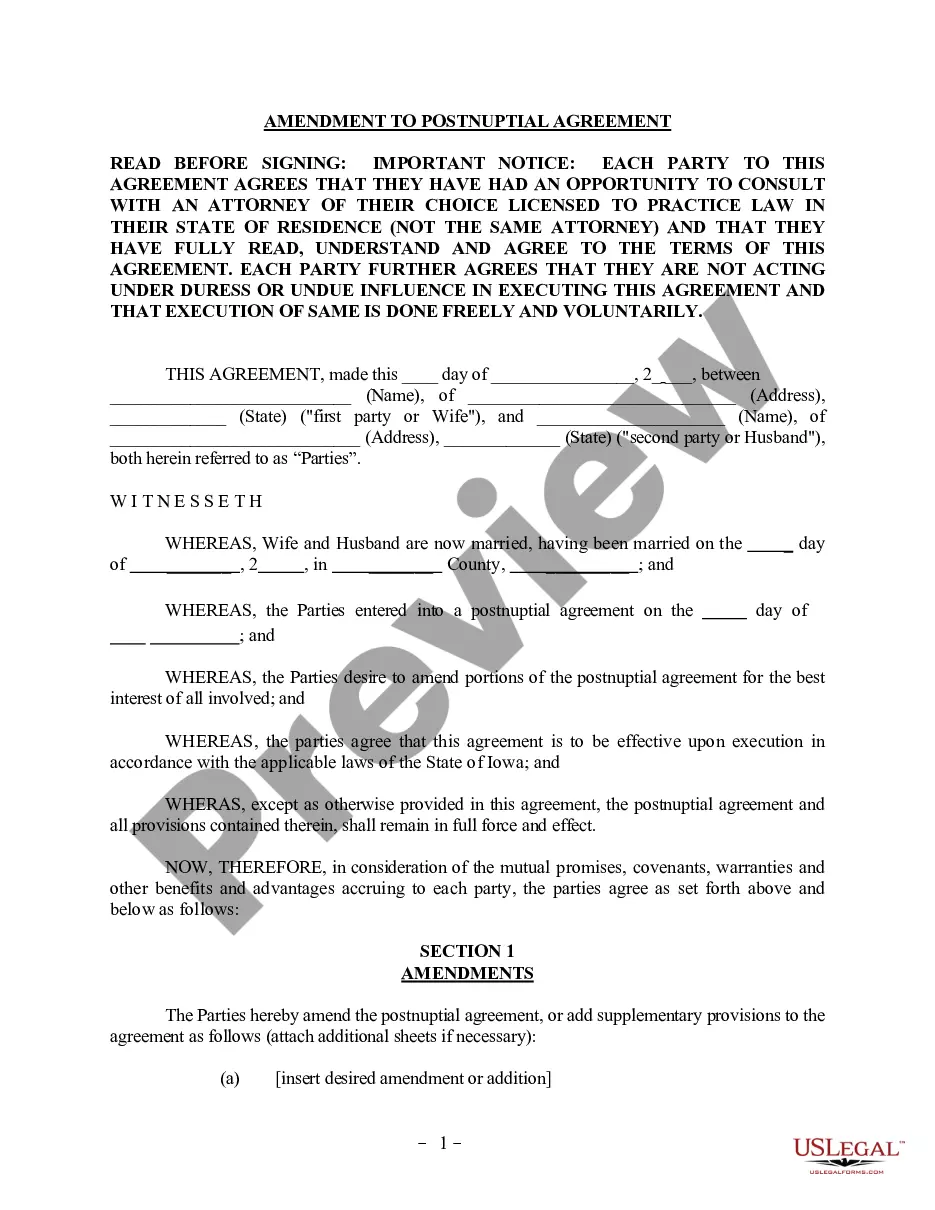

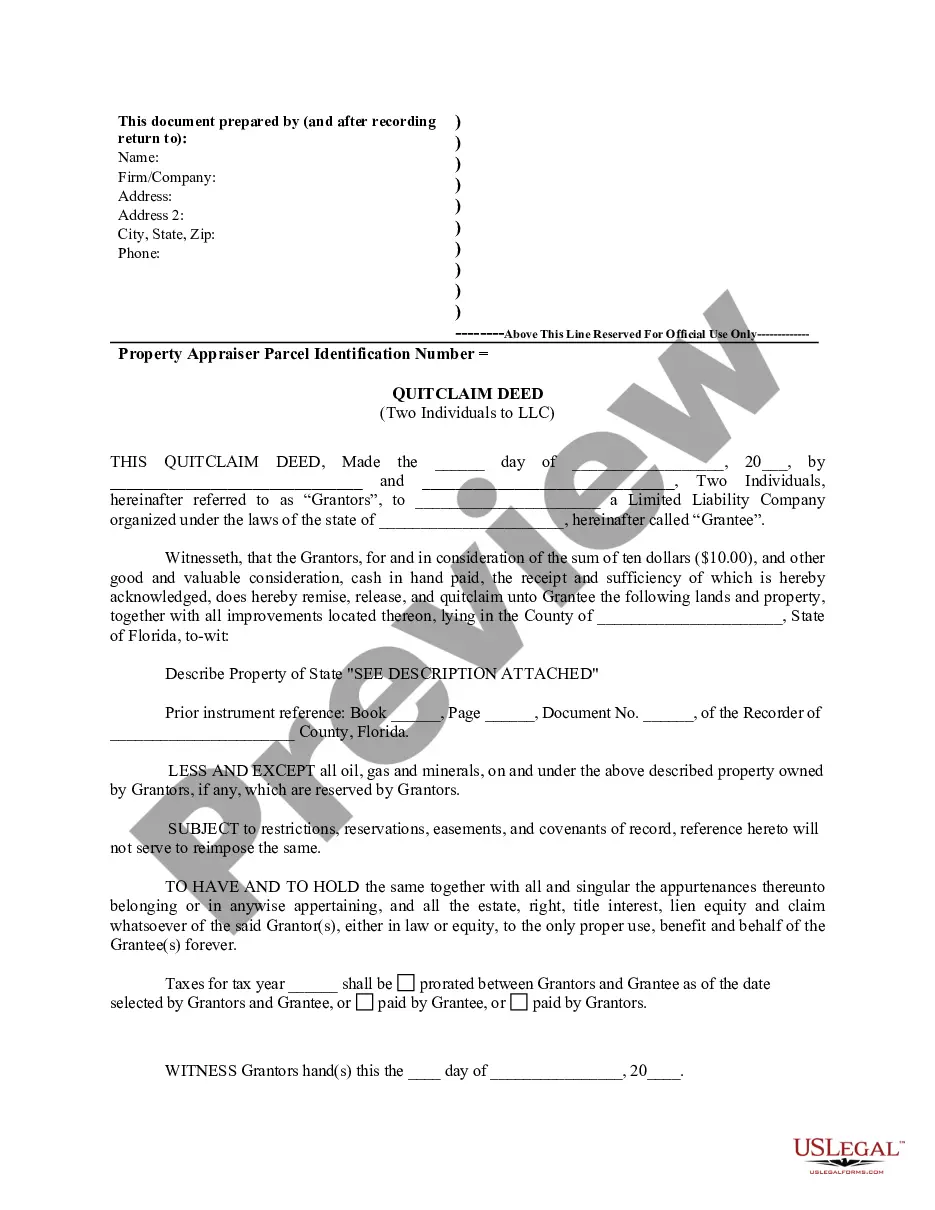

How to fill out Lien On Real Property Regarding Judgment In A Federal Court?

Selecting the appropriate official document template could be a challenge. Obviously, there are numerous designs accessible online, but how do you obtain the official form you require? Utilize the US Legal Forms website. The platform provides thousands of templates, such as the Colorado Lien on Real Property Regarding Judgment in a Federal Court, that can serve for business and personal needs. All the forms are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and then click the Download button to obtain the Colorado Lien on Real Property Regarding Judgment in a Federal Court. Use your account to browse through the official forms you have previously purchased. Navigate to the My documents tab of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have chosen the correct form for your city/region. You can preview the form using the Preview button and review the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are certain the form is suitable, select the Get now button to obtain the form. Choose the pricing plan you wish and enter the necessary information. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Select the document format and download the official document template for your product. Complete, modify, print, and sign the downloaded Colorado Lien on Real Property Regarding Judgment in a Federal Court.

Make the most of US Legal Forms to access well-designed documents that fulfill legal requirements.

- US Legal Forms is the largest repository of official forms where you can find various document templates.

- Utilize the service to obtain professionally crafted documents that adhere to state regulations.

- The platform offers thousands of templates for various legal needs.

- All forms are vetted by professionals to ensure compliance.

- Easy navigation and user-friendly interface for finding documents.

- Secure payment options available for transactions.

Form popularity

FAQ

The policy of Colorado law is to subject all the property of a judgment debtor not specifically exempt to the payment of his debts. All goods, lands, and real estate of every person against whom any judgment is obtained in any court for any debt or damages are liable to be sold.

Generally, a lien of judgment expires six years after the entry of judgment unless revived. Colo. Rev. Stat.

Complete a Satisfaction of Judgment (JDF 111) and file with the Court. Step 2: Mail a copy of the Satisfaction of Judgment to the Judgment Debtor, and Garnishee if any. Recorder to release the lien.

If the debtor does not comply with the court order to pay you, your attorney can file a Transcript of Judgment to obtain a lien on their property so that it can be used in collection proceedings. If the debtor has property in more than one county, you must record this in every county where the property is owned.

§ 13-52-102(2)(b)(I) and (II) (referencing 6 years to execute a county court judgment and restitution judgments that can be executed on at any time until paid). Generally, a lien of judgment expires six years after the entry of judgment unless revived. Colo.

What Is The Colorado Homestead Exemption? The Colorado homestead exemption protects equity in a home from judgment creditors and the Chapter 7 bankruptcy trustee. It prevents judgment creditors from foreclosing on liens that may have arisen from unsecured debt, such as credit cards or medical bills.

* You need to make sure to collect your money before your judgment expires. * If you were awarded a money judgment in County Court, it will expire 6 years from the date of the judgment. * If you were awarded a money judgment in District Court, it will expire 20 years from the date of the judgment.