Colorado Owner Financing Contract for Moblie Home

Description

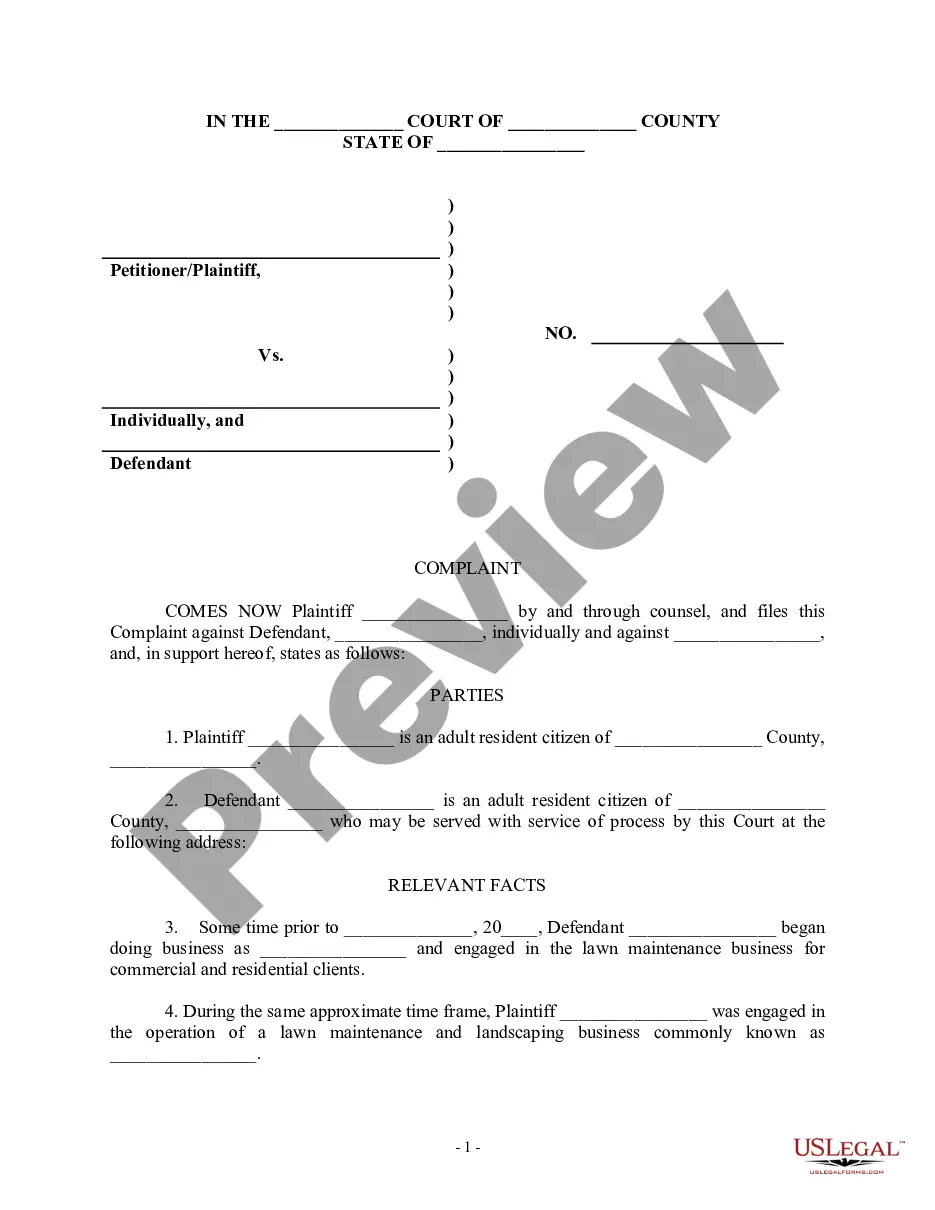

How to fill out Owner Financing Contract For Moblie Home?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Colorado Owner Financing Contract for Mobile Home in just moments.

If you possess a subscription, Log In and download the Colorado Owner Financing Contract for Mobile Home from the US Legal Forms library. The Download button will appear on each form you encounter. You have access to all previously downloaded forms from the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your locality/region.

- Click the Preview button to review the form's details.

- Check the form summary to confirm you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Download now button.

Form popularity

FAQ

Owner financing a mobile home involves several straightforward steps. First, create a Colorado Owner Financing Contract for Mobile Home that outlines the terms and conditions of the sale. Next, ensure the buyer understands the financial obligations, including the down payment, interest rate, and repayment schedule. By using our platform, you can generate customized contracts that simplify the ownership transfer and protect your interests.

Owner financing can take several forms, including land contracts, lease options, and wrap-around mortgages. Each type offers unique benefits tailored to different buyer and seller scenarios. Engaging in a Colorado Owner Financing Contract for Mobile Home allows you to choose the type that best fits your financial goals and needs.

Owner financing can be a practical option for individuals looking to buy a mobile home without the restrictions of traditional bank financing. It often allows for faster transactions, as buyers and sellers negotiate terms directly. With a Colorado Owner Financing Contract for Mobile Home, you can enjoy flexibility in payment plans and interest rates, making it easier for buyers with unique financial situations.

If a buyer defaults on a Colorado Owner Financing Contract for Mobile Home, the seller may initiate foreclosure proceedings to reclaim the property. The process usually involves legal steps, which can be time-consuming and costly. It's crucial for both parties to understand the consequences of default before entering into a seller financing agreement. To minimize risks, having a detailed contract and considering the guidance of a legal expert can be highly beneficial.

To protect yourself when using a Colorado Owner Financing Contract for Mobile Home, start by securing a thorough legal contract that clearly outlines all terms. It's wise to conduct a comprehensive title search before finalizing the deal to ensure the seller has a legitimate title. Additionally, including clauses for late payments and default processes can safeguard your interests. Engaging with experienced professionals can help you navigate these complexities effectively.

In Colorado, a 'subject to' financing arrangement typically involves the buyer taking over the existing mortgage of the property. This arrangement can be beneficial when structuring a Colorado Owner Financing Contract for Mobile Home, as it allows buyers to leverage the seller's financing terms. However, it's important to understand that the original lien remains in the seller's name, which can lead to complications if the buyer defaults. Always review the details with a professional to ensure clarity.

When using a Colorado Owner Financing Contract for Mobile Home, misunderstandings about the terms can lead to conflicts. Another risk includes the possibility of the seller not holding clear title, which can create legal complications. Additionally, if the buyer fails to make payments, the seller may encounter issues when trying to reclaim the property. Therefore, it's essential to draft a solid contract and consider professional legal advice.

If the buyer defaults on their payments, the seller typically has the right to rescind the contract and potentially reclaim the property. The specifics can vary based on the terms outlined in the Colorado Owner Financing Contract for Mobile Home. The seller may also choose to negotiate with the buyer to find a solution, such as a payment plan or forgiveness. Legal actions may be necessary depending on the situation.

The primary downside of owner financing is the risk of default, which can lead to complicated legal situations. If the buyer fails to make payments, the seller may need to initiate foreclosure proceedings. Additionally, sellers may face challenges in determining fair market value and setting appropriate interest rates. Utilizing a solid Colorado Owner Financing Contract for Mobile Home can mitigate these risks.

Yes, seller financing is legal in Colorado, provided the parties adhere to state regulations and guidelines. Both sellers and buyers must understand their rights and responsibilities under the contract. It’s pivotal to create a comprehensive Colorado Owner Financing Contract for Mobile Home to address terms, payments, and contingencies. Consulting a legal expert can also assist in this process.