Colorado Owner Financing Contract for Vehicle

Description

How to fill out Owner Financing Contract For Vehicle?

Are you currently in a situation where you require paperwork for both organizational or personal reasons on a daily basis.

There are numerous legal document templates accessible online, but finding ones you can trust isn't straightforward.

US Legal Forms offers a substantial collection of form templates, such as the Colorado Owner Financing Agreement for Vehicle, that are designed to comply with state and federal regulations.

When you find the correct form, click Acquire now.

Choose the payment plan you need, fill in the required information to create your account, and complete your purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Colorado Owner Financing Agreement for Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/state.

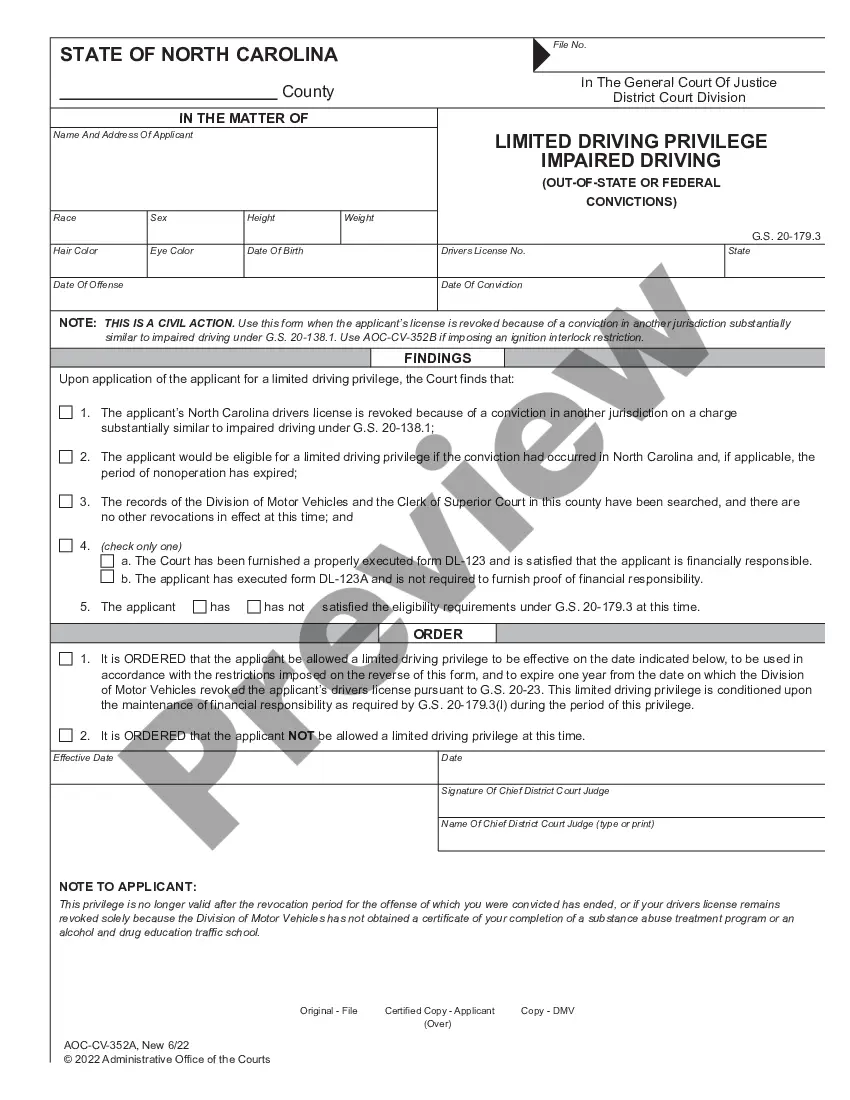

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the right document.

- If the form isn’t what you’re looking for, use the Search field to find the document that fits your needs.

Form popularity

FAQ

Standard terms for a Colorado Owner Financing Contract for Vehicle typically include a down payment of 10% to 20%, an interest rate that mirrors current market rates, and a repayment period of three to five years. Additionally, sellers often specify penalties for late payments and the conditions under which the contract can be terminated. Understanding these terms is essential for creating a fair agreement.

One downside of owner financing is the potential risk for sellers, as buyers may default on payments. This can lead to financial loss and additional legal complications. Moreover, with a Colorado Owner Financing Contract for Vehicle, sellers may need to manage paperwork and ensure compliance with local laws, which can be challenging without proper guidance.

To set up a Colorado Owner Financing Contract for Vehicle, begin by discussing the terms with the buyer, including payment structure and interest rates. Next, both parties should outline these agreements in writing, ensuring clarity on payment schedules and any penalties for late payments. Utilizing platforms such as uslegalforms can streamline this process, providing user-friendly templates tailored for your needs.

Good terms for seller financing will depend on multiple factors such as the vehicle's value and the financial situation of both parties. Generally, a Colorado Owner Financing Contract for Vehicle should include a reasonable interest rate, a manageable down payment, and clear timelines for repayment. These terms can help create a mutually beneficial arrangement, which can lead to a successful sale.

The average length of seller financing can vary significantly based on the agreement between the buyer and seller. Typically, a Colorado Owner Financing Contract for Vehicle lasts from three to five years, although terms can be negotiated to be shorter or longer. It's crucial to ensure that the duration suits both parties' needs and expectations.

In a Colorado Owner Financing Contract for Vehicle, the seller retains the title until the buyer completes the payment terms outlined in the contract. This arrangement offers protection to the seller while enabling the buyer to use the vehicle immediately. It's essential that both parties clearly understand their responsibilities and rights, which can be efficiently managed through clear documentation. For a seamless experience, consider using the US Legal Forms platform to create your contract.

Different types of owner financing include land contracts, lease options, and promissory notes. Each type has unique terms and conditions that outline how payments are made and how ownership is transferred. Understanding these types can help buyers and sellers find the best arrangement to suit their needs in a Colorado Owner Financing Contract for Vehicle.

An example of a Colorado Owner Financing Contract for Vehicle might be where a seller offers to sell a car for $20,000 with a 15% down payment. In this case, the buyer pays $3,000 upfront and finances the remaining $17,000 over a set period, say three years, at a defined interest rate. This structure opens up flexible options for both parties.

To obtain your own financing for a car, evaluate your budget and identify how much you can afford for a down payment and monthly payments. Explore various financing options, such as banks, credit unions, or owner financing deals. If you decide on owner financing, ensure you draft a detailed agreement using a Colorado Owner Financing Contract for Vehicle available on USLegalForms, which simplifies the process and protects both parties.

To write an owner finance contract, start by clearly defining the roles of both the buyer and the seller. Include critical details such as the vehicle description, payment terms, interest rates, and duration of the financing. Additionally, outline the responsibilities of both parties concerning taxes, insurance, and maintenance. For an accurate and legally sound agreement, refer to USLegalForms for Colorado Owner Financing Contract for Vehicle templates.