This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Colorado Online Return and Exchange Policy for Purchases and Gifts

Description

How to fill out Online Return And Exchange Policy For Purchases And Gifts?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a broad selection of legal document designs that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of documents such as the Colorado Online Return and Exchange Policy for Purchases and Gifts in just a few seconds.

If you already have a subscription, Log In and obtain the Colorado Online Return and Exchange Policy for Purchases and Gifts from your US Legal Forms collection. The Download button will be visible on each form you view. You can access all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finish the transaction.

Choose the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Colorado Online Return and Exchange Policy for Purchases and Gifts. Each template you add to your account does not have an expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Colorado Online Return and Exchange Policy for Purchases and Gifts with US Legal Forms, one of the largest libraries of legal document designs. Utilize a wide range of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you select the correct form for your location.

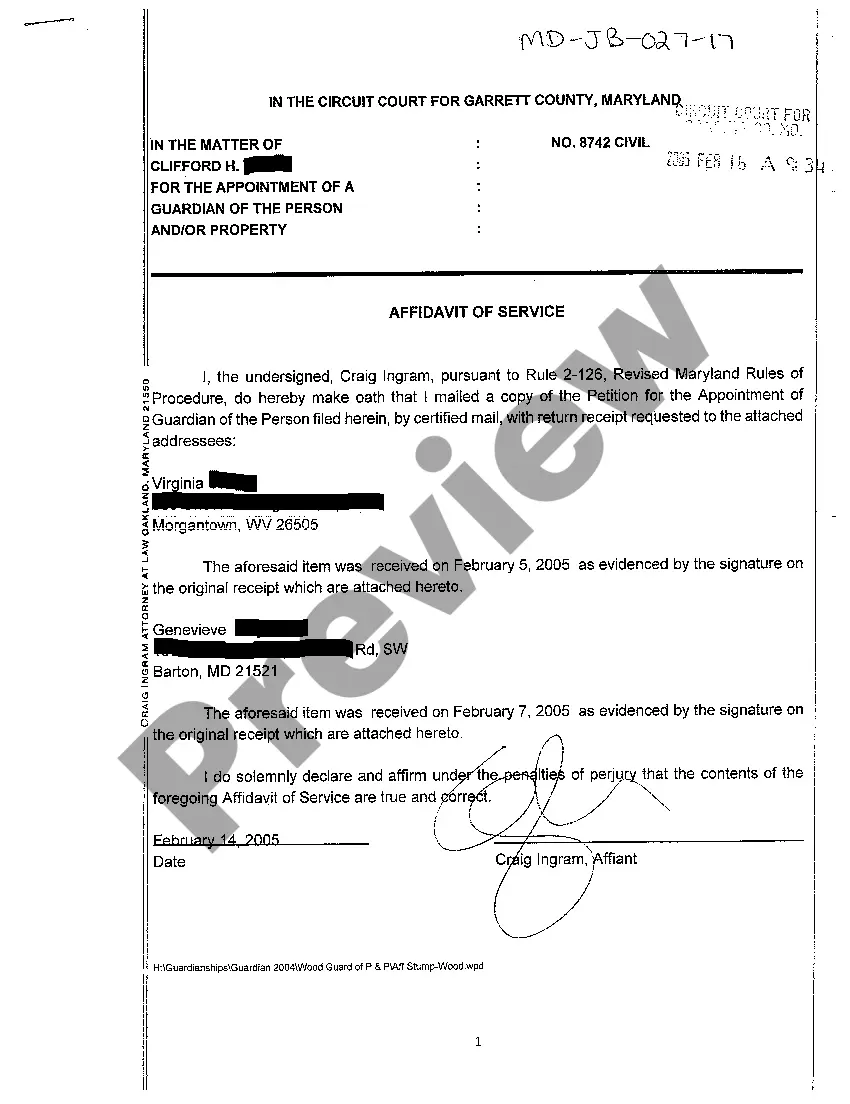

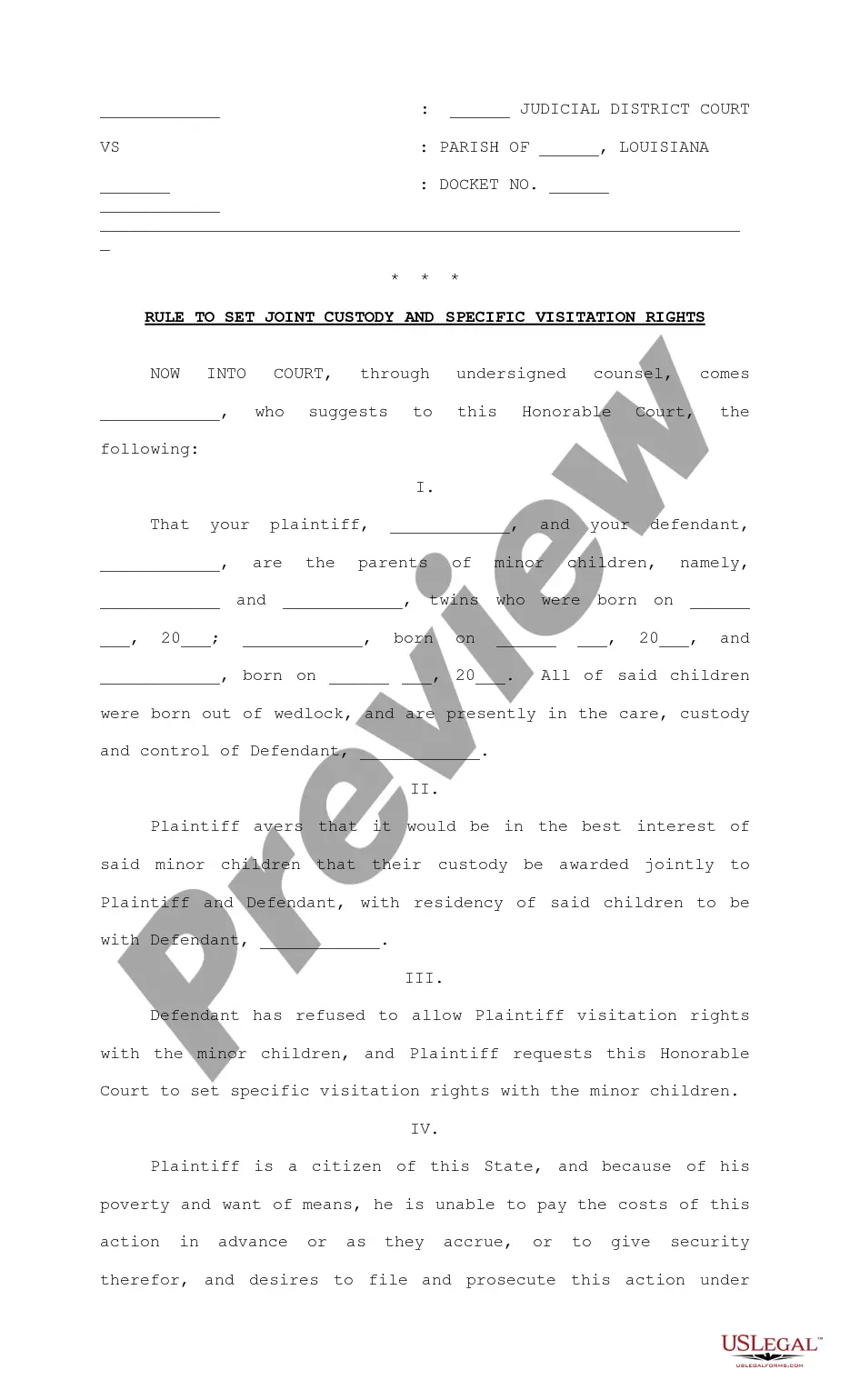

- Click the Preview button to review the document’s content.

- Check the form description to confirm you’ve chosen the correct one.

- If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

If you earn income in Colorado or meet certain filing requirements, you most likely need to file a state return. It’s essential to evaluate your specific situation; factors include your income level and residency status. Resources like the Colorado Online Return and Exchange Policy for Purchases and Gifts can guide you in making informed decisions about your tax obligations.

There could be several reasons you cannot e-file your Colorado tax return, such as incomplete forms or certain tax situations that require paper filing. Make sure you have all required information and that your income and deductions are correctly reported. For further assistance, consider how the Colorado Online Return and Exchange Policy for Purchases and Gifts might offer solutions for better tax reporting.

In general, you do not have to report gifts you receive on your tax return. However, if you give gifts that exceed the federal exclusion limit, you must report those on your federal tax return. Familiarizing yourself with the Colorado Online Return and Exchange Policy for Purchases and Gifts can provide insight into any necessary documentation to maintain.

Colorado does not impose a state gift tax, so you do not need to file a gift tax return for gifts made within the state. However, if you make gifts that exceed the federal exclusion limit, you need to file a federal gift tax return. Understanding the Colorado Online Return and Exchange Policy for Purchases and Gifts can help clarify any obligations related to gifts you give in the state.

Residents can typically expect their Colorado tax refund within six to eight weeks after filing their tax return. However, delays can occur due to various factors, such as additional processing requirements or errors on the return. Being aware of these timelines is crucial, especially if you are making purchases under the Colorado Online Return and Exchange Policy for Purchases and Gifts that may depend on refund timing.

To qualify for a Colorado refund, individuals must meet specific residency and income criteria established by the state. Generally, residents who file a Colorado tax return and have an adjusted gross income within certain limits may be eligible. Familiarizing yourself with these qualifications can enhance your understanding of the potential benefits available under the Colorado Online Return and Exchange Policy for Purchases and Gifts.

In Colorado, the gift tax limit aligns with federal regulations, which allows individuals to gift up to $15,000 to any one person per year without incurring a gift tax. This limit encourages generosity among residents while providing clarity on possible tax implications. For individuals utilizing the Colorado Online Return and Exchange Policy for Purchases and Gifts, keeping the gift tax limit in mind can be advantageous for planning significant gifts.

The Colorado Tabor refund is not included in your tax return as taxable income. This refund is a way for the state to distribute surplus taxes back to residents, and it is treated as a credit rather than income. Understanding this distinction can help you better navigate your finances and the Colorado Online Return and Exchange Policy for Purchases and Gifts, ensuring that you maximize your benefits.

The $800 tax refund in Colorado refers to a one-time refund provided to eligible residents. This refund helps residents manage their tax liabilities and is part of Colorado's commitment to returning excess revenue to its citizens. It is important to note that this refund may relate to the state's overall tax structure, and it can influence your decisions regarding purchases, especially under the Colorado Online Return and Exchange Policy for Purchases and Gifts.

The $800 refund in Colorado refers to a state tax refund that certain individuals may qualify for, typically when they are considered low to moderate-income earners. This refund helps ease the tax burden for eligible residents. It's an excellent incentive to ensure you file correctly. The Colorado Online Return and Exchange Policy for Purchases and Gifts can guide you through the application process to maximize your potential refund.