A home equity line of credit is a form of revolving credit in which your home serves as collateral. Because the home is likely to be a consumer's largest asset, many homeowners use their credit lines only for major items such as education, home improvements, or medical bills and not for day-to-day expenses. A home equity line of credit differs from a conventional home equity loan in that the borrower is not advanced the entire sum up front, but uses a line of credit to borrow sums that total no more than the amount, similar to a credit card.

Another important difference from a conventional loan is that the interest rate on a home equity line of credit is variable based on an index such as prime rate. This means that the interest rate can - and almost certainly will - change over time. The margin is the difference between the prime rate and the interest rate the borrower will actually pay.

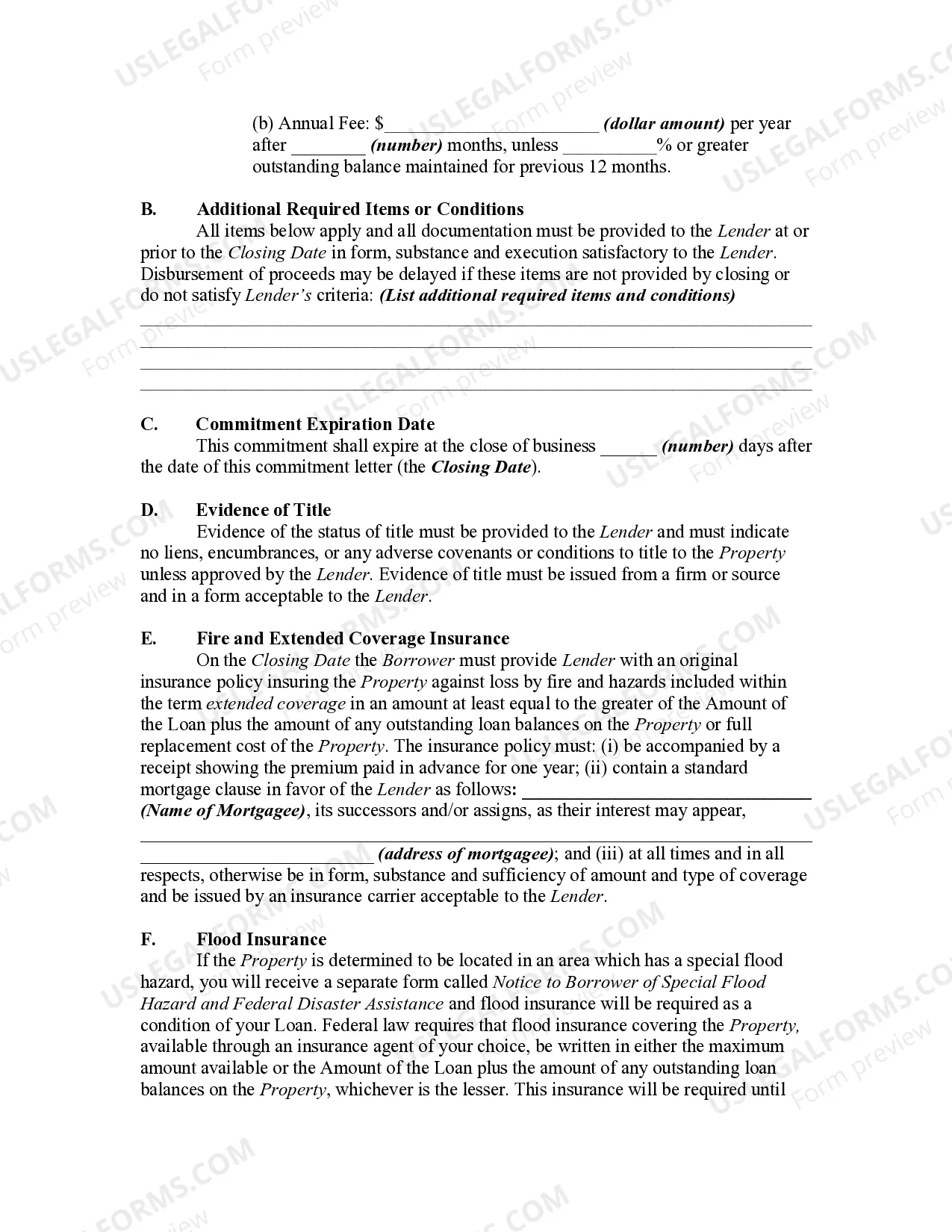

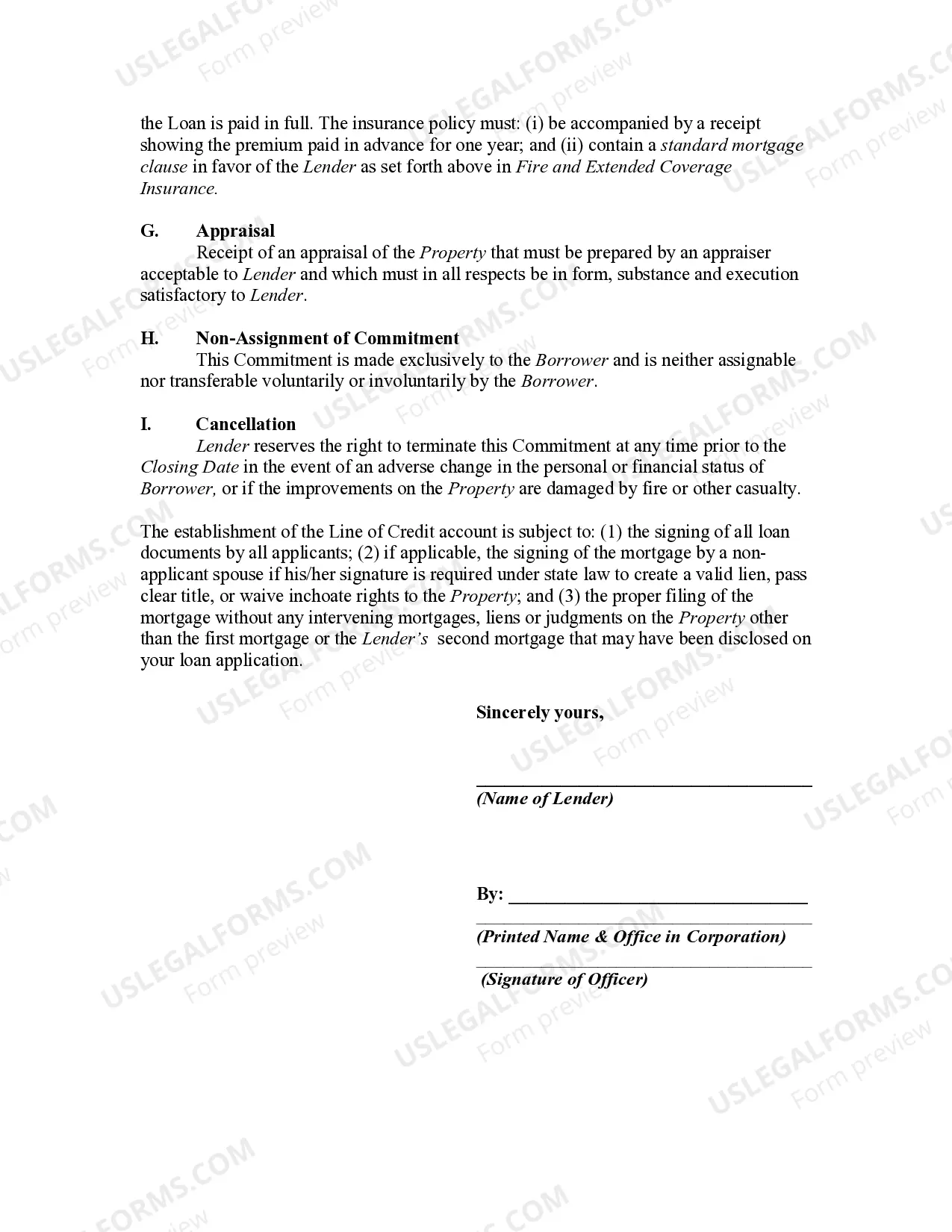

Colorado Mortgage Loan Commitment for Home Equity Line of Credit refers to a legal agreement between a borrower and a lender in the state of Colorado, which outlines the terms and conditions of a loan specifically designed to utilize the borrower's home equity. This type of loan allows homeowners to access a certain amount of money by utilizing the difference between the market value of their property and the outstanding mortgage balance. The Colorado Mortgage Loan Commitment for Home Equity Line of Credit provides homeowners with a flexible way to borrow money as needed, up to a specific limit, using their home as collateral. The loan commitment gives the borrower a sense of security by specifying the lender's commitment to provide the funds on an ongoing basis, within the designated limit, while also establishing the repayment terms and interest rate. There are several types of Colorado Mortgage Loan Commitment for Home Equity Line of Credit available, each catering to different borrower needs: 1. Variable Rate HELOT: This type of loan commitment comes with an adjustable interest rate. The interest rate is usually tied to a specific benchmark, such as the Prime Rate, and may fluctuate over time. Borrowers with a variable rate HELOT can benefit from potential interest rate decreases, but should also be prepared for potential increases. 2. Fixed Rate HELOT: Unlike a variable rate HELOT, this type of loan commitment offers a fixed interest rate for the entire term of the loan. Borrowers can enjoy the stability of knowing their interest rate won't change, which can be beneficial if interest rates are anticipated to rise in the future. However, fixed rate Helots may have higher initial interest rates compared to variable rate Helots. 3. Interest-Only HELOT: This type of loan commitment allows borrowers to make interest-only payments for a certain period, typically around 5 to 10 years. During this period, borrowers are not required to repay the principal amount borrowed, which can provide financial flexibility. However, once this period ends, borrowers must start repaying both principal and interest, which may result in higher monthly payments. 4. Convertible HELOT: A convertible HELOT gives borrowers the option to convert their variable rate loan into a fixed rate loan at a predetermined time, often after an initial fixed-rate period. This type of loan commitment provides borrowers with the ability to switch to a more predictable payment structure when interest rates become less favorable or uncertain. In conclusion, a Colorado Mortgage Loan Commitment for Home Equity Line of Credit is an agreement allowing homeowners in Colorado to access funds based on the equity in their property. The commitment outlines the terms and conditions of the loan, including interest rates, repayment schedules, and any applicable fees. By understanding the different types of loan commitments available, borrowers can choose an option that best suits their financial needs and goals.Colorado Mortgage Loan Commitment for Home Equity Line of Credit refers to a legal agreement between a borrower and a lender in the state of Colorado, which outlines the terms and conditions of a loan specifically designed to utilize the borrower's home equity. This type of loan allows homeowners to access a certain amount of money by utilizing the difference between the market value of their property and the outstanding mortgage balance. The Colorado Mortgage Loan Commitment for Home Equity Line of Credit provides homeowners with a flexible way to borrow money as needed, up to a specific limit, using their home as collateral. The loan commitment gives the borrower a sense of security by specifying the lender's commitment to provide the funds on an ongoing basis, within the designated limit, while also establishing the repayment terms and interest rate. There are several types of Colorado Mortgage Loan Commitment for Home Equity Line of Credit available, each catering to different borrower needs: 1. Variable Rate HELOT: This type of loan commitment comes with an adjustable interest rate. The interest rate is usually tied to a specific benchmark, such as the Prime Rate, and may fluctuate over time. Borrowers with a variable rate HELOT can benefit from potential interest rate decreases, but should also be prepared for potential increases. 2. Fixed Rate HELOT: Unlike a variable rate HELOT, this type of loan commitment offers a fixed interest rate for the entire term of the loan. Borrowers can enjoy the stability of knowing their interest rate won't change, which can be beneficial if interest rates are anticipated to rise in the future. However, fixed rate Helots may have higher initial interest rates compared to variable rate Helots. 3. Interest-Only HELOT: This type of loan commitment allows borrowers to make interest-only payments for a certain period, typically around 5 to 10 years. During this period, borrowers are not required to repay the principal amount borrowed, which can provide financial flexibility. However, once this period ends, borrowers must start repaying both principal and interest, which may result in higher monthly payments. 4. Convertible HELOT: A convertible HELOT gives borrowers the option to convert their variable rate loan into a fixed rate loan at a predetermined time, often after an initial fixed-rate period. This type of loan commitment provides borrowers with the ability to switch to a more predictable payment structure when interest rates become less favorable or uncertain. In conclusion, a Colorado Mortgage Loan Commitment for Home Equity Line of Credit is an agreement allowing homeowners in Colorado to access funds based on the equity in their property. The commitment outlines the terms and conditions of the loan, including interest rates, repayment schedules, and any applicable fees. By understanding the different types of loan commitments available, borrowers can choose an option that best suits their financial needs and goals.