Colorado Acknowledgment by Debtor of Correctness of Account Stated is a legal document used in Colorado to confirm the accuracy of an account statement. This acknowledgment serves as evidence that the debtor recognizes the statement's correctness and agrees to its contents. The Colorado Acknowledgment by Debtor of Correctness of Account Stated is crucial for businesses or individuals who provide goods or services on credit, as it helps protect their rights in case of disputes or non-payment. By signing this acknowledgment, debtors confirm that they have received the account statement and agree that it accurately reflects their financial obligations. It's important to note that there are no specific variations or types of Colorado Acknowledgment by Debtor of Correctness of Account Stated, as it primarily serves a single purpose — confirming the accuracy of an account statement. However, there may be slight variations in the format or layout of the acknowledgment based on the preferences of the parties involved or the document's purpose (e.g., personal or business account). To create an effective Colorado Acknowledgment by Debtor of Correctness of Account Stated, the following relevant keywords and information should be included: 1. Parties involved: Clearly state the names and contact information of both the debtor and the creditor. 2. Date of acknowledgment: Include the date on which the debtor signs the document to validate its accuracy. 3. Account details: Provide a detailed description of the account being acknowledged, including the account number, statement period, and any outstanding balances or payments due. 4. Acknowledgment statement: Clearly state that the debtor acknowledges the correctness of the account statement, agrees to its contents, and confirms their intention to fulfill their financial obligations. 5. Signature and notarization: Provide space for the debtor's signature and date, followed by a section for a notary public to notarize the document for legal validation. 6. Witness information: If required or preferred, include space for one or more witness signatures to further authenticate the acknowledgment. 7. Governing law: Mention that the acknowledgment is governed by the laws of the state of Colorado, ensuring its enforceability in the appropriate jurisdiction. Remember to consult a legal professional or use reputable legal document services to ensure compliance with Colorado's specific requirements for the Acknowledgment by Debtor of Correctness of Account Stated.

Colorado Acknowledgment by Debtor of Correctness of Account Stated

Description

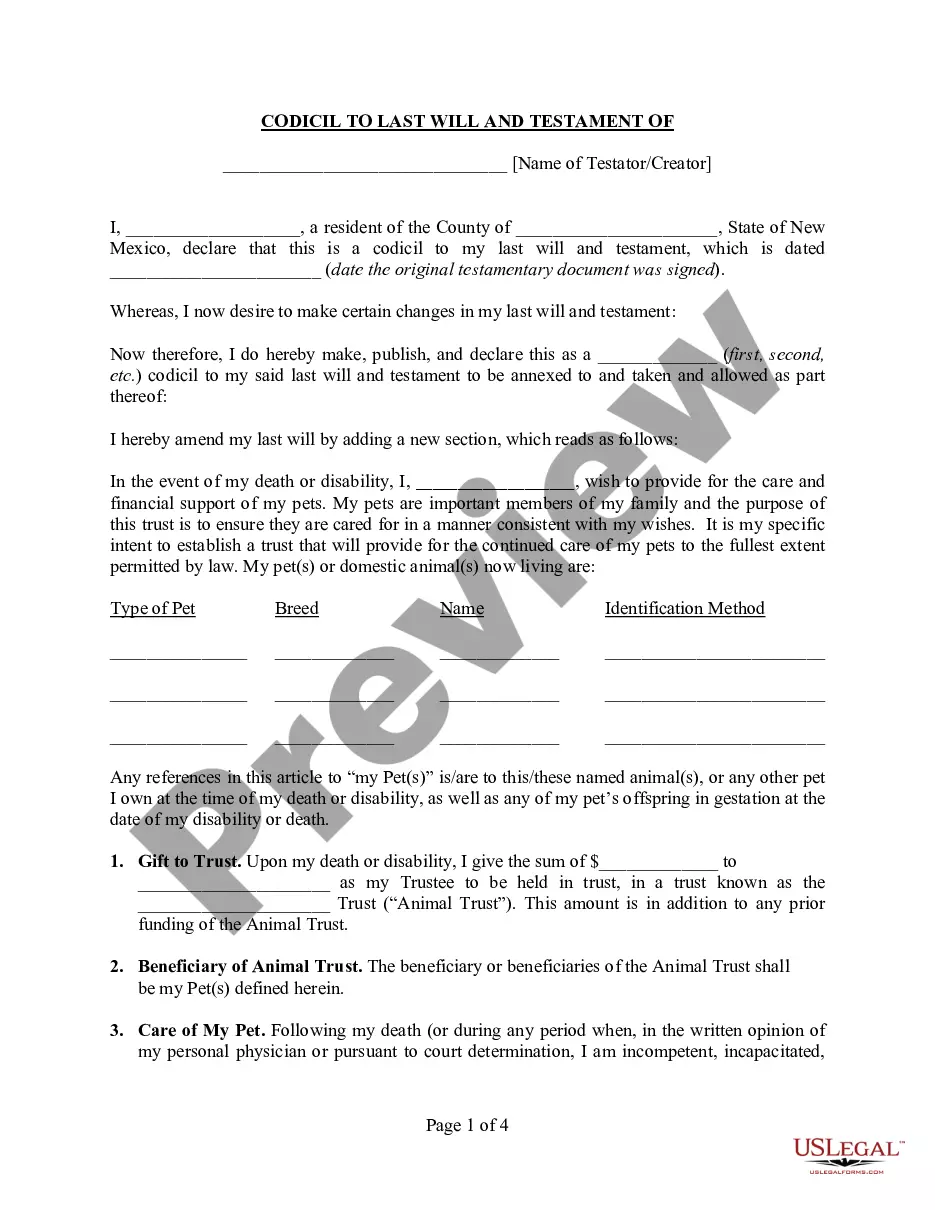

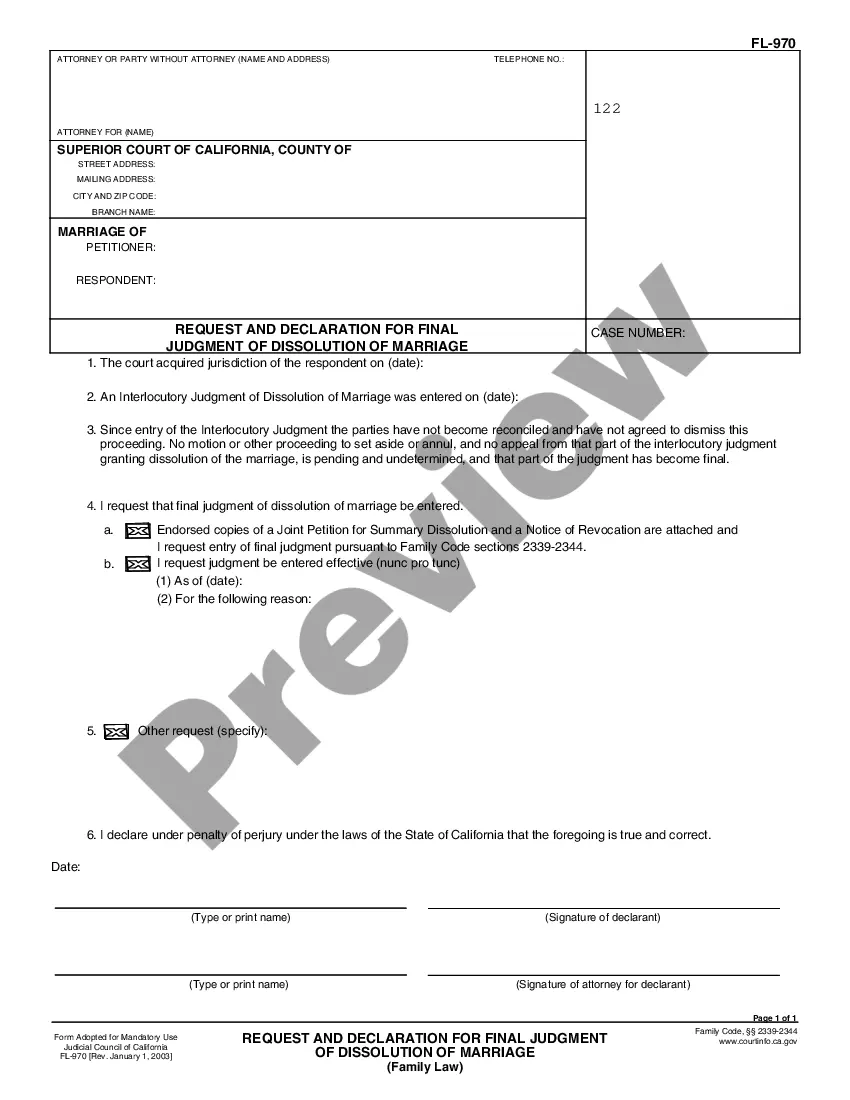

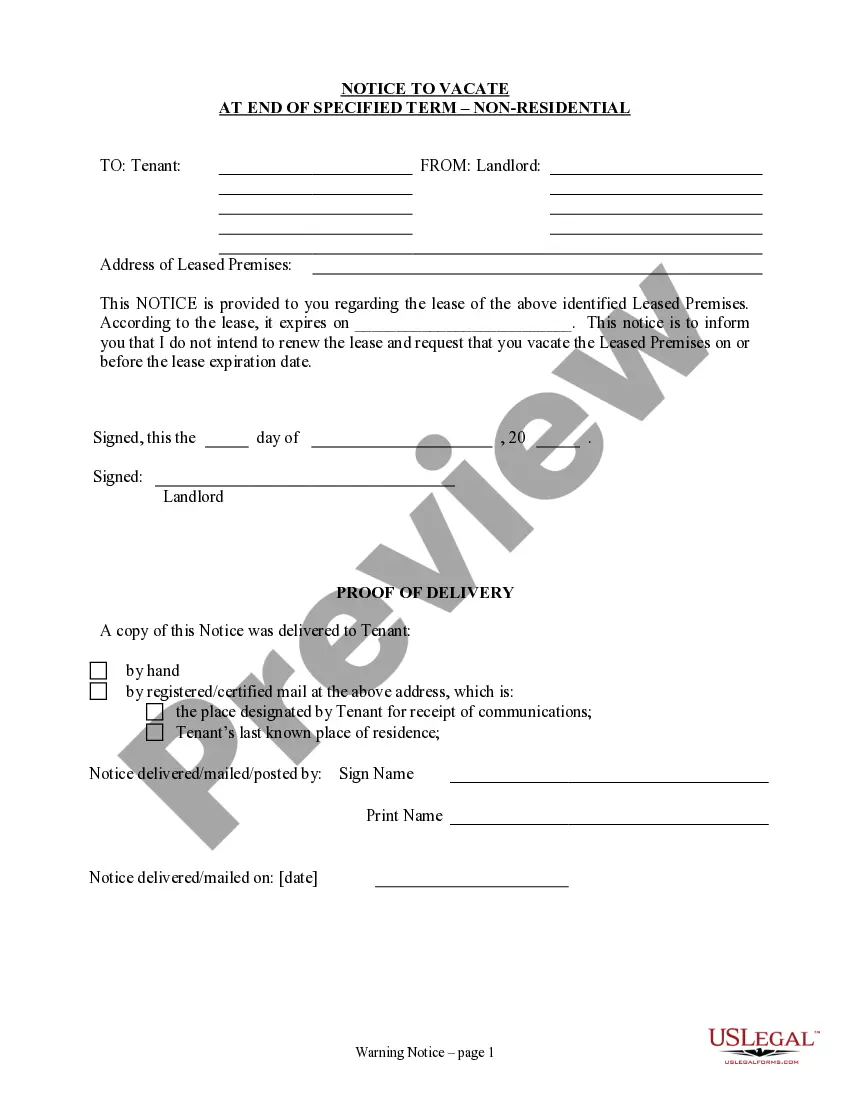

How to fill out Colorado Acknowledgment By Debtor Of Correctness Of Account Stated?

If you need to full, obtain, or print lawful file layouts, use US Legal Forms, the biggest assortment of lawful types, which can be found on the web. Use the site`s simple and easy convenient look for to find the papers you will need. Different layouts for organization and individual uses are sorted by categories and states, or keywords and phrases. Use US Legal Forms to find the Colorado Acknowledgment by Debtor of Correctness of Account Stated within a few clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and click on the Obtain switch to obtain the Colorado Acknowledgment by Debtor of Correctness of Account Stated. You can even accessibility types you previously delivered electronically within the My Forms tab of the bank account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for your right city/region.

- Step 2. Use the Preview method to check out the form`s information. Never neglect to see the description.

- Step 3. In case you are not satisfied together with the develop, use the Search discipline towards the top of the display to discover other variations of your lawful develop format.

- Step 4. Once you have identified the shape you will need, click the Acquire now switch. Opt for the costs plan you choose and put your accreditations to sign up to have an bank account.

- Step 5. Process the purchase. You can use your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Select the format of your lawful develop and obtain it on your own product.

- Step 7. Full, change and print or indication the Colorado Acknowledgment by Debtor of Correctness of Account Stated.

Each lawful file format you acquire is the one you have permanently. You may have acces to each develop you delivered electronically within your acccount. Select the My Forms section and select a develop to print or obtain once more.

Be competitive and obtain, and print the Colorado Acknowledgment by Debtor of Correctness of Account Stated with US Legal Forms. There are thousands of specialist and express-specific types you may use to your organization or individual needs.

Form popularity

FAQ

Under California law, "[a]n account stated is an agreement, based on prior transactions between the parties, that the items of an account are true and that the balance struck is due and owing."4 The three elements of the claim are 1) previous transactions between the parties establishing the relationship between debtor ...

The elements of an accounts stated claim are (1) A previous transaction that created a liability; (2) An agreement by the Defendant that the balance is due and correct; (3) A promise has been made, either expressly or implicitly, to pay the balance; (4) The balance remains unpaid.

An Account Stated establishes an implied contract, whereas a breach of contract traditionally refers to an expressly written contract. Account Stated is used when no contract exists or when the plaintiff cannot prove the existence of the contract.

There are three elements of an account stated claim: (1) the account was presented, (2) by mutual agreement, it was accepted as correct, and (3) the debtor promised to pay the amount so stated. The second and third elements may be shown by the debtor's failure to object to the stated amount within a reasonable time.

Collections actions involving the sale of goods often include two varieties of ?account? claims in addition to traditional breach of contract theories: ?account stated? and ?open account.? Generally, an account stated claim alleges the failure to pay an agreed-upon balance, while an open account claim alleges an ...

Account stated refers to a document summarizing the amount a debtor owes a creditor. An account stated is also a cause of action in many states that allows a creditor to sue for payment.

Account stated refers to a document summarizing the amount a debtor owes a creditor. An account stated is also a cause of action in many states that allows a creditor to sue for payment.

The elements of account stated are: (1) prior transactions between the parties which establish a debtor-creditor relationship; (2)an express or implied agreement between the parties as to the amount due; and (3) an express or implied promise from the debtor to pay the amount due.

No. However, the plaintiff does have to prove a potential right under a preexisting relationship. Conceptually, an Account Stated forms a new, implied contract based on the old contract. It's a second cause of action for an implied contract.