A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships.

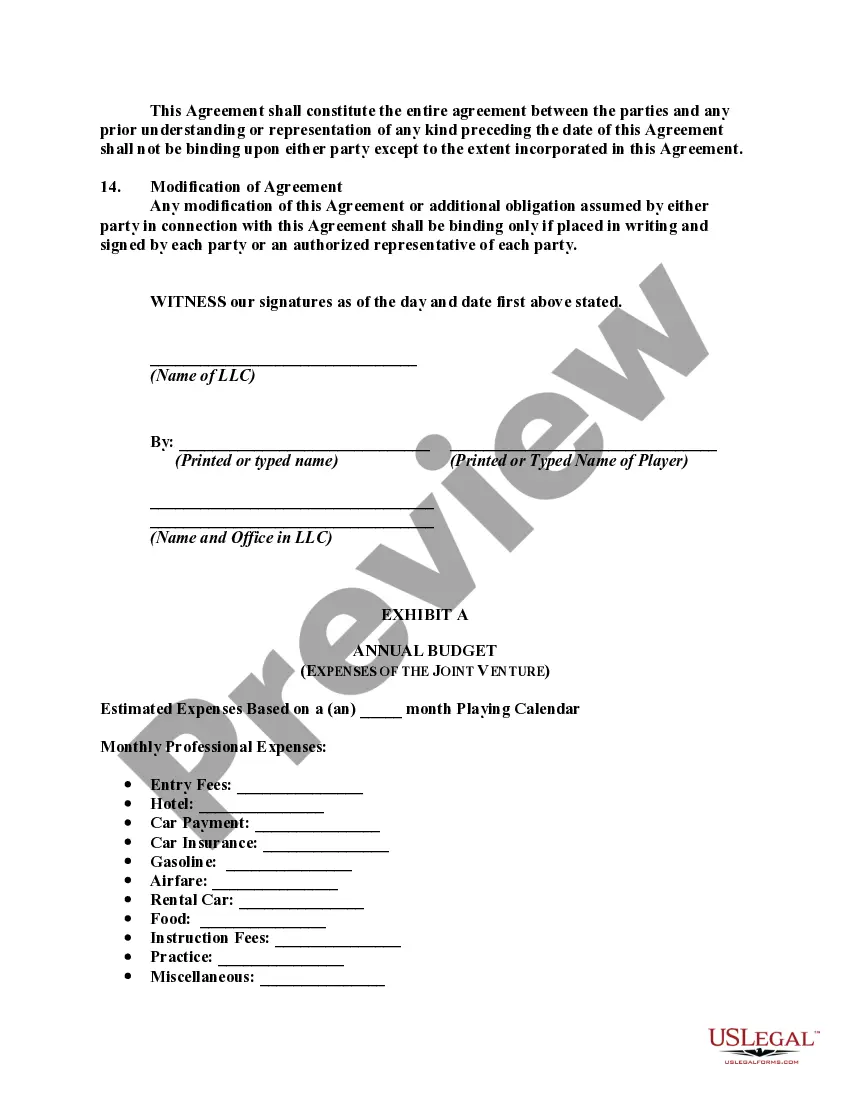

Colorado Joint Venture Agreement between a Limited Liability Company and Professional Golfer to Sponsor and Provide Funds Introduction: A Colorado Joint Venture Agreement is a legally binding contract entered into by a Limited Liability Company (LLC) and a Professional Golfer to collaborate on sponsoring golf events or activities and providing funds for these ventures. This agreement outlines the terms, conditions, obligations, and liabilities of both parties involved in the joint venture. The ultimate goal is to create a mutually beneficial partnership that promotes successful golf events while ensuring transparency and accountability in financial matters. Key Components of a Colorado Joint Venture Agreement: 1. Identification of Parties: Clearly identify the LLC and the Professional Golfer participating in the joint venture, detailing their legal names, addresses, and contact information. 2. Purpose and Scope: Define the purpose and scope of the joint venture, specifying the golf events or activities to be sponsored, and outlining the goals and objectives of the partnership. 3. Contributions: Clearly state the financial investment or other contributions to be made by each party. This may include funds, equipment, facilities, or services that are necessary to fulfill the objectives of the joint venture. 4. Distribution of Profits and Losses: Outline how profits or losses generated from the joint venture will be distributed among the parties. This could be based on a predetermined percentage or any other agreed-upon method. 5. Management and Decision-Making: Establish the decision-making authority and management responsibilities of each party. Define the roles, responsibilities, and limitations of the LLC and the Professional Golfer in executing and managing the joint venture. 6. Term and Termination: Define the duration of the joint venture agreement, including a specific start and end date if applicable. Specify the circumstances under which the agreement can be terminated, such as breach of contract or mutual agreement. 7. Intellectual Property: Address any intellectual property rights related to the joint venture, including trademarks, brand logos, or any other proprietary assets used in promotional activities or sponsorship materials. 8. Confidentiality and Non-Disclosure: Include provisions that ensure the confidentiality of all proprietary or sensitive information shared between the parties during the course of the joint venture. This may also include non-disclosure agreements to protect trade secrets or business strategies. Different Types of Colorado Joint Venture Agreements: 1. Exclusive Sponsorship Joint Venture: This type of joint venture agreement establishes a long-term partnership between the LLC and the Professional Golfer, granting exclusive sponsorship rights for a specified period. Only the Professional Golfer associated with this agreement will be permitted to endorse or participate in the events sponsored by the LLC. 2. Project-specific Joint Venture: These agreements are structured for a particular golf event or activity. The LLC and the Professional Golfer collaborate on a temporary basis to sponsor and provide funding for a specific golf tournament, charity event, or other initiatives related to golf. Conclusion: A Colorado Joint Venture Agreement between an LLC and a Professional Golfer serves as a legally binding contract that outlines the terms of the collaboration, financial obligations, decision-making authority, and other crucial aspects. Such agreements facilitate successful partnerships in the golf industry, ensuring that both parties work together seamlessly to achieve common objectives.