An IOU is usually an informal document acknowledging a debt. The term is derived from the phrases I owe unto and I owe you. An IOU differs from a promissory note in that an IOU is not a negotiable instrument as defined by the Uniform Commercial Code and generally does not specify repayment terms such as the time of repayment. IOUs usually specify the debtor, the amount owed, and sometimes the creditor.

Colorado Debt Acknowledgment - IOU

Description

How to fill out Debt Acknowledgment - IOU?

Are you in a circumstance where you require documents for either business or personal reasons almost all the time.

There are numerous legal document templates accessible on the web, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the Colorado Debt Acknowledgment - IOU, designed to comply with federal and state requirements.

Use US Legal Forms, the most comprehensive collection of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Colorado Debt Acknowledgment - IOU template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct city/county.

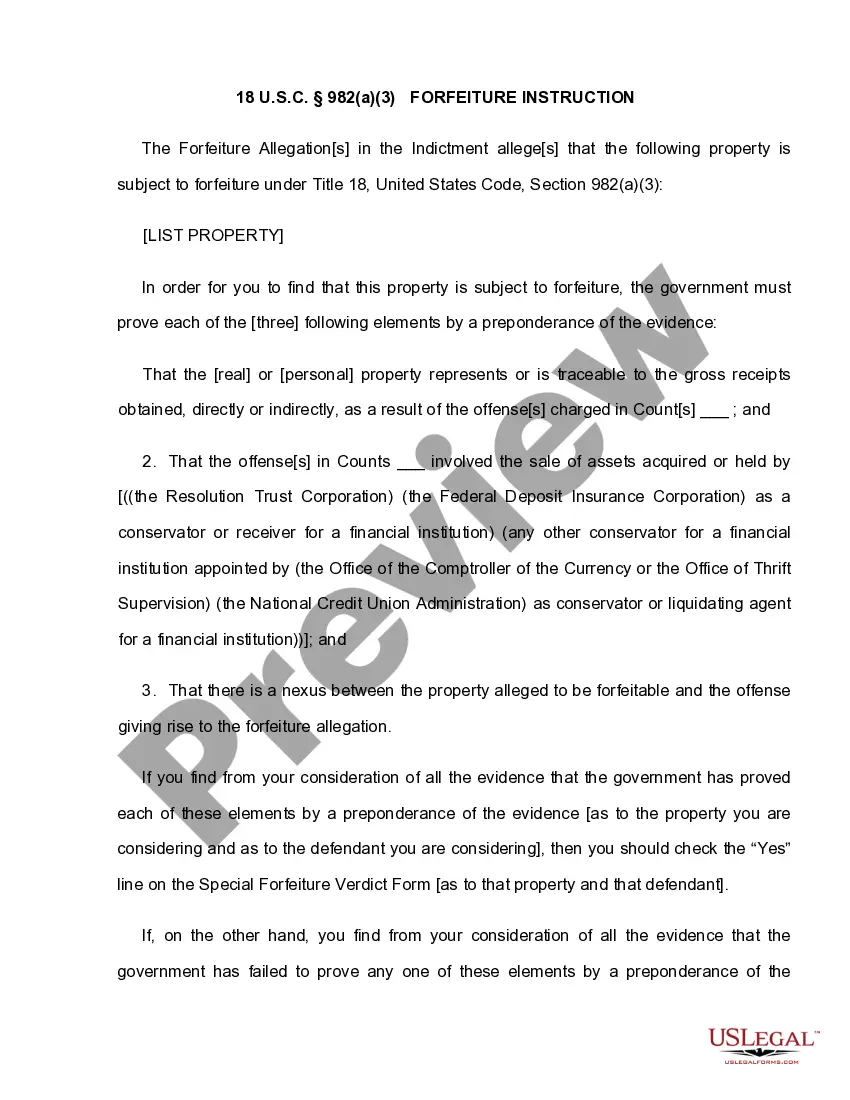

- Use the Preview button to review the document.

- Check the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Search field to find the form that meets your needs.

- Once you find the appropriate form, click on Get now.

- Select the payment plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Colorado Debt Acknowledgment - IOU at any time, if necessary. Just follow the required form to download or print the document template.

Form popularity

FAQ

The more specific the IOU the more likely it is enforceable. IOUs that identify and are signed by the borrower and include the loan amount, terms of repayment and interest, if any, are more likely to be legally binding.

Yes, a handwritten IOU is a legal document. Whether the agreement was typed or written by hand, the IOU can still hold up in court and be used to recover debts. You should ensure the IOU contains the essential elements mentioned earlier in the article to be valid in court.

Other Uses of the Term IOU Bonds are technically a form of IOU, whereby an individual loans an amount of money to a company or government and is given a contract promising to repay the money with interest by a certain date. Whilst this agreement is sometimes referred to as an ?IOU?, it is in fact legally binding.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

At a bare minimum, an IOU should include the borrower's name, the lender's name, the amount of the debt, the current date, the date the debt is due, and the borrower's signature. In addition, it's recommended that IOUs contain: How the debt is to be repaid (lump sum or installments)

Some authorities feel an IOU isn't binding at all; it's merely the acknowledgement that a debt exists. Others feel it is binding, though whether it can actually be enforced is a different story. Basically, the more detailed the IOU, the more likely it is to be enforceable.

A: Yes, an IOU doesn't have to be notarized. However it should specify particular terms, such as what is the amount of the principal amount owed, when it is due, what if any interest is charged, etc. A witness and notarization can be useful to prove that it was in fact signed, but they are not strictly necessary.