A reservation of rights defense is a means by which a liability insurance carrier agrees to protect and defend its insured against a claim or suit while reserving the right to further evaluate and perhaps even deny coverage for some or all of the claim. It is most commonly used when the claim or suit contains both covered and non-covered allegations, when the allegations are in excess of policy limits, or when the insurer is still investigating its defense and coverage obligations. For the insurer, a reservation of rights provides the flexibility to satisfy its duty to defend without committing to coverage. For the business owner who ultimately may have to pay for an adverse judgment, it requires careful monitoring and attention.

Colorado Reservation of Rights Letter

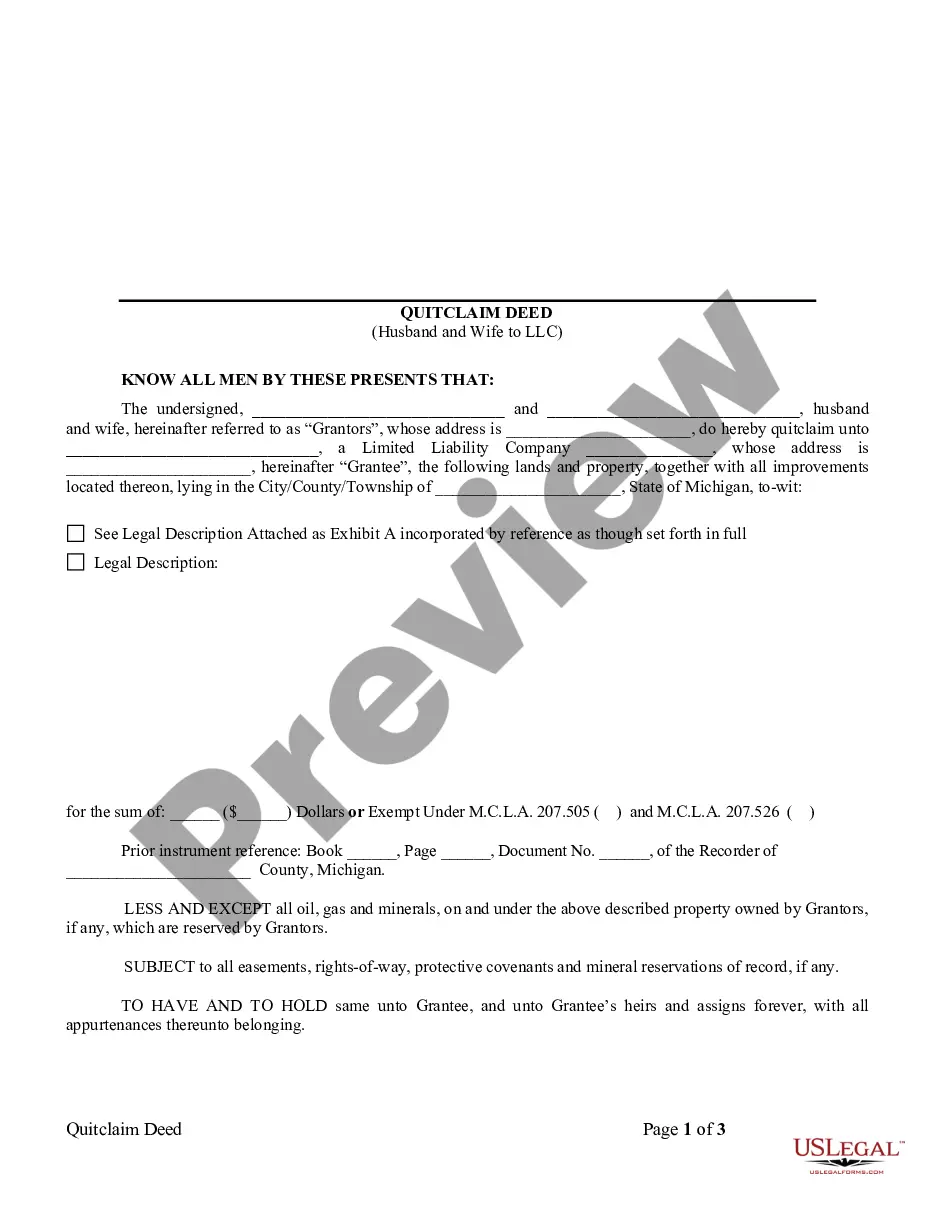

Description

How to fill out Reservation Of Rights Letter?

If you have to complete, obtain, or produce lawful document web templates, use US Legal Forms, the largest selection of lawful varieties, that can be found on the Internet. Make use of the site`s easy and convenient lookup to discover the papers you need. Various web templates for organization and individual uses are categorized by classes and says, or search phrases. Use US Legal Forms to discover the Colorado Reservation of Rights Letter in a handful of click throughs.

If you are already a US Legal Forms customer, log in to the accounts and then click the Down load button to have the Colorado Reservation of Rights Letter. Also you can gain access to varieties you earlier acquired within the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your correct city/country.

- Step 2. Make use of the Review solution to examine the form`s information. Never neglect to learn the information.

- Step 3. If you are not satisfied using the form, take advantage of the Search discipline towards the top of the display to locate other variations of the lawful form format.

- Step 4. Upon having located the shape you need, go through the Purchase now button. Pick the rates plan you like and add your references to sign up for an accounts.

- Step 5. Process the financial transaction. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the file format of the lawful form and obtain it in your device.

- Step 7. Total, edit and produce or indication the Colorado Reservation of Rights Letter.

Each and every lawful document format you get is your own property for a long time. You have acces to each form you acquired in your acccount. Click on the My Forms area and choose a form to produce or obtain once again.

Compete and obtain, and produce the Colorado Reservation of Rights Letter with US Legal Forms. There are millions of professional and condition-particular varieties you can utilize for your personal organization or individual requirements.

Form popularity

FAQ

When an insurer defends an insured party under a reservation of rights, there is the potential for a conflict of interest to arise because the insurer is attempting to balance its own interests with those of the insured party. This can lead to a situation where the insured party's interests are compromised.

Insured parties that receive a reservation of rights letter should contact their insurer to find out more information about the claim and the investigation process. The insurer may provide some initial information as to what aspects of the claim it is investigating.

Article Talk. A reservation of rights, in American legal practice, is a statement that an individual, company, or other organization is intentionally retaining full legal rights to warn others of those rights.

If a commercial property owner receives a reservation of rights letter, they should do the following: Review the letter and respond promptly: Policyholders should take the time to thoroughly review both the letter and the applicable policy to see if what the insurance company says lines up with the terms of the policy.

A reservation of rights letter is provided by an insurance company to an insured party indicating that a claim may not be covered under a policy. Reservation of rights letters do not deny a claim.

Article Talk. A reservation of rights, in American legal practice, is a statement that an individual, company, or other organization is intentionally retaining full legal rights to warn others of those rights.

Once a personal injury victim files a claim with or against an insurance company, the first document they might receive from the insurance provider is called a ?reservations of rights? letter. This letter is sent by the insurance company before the negotiations process begins.

Demand letter reservation of rights clause The demand letter advises the recipient that the sender has legal rights, and those rights may be pursued in a legal setting, such as a courtroom, if the sender does not receive satisfactory relief from the recipient.