Colorado Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

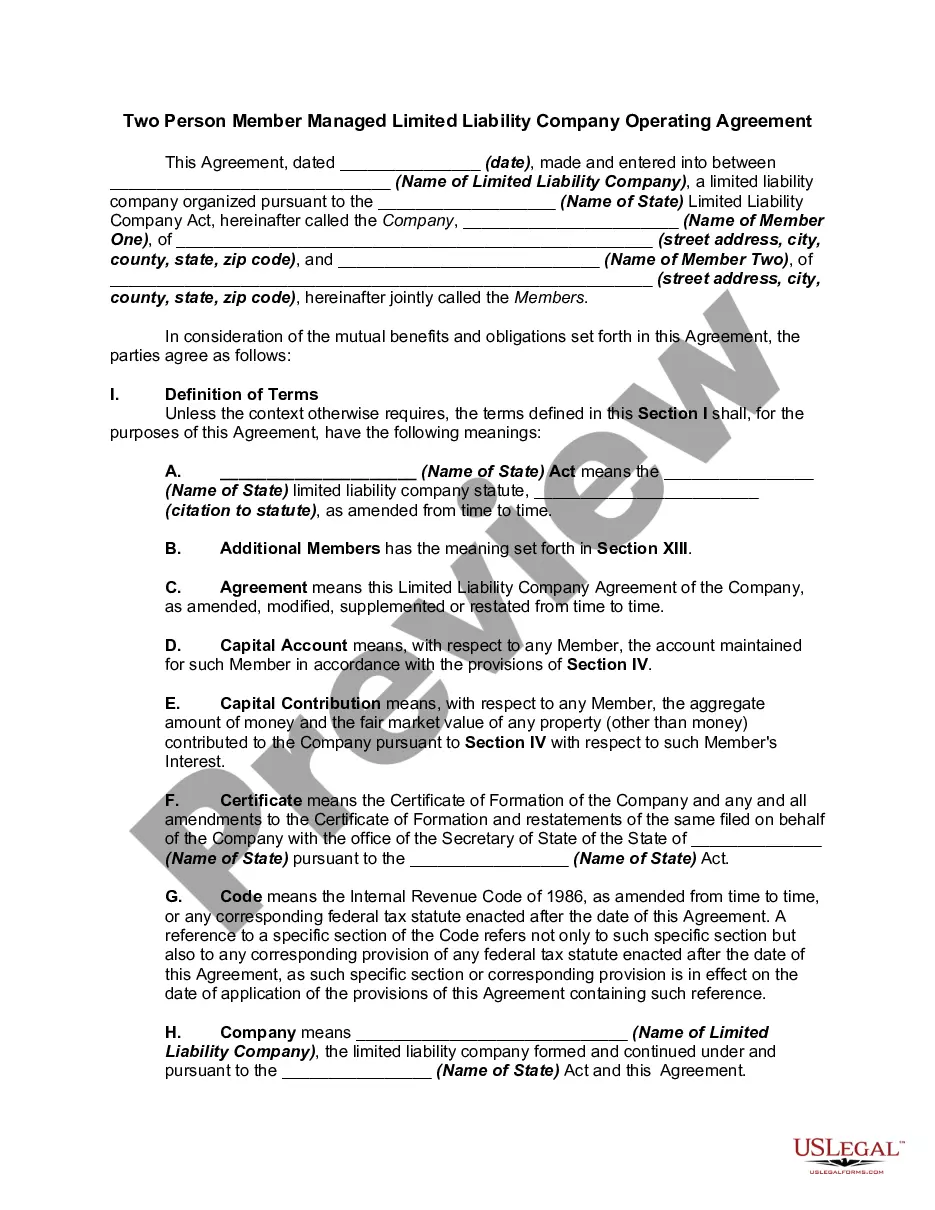

Finding the appropriate legal document template can be challenging. Obviously, there are numerous templates available online, but how can you find the legal form you require? Visit the US Legal Forms website. The service offers thousands of templates, including the Colorado Sample Letter to Include Article Relating to Tax Sales, which you can utilize for business and personal needs. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the Colorado Sample Letter to Include Article Relating to Tax Sales. Use your account to browse the legal forms you have purchased previously. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, make sure you have selected the correct form for your city/county. You can review the form using the Review button and read the form description to ensure it is the right one for you. If the form does not meet your needs, use the Search box to find the appropriate form. Once you are certain that the form is correct, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and process the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Colorado Sample Letter to Include Article Relating to Tax Sales.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to download professionally crafted paperwork that adhere to state regulations.

- Ensure compliance with legal standards when using templates from the site.

- Access a wide range of legal documents for different purposes and needs.

- Easily navigate through the platform to find the necessary forms.

- Benefit from expert-reviewed templates that guarantee quality.

Form popularity

FAQ

Colorado state sales tax is imposed at a rate of 2.9%. Any sale made in Colorado may also be subject to state-administered local sales taxes. Tax rate information for state-administered local sales taxes is available online for how to look up sales use tax rates(opens in new window).

Colorado state sales tax is imposed at a rate of 2.9%. Any sale made in Colorado may also be subject to state-administered local sales taxes. Tax rate information for state-administered local sales taxes is available online for how to look up sales use tax rates(opens in new window).

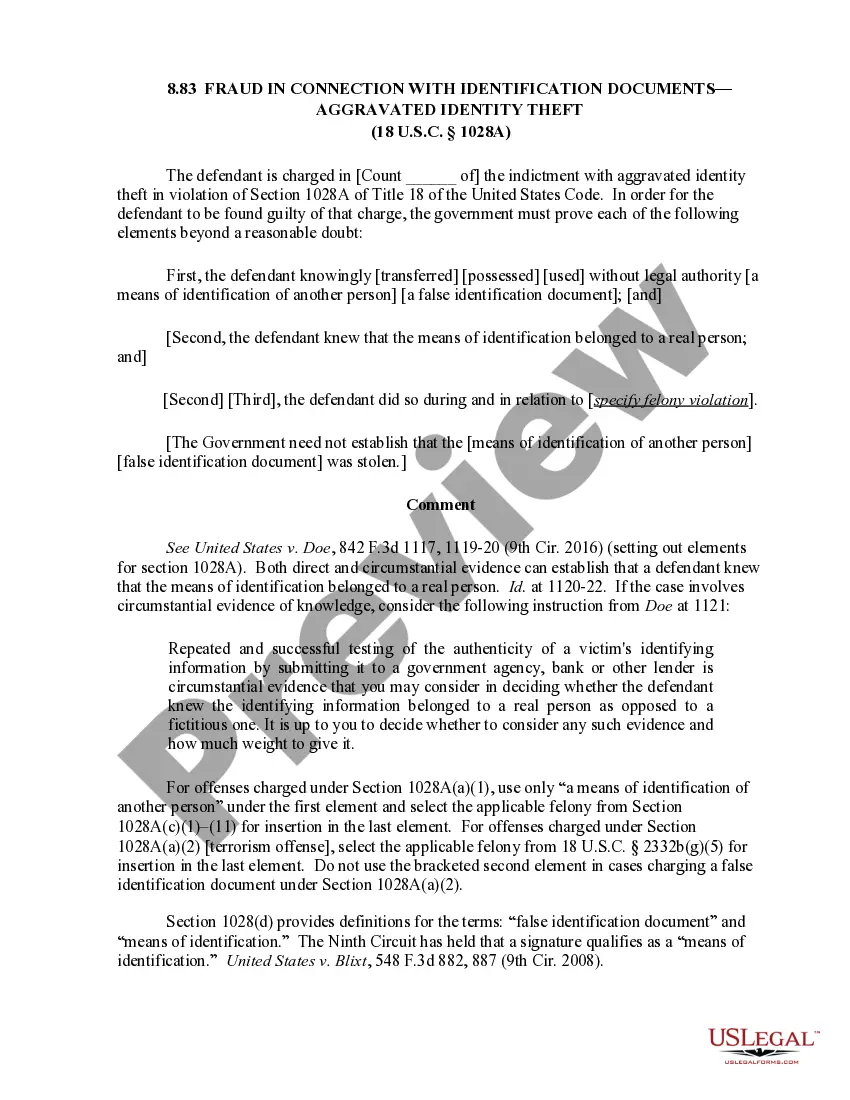

Identity Verification Letter CDOR routinely takes precautionary measures to ensure taxpayer refunds are not diverted to identity thieves. The Department reviews all income tax refunds because it is operating in the public trust with revenue dollars collected and refunded.

Examples of physical nexus: A company based in Ohio has employees located in Ohio, California, Colorado, and Georgia. The business would be considered to have physical nexus in all of those states.

Private letter rulings are advance rulings issued to specific taxpayers regarding the Department's application of tax statutes and rules to a proposed or completed transaction. Private letter rulings are generally binding upon the Department, but may only be relied upon by the taxpayer to whom they are issued.

All Colorado counties that impose a sales tax are state-collected, except Denver County and Broomfield County. Cities that have enacted a "home-rule" charter, and which have elected to administer their own local sales and use taxes are referred to as "self-collected".

Taxes, penalties, or interest must be assessed within three years of their due date. ( Sec. 39-26-125, C.R.S., ¶96-077; Sec. 39-26-210, C.R.S., ¶96-118) The three-year statute of limitations also applies to the filing of lien notices, issuance of distraint warrants, and commencement of collection suits.

A private letter ruling, or PLR, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's represented set of facts. A PLR is issued in response to a written request submitted by a taxpayer. A PLR may not be relied on as precedent by other taxpayers or by IRS personnel.