The Colorado Consumer Loan Agreement is a legally binding contract between a lender and a borrower for the provision of a loan specifically for consumer purposes in the state of Colorado. This agreement outlines the terms and conditions under which the loan is granted, including the principal amount, interest rate, repayment schedule, and any additional fees or charges. The key elements covered in a Colorado Consumer Loan Agreement include: 1. Parties Involved: The agreement identifies the lender, usually a financial institution, and the borrower, an individual seeking a loan for personal use. 2. Loan Amount: The agreement specifies the principal amount that the borrower will receive from the lender. This can vary depending on the borrower's creditworthiness and the purpose of the loan. 3. Interest Rate: The agreement states the fixed or variable interest rate charged by the lender on the loan. Colorado's law imposes certain restrictions on interest rates to protect consumers from predatory lending practices. 4. Repayment Terms: The agreement specifies the repayment schedule, including the number of installments, their frequency (monthly, quarterly, etc.), and the due dates. It may also outline any grace periods or late payment penalties. 5. Fees and Charges: The agreement outlines any additional fees or charges associated with the loan, such as origination fees, late payment fees, or prepayment penalties. These fees must comply with Colorado's consumer protection laws. 6. Default and Remedies: In case of default, the agreement details the consequences, such as accrual of interest on outstanding amounts, collection costs, and potential legal actions that the lender may take to recover the debt. 7. Governing Law: The agreement specifies that it is governed by the laws of the state of Colorado, ensuring compliance with the state's regulations regarding consumer loans. Different types of Colorado Consumer Loan Agreements may exist depending on the purpose of the loan or the specific terms. Some common variations include: 1. Personal Loans: These are general-purpose loans that borrowers can utilize for various personal expenses, such as medical bills, home improvements, or debt consolidation. 2. Auto Loans: Colorado Consumer Loan Agreements designed specifically for financing the purchase of vehicles, either new or used. These loans are often secured by the vehicle itself. 3. Small Business Loans: These loans cater to entrepreneurs and small business owners seeking financial assistance to start or expand their businesses. They may require additional documentation, such as a business plan or financial statements. 4. Home Equity Loans: This type of loan utilizes the borrower's home equity as collateral, allowing them to borrow against the appraised value of their property. Home equity loans are typically used for significant expenses like home renovations, education, or debt consolidation. In summary, the Colorado Consumer Loan Agreement is a legal contract between a lender and a borrower, establishing the terms and conditions of a loan for consumer purposes. It covers essential aspects such as loan amount, interest rate, repayment terms, fees, and the rights and obligations of both parties. Various types of consumer loans exist, tailored to specific purposes, such as personal loans, auto loans, small business loans, and home equity loans.

Colorado Consumer Loan Agreement

Description

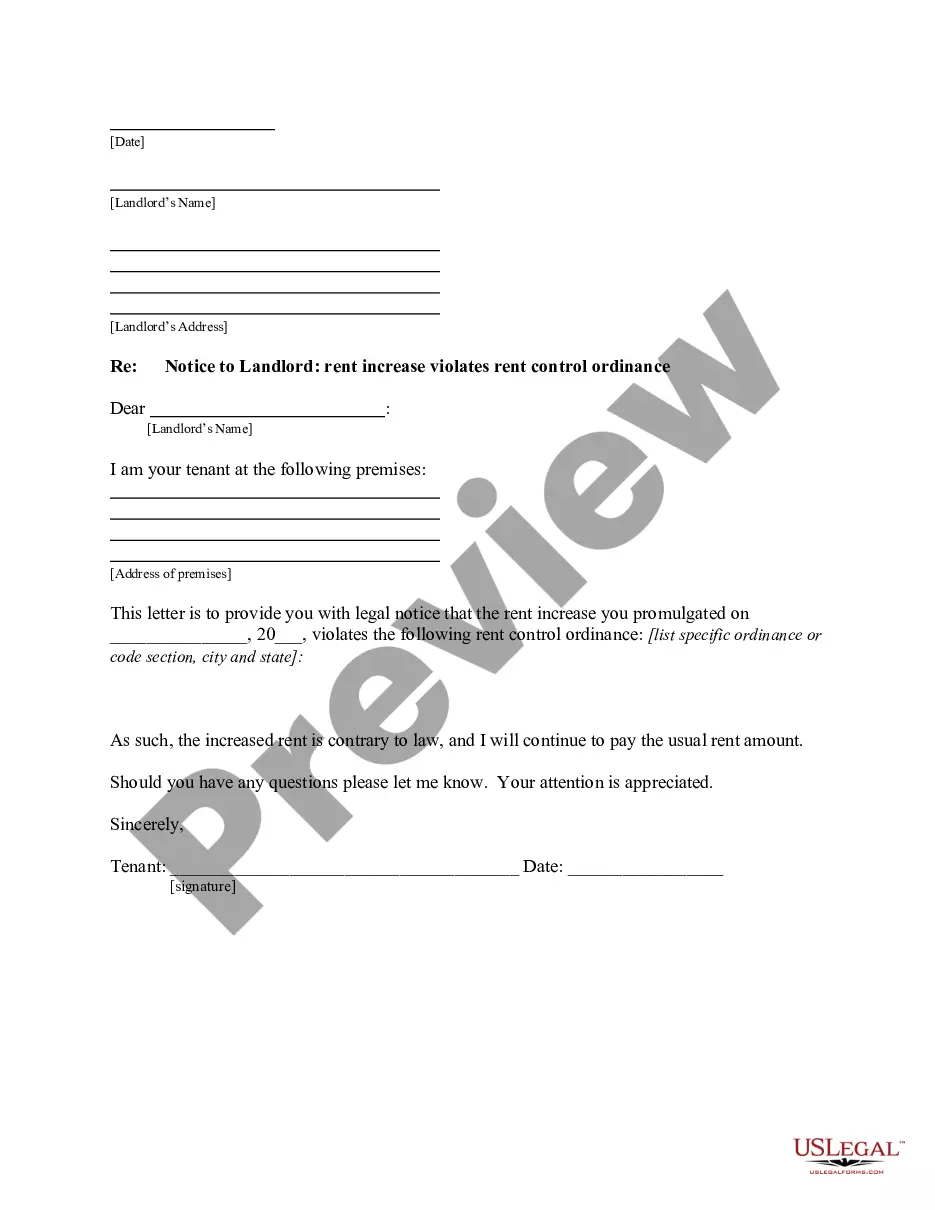

How to fill out Colorado Consumer Loan Agreement?

Choosing the best legitimate record web template can be quite a have difficulties. Of course, there are plenty of layouts available on the Internet, but how will you find the legitimate type you require? Make use of the US Legal Forms internet site. The assistance offers 1000s of layouts, like the Colorado Consumer Loan Agreement, that you can use for enterprise and personal needs. Each of the types are inspected by pros and fulfill state and federal specifications.

In case you are already authorized, log in to the profile and click on the Obtain option to obtain the Colorado Consumer Loan Agreement. Make use of your profile to appear with the legitimate types you possess acquired previously. Visit the My Forms tab of the profile and acquire an additional copy in the record you require.

In case you are a fresh end user of US Legal Forms, allow me to share straightforward guidelines for you to comply with:

- Initially, make certain you have selected the correct type for your personal town/state. You are able to examine the form while using Review option and browse the form information to make certain this is the right one for you.

- When the type will not fulfill your requirements, make use of the Seach field to discover the proper type.

- When you are positive that the form is acceptable, click on the Get now option to obtain the type.

- Opt for the costs plan you would like and enter the required information. Make your profile and buy your order making use of your PayPal profile or bank card.

- Opt for the submit file format and down load the legitimate record web template to the product.

- Complete, revise and print and signal the attained Colorado Consumer Loan Agreement.

US Legal Forms will be the most significant local library of legitimate types in which you can find various record layouts. Make use of the company to down load professionally-produced files that comply with status specifications.

Form popularity

FAQ

Under Colorado law, a consumer reporting agency shall, upon written or verbal request and proper identification of any consumer, clearly, accurately, and in a manner that is understandable to the consumer, disclose to the consumer, in writing, all information in its files at the time of the request pertaining to the ...

Most other consumer credit transactions such as payday loans, automobile loans, second mortgages, state-issued credit cards, and signature loans are subject to the UCCC.

Five states?California, Colorado, Connecticut, Utah and Virginia?have enacted comprehensive consumer data privacy laws. The laws have several provisions in common, such as the right to access and delete personal information and to opt-out of the sale of personal information, among others.

This Act applies to every contract for goods or services entered into between a consumer and a merchant in the course of his business.

The Colorado Consumer Protection Act protects consumers from a wide range of unfair and deceptive business practices.

The Colorado Attorney General is dedicated to protecting Colorado consumers and businesses by upholding Colorado and Federal laws designed to maintain a fair and competitive business environment while protecting consumers from being targets of fraud.

The Uniform Consumer Credit Code (UCCC) is a draft law, adopted by 11 states, that governs consumer credit transactions. It establishes rules related to the issuance and use of all types of credit products from credit cards to mortgages.

Under Colorado law, a consumer reporting agency shall, upon written or verbal request and proper identification of any consumer, clearly, accurately, and in a manner that is understandable to the consumer, disclose to the consumer, in writing, all information in its files at the time of the request pertaining to the ...