A Colorado Simple Promissory Note for Car Loan is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender for the purpose of financing a car purchase. This type of promissory note specifically applies to car loans in the state of Colorado. The Colorado Simple Promissory Note for Car Loan serves as a written agreement that provides protection for both the borrower and the lender. It defines the repayment terms, including the loan amount, interest rate, repayment schedule, and any additional fees or charges. By signing this document, the borrower agrees to the terms outlined and promises to repay the loan in a timely manner. Colorado offers several types of Simple Promissory Notes for Car Loans, which vary depending on the specific requirements and circumstances of the borrower: 1. Secured Promissory Note: This type of note involves collateral, usually the car being purchased. In case of default, the lender has the right to seize and sell the vehicle to recover the outstanding balance. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. However, the lender may charge a higher interest rate to compensate for the increased risk. 3. Interest-Only Promissory Note: This type of note allows the borrower to make regular interest payments for a specific period before starting to repay the principal amount. It provides flexible payment options, especially for borrowers who anticipate financial changes in the future. 4. Balloon Promissory Note: A balloon note features lower monthly payments over a specified term, but a larger lump-sum payment (balloon payment) at the end of the loan term. This type of note is popular for borrowers who expect improved financial conditions or plan to refinance before the balloon payment becomes due. 5. Demand Promissory Note: A demand note allows the lender to request repayment of the loan balance at any time, without adhering to a fixed repayment schedule. This note gives the lender more flexibility in case the borrower's circumstances change quickly. It is important to note that these different types of promissory notes may have specific requirements, terms, and consequences in case of default. Therefore, it is advisable for borrowers and lenders to consult legal professionals or financial advisors to ensure compliance with Colorado car loan regulations and to protect their respective rights and interests.

Colorado Simple Promissory Note for Car Loan

Description

How to fill out Colorado Simple Promissory Note For Car Loan?

Are you presently inside a situation the place you need papers for both company or personal reasons just about every day time? There are tons of lawful document layouts available on the net, but finding ones you can trust is not simple. US Legal Forms offers a large number of kind layouts, much like the Colorado Simple Promissory Note for Car Loan, that happen to be published to meet federal and state demands.

Should you be previously informed about US Legal Forms web site and possess your account, just log in. After that, you may obtain the Colorado Simple Promissory Note for Car Loan design.

If you do not offer an account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is for the proper town/area.

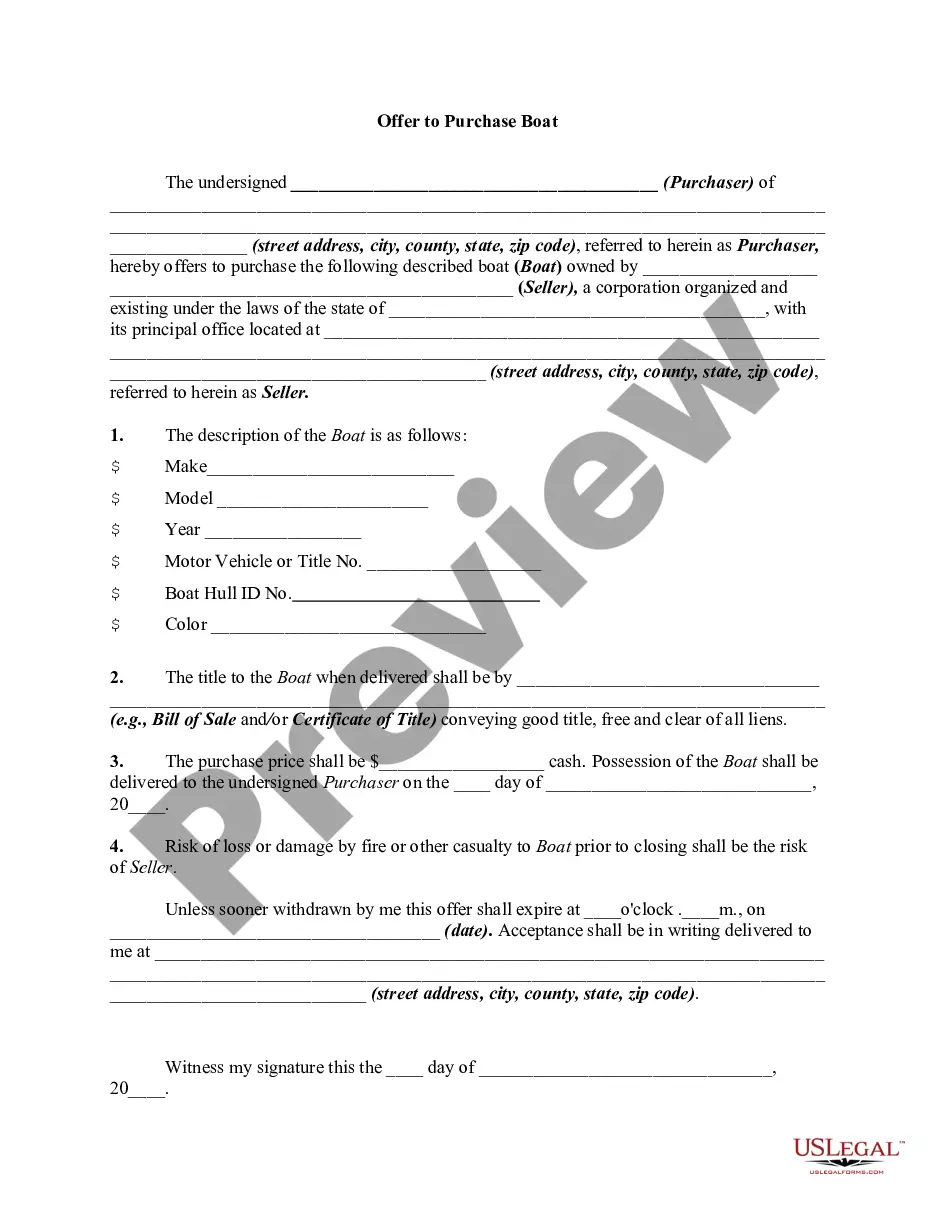

- Utilize the Review key to examine the form.

- Read the description to ensure that you have chosen the correct kind.

- If the kind is not what you`re trying to find, take advantage of the Look for industry to find the kind that meets your requirements and demands.

- Whenever you obtain the proper kind, click on Get now.

- Choose the pricing program you need, complete the specified details to create your account, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Select a practical document file format and obtain your copy.

Discover all of the document layouts you might have bought in the My Forms menus. You can aquire a extra copy of Colorado Simple Promissory Note for Car Loan anytime, if necessary. Just select the essential kind to obtain or produce the document design.

Use US Legal Forms, by far the most considerable selection of lawful forms, to save lots of efforts and steer clear of blunders. The service offers expertly manufactured lawful document layouts which you can use for an array of reasons. Make your account on US Legal Forms and commence making your lifestyle a little easier.