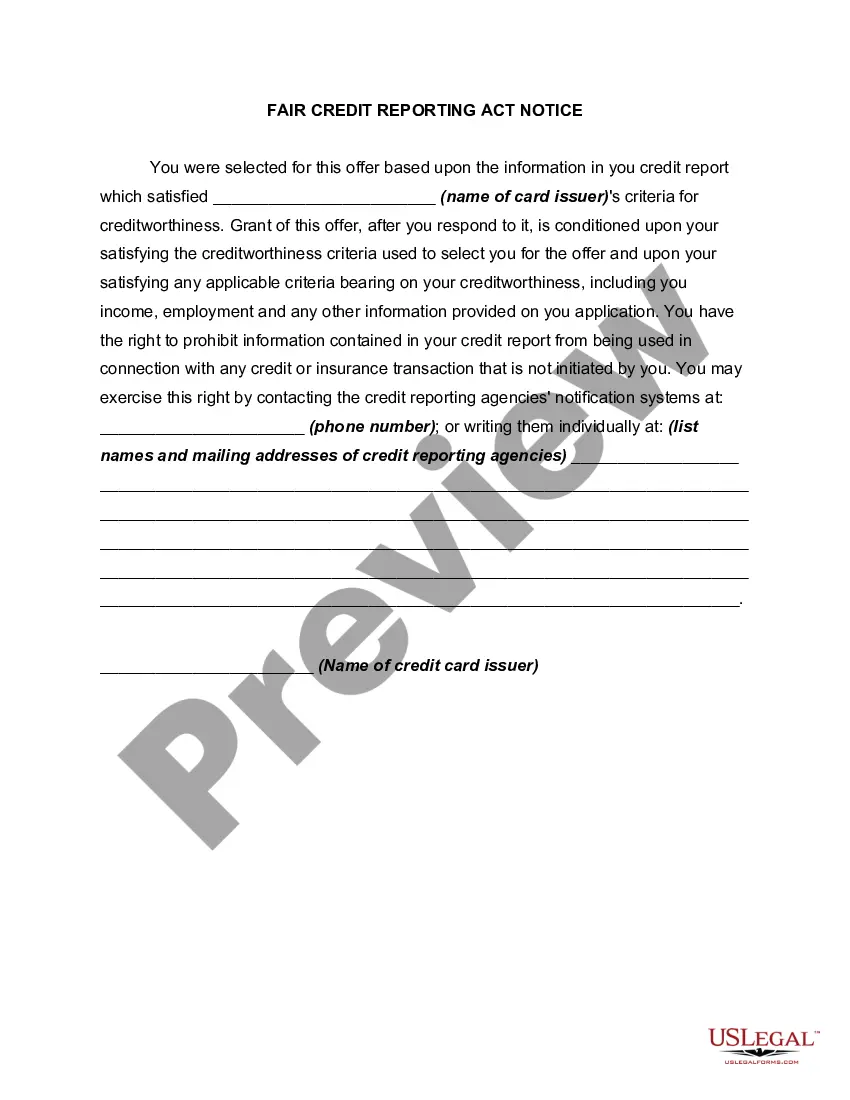

Pre-approved credit card offers must provide with each written solicitation a clear and conspicuous statement that a credit reporting agency was the source of the information and that the consumer can opt out. The follow form is an example of such a notice.

Colorado Notice to Accompany Credit Card Offer - Right to Prohibit Use of

Description

How to fill out Notice To Accompany Credit Card Offer - Right To Prohibit Use Of?

US Legal Forms - one of many biggest libraries of legal types in the USA - offers a wide array of legal record templates you are able to acquire or print. Making use of the internet site, you can find a huge number of types for enterprise and person functions, categorized by types, claims, or key phrases.You will discover the most up-to-date types of types such as the Colorado Notice to Accompany Credit Card Offer - Right to Prohibit Use of in seconds.

If you already possess a membership, log in and acquire Colorado Notice to Accompany Credit Card Offer - Right to Prohibit Use of through the US Legal Forms local library. The Down load option will show up on every type you look at. You gain access to all previously delivered electronically types inside the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, listed below are basic recommendations to obtain started out:

- Be sure you have picked out the right type to your city/area. Click the Preview option to examine the form`s information. Read the type information to actually have selected the proper type.

- If the type doesn`t fit your needs, use the Look for discipline at the top of the screen to discover the one who does.

- Should you be happy with the form, affirm your selection by visiting the Purchase now option. Then, opt for the prices program you like and give your qualifications to sign up for the profile.

- Approach the financial transaction. Make use of credit card or PayPal profile to finish the financial transaction.

- Find the format and acquire the form on the system.

- Make changes. Load, revise and print and indication the delivered electronically Colorado Notice to Accompany Credit Card Offer - Right to Prohibit Use of.

Each and every format you added to your bank account does not have an expiry day and is also your own property permanently. So, if you wish to acquire or print another duplicate, just visit the My Forms portion and click about the type you require.

Gain access to the Colorado Notice to Accompany Credit Card Offer - Right to Prohibit Use of with US Legal Forms, by far the most considerable local library of legal record templates. Use a huge number of specialist and express-certain templates that satisfy your organization or person requires and needs.

Form popularity

FAQ

The Truth in Lending Act and the Credit CARD Act are the two major laws that govern credit cards. The Truth in Lending Act requires credit card companies to disclose the key terms of the credit card in the application or solicitation.

The Equal Credit Opportunity Act (ECOA) prohibits credit-related discrimination based on age, marital status, nationality, race, religion or sex. The act, which dates back to 1976, additionally states that creditors cannot discriminate against individuals receiving government aid or public assistance.

Know your rights Your interest rate on existing balances generally cannot increase unless you're late on your payments. A card issuer cannot take more than 90 days to resolve a billing error. If you report a lost or stolen card before it's used, you can't be held responsible for unauthorized charges.

The Consumer Credit Protection Act Of 1968 (CCPA) protects consumers from harm by creditors, banks, and credit card companies. The federal act mandates disclosure requirements that must be followed by consumer lenders and auto-leasing firms.

Some other rights that the FCBA gives credit card holders are: In case you did not authorize a charge (if you lost or misplaced your card, for instance), you will not be liable for more than $50 no matter how big the charge is. You can dispute charges that are incorrect ? for instance, if a merchant overbilled you.

Federal laws provide important protections for credit card users. These include: If your card is lost or stolen, your losses may be limited to $50 as long as you notify your issuer promptly. You may not be responsible for any charges if you report your loss before your credit card is used.

The Credit CARD Act Also referred to as the Credit Card Bill of Rights, this law makes sure credit card companies provide fair interest rates and penalties and transparent notifications. These are just a few of the provisions relating to consumer financial rights.