Colorado Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions of an agreement between a creditor and a debtor to settle a debt by returning the secured property to the creditor. This type of agreement is commonly used in Colorado as a means of resolving financial obligations and avoiding further legal actions. The Colorado Agreement to Compromise Debt by Returning Secured Property is designed to protect the rights and interests of both parties involved. It requires the debtor to return the secured property, typically a collateral or asset used as security for the debt, to the creditor in exchange for the cancellation or reduction of the owed amount. By returning the property, the debtor releases their ownership rights and relinquishes any claim over it. The agreement includes various details and conditions related to the debt compromise. It outlines the exact property to be returned, including a detailed description of the asset, such as make, model, serial number, or any other identifying information. Additionally, it specifies the agreed-upon value of the property, which is often used to determine the amount of debt reduction. There may be different types of Colorado Agreement to Compromise Debt by Returning Secured Property depending on the nature of the debt and the assets involved. These variations could include agreements related to residential or commercial real estate properties, vehicles, equipment, or any other valuable items used as collateral. It is essential for both parties to carefully review and understand the terms and conditions outlined in the agreement before signing. Seeking legal advice or assistance may be beneficial to ensure the compliance of the agreement with Colorado state laws and regulations. In conclusion, the Colorado Agreement to Compromise Debt by Returning Secured Property is a legally binding document that facilitates the settlement of debts by returning the secured property. It serves as a means for debtors and creditors in Colorado to reach a mutually satisfactory agreement, allowing debtors to reduce their obligations and creditors to regain possession of valuable collateral.

Colorado Agreement to Compromise Debt by Returning Secured Property

Description

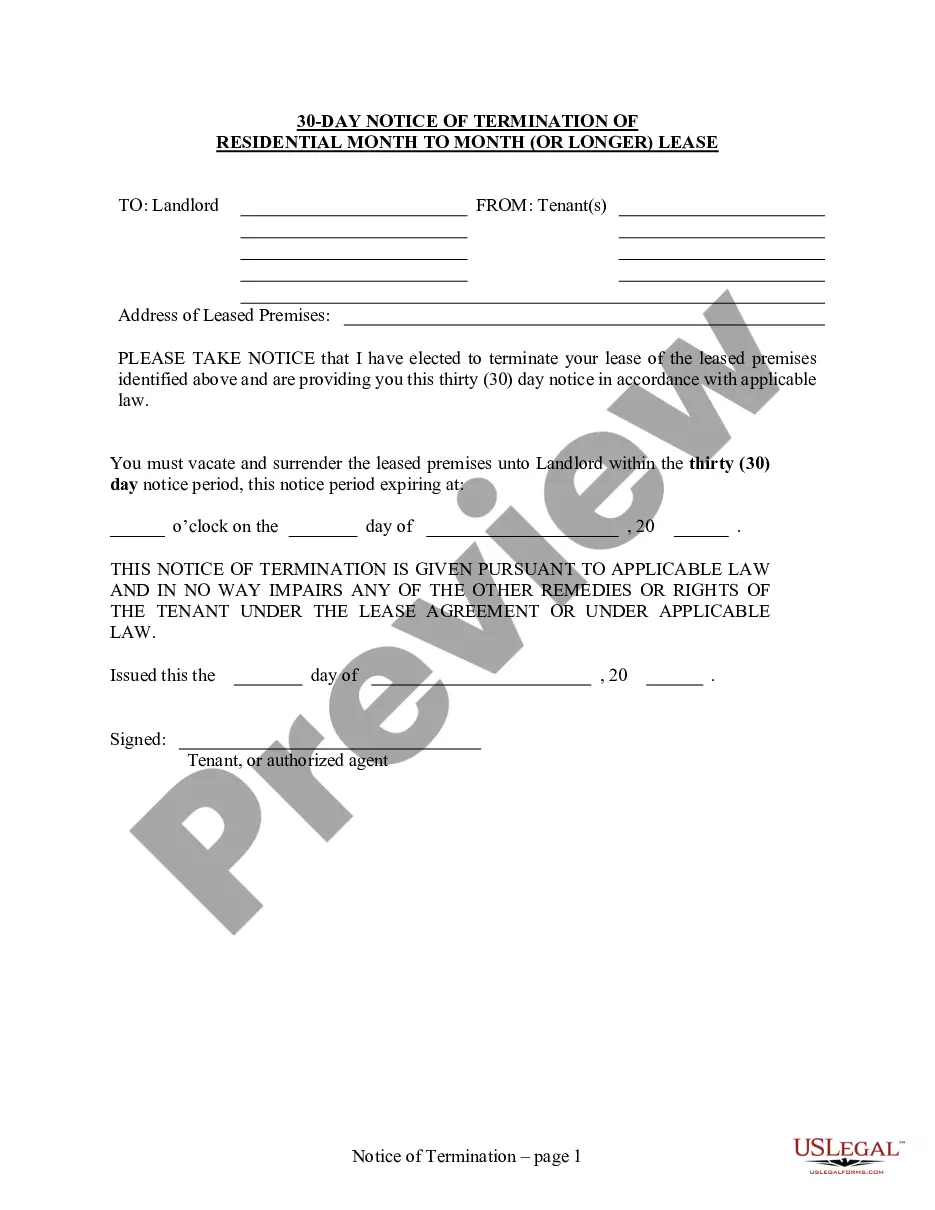

How to fill out Colorado Agreement To Compromise Debt By Returning Secured Property?

It is possible to commit time on the web looking for the authorized document template that suits the federal and state specifications you want. US Legal Forms supplies thousands of authorized varieties that are reviewed by experts. You can easily obtain or produce the Colorado Agreement to Compromise Debt by Returning Secured Property from our assistance.

If you already have a US Legal Forms profile, you can log in and click on the Download switch. After that, you can complete, change, produce, or signal the Colorado Agreement to Compromise Debt by Returning Secured Property. Every single authorized document template you purchase is yours forever. To have one more duplicate of the bought form, go to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website the very first time, stick to the straightforward recommendations beneath:

- Initially, be sure that you have selected the proper document template for the state/town of your liking. See the form outline to ensure you have chosen the right form. If readily available, take advantage of the Preview switch to check with the document template too.

- If you want to discover one more model in the form, take advantage of the Search field to find the template that suits you and specifications.

- Once you have located the template you desire, simply click Purchase now to move forward.

- Select the costs strategy you desire, enter your qualifications, and sign up for your account on US Legal Forms.

- Full the transaction. You can utilize your charge card or PayPal profile to cover the authorized form.

- Select the format in the document and obtain it to the system.

- Make alterations to the document if necessary. It is possible to complete, change and signal and produce Colorado Agreement to Compromise Debt by Returning Secured Property.

Download and produce thousands of document templates making use of the US Legal Forms website, that offers the largest collection of authorized varieties. Use specialist and status-particular templates to take on your organization or individual needs.

Form popularity

FAQ

Tips To Write A Debt Compromise Letter Keep it precise with all relevant information underlined. Provide Evidence: Make sure you attach a photocopy of documents related to the matter. In your letter, highlight the list of copies you have attached to it. Make sure these documents are self-attested.

Writing the Settlement Offer LetterInclude your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return. A good starting point for negotiation could be offering around 30% of the amount that you owe.

You have to prove it. Often, people who do have an Offer in Compromise accepted through their own work ended up offering the IRS way too much money. There is a reason the IRS jumps at certain offers. The IRS benefits all too often when taxpayers don't have a good legal team behind them.

In most cases, the IRS takes about six months to decide whether to accept or reject your offer in compromise.

To be valid, a compromise agreement must be in writing, identify a valid 'relevant independent adviser', identify the possible claims the employee has, and be signed by the employee after speaking with the relevant independent adviser.

Who qualifies for an IRS offer in compromise?You forget to provide necessary information on the application.You're behind on filing your tax returns.You haven't received a bill for at least one tax debt included on your offer.You haven't made all required estimated tax payments for the current year.More items...

OIC-DATC acceptance rates In general, IRS OIC acceptance rate is fairly low. In 2019, only 1 out of 3 were accepted by the IRS. In 2019, the IRS accepted 33% of all OICs.

For a compromise agreement to be valid, it must be in writing, can only settle existing and known claims and the employee must have obtained the advice of a legal advisor on the terms and conditions of the agreement before signing.

Debt / Compromise Letter. A Debt Compromise letter is a formal written agreement between a lender and borrower for final settlement of the debt with a compromise on interest or principle payable.

If you have a legitimate doubt that you owe part or all of the tax debt, you will need to complete a Form 656-L, Offer in Compromise (Doubt as to Liability).