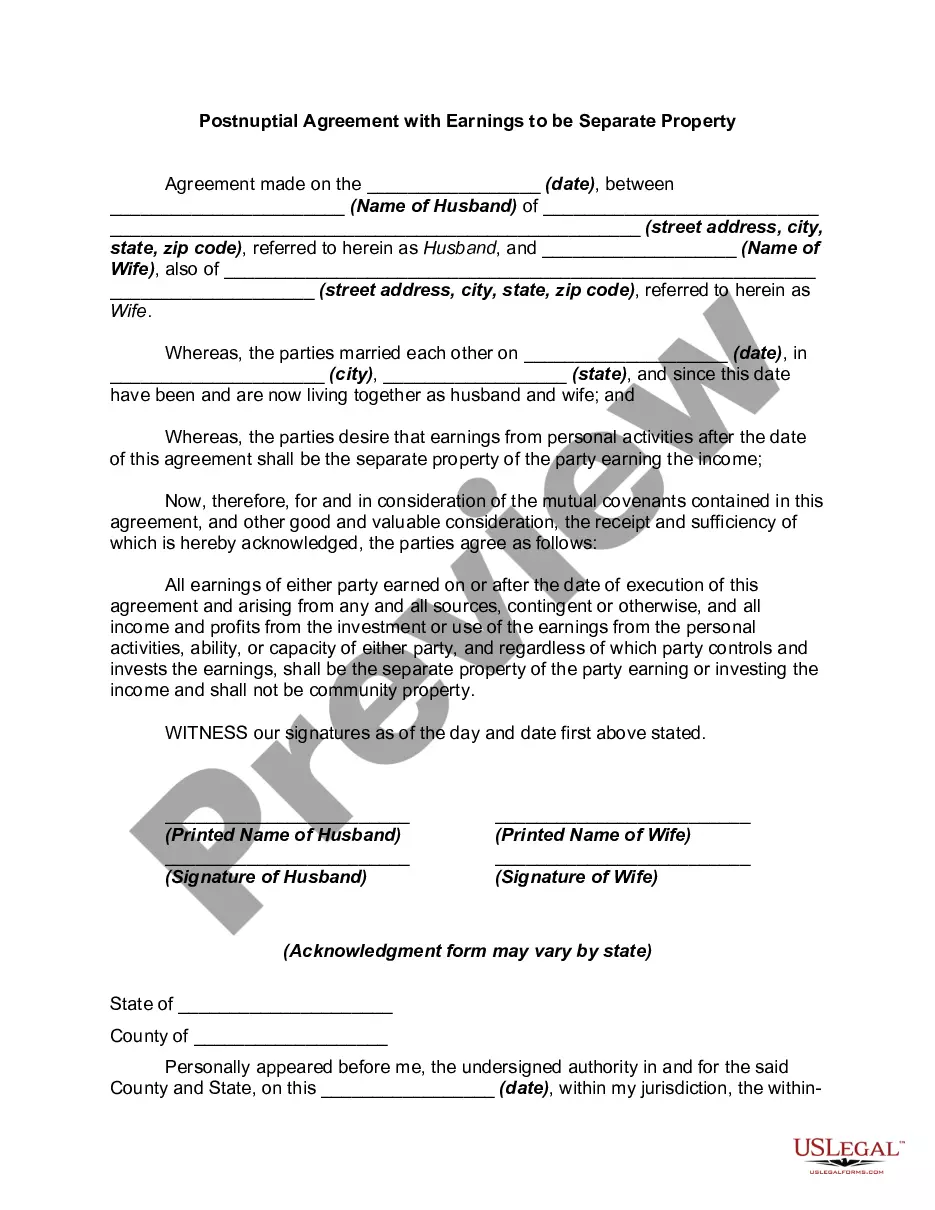

A postnuptial agreement is a written contract executed after a couple gets married to settle the couple's affairs and assets in the event of a separation or divorce.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Colorado postnuptial agreement with earnings to be separate property is a legally binding document created by a married couple residing in Colorado to define the rights and ownership of their assets and income acquired during their marriage. This agreement is specifically designed to ensure that the earnings of each spouse remain separate property, rather than being subject to equitable distribution in the event of a divorce or separation. Keywords: Colorado, postnuptial agreement, earnings, separate property, married couple, assets, income, equitable distribution, divorce, separation. Types of Colorado Postnuptial Agreements with Earnings to be Separate Property: 1. Basic Earnings Separation Agreement: This type of postnuptial agreement focuses solely on keeping the earnings of each spouse separate. It clearly outlines that the income earned by each spouse during the marriage will be considered their individual property, excluding it from division during a divorce or separation. 2. Comprehensive Property and Earnings Separation Agreement: In addition to addressing separate earnings, this agreement goes further by outlining the division of all other assets acquired during the marriage. It defines which properties, such as real estate, investments, or businesses, will remain separate property for each spouse. 3. Prenuptial Conversion Agreement to Postnuptial Agreement: This type of postnuptial agreement typically occurs when a couple wants to amend their prenuptial agreement after getting married. It specifically focuses on transforming the prenuptial agreement into a postnuptial agreement with a specific emphasis on keeping earnings separate. 4. Farm or Business Earnings Separation Agreement: This agreement is tailored for couples involved in agricultural or entrepreneurial pursuits. It addresses the division of farm or business-related earnings, ensuring that the income generated from these activities remains separate property for the respective spouse. 5. Child Support and Earnings Separation Agreement: In certain cases, couples may wish to address child support obligations in addition to earnings separation. This type of postnuptial agreement ensures that child support payments are calculated based on individual earnings, preventing one spouse from benefiting unduly from the other's income. In summary, a Colorado postnuptial agreement with earnings to be separate property is a versatile legal tool that allows couples to establish clear guidelines regarding the ownership and division of income acquired during their marriage. By customizing the agreement to their specific needs, couples can protect their financial interests and maintain peace of mind.A Colorado postnuptial agreement with earnings to be separate property is a legally binding document created by a married couple residing in Colorado to define the rights and ownership of their assets and income acquired during their marriage. This agreement is specifically designed to ensure that the earnings of each spouse remain separate property, rather than being subject to equitable distribution in the event of a divorce or separation. Keywords: Colorado, postnuptial agreement, earnings, separate property, married couple, assets, income, equitable distribution, divorce, separation. Types of Colorado Postnuptial Agreements with Earnings to be Separate Property: 1. Basic Earnings Separation Agreement: This type of postnuptial agreement focuses solely on keeping the earnings of each spouse separate. It clearly outlines that the income earned by each spouse during the marriage will be considered their individual property, excluding it from division during a divorce or separation. 2. Comprehensive Property and Earnings Separation Agreement: In addition to addressing separate earnings, this agreement goes further by outlining the division of all other assets acquired during the marriage. It defines which properties, such as real estate, investments, or businesses, will remain separate property for each spouse. 3. Prenuptial Conversion Agreement to Postnuptial Agreement: This type of postnuptial agreement typically occurs when a couple wants to amend their prenuptial agreement after getting married. It specifically focuses on transforming the prenuptial agreement into a postnuptial agreement with a specific emphasis on keeping earnings separate. 4. Farm or Business Earnings Separation Agreement: This agreement is tailored for couples involved in agricultural or entrepreneurial pursuits. It addresses the division of farm or business-related earnings, ensuring that the income generated from these activities remains separate property for the respective spouse. 5. Child Support and Earnings Separation Agreement: In certain cases, couples may wish to address child support obligations in addition to earnings separation. This type of postnuptial agreement ensures that child support payments are calculated based on individual earnings, preventing one spouse from benefiting unduly from the other's income. In summary, a Colorado postnuptial agreement with earnings to be separate property is a versatile legal tool that allows couples to establish clear guidelines regarding the ownership and division of income acquired during their marriage. By customizing the agreement to their specific needs, couples can protect their financial interests and maintain peace of mind.