Colorado Agreement to Compromise Debt

Description

How to fill out Agreement To Compromise Debt?

Are you in a position where you often need documents for various corporate or specific purposes.

There are numerous legal document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Colorado Agreement to Compromise Debt, designed to comply with state and federal regulations.

You can obtain another copy of the Colorado Agreement to Compromise Debt whenever needed; just choose the required document to download or print the template.

Utilize US Legal Forms, the largest collection of legal documents, to save time and prevent errors. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Colorado Agreement to Compromise Debt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/county.

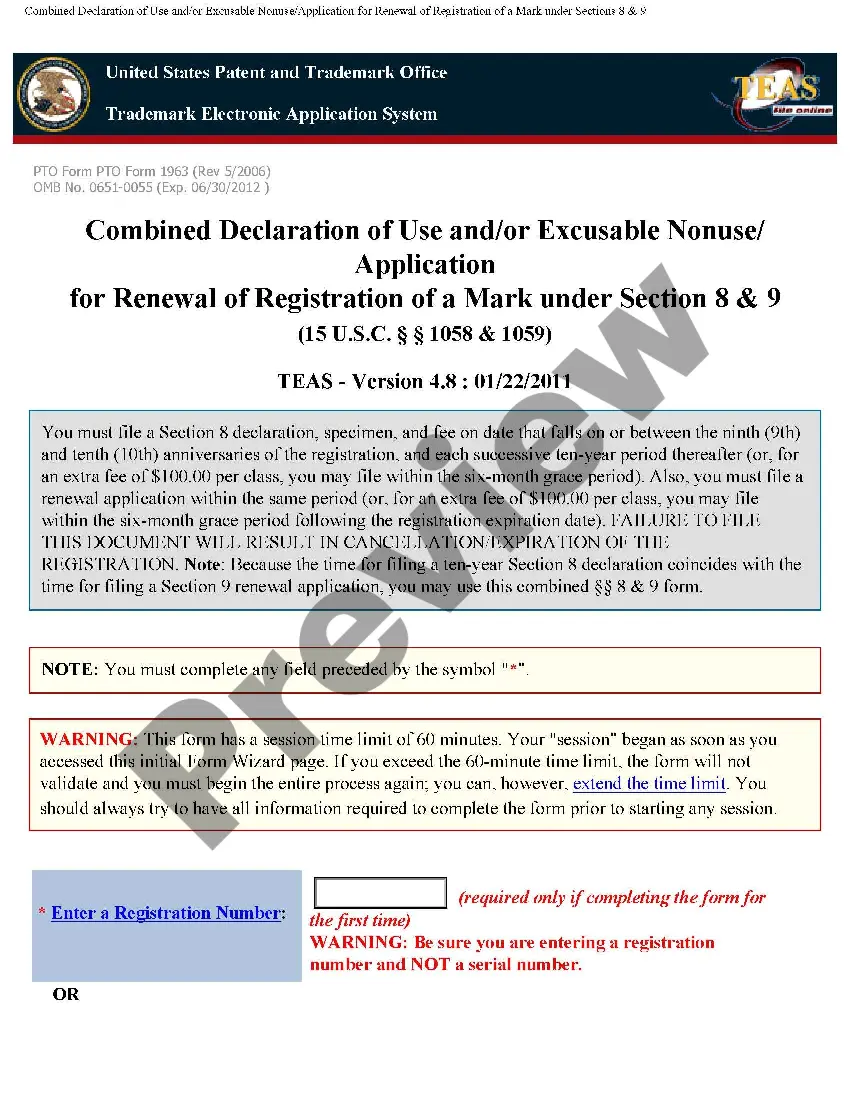

- Click the Preview button to review the form.

- Check the details to confirm you have selected the right document.

- If the document is not what you are looking for, use the Search section to find one that fulfills your needs.

- Once you find the appropriate document, click Get now.

- Choose the pricing plan you want, complete the required information to create your account, and pay for your order using PayPal or a credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section.

Form popularity

FAQ

To set a payment plan for IRS taxes in Colorado, you should first assess your total tax liability and review your financial situation. You can apply for an installment agreement online or through a paper form. By making timely payments, you can avoid additional penalties and interest. Consider using a Colorado Agreement to Compromise Debt to explore options for settling your tax debt more effectively.

An offer in compromise can be a wise strategy for managing debt, especially under the Colorado Agreement to Compromise Debt. It allows you to settle your debts for less than you owe, preserving more of your financial resources. However, it's important to consider your specific situation, as this option may not be beneficial for everyone. Consulting with experts or platforms like US Legal Forms can help you assess your choices and determine the best plan for your financial health.

The Colorado Agreement to Compromise Debt can have varying effects on your credit score. While it may initially lower your score due to the settlement, it often allows you to resolve debt faster than traditional methods. Once creditors see that you've fulfilled the agreement, your credit can begin to improve. Remember, managing your debts responsibly and making timely payments afterward can boost your credit standing.

Yes, you can settle state tax debt using a Colorado Agreement to Compromise Debt. This agreement allows you to negotiate with the state to reduce the total amount you owe. By demonstrating financial hardship, you may secure a more manageable repayment plan. It's a practical step towards regaining your financial stability.

Setting up a payment plan for Colorado state taxes involves contacting the Colorado Department of Revenue and submitting a payment plan application. You will need to detail your financial situation to negotiate terms that suit you. The Colorado Agreement to Compromise Debt may offer resources to simplify this process.

Yes, the IRS may settle your tax debt for less than the full amount owed if you submit a successful offer in compromise. They assess your financial circumstances to determine if a compromise is appropriate. The Colorado Agreement to Compromise Debt can be instrumental in preparing a persuasive offer.

Key documents needed for an offer in compromise include Form 656, a completed Form 433-A or 433-B, and detailed financial statements. You'll also need to provide proof of income, expenses, and assets. The Colorado Agreement to Compromise Debt can help organize and streamline these document requirements.

The acceptance rate for IRS offers in compromise fluctuates based on various factors, including applicant financial status and completeness of submission. Historically, the acceptance rate hovers around 25%. The Colorado Agreement to Compromise Debt can increase your chances by ensuring your application meets all necessary requirements.

Yes, individuals can file an offer in compromise without professional help. However, it's often recommended to seek assistance to maximize your chances of acceptance. Utilizing the Colorado Agreement to Compromise Debt can help you understand the filing process and prepare your application correctly.

Filing an offer in compromise involves submitting Form 656 along with required documentation to the IRS. You’ll need to provide financial information that supports your claim for compromise. The Colorado Agreement to Compromise Debt can provide a clear step-by-step guide to ensure your submission is complete.