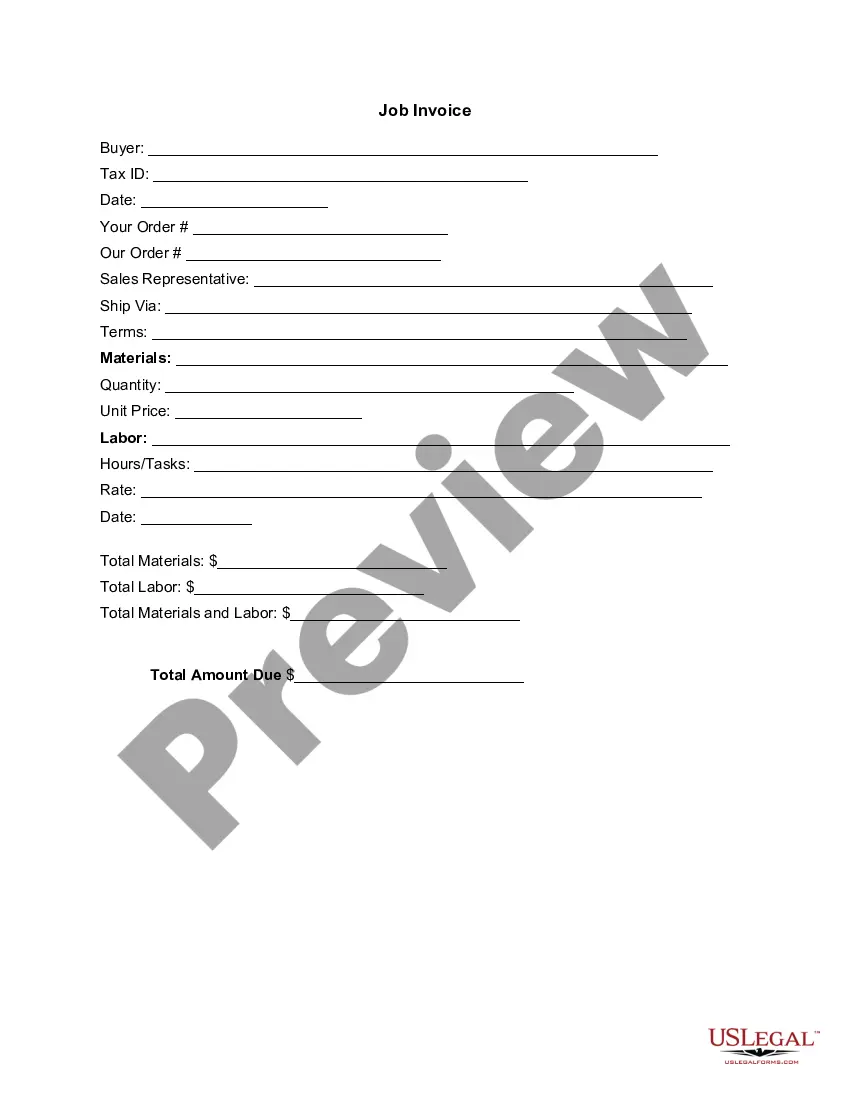

Colorado Invoice Template for Receptionist

Description

How to fill out Invoice Template For Receptionist?

If you need to aggregate, retrieve, or create legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online. Take advantage of the site's user-friendly and efficient search to locate the documents you need. Various templates for business and personal use are organized by categories and states, or keywords. Use US Legal Forms to find the Colorado Invoice Template for Receptionist with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Colorado Invoice Template for Receptionist. You can also access documents you have previously saved in the My documents section of your account.

If you are utilizing US Legal Forms for the first time, follow the steps below.

Every legal document template you purchase is yours forever. You will have access to every form you saved in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download, and print the Colorado Invoice Template for Receptionist with US Legal Forms. There are countless professional and state-specific templates you can utilize for your business or personal requirements.

- Step 1. Make sure you have selected the form for the correct city/region.

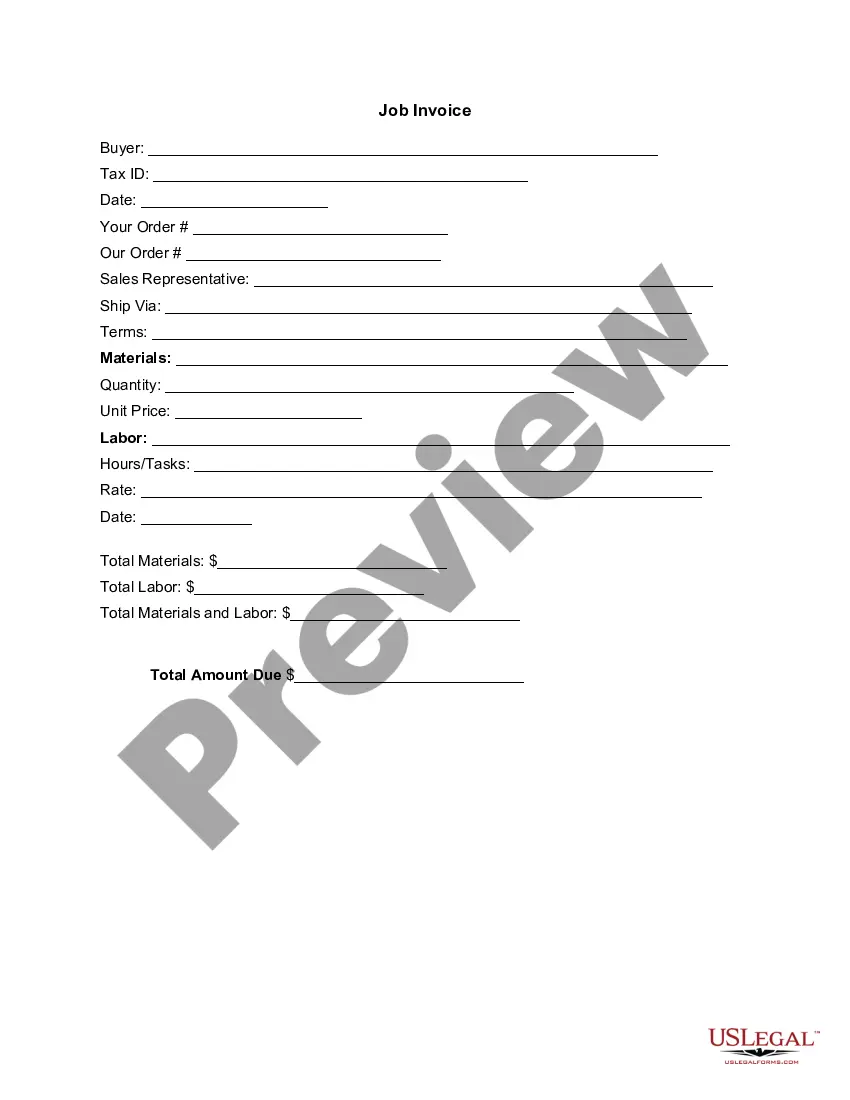

- Step 2. Use the Preview feature to examine the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Colorado Invoice Template for Receptionist.

Form popularity

FAQ

Creating a PDF invoice can be done easily once you have your invoice ready in Word or Excel. Use the 'Save As' function to convert your document into a PDF format. This approach preserves your invoice format and ensures it looks professional when sent to clients. Look for a Colorado Invoice Template for Receptionist that can be directly converted to PDF for added convenience.

To create an invoice file, choose a software platform that suits your needs, like Word or Excel. Many find it beneficial to use a Colorado Invoice Template for Receptionist, as it provides a ready-made structure. Simply fill in your business information, client details, and services to finalize your invoice file.

Filling out an invoice template involves entering specific information into designated fields. First, add your business details and the recipient’s information. Next, include a detailed list of services rendered along with their respective costs. Using a Colorado Invoice Template for Receptionist streamlines this process, allowing you to create invoices accurately and efficiently.

To set up an invoice template, begin by determining the necessary components, such as company name, customer details, itemized services, and payment terms. Using a Colorado Invoice Template for Receptionist, you can seamlessly insert these elements into a cohesive layout. This ensures professional appearance and consistency in all your invoices.

Choosing between Word and Excel for invoice creation depends on your preferences and needs. Word offers a more visually appealing layout while Excel provides better functionality for calculations. By opting for a Colorado Invoice Template for Receptionist, you can enjoy the best of both worlds, combining aesthetics with automated calculations efficiently.

To create an invoice file, start by selecting a suitable format for your needs, such as Word or Excel. You can utilize a Colorado Invoice Template for Receptionist, which simplifies the process. Once you have the template, fill in the essential details like your business logo, customer information, and service or product descriptions. Finally, save the file to your preferred location for easy access.

Yes, Word includes a variety of invoice templates available for users. These templates can be customized to fit the unique aspects of your business. For receptionists seeking a tailored design, a Colorado Invoice Template for Receptionist can help create a polished and professional invoice that meets your needs.

To create an invoice format in Word, start by selecting a blank document or an existing template. Include essential elements such as your business name, client details, itemized services, and payment terms. For receptionists, utilizing a Colorado Invoice Template for Receptionist can simplify this process and ensure consistency in your invoices.

Microsoft offers several applications that support invoicing, including Microsoft 365 with Excel, which can be used to create detailed invoices. Additionally, their online services often provide features that streamline invoice creation. For specific needs, such as a Colorado Invoice Template for Receptionist, consider integrating these tools for efficiency.

Open Office provides several invoice templates, suitable for various needs and industries. Receptionists can easily customize these templates to align with their business requirements. For a professional appearance, consider exploring the Colorado Invoice Template for Receptionist within Open Office’s offerings.